There is a roaring debate within the personal finance community about which method should be used to pay off debt whether it’s the debt backpack method, the debt savvy, snowball, avalanche or debt tsunami.

Most likely you’ve heard of the “Debt Snowball” and the “Highest Interest First” approaches. In addition, I wanted to review 2 methods, which is certainly not new, but that you might be far less familiar with, such as the Debt Savvy and Debt Tsunami method.

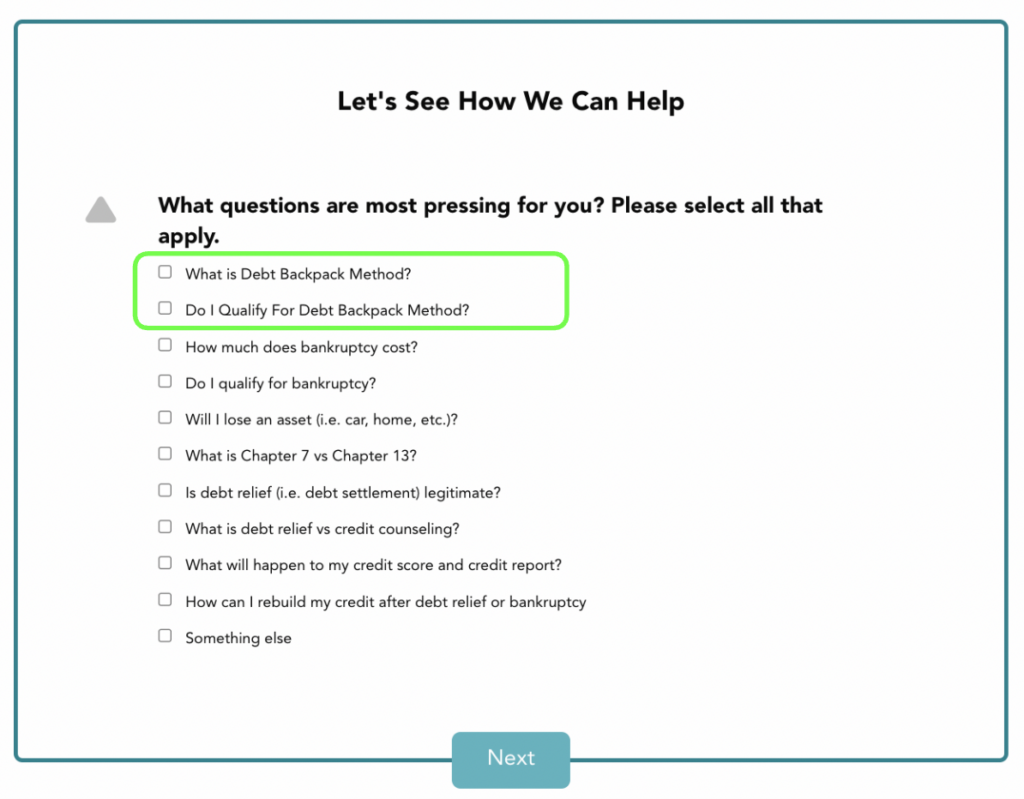

Let’s review 5 different methods to payoff debt starting with the debt backback method.

What Is The Debt Backpack Method?

The term “Debt Backpack Method” is metaphorical debt payoff strategy that likens debt to carrying a heavy backpack, where each debt adds weight, slowing down one’s financial progress.

Please watch this video explaining the Debt Backpack method.

The goal of the Debt Backpack method’s goal is to reduce the total amount owed, not allowing interest to accrue and continue to add rocks to your backpack to make your debt load impossible. Here are 2 things you need to know.

1. You Have To Qualify

In order to use the debt backpack method, you have to qualify although you may be able to also do it yourself. You can see whether they qualify and also share the cost, duration, pros and cons with Ascend Finance. The company has a 5.0 on Google based on over 300 reviews, and they provide free evaluations to see if you qualify in a simple phone call.

The process is easy, as you would just go to: https://tryascend.com/ and then you would click on the button “Get Started”.

2. Understanding Your Options

If you qualify, ask your debt analyst at Ascend information on all your options. Ascend Finance’s team specializes in understand all the options, costs and pros and cons, so they would be happy to share.

The debt backpack method may be the best option for you, but it can be helpful to understand all of your options to make the most informed decision.

3. Free Debt Backpack Method PDF

To help you along on your journey, I created a free PDF that you can download to help you understand the debt backpack method if you qualify. You would just click on the link, and then make a copy of the PDF. If you have any questions or run into any issues, please email me at [email protected].

Here’s how you use the free Debt Backpack Method PDF

- Write in how much you owe in each rock.

- Write how much the debt was reduced by.

- Color in the rock once it’s paid off.

Debt Savvy Method

The Debt Savvy method was popularized by Ascend Finance with the idea that your debt payoff method should be customized based on the perfect mixture of the snowball and avalanche method.

For example, if your debts are smaller, then the Savvy method would prioritize smaller debts. If you have high interest, it may go with the high interest.

It’s savvy.

To go with this option, you would just download the Savvy Debt Payoff Planner or checkout Ascend’s free Debt Snowball Spreadsheet, which I find is the best free one on the market.

The Debt Tsunami

Simply, the Debt Tsunami is a debt reduction method in which you pay off your debts in order of their emotional impact. This method tends to be extremely flexible and able to adapt depending on the personality of the individual. Here’s how I came upon the name…

In our physical world, Tsunamis are often cause by abrupt earthquakes, plate shifts, and even volcanic eruptions. This is also true in most successful financial turn-arounds. At some point, you’ve got to draw a line in the sand and say, “No more”! You’ve got to stomp your foot down and reclaim personal responsibility. This needs to be a tangible, singular moment which will help power the entire journey towards the shore.

At first, though, Tsunamis are nearly undetectable when they are in deeper waters. However, as the water begins to get shallower and shallower the wave grows exponentially in size and strength. In the beginning, slashing your budget and applying extra towards your mound of debt may appear to be futile. But as many have proved, constant effort and dedication will rapidly begin to compound. As your overall debt begins to get smaller and smaller, the scales start to tip in your favor as the momentum is nearly impossible to stop.

Once they reach land the destructive force of these natural phenomenon is undeniable. They will annihilate anything in their path, leaving little more than bare ground when they are finished. As you approach the end of your journey, you will be riding a roaring wave of passionate debt-reduction. You’ll not only have completely changed your own life, but you’ll be an awesome example of success for others. With no debt, your financial life will be the proverbial blank slate. Life will be yours to build, create, and live as intentionally and as passionately as you desire.

Ladies and gentleman, that is a Debt Tsunami.

Before digging into the principles a little deeper, let’s review some common issues with the popular strategies for eliminating debt.

Debt Snowball

This method encourages paying off debt by focusing your efforts on the lowest balance debt first. In theory, knocking out your smallest debts will help encourage confidence and build momentum. In addition, many people find themselves overwhelmed simply by the number of different debts they owe. In these cases, one less debt can go a long way in helping an individual grasp their situation even better.

In some specific cases, though, totally ignoring interest rates can end up costing you a lot of money. The biggest downfall of this system is the assumption that eliminating the next lowest balance will always build the most momentum. This simply isn’t always true, especially for different personality types.

Debt Avalanche Highest Interest First

By paying off your debt in order of the highest interest first, you ensure the quickest theoretical finish. Therefore a successful attempt utilizing this approach will result in paying out the least amount of money. This is very desirable among individuals who draw inspiration from detaching themselves from the emotions of debt altogether.

The biggest problem I have with this method is in the assumptions of a large amount of its supporters. You commonly hear that this is the only “logical” choice, or the most “mathematically-correct” method. The only reason you would not want to follow this is if you were “struggling” or if you were “irresponsible” or “lacked control”. I hear this kind of thing so much, it makes me want to vomit.

There is nothing wrong with simply choosing between two benefits, especially when one meshes better with your personal tendencies. My only problem is when there is a pretense that no benefit exists in any other method. Don’t forget that probability of success is a very “mathematical” concept. Or ignore the fact that it just might be the most important part of this equation.

What Role Do Our Emotions Have in Paying Off Debt?

For most people, the process of debt reduction is an emotional one. Often times, people allow their emotions to freely dictate their behaviors, which plays a significant role in deepening the levels of debt. There are two solutions to this problem.

- Attempt to remove emotions from the process completely. This is really what the “highest interest first” crowd tries to teach/implement. It’s the “logical” choice. The “mathematically-correct” approach.

- Recognize the emotions, identify with them, and leverage them to help you. I strongly prefer this approach. Rather then fight to eliminate them, I’d rather install new methods for handling them that embolden my values.

Why The Debt Tsunami Works

A major advantage of the Debt Tsunami approach is its flexibility.

For example, let’s examine the story of a fictional young couple whom is truly overwhelmed. They’ve recently taken back control of their spending and have a firm grasp on a budget. However, they are left starting at 12 different debts spread out amongst credit cards, car loans, two mortgages, and even family members.

In this case, the couple could receive a lot of benefit from the debt snowball approach. Eliminating the smallest debts first would allow them to quickly simplify, build momentum, and reinforce the positive changes they’ve recently made. However, let’s say the three smallest debts are a $500 credit card, a $700 credit card, and a $1000 loan from the in-laws. Unfortunately, the $1000 loan to the parents has caused some tension within an otherwise great relationship. The young couple would receive much more emotional benefit from eliminating this debt first. They would earn a piece of their dignity back, which would be priceless over the long journey ahead.

On the other hand, let’s view an example using an individual whom is very detailed oriented and excels at removing emotions from the process altogether. He too has recently drawn a line in the sand, but for him he sees no benefit in paying off his $500 loan from a family member. It hasn’t changed the relationship and was given interest free. Why would he pay it off now? He attaches no emotional benefit from this accomplishment. Instead he’d rather focus on his $6500 dollar credit card at 12.5% interest. He receives the most emotional validation from knowing he is pursuing the “optimal” method. He draws inspiration from knowing he will be out of debt two months earlier. He plans to celebrate by spending those months backpacking overseas.

In this scenario, our hero takes a totally different approach, but still is paying of the debts which have the biggest emotional impact given his values.

This is why I’m a huge fan of the Debt Tsunami. With all this flexibility, though, it’s easy to fall into a “do whatever works” mentality. This doesn’t produce great results for a large majority of people. Too much flexibility and we lose the awesome benefit that comes with a well-written plan or a set of easy-to-follow steps. Therefore, let’s find a balance by reviewing a systematic approach to creating your own Debt Tsunami.

A Step-By-Step Strategy

Create The Initial Mental Shift

You’ve got to find a way to create that first burst of energy. That underwater earthquake. The volcanic explosion. Write a Declaration of War. Freeze your credit cards in a block of ice. Sleeve your ATM cards. Tape pictures of your kids in your wallet. Track spending for a week. Make a list of everything you own and sell half of it. Try a cash budgeting system. Take a shotgun to your credit cards out in the back field.

Do whatever you want, but just do something. Start hating debt. You can always kiss and make up later. Remember, the entire effectiveness of your Tsunami depends on the energy of this first surge. Make it pop. It’s this spark that creates the momentum for all the events to follow.

List Your Debts From Smallest To Largest Including Interest Rates

A simple list. Don’t make this complicated. Name, Amount, Interest Rate. That’s all.

Why smallest to largest? In general, people will attach more emotional value to eliminating the smallest debt. More bang for the buck so they say. However, unlike the Debt Snowball, we won’t be totally ignoring interest rates. That information will help you judge in this next step.

Focus On The Emotional Connection With Each Debt

Starting with the first debt on the list, close your eyes and imagine paying it off completely. I don’t care if you think it’s corny. Do it anyway. Really try to get a gauge of how you feel about the debt. How long will it take to pay it off (run the numbers if you have to)? How do you feel about the creditor? On what did you waste spend the money? How much of a burden is this particular debt in your financial life? Is it secured or unsecured?

Stop. Jot down your thoughts on the list. Create a scale. Give it stars. Do whatever you want so you’ll remember what you felt. Proceed to the next debt on the list. Ask yourself the same questions. Start from scratch each time and really attempt to be open and honest. No one is looking. Continue until you’ve done each debt. If you get tired or start to have a slight headache, that’s a good sign.

Reorder Your List Based On Potential Emotional Impact

Now that all the hard work is out of the way comes the fun part. Look back over your list and make any changes that you need to. Move that 20% interest credit card up a couple spots. Push back that $800 student loan at 2.75% interest if there isn’t a big connection with eliminating it quickly. Order the debts by how awesome it’ll feel to eliminate them combined with how easily you can actually get that result.

Head Immediately Towards Shallower Water

Now that you have your list, the real journey can begin. You’ve already created the spark, the mental earthquake. But your work isn’t done. If you head out to deeper water, you’ll get lost at sea. The only way to build momentum is to go as fast as you can towards shallow water. Track spending, learn to budget, adopt frugality, and grow your income. With you new list as your guide you’ll be destroying everything in your path before you know it.

Your debt won’t stand a chance.

What are your thoughts on the Debt Tsunami? In what order do you (or did you) pay off debt? Did I miss the boat, or hit the nail on the head? Join in on the discussion by leaving your comment below!

The debt tsunami is a great concept. I like that it acknowledges that particular debts can have an emotional impact and prioritises repayments accordingly, without ignoring practical factors like interest rates.

It is also useful to remember the emotional feeling of being overwhelmed with debt when you’re making decisions about potential purchases!

Rachel’s last blog post..Keeping it balanced

Your comment about spending is spot on. Hopefully, the “singular moment” will be strong enough for you to able to reference it while spending. I know we do this in our daily lives. Sometimes we’ll be tempted to spend money a little outside of the budget and often times just thinking about that moment helps us maintain our focus!

Absolutely, it really does work.

The only debt my husband and I have now is our mortgage which we’ve paid ahead on. There is incredible freedom in that.

Every bit of sacrifice IS worth it. I got really sick 18 months ago and couldn’t work for a year. Because we were living essentially debt free, we managed until the insurance payment came in (over 6 months). I then had the freedom to concentrate on getting better without worrying about money – and I can tell you that makes a HUGE difference.

Rachel’s last blog post..Off the Couch – Fitness for Free

Good article on the psychology of debt. I know many people use this approach even if they didn’t have a name for it. A good example is people who pay off student loan debt early or first, even if it is the cheapest debt they have, because they have a need to be rid of it.

You bring up a good point about people using this sort of system without really having a name for it. I totally agree. I am big believer in the power of following a system, though, so I’m continually working on refining this to help ensure we stay on the right path.

I’ve always been the sort of personal to attack higher interest debts first, because I never really had emotional feelings about any debt. I never had any family loans, and student loans, credit cards, car loan, etc never really made an emotional impact – they were just debts that needed to be repaid; nothing more, nothing less. I’d just try to reduce the gross number.

Probablity of success is a key component. For me, there was never the thought that I would fail. But if someone doubts their success, than debt snowaball might make sense for them.

Kosmo @ The Casual Observer’s last blog post..News Recap

Yeah, it seems that you are one of the people I referenced whom try to eliminate emotion from the process altogether. I still think this concept works for you too though. It’s important to still think about each debt, and realize that you don’t attach nearly any emotional value to them (which you have already). With nearly no emotional value attached to them, it’s easy to see how you obtain more validation from paying off the highest-interest first. That’s why I kind of think this process is cool.

I like the idea of personality types in the discussion…. I personally like the traction and footholds gained by dumping the small ones first but I understand the other side too. The tsunami takes both into consideration… good idea.

The key to any of the plans is to take action… and in reality if you’re ‘doing nothing’ today then the math behind ANY approach is sound!

Thanks for sharing this hybrid approach.

Dave

You are totally right about action being the key! Anyone can make a theory sound good, but weaknesses really start to show once you put it into action. That’s why I decided to end this post with a step-by-step plan to get things rolling. I couldn’t agree more!

You all know how I feel about reclaiming personal responsibility 😉 …well said Baker.

I really appreciate the rich and useful content of this article, and also love the literary use of parallels between our personal debt reduction phenomenon and the natural phenomenon of tsunami.

I am currently “riding a roaring wave of passionate debt-reduction.” and will never look back for the next wave! I’m riding this one all the way in BABY!!

Matt Jabs’s last blog post..The Importance of Financial Mentoring

You and me both buddy! We should learn how to surf!

Pingback: around the web: when allergies attack edition | the ¢entsible life

Great idea, and great concept. I think it’s important to take the emotional aspect of debt reduction into the equation, because it does have an affect on how you’re able to pay off debt. I think the debt snowball does that by helping you to have the quick wins, and the emotional highs of paying off debt quickly and seeing the snowball effect.

I think you method takes a bit of both worlds, and combines them in an effective way. Would it be more effective than the other methods? It’s hard to say, but I think it’s definitely creative, and worth a shot for many people.

As Dave Ramsey says, ” You can’t go wrong getting out of debt!”.

Bible Money Matters’s last blog post..Book Giveaway Winner, Beautiful Weekend Weather, And The Start Of A New Week!

You are exactly right! As long as you are eliminating debt, you can’t go wrong. But when those times come when we start to get a little sluggish, a fresh approach is definitely worth a shot! Great insight!

Pingback: -> Book Giveaway Winner, Beautiful Weekend Weather, And The Start Of A New Week! | Bible Money Matters

I’ve always seen both sides of the debate as being slightly incorrect, but the “tsunami” approach definitely addresses the issues that I had with both methods of debt repayment. I think, in the future, this is the method that I will both do and recommend.

While one method may save some money, the other may have a greater chance of success. The tsunami combines the emotional needs and the financial implications by simply asking, “what’s more important to you”? Once you understand what is important to you, building motivation is easy.

Personally, we have only student loans and a line of credit. The line of credit goes first – it has the smallest balance, the highest interest rate, and the greatest emotional affect. We’re lucky to have a simple answer, I guess.

Alan @ Saving For Serenity’s last blog post..Viral Films – A Weekend Review

Haha, you do in fact have a simple answer! Regardless, though, I’m glad the concept connected with you in the same way it did with me!

Well, you know what I think already…. great idea. It’s all about what can get you motivated to pay off the debt. If you’re not motivated about highest-interest-first and that’s the way you try to do it, it still may not work for you. So I say find your inner tsunami and just do that – you’ll reach the shore faster. Great metaphor, can extrapolate to other areas of life, too!

MoneyEnergy’s last blog post..The Real Costs of Graduate School

“Find your inner tsunami” – Nice! I might just have to use that coming up…

Definitely like.. love… this article.

The parallel to a tsunami is spot on and a great image.

I will say that I am very detached from things like money and would probably make you vomit as I say “mathematically this one makes the most sense.” BUT, I do acknowledge that for some people it makes more sense to do things differently.

In the end, if you are paying off debt that is all that matters, right?

MLR’s last blog post..Save Money On Gas By Knowing Your Cars Cost Per Mile (Thanks Fuelly!)

You, sir, are far away from vomit-provoking ;-). I was mainly referring to those who discount other methods are for only people who lack responsibility or control. As if, everyone it’s a lesser model to be spat on!

As you and Peter have both pointed out, if you are motivated and paying off debt you are ahead of the game!

Right on, well said. I love giving it a name like Debt Tsunami, Debt BeatDown, Debtsaster 2009… I could go on for days. You’ve put a name on it, we are Debt Snowballing but that dang Citibank card just made me angry, cranking my interest rate to 29.8% that put them first on the list regardless of where the others fell. It feels so good to have that monkey gone, now continue with the TSUNAMI!

Thanks for the article.

Hey, this is a perfect example of what I’m talking about! Way to kill it!

Please stop by I gave your blog an award!

Debt Tsunami is a great concept and will work well if people approach it with discipline it requires. I am also in favour of Debt Snowball method as its easier and does not really ask you to differentiate debt based on emotions. All debt dont necessarily have emotive connotationas and there the debt snowball might work best, Hoever overall debt tsunami is an effective way of deling with debt too.

Rajeev Kumar Singh’s last blog post..CREDIT CARD THAT CAN NOT BE MISUSED OR STOLEN

I agree. In times where I lack emotional connection with a debt, I also default to the snowball. This is why I think it’s best to start your list in snowball order, but to adjust it as the emotional impact becomes more clear.

Aloha!

Living on a small island in the middle of the Pacific your post caught my eye….living in the real world of credit cards, loans and increasing interest rates your idea caught my soul! I for one have an emotion about everything 🙂 So this approach is perfect for types like myself and the people I coach and write for also.

Perhaps you can continue with this idea and help some of us (less focused types) keep on track?

In any event you have caused me to stop and take stock and for that I say a big Maui Mahalo!

Gina’s last blog post..Health and Wellness of Community

Gina, I loved the process of writing this post and will definitely continue down that path! If we ever are in Hawaii, I’m going to have to hit you up! Maui Mahalo… whatever that means!

Love the Tsunami idea because of it being based on emotional impact! Right now… I feel like I am in a forest of bamboo and my ninja skills are ready to run through and chop it all down! ha! I’m so sick of this debt. Time to banish it once and for all! 🙂

Money Funk’s last blog post..(Near) No Spend Month Project

Haha, sounds like my kind of strategy!

Working hard to stop the younger generation from making this mistake – but video game systems and expensive gym shoes are screaming out to them! I am just trying to be louder. ha

I think any approach that keeps you going is the one to do – i prefer the idea of paying off high interest first however if encourgement is needed and they start small and build up – then the end result is what counts.

I love the take no prisoners attitude to fighting debt like a war. No pussy footing around and cutting out a latte or whatever. Thanks for the kick in the pants!

Chris’s last blog post..How to Be More Persuasive in Business and Life

No problem. I love kicking and getting kicked! We all need it!

Pingback: Budgeting Tips: Back to the Basics | My Life ROI, Getting the Best Return On Life

There is a third way for revolving debt that beats highest-interest first in terms of optimality (usually), but it carries a *very large risk* of winding up in a deeper hole if not done with strict adherence. It involves clearing out a reasonably high credit line in the hope that a teaser balance transfer offer will appear, then juggling the debt so a large amount stays at those low rates while you aggressively pay it down.

It takes a true commitment to always paying off the same (over-minimum) amount and not adding to your debt to make this one work, but it can shave months off the repayment plan and bring effective interest rates way down. It starts similarly to the debt snowball, focusing efforts on a line with low utilization, then switches to working on highest-interest debt when a transfer has been effected.

Although this kind of stuff in theory can save you some time/money. I find the whole process very distracting and risky. Therefore, it’s better for me to just simplify and concentrate my energy on increasing motivation and passion.

Your post shows that there are many ways to get out of debt. I like your flexible approach. Since debt can be quite a complex issue, I don’t think there is one single answer to get rid of any debt under all circumstances. You got to be flexible and approach each person and each person’s many debts individually.

That’s exactly why I fell in love with this post when i wrote it. I realized I had been using this method for a while and how great the flexibility was. As long as you still maintain a written plan this can be a huge boost!

Regarding Rachel’s post (#3):

“The only debt my husband and I have now is our mortgage which we’ve paid ahead on. There is incredible freedom in that.”

Unless this topic has been covered before, Baker, will you please explain to your loyal readers what a colossal MYTH this belief is? The bank doesn’t care if you’re “ahead”, they only want a payment every 30 days. Hence the value of a well-stocked emergency fund.

Hi Diane. You’re right and I didn’t make it clear in my previous post (for the sake of brevity – but I can see it gave the wrong impression).

I’m not sure if you have the same arrangement in the US but we have a mortgage offset facility. It is a linked savings account that we can deposit into and withdraw from at any time with no charges or penalties. Each dollar in that account reduces the interest payable on the mortgage, as if that amount had already been paid ahead.

However we do have to actually transfer the mortgage payment from that account into the black hole each month.

So you are exactly right. The ‘paying ahead’ reduced my interest and allowed me freedom (I could withdraw the whole lot if I needed it for an emergency for example) and can also incrementally use those savings to pay out the mortgage and keep up with payments each month.

This arrangement is good because the money is able to be accessed and also reduces the interest payable on the mortgage.

I apologise again for lack of clarity!

Rachel’s last blog post..Keeping it balanced

Hi Rachel. Thanks for your kind, thoughtful and well-thought-out-response. There is nothing like that in the US and you wouldn’t believe how often I hear people say they’re “paid ahead”. Unfortunately, they find out they’re wrong when they can least afford to be. Where are you writing from? I wish the US Mortgage System was as progressive as the one you’ve described. I often feel I’m not making good use of my emergency money. Your system would certainly make me feel more of that “incredible freedom” you’re referring to. Thanks!

Hi Diane

I’m in Australia. 🙂 Our banking system is for the most part pretty good here.

Of course, like anything, a mortgage offset is not a perfect solution. Sometimes the interest rates are higher on these accounts (although we got a very good deal and there was no difference in interest rates between different mortgage accounts) and you need to factor that in when working out if its the best system for you.

Our pay goes straight into that mortgage offset account each fortnight and we transfer out to pay bills and the mortgage of course.

Rachel’s last blog post..Keeping it balanced

Aha! A version of this has recently surfaced here. I believe the account is set up through a third party after the mortgage is in place. I’m also not sure it’s as easy to withdraw funds needed for other purposes. The emphasis is on paying your mortgage off early, but I have a couple of hesitations with that: 1. I am not a fan of prepaying cheap mortgage money vs. having personal savings and 2. I can’t imagine giving up control of my paycheck! Thanks for sharing your perspective and experience. I think I’ll give it a second look!

Pingback: Weekly Links:5/23/9

Pingback: This past week’s blog reading » JoeTaxpayer

Although I’ve been following Dave Ramsey’s debt snowball approach, I’ve inadvertantly been using the debt tsunami. Although I have one and only one credit card that I no longer use, I still have a balance of $2900 at 9.9% interest and should be paying this off first for the debt snowball. But a more emotionally important loan is a home equity loan of about $6500 at 5.25% interest that I’m working on paying off before the credit card. Except for this loan my house is paid for and until this loan is gone, I don’t feel like I truly own my house. In addition, it will free up an extra $160 to throw at my other loans. Yep, the debt tsunami is the way to go!

Awesome, to hear yet another example of this method in action! Keep it up and I’m sure you’ll knock both of them out in no time!

Pingback: The Simple Dollar » The Simple Dollar Weekly Roundup: Slight Redesigns Edition

Enjoyed your article. However, tsunamis do not grow exponentially as they near shore. Wave height is a multiplier, adjusted by gravity/friction, etc., of the compression of the length of the wave. It becomes shorter and higher along a roughly straight line.

Good point. But that doesn’t fit the theme as well ;-). They do appear to grow exponentially though as they come closer and closer (due to shallower water and depth perception). That’s my story and I’m sticking to it :)!

This is a GREAT idea. Our current plan is to pay off the home equity loan, pay off the house, and be done. But your post got me to thinking–the emotional payoff for owning our home is much greater! Will have to talk this over with the hubby tonight.

And thanks to Trent for connecting us to you.

Brown Thumb Mama’s last blog post..Why Didn’t I Think of That? Wednesday

I’m glad you connected with the post! And, yes, a big thanks to Trent for helping turn on a boatload of readers to this concept!

Pingback: Debt Reduction Methods and Philosophies: Snowball, Avalanche and More - Consumerism Commentary, personal finance since 2003

Pingback: Simple Weekend Round Up - Graduate Edition | Simplified Financial Lifestyle

Hey – Thanks for the article! Whilst not in out of control debt myself it’s good to know so I can help others, and continue to manage and control what we are allocated as well.

Welcome to Australia by the way ( I thought I saw an entry titled “setup new life in Australia”)

Send me a mail sometime!

Cheers

J

Jon Coleman’s last blog post..Repair or Replace?

Pingback: Moments of Fame | All The News

Pingback: One Man’s War on Debt – Part 2

Pingback: What Order Should I Pay Off My Debt? | Frugal Dad

Pingback: Get Out Of Jail Free Card - Visualize Yourself Without Debt | The Happy Rock

Pingback: DebtFreeDadof6 » Blog Archive » In the Beginning… Credit Cards

Pingback: Yes, We Paid Off The Tahoe | Frugal Dad

Pingback: Building Financial Momentum — StretchyDollar

It’s true. When you look at your unpaid debt, you would wish the earth to eat you up or perhaps vanish into thin air. But debts are debts so we’ve got to face it. I like the debt tsunami – it makes anyone hope that there is still a way to eventually shove your debts away. Don’t get me wrong; what I am trying to say is that with small and frequent installment payments, a mound of debt can totally disappear before you notice it. That’s how I understood the debt tsunami.

For tips on personal finance, visit http://www.mikesmillions.com/blog.

Pingback: 10 Personal Finance Blogs You're Missing Out On — Automatic Finances

Have a question for you guys, that hopefully you can share your opinion with.

First of all, this is a great blog entry. Thanks.

I have $34,000 in student loans at an interest cost of only 2.6%. At the time (3 yrs ago), I locked that rate in, and I extended the repayment plan to 20 years. Hence, it only costs $220/month. I figure, why not since the rate is so low.

Even after rates have come down, i’ve got about 90% of my CASH locked up in a 4.1% yielding CD, and about $52,000 in a 1.5% savings account and brokerage account to trade the market.

My question is, What would you guys do if you were me? The $34,000 Student Loan is my LOWEST debt compared to my home mortgage at 4.6%, rental property mortgage at 5.25% (cash flow positive) and vacation home mortgage at 5.875% (which i don’t want to throw money at anymore since the market is so bad).

Would you guys try and payoff the 2.6% student loan using the snowball/flake method? Or, pay off the rental property mortgage of 5.25% (2nd smallest loan)? Or, any other suggestions ie don’t pay the student loan off b/c it is so cheap?

Thnx

BulldogGin.com

Pingback: Lack of Sleep and the Internet « Adventures with Little Miss

My favourite (Canadian spelling) part of this post was ‘In the beginning, slashing your budget and applying extra towards your mound of debt may appear to be futile. But as many have proved, constant effort and dedication will rapidly begin to compound.’

In the book I’m reading, The Slight Edge by Jeff Olson, he talks about this exact idea. How it is not a catastrophic event that leads to failure or a quantum leap that leads to success. It is the little things we do everyday that either lead us up or down the success curve. All things that are easy to do, however, they are equally easy not to do.

Just like cutting $50 per month off the entertainment budget to eliminate a credit card debt. Easy to do… Easy not to do. We just have to decide on which side of the debt Tsunami we want to ride. The elimination side or the creation side.

Cheers folks,

Guy

.-= Guy Gagnon´s last blog ..Book Review: Automatic Wealth by Michael Masterson =-.

I stumbled across this site via MSN (albeit after quite a few clicks!) and I’m glad I did. My wife and I are currently in the throes of battling our debt (I just paid off two revolving credit facilities, and while both were interest-free, we’re very happy about being able to snow-ball the monthly payments for both towards what I believe will be my auto loan).

Right now I’m struggling with taking the plunge and pulling out just shy of 13k from savings to pay off the auto loan (and saving close to $125 per month in interest and fees, not to mention being able to drop comprehensive insurance coverage in favor of liability+collision). While I know it’s a smart move overall, I’m very much like my father in regards to having a solid amount of money in savings… I’d still have roughly 5k in savings, but that’s really only 3-4 months cushion should something happen to my employment (I’m on a long-term contract with the US Government, but it’s still a contract).

Any thoughts?

Pingback: Getting Motivated About Tackling Credit Card Debt | MoneyEnergy

Great content. I can see your growth in your articles.

I believe in much of what you are preaching. Everyone is different and has to approach it their own way. Great examples in your article.

Thanks

Dave

LifeExcursion

Great concept of incorporating emotional issue in repayments of debt since we are humans not computers!

.-= mewithoutdebt´s last blog ..Managing Debt Without a "Debt Management" Plan =-.

Pingback: Tyler Durden's Guide To Personal Finance | Man Vs. Debt

Pingback: Pay Off Debt:Tracking your debt repayment goals on iPhone – Get Organize and Getting Things Done | The Productive Organizer

Pingback: Slik hopper du av kreditkortkarusellen « PersonligBudsjett.no

Pingback: My Debt Regret » Blog Archive » Not Knowing Where to Start

Pingback: I'm a Big, Fat Hypocrite: Our Updated War on Debt | Man Vs. Debt

FYI, the link on this page to “Sleeve your ATM cards” is broken.

Pingback: Pay Off Debt - The Hybrid Debt Snowball and High Interest Solution | Debt Free Adventure!

I’ve heard that the “Highest Interest First” method is the “mathematically-correct method”, as well. I believe it IS NOT. I have used some form of the Debt Tsunami method from time to time, and I agree it should be part of the mix. But the question of what really is the quickest and cheapest method has become an intriguing – and therefore, emotional – issue to me, as well. For me, the best method is to add your monthly payment to the amount you lose in interest each month. That is the amount you are losing the use of each month. Rank these, highest to lowest, and pay off from top to bottom. The “Highest Interest First” method fails to consider 1) that you may have a high interest rate on a low balance and are not losing that much money on that debt each month; 2) that you may have a low interest rate on a high balance and are losing a lot of money servicing that debt each month; 3) that your monthly payment amount on any one debt is taking that money away from paying down some other debt. By combining monthly payment with amount paid to interest each month, you take care of all three issues.

Michael, this isn’t correct. It doesn’t matter what your balances are – paying the highest interest debt first is always the quickest and cheapest approach mathematically.

Suppose you have the following debts:

Debt 1: $100,000 at 6% – monthly interest $500.

Debt 2: $1,000 at 24% – monthly interest $20.

Every spare dollar you put into debt 1 saves you $0.06 per year in interest. But every spare dollar you put into debt 2 saves you $0.24 per year. In the long run, choosing to pay debt 1 first could cost you a lot of money.

Excellent article. I’ve had a couple of false starts in my plan to axe credit card debt, and I think the thing I’ve been missing is the emotional element. I can apply all kinds of logic when I’m sitting at my desk looking over the budget spreadsheets, but it doesn’t help when I get out in the wild and see a fabulous pair of shoes that will go with everything in my closet. So I not only need to create that first burst of energy and debt hate, but find a way keep it going for the months and years that it will take to pay everything off.

.-= Reality Tiara´s last blog ..Mortgage banks prefer foreclosure =-.

Pingback: Good Reads

Pingback: 100 Inspiring Personal Finance Posts for the New Year | Accounting Degree.com

Exactly! Making a drastic change in your financial life is exactly the way to start getting rid of debt. BUT I think the biggest problem with drastic change is keeping the momentum going. So, setting little goals along the way is how to keep the ball rolling. As you accomplish each individual goal, celebrate your win. At least that’s MY opinion.

Good luck to everyone getting out of debt! Thanks for the great post.

Pingback: How To Make The Most Of A Windfall - Amateur Asset Allocator

Very good concept! I have used something similar in my path to debt freedom. I like your ideas and you have a nice site. I also blog about my financial freedom on my blog “Dollars Not Debt”. Keep up the great work!

Dollars Not Debt

Whilst I like the concept of the debt Tsunami, it’s essentially a re-hash of the snowball approach.

The important thing is to stop spending and start doing something.

Cut up the credit cards and start hating debt and sell half your stuff are all important things to do as you say.

There is the other option of looking for additional income either part time or full time which will pay you more money to accelerate the paying off the debt.

I don’t know that it’s a rehash of the snowball, not if you’re talking about the Dave Ramsey one. That one is strictly a smallest to largest approach. This is an anger approach. For instance, in paying off my debts, I paid off Bank of America first, which had the highest interest rate. Then Citibank, which was third. Now Spirit Airline, which is second, and last Capital One, which is the lowest interest rate. This is based on the fact that I was PO’d at BofA for jacking my interest rate 14%, then I was just sick and tired of looking at Citibank, then realized I was paying the same amount of interest for Spirit as for Capital One, even though I owe a grand more. My payoff is based on which card I’m most angry with at the time, and believe me, that’s worked MUCH better for me than either the snowball or avalanche.

@ AJ –

I did my debt snowball similarly. I listed my banks from first to last in terms of which one I HATE THE MOST!. And that really got things rolling. I’m down to my last CC and I’m a little over a year in.

However, as my luck goes, I paid off Bank of America credit card and figured I was done with them — I told them to ‘go to hell’ and ‘I hope you all get herpes.’ Six weeks later, they bought my mortgage. There is no escape from Bank of Hell.

What an awesome life you three have! I too am on the road to simplicity and have been purging on Ebay and Craigslist. As for the debt Tsunami I concur! I had at one time almost $100,000 in debt and $12k of it was to my father at no interest. I paid him first because holidays and even ordinary visits became strained under the weight of the loan. Banks don’t give you dirty looks across the Thanksgiving table, family will and did.

I am ready to list my stuff. I live in one bedroom and a closet with my elderly parents caring for them. I have had to downscale from when I had 1200 sq feet with my own family at home. I still have too much. I am planning an extensive trip through India in about a year and your tips are just what I needed. Thanks for sharing!

Ellen

This is a good way to eliminate debt. It should be called pay your friends and family first then your creditors. I have some strong feelings of hatred towards all my debt. But my biggest problem is paying off one debt and then knowing that another debt is there just around the corner.

Pingback: Financial Planning Resources

Pingback: Organización de finanzas personales (IV): ¿cómo salir de deudas?

Great way to take all factors into consideration when deciding which debts to eliminate first – rather than just looking at the amount and the interest rate. Life isn’t just about the numbers – it’s about emotions, and quality of life and motivation. . . so really looking at the emotional impact each debt (or the paying off of each debt) has on you, and your life, has a wider breadth to it than just focusing on the numbers.

Pingback: how do I snowball here - Page 2 - Saving Advice

Debt is the enemy!!

Simple rules….30 yr old, 40 yr old, 50 yr old

1.The worst is credit card so pay off all before you are 30 then pay in full every month and never pay another penny in interest..

2. Next worst is car loans pay off all before 40 then always pay cash for a 2 yr old car and keep it 10 years.

3. Finally pay off all mortgage debt before 50.

4. Retire in your 50’s or 60 at latest.

If you can’t follow this then you are spending more money than you can afford to.

Shaun Donovan – good idea, if idealistic and overly simplified. This plan does not help people who are already saddled with credit card, car loan, and mortgage debt in their 40s and 50s. I absolutely agree that debt is the enemy, and I hope to never borrow another penny, but sometimes reality is beyond our control. Paying cash for a 2-year-old car is simply not feasible for many people, nor is paying off all mortgage debt before 50.

Expecting to keep a car until it is 12 years old is unrealistic. I’ve driven a few cars into the ground in my life, but have never had one last that long. I cannot have a car that’s unreliable, and after a certain point, they cost more to maintain than the car is worth. If you’re going to attempt this, keep a big fat savings account for towing bills, rental cars and major repairs, which always happen when you least expect them.

It IS feasible and I am 40 years old and on step 3. With the debt snowball….I calculate I will be mortgage and equity line free by 2018!!! It’s all about what you spend and not what you make. 🙂

Reality Tiara you’re right i forgot to mention the most important part.

ALWAYS Live BELOW your means and save at least 20% of your income, half in retirement accounts and half in regular savings . Saving must be your priority. You’ll have enough to pay cash for cars etc. As far as cars that last… always buy hondas, acuras lexus’s and toyotas that will easily last the 12 years and 150k miles.

I’m gonna be honest. I really think you hit it on the head with this one. Your Debt Tsunami is really the best of both worlds (snowball and highest interest rate first). Everyone I’ve ever talked to always has those couple debts that eat them up inside the most. When they think about being in debt they first think about those debts. Whether it be $ owed to a family member, friend, business partner etc.

I really like this approach and I’m going to start recommending it to some of my readers. I really think it could help people gain the momentum they need to get rid of their debt FOREVER!

Pingback: The Debt Tsunami Method for Paying off Debt

Thanks for the awesome idea of a Debt Tsunami. I enjoyed reading the comments from others as well. I certainly know firsthand how much of an emotional burden debt is. It is painful to think that if I was able to pay off all my non-mortgage debt tomorrow, I would have over $600 extra a month!!! Just imagine how fast I could save a substantial amount of money! I plan to tackle this assignment immediately and hope to remain focused enough to accomplish it as fast as possible. I think I really just needed a kick in the a$$ to help get focused!

Pingback: Stop Living Paycheck to Paycheck

Pingback: How NOT to Suck at New Year’s Resolutions

Pingback: Personal Finance Strategies for Life Long Prosperity | Daniel Hoang

Pingback: Morning Rituals « Lunasea Life

Pingback: Digging out

Great post. I’m figuring out my highest interest rates now. I had one credit card that I froze two years ago with a 300 dollar limit I haven’t paid. And a large amount worth of a traffic ticket. That’s pretty much it.

Baker –

Hey! We met at SXSW in 2011 at the Copyblogger party. David Crandall of Heroic Destiny. I realize this is an older post, but I’ve read it several times over the last two years and it definitely makes sense (and cents for that matter), to do it this way. I know how much I owe, but I have yet to put the hard dates to learn how long it would actually take me to pay off my debts using this method. I have several websites, that are mainly hyper-local event based, but you’ve inspired me to start a new hub that’s I’ve decided to focus on wealth. It’s a little bit a of a spin. On it, I plan on sharing my journey to becoming a networth millionaire from Internet properties. It’s also sort of a lifestyle design motivation website. Anyway, I hope you’re doing well. You have a beautiful family.

Keep up the good work.

Neil

Pingback: Get Out Of Debt The Adam Baker Way – Man vs Debt | My One Resolution

This post really spoke to me. I am just getting my list made this week. Your summery of the different stratigies is a big help. Thank you!!

Pingback: It’s Time to Build Cash and Get Out of Debt

Pingback: I’m 30 yrs old and I’m debt FRREEEEEE | The 7th Rock

Pingback: 4 Quick Actions You Could Do Today to Unplug Your Life and Find More Mobility | Discover Share Inspire

Pingback: I Wish I Could Buy But… | Foreclosures Now

Pingback: 10 Shattered Financial Templates - Untemplater — Untemplater

Pingback: The Debt Snowball: Our Chosen Method of Getting Out of Debt

Pingback: The Psychology of Paying Off Debt | Save Money Blog

Pingback: Logic and Emotion: Why Smart Money Management Isn’t Just About Math | KM Sciences

I am glad you wrote this article. I also combine debt payoff methods. I have all my debts listed from smallest to largest with the interest rates next to them. I can’t justify paying off my $200 debt when that is the bill with the lowest interest rate. I focus on the higher interest rate bills monthly, but if I have a lump sum I can use, I like to use it to pay off a bill. It’s not necessarily the highest interest rate or the lowest balance, but if I get $1800 and I have a bill that is $1400 and one that is $3500, I pay the $1400 bill and get rid of it forever. Then I take that payment and roll it in to another bill. I feel satisfied that I am taking care of the highest interest rates, but also get the satisfaction that I have fewer debts to take care of after I pay one off.

Pingback: Seven Years of Fiscal Responsibility | Jackpot Investor

Pingback: Finance bloggers posts I like | Kylie Ofiu

I just found your blog and have learned so much already. I like the Debt Tsnaumi concept.

I have a small debt that I was almost taken to court over and I settled instead..it caused me a lot of emotional distress and paying it off is more important then my larger debts.

Pingback: Digging out — My Life Better

When my husbaand and I were in a ton of debt, I used a site called, whatsthecost.com. It allows you to see all the scenarios, what the cost of them are, how expensice consolidating into your mortage is and a whole bunch of little goodies. It also creates a to the cent payment plan. The guy who runs it, runs it to help people…. so folks, it’s free because someone cared.

Pingback: Debt Reduction Methods and Philosophies: Snowball, Avalanche and More —

Pingback: A Hot-Water Heater and New Tires Didn’t Stop Us: Joan’s Mid-June Financial Update

Pingback: 3 Ways to Get Out of Debt |

Pingback: 6 Reasons We Chose NOT to Use Debt Settlement, Debt Consolidation or Bankruptcy to Pay Off Our Debt

Pingback: Snowball vs. Interest vs. Emotional Debt Reduction « Homestead Freedom

I firmly believe paying off debts from smallest to largest is better because the psychology of seeing some success of paying a debt off is worth much more than saving a few bucks in interest. People want to see and feel success as they utilize the debt snowball technique.. The positive reinforcement of paying off a small debt helps motivate debtors to attack the next biggest debt. It’s all about behavior modification.

Hello,

Any suggestion on how to get out of debt from Student loans.

– The government will not let you claim bankrupcty unless you are distitude (I checked) and by then it is too late.

– I had to ask for hardship forebearance because I cannot pay what the gov. want for the loans plus have enough for food & rent but the interest keeps building (which makes my 100K now 120K in just a year and no way to pay it down with that going on.

– No seeming hope for a job that will pay enough to pay it off and enjoy life.

BTW – I never got to even finish school because my wife got laid off and I had to quit school to go back to work for food and rent.

Feel trapped and hopeless.

Any workable solutions?

I’m sorry, I don’t have any good answers for you. I had the same problems you did and put my student loans into forbearance until I could afford to pay them, which was a matter of years. By then, my loan balance had more than doubled due to interest. I’m able to pay some now, but even at $500/month, I will literally be paying these off until I’m eighty.

Student loans are a trap, and IMO lenders need to be a LOT clearer about this with applicants. It doesn’t matter whether you graduate, or whether your income actually improves after you do – they have to be repaid just the same. Unlike any other debt, you cannot discharge them in bankruptcy unless you can prove additional “undue hardship”, which is very difficult to do. Some people do manage it though; if you are in a bankruptcy situation you may want to research how to do this. I went through Chapter 7 two years ago and my student loans are my one remaining debt.

Very good read. Have used this method before. My only difference was after a debt was paid off, I reassessed which debt to work on next. Time does seem to have changed my priority’s on debt. 🙂

Pingback: Relaunch Your Life: 5 Lessons from Life After a Double Lung Transplant

I have been using a slightly similar method to reward companies with good customer service. So that one £200 debt was paid off fairly quickly after some pleasant chats on the phone, and another of about the same size is still being paid at £10 a month due to their bullying attitude and continual nagging at me to increase the rate. I’m paying them off last of all and thoroughly enjoying the idea.

I chose to look at my debt from a different direction.

If I had to declare bankruptcy right now, what wouldn’t I be able to eliminate?

For me, that is student loans and my car, because the government sucks and I need to keep my car. For others, their house might be on this list too, but I’m willing to let the house go.

That totally changes my approach since I’d want to be completely debt free if I had no choice but to go the bankruptcy route.

My student loans should be paid off by the end of February. I hope to have the car paid off by the end of 2013.

I’m stock piling a ton of possessions to sell that I hope will be enough to wipe out my credit card debt.

That leaves the mortgages. I’m still debating trying to sell vs taking in a boarder to help pay down the mortgages.

If I sell, I’m back to paying rent. But if I pay off the mortgages, I have a place to stay for cost of upkeep, insurance and property taxes, which hopefully would cost less than rent.

Pingback: Another Debt Reduction Strategy: Pay Off the Most Painful Debts First

Pingback: SoRaspy - SoRaspy: Another Debt Reduction Strategy: Pay Off the Most Painful Debts First

Pingback: What’s the Best Way to Pay Off Debt?

I have never heard of the Debt Tsunami before. We used the debt snowball method to pay off our debt, however, I can totally see how this would work as well.

I do NOT agree. I am a banker and have taught budget counseling for years. Successfully paying off debt is, in no small way, tied to a change in behavior. To change one’s behavior, they need to see and feel success. They do that by knocking out the smallest debt first and then snowballing that payment on top of the next smallest debt to get that one paid. The small victories encourages the person to work toward paying the next debt off and so on.

The debt snowball is THE best method…hands down.

Pingback: 3 Steps Toward Doing Work You Love | Donald McAllister

Pingback: Adam Ginsberg’s Guide to Paying off Debt | Adam Ginsberg Marketing

Pingback: Adam Ginsberg’s Guide to Paying off Debt | Adam Ginsberg Student Websites

Pingback: Five Basic Rules for More Cents | Saved Cents Blog

Wow – Like it. My husband and I made our list of debts and created an order of how to pay them off. Thanks for your support and help – Just by creating the plan I feel like we did something…that is a start.

Pingback: The True Costs of College: How I Plan to Pay Off $20,000 in 3 Years | Diaries of a Wandering Lobster

Pingback: 10 Tips to Reduce Your Debt