[share_sc]

Note: This is a post from Joan Concilio, Man Vs. Debt community manager. Read more about Joan.

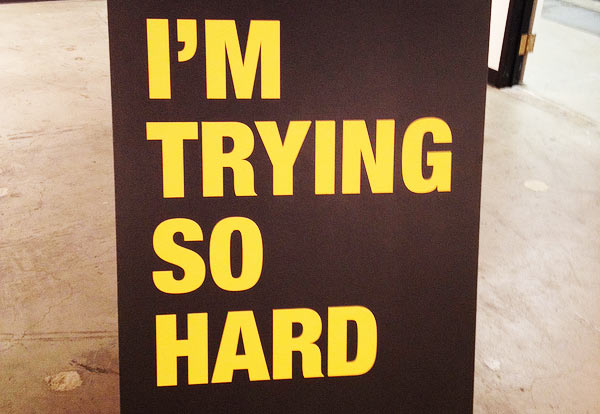

Huge news, everyone!

Our debt balance has made huge strides this month. It’s down $3.29 from where we finished last month.

And I couldn’t be happier.

We are making progress again

Last month, I shared that we ended the month $9 and some change MORE in debt than we started it. I was happy with that number – because we busted butt to make sure we didn’t end up in a bigger hole.

This month, we sorted some things out financially and reconfigured our plan moving forward. We could have made a larger dent in the debt, but we chose to wait, knowing we have some expenses coming in the next month.

We didn’t hit any Very Next Steps (which you can see in detail here on my Joan’s Finances page). But we hit the goal I’d secretly set for myself at the end of last month: to be able to report, this month, that we were moving in the right direction.

Big things are in the works

I don’t have a lot to share in this month’s update. We’re happy, we’re motivated, and we have some clear plans that will have us showing some SIGNIFICANT progress again around September or October.

Is it the best thing in the world that our debt repayment has become a treading-water exercise in the past couple of months? Of course not. But it’s not the worst thing, either.

As of this month, we have paid off $32,901.75 in debt since April 2011. We have $56,785.48 to go. At the end of this year, thanks to some financial changes we’re making (and that I’ll talk about as soon as I can!), we fully believe we can almost reverse those numbers – getting ourselves to almost two-thirds of our debt GONE!

What an awesome Christmas present to ourselves THAT will be!

And I do have some good news to share: This Saturday, July 20, I’m realizing a major non-financial goal. I’m testing for my black belt in tae kwon do, a hobby I’ve shared about in the past on MvD! That’s taken a significant amount of time and money over the past years, and I’m certainly not quitting at the first-degree black belt I hope to receive this weekend. More time (and another significant expense) will be required to continue my studies.

That’s a choice we’ve made, and I’m proud to say we’re doing that, as well, without digging any kind of hole financially. That’s right – while the old balances on our accounts might not be dropping as quickly as we’d like, we’re proud to say there is still no new debt.

You can do it too

To conclude this month’s slightly rambling and less-full-of-numbers-than-usual update, I just have to say thank you, hugely, to all those who commented, emailed and otherwise cheered me on after last month’s frustrating and dismal news.

While the dollar figure may not have changed drastically, we’ve made significant improvements this month, both in mindset and in our personal lives.

You can do the same. It’s not easy to stick to it when tractors break and cats get sick and sneakers wear out and orthodontists’ bills arrive. But it’s possible.

And I’m always here to cheer YOU on, just like you’ve all been so amazing at cheering for me.

[share_sc]

So what’s been your biggest “win” this month? (Financial – or otherwise!)

Let’s cheer for each other in the comments!

Wow, can’t wait to hear about your plans for Sept / Oct! You sound really motivated. Small steps add up to big steps in the long run. 🙂 This month, my biggest win was having an excess refund on our house insurance – £100! Which I paid straight off the debts, result! It’s great when money comes in that you’re not expecting!

That’s awesome – and such a good example of how much it matters to have a plan for every extra dollar (or pound!)

First of all, BIG congratulations for obtaining your black belt!!!! That is a HUGE accomplishment, that took years of hard work and determination. I am quite sure the mental and physical benefits from this achievement has strengthened you considerably, and will carry over into future success for both yourself and your family! I practise Bikram yoga myself and feel it has helped me a lot. It is also good to have something positive, other than debt elimination to continually focus on!

It was really helpful for me personally to hear of your temporary struggles to make progress. We are quite close to you in our overall debt numbers , and after clearing $20 000 in the last year, I am kind of in the same boat both last month and this. It feels like I am just barely keeping my head over water. We have an adult child with very serious substance abuse issues, who has cost us a lot.

This month, I am clearing a $1000 overdraft., Also, only now in my overall debt reduction plan, will have $1000 in an emergency fund. I know this is a cornerstone of a good plan, but I have been resisting putting this off until now. I can see the wisdom of it, but I think because I grew up in a family with no emergency fund, it somehow felt normal to live that way, so it is going to be a milestone for me to change this mindset.

I’m really looking forward to the news to come about your plans in the coming months!

I just reread your post, and realized that you didn’t recieve your black belt yet, but are being tested for your black belt this weekend. Good luck – I have total confidence you will succeed!

Thanks!! I will keep your good wishes in reserve for what I HOPE will be a wonderful time Saturday afternoon celebrating! 🙂

And I am so proud of the emergency fund decision. That’s a hard one to wrap your head around, for sure – I did not grow up with one either… but I am so happy to have it now!

Christina

Congrats on your progress so far. We too have an adult child with a serious substance abuse problem. He is currently at his 3rd rehab this year. The cost of his disease and attempts at recovery have been astronomical to us. Our debt is enormous (definitely not all his fault – but I feel they are linked). Up until a few months ago I didn’t have the energy to sort out our finances because son’s problem was so emotionally, psychologically and financially devastating to us. Just wanted you to know that you are not alone – others are struggling with the same issues. I almost had my emergency fund together when we were hit with my son’s return from rehab #2 and all the medical bills and chaos of his disease. He left for #3 five days ago and I have $300 to get our family of four through until the end of the month. Bills are paid though and I am determined to do it. Goodluck to you!

Chris M

Thanks so much for sharing your similar situation with an adult child with substance abuse issues. Your kind words are very appreciated. Things are so bad with our son, I’ve been advised to get court-ordered residential rehab. Rehab #1 was 18 months, but ultimately failed. Fortunately here in Canada, there are some programs that are covered by our provincial medicare plan, but outside private care can offer a lot to support a person once they have left rehab. Just finished reading an awesome book on understanding addiction; ‘ In the Realm of the Hungry Ghosts, by Dr. Gabor Mate.

Congratulations on testing for your black belt! My wife, son, and I started Karate last year. I am a little ahead of each of them, and will be testing for my orange belt either next week or next month, depending on how class goes this Friday. I love the discipline and self-confidence that studying a martial art brings. I am still considered a beginner, but I fully intend to continue training as long as I am physically able. It will probably take at least another 2-3 years to get to black belt, but I am looking forward to it.

Financially, we have come pretty far in the last year or so. We moved and purchased a new house to go with my new job last year. Besides mortgages, our high debt mark was around $40K last spring. We are down to a little over $14K, so have made excellent progress during the last year plus. We were hoping to sell our house in another state to pay off the rest of our debt this year, but the market there is lackluster, so we decided to keep that house and rent it for at least another year. We expect to finish paying off the last $14K next year.

Paul, good for you – and good luck tomorrow in class getting ready for your test! It is WELL worth the wait. 🙂

So glad to hear you’ve made such progress on your debt, too! I am very sure the discipline and self-confidence of martial arts tie in to your ability to do that… in fact, maybe there’s a topic for a future post, huh?

Keep up the awesome work!

You guys are doing awesome! Some progress, or no progress, is still better than going in the opposite direction!

We have been throwing every penny we can get our hands on toward paying off our house, but last fall we had a situation where we had to replace both of our cars in the same month (the first was planned, then an hour later someone hit our other car and totaled it). Thankfully, we had the cash on hand to pay for two used cars outright, but it set us way back in terms of paying off the house. It’s super frustrating, and nearly a year later, we are still saying, “If we hadn’t had to buy that second car…” But, we do what we can, and regardless, we’re glad we didn’t have to take out more debt. I think being angry about it just motivates us even more. 🙂 This month we paid our house down below another milestone number, so we’re pretty excited about that!

Keep up the good work!

Lisa, that’s AWESOME – and I cannot even tell you how much it floors me to think you could pay cash for two cars. That is very much something I aspire to – we plan to pay cash for our replacement car in a couple years and I can’t even imagine how it’ll feel!

You rock… keep up the good work yourself, and congrats on the house milestone!

Congrats on your black belt in tae kwon do! Its no simple feat and I think with the same dedication and focus you’ll reach your debt-free goals in barely no time! I think as you have mentioned it time and again, the key lies in maintaining an optimistic attitude, celebrating the wins however small along the journey and keeping the ultimate goal in mind whatever you are doing. You have been very inspirational to me…Keep going Joan!

Thanks, Simon!! I am very excited for this weekend’s test… cross your fingers for me! I am certainly optimistic about that as well as our debt!

Congratulations!

Thanks!

Woohoo! Black belt sounds cool 🙂 I love reading your updates, and I love the positive attitude that always pervades your posts. It helps me keep a good perspective on my own debt and feel good about the steps that I’m taking.

This month I got my first bonus check at work and I spent almost all of it taking a swipe at my accrued interests on my student loans. There was around $6700 in accrued interest and I thought I would never get rid of that, let alone start chipping away at the principal. I’ve been making veeeerrrrryyyyy sloooooooow progress on that front, but this month alone I’m paying back about $2000 of it. It feels SO good to see that accrued interest number shrink. I feel like I’m so much closer to making my loans start to disappear. Hooray!

Meg, that’s AWESOME! Congrats! 🙂

Woohoo! $3 headed in the right direction! My last debt update showed us $38 in the wrong direction. I’m very much looking forward to this month’s update … we’re back on the right path! Great job!

Keren, it rocks that we’re both going back in the right direction! Keep it up!

Congrats on the black belt! And to moving back in the right direction!

Our biggest win this month is finally tackling our budget, setting up limits, and seeing exactly where our money goes. With a move, and theft in June (Goodbye, MacBook Pro. Goodbye, Wallet), AND a humongous parking ticket ($150. OUCH!), we were hit pretty hard financially, but we’re making the best of things. It’s good to finally have some perspective and in August we’ll really be making huge changes to our lifestyle. Already we are fore-going a proper “vacation” this summer, and instead will be hiking and camping nearby, and visiting friends up north instead.

I can’t wait to see our debt numbers going down.

I’m late saying so, but congrats on the changes you’re making, Catherine, and the positive attitude! I hope August started as good for you as it did for me… new update coming tomorrow! 🙂

Good luck in getting your black belt, Joan! You can do it! It’s a great milestone in your journey as a martial artist. It’s certainly something to celebrate and be proud of!

Truth be told, I think of getting a black belt as the end of the beginning. At least that’s what I’ve come to understand after I got mine. It’s a testament to your dedication and development. You’ve mastered the basics and are ready for more advanced knowledge. I wish you all the best!

Ivan, you hit one of the themes of my black-belt speech! (We have to speak briefly about our journey.) I used the phrase of the first landmark along the way, not the end of the trip.

Joan, you are awesome! You are continually moving in the right direction and every step you take is moving you forward towards your goal of living debt-free. It would have been so easy for you to give up last month and decide that the struggle wasn’t worth it, but you persevered through a really tough time and you are more on track than ever. Getting your black belt is not going to be hard for you – you are so focused and determined. Keep up the tremendous work and you WILL be debt-free. Every day brings you closer and closer.

Sophie, thank you so much for the kind words. I’m late saying so but they REALLY mean a lot. We are keeping at it, and it is in large part thanks to you and everyone else cheering us on!

I am so impressed with your month. You have turned the corner and are gaining ground. I just discovered your blog and I love it. You will probably see me here more often. Thanks for the inspiration.

Jenny, thanks so much – glad to have you here!

I just recently started reading Joan’s post. I purchased a franchised accounting firm. Not a lot of support, and within 5 years ran up $36,000.00, in credit card bills. Mainly buying systems, advertising, money not coming in, Christmas, car problems, on the card. One time, I even paid 10 K , for training, and got no revenue from it. I carried a lot of guilt, about all of it. My husband took a 401 K loan from in retirement for . 25 K. This has helped me a lot, I pay it back at 4.% now. What I wanted to ask you, is how you got the 90 K , credit card debt. , if you do not mind.

Hi Randi! Good to “meet” you! We’ve talked about that extensively in past posts, but the short answer is medical debt (me) and college debt (my husband) about 13-14 years ago, plus a couple house things (heat pump when we had no heat, repair to leaking roof). We hadn’t charged anything since around 2004, either of us, but we weren’t making progress, either, and before credit-card laws changed, our balances were actually going UP every month making the minimum payments, thus pushing our APRs up even farther too. If you check out some of my past posts at https://manvsdebt.com/category/joan-posts/ you can read much more of our story!

Wow Joan I think you are amazing! And inspirational.

I needed to read this to know that when things are not going as fast as I would like in terms of paying off our debt it doesn’t necessarily mean we are failing. Sometimes stuff happens in life, and I’ve noticed that changes in circumstance often cost money!

It’s important to look at the big picture and what HAS been achieved long term. As you say the most important thing on these months where we stand still is that we are not getting any new debt or further into the black hole! That time has passed.

Thank you.

Julie.

Julie, you are so right – we ARE out of that black hole of making it worse each month! Go us! 🙂

Joan

You have been such an inspiration to me. I started reading Man v. Debt a few months ago when I started to get serious about repaying our more than $100,000 in debt. Until I saw your financials I didn’t think another soul had anything close to our debt. Your journey has been so important to me, showing the way like a beacon of light in the dark. Each time I read one of your posts I come away with a little nugget of information or inspiration to keep me going. My biggest accomplishment this month is just staying the course and not dipping into the credit to cover all the unexpected expenses. Thank you and keep up your incredible progress!

Chris, I know people who had even larger debt than you. One family had over a million in consumer debt outside of their mortgage! If they can become debt free (and they did!), you can too! Stay the course and the rewards are huge!

Chris, Freeze those credit cards!!!! Don’t touch them at all. If you can’t get to them you can’t use them. You will also be able to become creative in HOW you meet a financial challenge in paying for those “unexpected” expenses.

First, set up a $1000.00 emergency fund for those “unexpected expenses.” (murphy law and all of that-because he will come a knocking at your door).

Second, stick to your budget! You and your spouse/family. Get the family involved. Make a plan, make charts! Rewards-extra family time activity.

Third, I feel is sometimes lacking into today’s budget is “fun money”. Set aside some money for a vacation, a weekend away somewhere even to grandparents house. It doesn’t have to be alot. Budget $20.00 a month or so-whatever you can afford. If you get bummed, you can treat yourself to something special/fun without breaking the budget.

Fourth, this was important to my hubby and I: a weekly allowance. BUT, the agreement should be-you can’t tell your spouse what he/she can spend the money on or save the money for. What’s his is his type of deal. We each get $20.00 a week. If I want to eat lunch with a friend, I can. If he wants to save for a piece of hunting equipment he does..

I wish you all the best Chris! I may take a while to pay off all your debt but the rewards are well worth it. You can come back here and we-your budget buddies will always be glad to cheer you on and/or offer advice.

Chris, I apologize that I didn’t respond sooner, but I am SO HAPPY you are tackling your own heap-o-debt with me 🙂 I am thrilled to hear that sharing our story helped you guys realize you weren’t the only ones!

Good for you for not adding new debt for those unexpected expenses. That rocks! Here’s to a great month ahead!

Joan,

Thanks for another great post. You are one of the big reasons I now have a $1055 (and growing) emergency fund. Don’t worry about an extra $9 on your balance sheets this month, your mindset is so different now, that even in challenging times which before would have meant pulling out the plastic you are managing/hustling as necessary and still coming out a winner, that’s the biggest change for the better. Take care, congrats on testing for the black belt, my second-grader is a green belt and I have noticed such huge benefits for him from participating in martial arts for the last couple years. Looking forward to more inspiration from you in the coming months.

Kate

Kate, thank you so much for the kind words – and big congrats on that emergency fund!! 🙂

Congratulations to you Joan! That’s wonderful news 🙂

A couple of big wins this month: paying off one credit card and doubling my working hours in two days by a chance ‘being in the right place at the right time’ and getting another part time job. Interview today and I start tomorrow.

Great to read all the stories here 🙂

Claire, I’m late saying so, but YAY on your big wins! That rocks!

Hi Joan,

I just started reading this site and applaud you for owning up to your debt & working hard to get rid of it. In reading your entries, not sure if I missed it somewhere or what, but I keep asking myself how in the world does someone end up in that much credit card debt?! We aren’t perfect. My husband & I have a small student loan & an auto loan to get rid of but never have had credit card debt. Never in my life have I not saved for something first (except for school & cars). Did something major happen? I have a child who was born without kidneys so I am aware of what medical bills are & how fast they can grow! Not attacking, just trying to understand is all! Good luck & keep the good work going.

Hi Susan! That’s a great question that I got into a bit in another comment in this thread (and in many, many earlier posts), but the very short answer is that this debt is medical (me) and college-related (my husband) from long before our marriage, last accrued anywhere from 10 to 14 years ago. Our problem wasn’t that we were still charging, it was that (until credit-card laws changed), our balances were going UP each month since we were only paying minimums, and we were digging a deeper and deeper hole, with matching rising APRs and so on. (I believe the amount we charged originally back at that time was something like 47% of what we ended up owing at our worst – the rest was INTEREST! Yikes!)

I hope you’ll dig into our archives and read more of our story, where I talk about that in detail! 🙂

Joan,

Did you earn your black belt last Saturday?

YES!!! 🙂 Thank you for checking! And sorry for my late answer 🙂

rejoicing with YOU!!!! YAY!!! so excited and glad for you.

I just found this and now I will keep reading! We are trying to pay off our debt as well (over $97,000!). I just want to encourage you: any progress is still progress! We spent the first half of this year with almost no income. We are now finally able to make progress and it feels wonderful! Compared to the amount we owe we aren’t moving quickly, but progress is progress!

Julia, you’re so right – progress is progress! 🙂 Good for you for keeping your head up!

Pingback: Writer’s Voice: What it is and how to develop yours

There is a book called “Getting things done”. You should all read it. It’s about, well, how to get things done and how it is not good to leave things undone.

Pingback: Things Are Looking Up: Joan’s Mid-August Financial Update