[share_sc]

Note: This is a post from Joan Concilio, Man Vs. Debt community manager. Read more about Joan here.

I like paying my bills.

Now, I hear you. You’re saying, “That Joan, she’s crazy; I’m not reading any more!” But stick around and let me explain. This love of bill-paying is only a recent change; before we started our war on consumer debt, we were always the people with more month than money.

The biggest change, of course, is that we now stick to a budget, and that means we have enough money to pay the bills. Obviously, that’s the number-one factor in why it’s more enjoyable now than it was before.

But the reality is, that’s true for a lot of people. Many of us do have the money – but somehow we still dread paying the bills.

So how do we change that mindset? How did I personally change the way I think about bill-paying? Well, let me show your our system, and then we’ll talk about why I think it works so well for us.

How I keep track of the bills

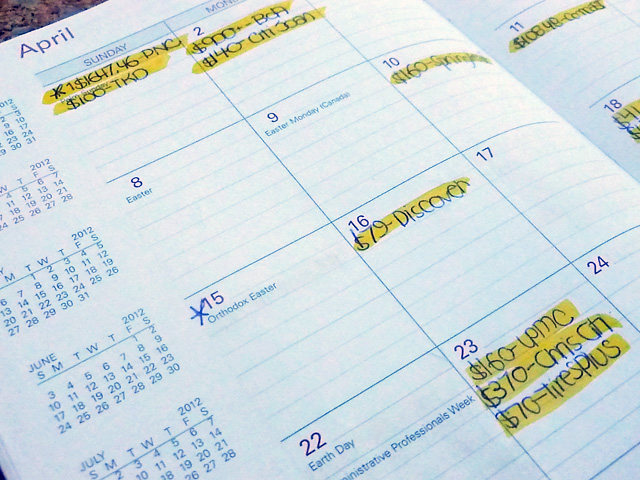

Meet our bill-paying schedule.

It’s just a simple 12-month calendar; you can get them in the dollar bin if you’re willing to wait until the middle of January. But every time we owe someone money, it’s reflected here.

At the start of the year, I go through and mark all our regular expenses and our regular income.

For instance, we have a contract for a home-security system, and that payment is due the 14th of each month. So earlier this year, I sat down and, on the 14th of every month, I wrote “$44.99 – APX.” I also did my car insurance, our mortgage (for as far ahead as our payment coupons go), our estimated taxes and so on.

You see that asterisk? That’s a payday. I’ve marked them for the whole year, too – at least all the ones I know of. When we make side money, that’s obviously great, but our bill-paying is now based only on our regular income.

And every time I receive a bill, I do two things.

1. I write the amount and the company name on the date on which I intend to pay it.

That’s key. I used to rack up late fees, even when I had sufficient money in my account, because I was keeping track of bills by their due date.

Obviously, that’s a problem if something comes up and you forget or are unable to pay, because you have almost no wiggle room.

But the other problem was that I was paying bills here and there throughout the month, and that was a recipe for disaster. One on the 10th, one on the 14th, one on the 15th… you know the drill. Now, for the most part, I pick a few days a month to pay bills, and I “stack” my payments on those dates, even if the due dates are a week or more out from there.

2. I slide the bill itself inside the calendar pages for that month.

That’s right – I prefer paper bills.

There are some accounts for which I receive e-bills, and when that happens, I stick to step 1 above when I get the email. For the most part, though, I get hard copies, and I slide them right inside the calendar, usually in the order I’m going to pay them.

How I actually pay the bills

So if you’ve read some of my previous posts, you know that I keep a detailed check register. I just said how much I like receiving paper bills.

That might make you think I’d write out checks and mail them. But I don’t. I pay almost entirely online (for national companies) or in person (for local ones).

Bill-paying night is basically me, at the computer, with the checkbook. I balance the checkbook first, then I knock out most online payments (credit cards, utilities and so on).

Then I write any checks for in-person payments (our water bill, for instance).

With each payment (either by check or online), I highlight the line in the calendar to show it’s been paid. And I write each transaction in the check register as I go and figure out the balance.

Last but absolutely not least, I go back to our Most Hated Debt, if it’s part of that set of bills. In case you’re wondering, that’s our Bank of America MasterCard with the $26K balance.

I pay our most-hated bill last, and before I enter the amount I’m paying, I look back at the checkbook and calculate how much money we need to keep in there, both as a “buffer” and for expenses like groceries before the next paycheck.

And then I put every cent that’s left on that Most Hated Debt. That’s the debt tsunami, you guys – the strategy of focusing your repayment efforts on the debt with the most emotional impact.

By putting this at the end of my bill-paying, it gives me something to look forward to. When I get to the end of the bills, and I see we can still hit this debt hard, that’s an amazing feeling!

So how do you create a joy in your own bill-paying?

Find a system that works for you

Our system works for us – and keeps me happy about paying the bills – for a few reasons.

1. It’s calendar-based.

I operate very much on a calendar system – not just for bills. We have a huge family calendar in our kitchen; I use a daily and weekly calendar for work tasks; you get the idea. Things to do go on a calendar.

So for me, a bill-paying system that’s list-based or spreadsheet-based, while it could contain all the same information as my calendar, wouldn’t “register” for me in the same way as looking at something that looks like a calendar.

2. It’s manual.

The act of writing down each bill I have to pay is very important for me. It helps me be very conscious of them, and I’ll often find myself saying, “Oh, I know I have to pay Discover $80 by the 14th” or something while I’m out shopping, which in turn changes my at-the-moment spending.

I’m a big fan of the idea of MANUALLY dealing with your finances. Baker had called that “unautomating,” and to me, it makes perfect sense. When I do the work, I become more conscious, and that’s always good.

3. It’s tangible.

So, OK, why don’t I use Google Calendar (which I use for other things) for my bills? I could even enter each payment manually and still have both benefits above.

Well, like I said, I like paper bills. I like to get the bills in the mail, go through the process of opening them and writing the amounts down, and then on the opposite end, I like to tangibly see the pile of bills go down after I’ve paid them.

Meanwhile, I like the physical calendar because I have it sitting on my desk, where I have very little “stuff,” and am physically reminded that the bills are there. It makes it much harder to forget to pay someone!

4. It’s visual.

I sort of hit on this above – I like to SEE my month laid out in calendar form. I like to SEE the calendar on my desk.

I’m not an “out of sight, out of mind” person in all areas – but I definitely have fallen into the trap of putting the bills “away” too much, or relegating them to an email folder, and then I’ve had cases where I forgot something and racked up a late fee.

5. It gives me a sense of accomplishment.

I love highlighting each amount as I pay it. (I am the kind of person who loves crossing things off a to-do list. I may or may not have ever added something I already did to a list just so I could cross it off.)

Again, this physical, tangible, visual act – the highlighting – serves a real purpose for me. Absolutely, if I used an online calendar, I could mark each payment as “done.” But I like to physically take the action and see it change.

Even more importantly, paying our most emotional debt last leaves me with a great feeling.

It’s ending the game with a grand slam or a 90-yard touchdown pass. You win either way – but when it’s the last moment, it feels better. I finish the bills off with a real sense of accomplishment when I see that high balance go down.

If you’re already debt-free, this can still work – maybe make your last “payment” a transfer to your vacation fund, or something else that really motivates you. The point is to end on a strong emotional note!

So what does this mean for you?

Maybe you would benefit from a bill-paying system exactly like I’ve described above. Or maybe you already have a system that works well for you – using an online calendar or some other tool.

But if not, ask yourself what motivates you. Then, work out your bill-paying system to include that.

Are you visually driven? Create a reminder you can SEE.

Do you like that “sense of accomplishment” feeling? Stack your bill-paying so that you hit your most emotional debt last.

Motivated by another factor? Create a system that ties into it.

[share_sc]

When it comes down to it, you may never “love” paying the bills. But you can certainly make it work for you.

· Unautomate Your Finances ebook

· You Vs Debt Sample Lesson

· What to Sell Where Flow Chart

· Debt Payoff Tracker

· 10 Tips for an Effective Craigslist Ad

So what motivates you? How will you tie that into your bill-paying system?

We’d love to hear about it!

These are really good ideas about how to stay organized. However, you’re paying way too much for security monitoring. You should never pay more than about $20 a month. And whatever you do, never sign a contract. Alarm companies love to lock you into a 2 or 3 year contract so they can provide inferior service. Go with a no-contract monitoring service like SimpliSafe for $15 a month.

Ryan, thanks for the idea, but this is one of a few areas where we choose to pay more because we particularly like some facet of what we get for the extra cost!

(No long-term contract, either; we have had this particular service for more than 7 years and have long since gone into the “cancel at any time” range! That was just lazy wording on my part – it’s more accurate to say, “We have an agreement for service that we can cancel at our discretion” than a contract, but I don’t think of it that way even though that’s more correct.)

I’m with Ryan on this one. Having installed security systems for one of the summer sales companies (similar to APX) I know that these systems are a waste of money for 95% of those who buy them. The salesman uses your emotions rather than needs to get the sale. But that’s beside the real point.

The reason they lock you into $45/mo for three years is to cover the salesman’s commission (around $1,000!), and to pay for the equipment (around $250). Once you’re no longer under contract, you should at least switch to a lower-priced company, or even just call up your current monitoring company and ask for a lower rate. If you need more motivation, just think of how much faster you’ll be paying off your mastercard with that extra $30/month.

Me personally, I’ll never pay to have a security system monitored. My security system is an ADT sign in my yard, and if that ever feels inadequate I’ll get a dog.

For us, we like where we are – but the tips are good ones! Just in our case, we made a choice that we’re happy with, and we’re not looking at this as a place to choose to save a few bucks. Some people might – and that’s great.

Just depends on what you choose to spend your cash on – and the beautiful part is that’s different for everyone!

I used to write it all out in calendar form, by hand, like you do. But since I moved to a new state and needed a new bank, I use PNC bank for my bill paying.

It is similar to your paper calendar – I can look and see what amount is coming out on what day of the month, as well as when paychecks are expected, but it is all electronic. You can set bills to be paid directly from the account, or you can set placeholders for bills you will pay offline but will still be deducted from that account. It keeps a “running total” to the next payday – so you see just how much cash you will have available beyond scheduled bills until next payday. It’s not perfect – if I log in on the 1st, I know a ton of money is scheduled to leave the account, but for some reason the listing disappears from the “pay date” until it shows up as “paid” a couple days later. This is my only complaint, but because I know about it I don’t feel giddy about “oh wow, I have $1000 available until next pay day!” because I know it’s just waiting for the transactions to process.

Also, I do “stack my bills” for the most part. The majority of bills are due on the 1st, though there are a few others scattered throughout the month that are auto-paid, so I don’t have to worry about missing them.

Jen, I’ve looked into systems like that, and I think if I were to make the leap, that would be a direction I’d consider.

And you seem to be on top of the biggest worry I have – that someone might look at a system like that and “think” they had more money than they do! (That’s why I ranted a little in an earlier post about people who just take the bank’s balance on their account for granted – that makes me itchy!)

But you have the exactly right mindset and you’re aware of what you REALLY have, which I think is key!

Joan,

I must admit, the first time I logged in on that day and didn’t see those transactions listed, my first instinct was not even “wow I have a lot of money”. It was “oh no if I screwed up and the payment isn’t going through, I’ll be late on paying bills, but if I resend the transaction and it does go through, it will overdraw my account!”.

I got really paranoid about bank balances when I had an account with Chase – they would process transactions to make themselves the most money. PNC doesn’t seem to do that – I noticed they processed a payment from my account before depositing my paycheck one day, because it showed up as a $45 overdraft fee. But then, right above that was a $45 credit because they decided I didn’t really overdraft.

Sounds like too much work. I used to do something similar, but after reading “I will teach you to be rich”, and getting on board with YNAB, my system now looks more like this:

1) Get a one month buffer in your checking account. This isn’t easy, but it frees you up so much. Never again to you have to play the “can I pay this bill and keep my balance above zero” game.

1) Set all bills to be due on the same day of the month. If that is too scary, pick 2 days in a month, and spread your bills to those two days.

2) Set up auto-bill pay for bills with fixed amounts. (optional)

This system means you only have to spend time and think about bills one day a month.

Bart, I’m glad you have something that works for you! In our case, that’s exactly what we’re trying to avoid – we WANT to be thinking about and taking time on this more often.

We do keep the checking account buffer – our reason for staggering payments near “paydays” is to take advantage of when we have the MOST money, not because we’re still living fully paycheck-to-paycheck. (We try to keep a steady balance all month, not have “highs and lows” – even if they’re higher highs and lows, if that makes sense.)

I think it would be too much work for a lot of people – but it’s time we choose to invest in this way, and we really do look at it as an investment!

Our system is fairly similar to yours. The only difference is that ours is electronic.

At the beginning of the year, I go into Google calendar and put all our paydays and bill due dates in the calendar. I then review the calendar for any issues that might come up that need to be dealt with ahead of time (like insurance payments and other odd bills).

For the bills, I add two reminders in Google calendar. The first one is an email that will come into my inbox at about the time the bill is issues. Most of the time, I go ahead and make the payment right then (I use our banks bill payer). Just in case something would come up, I also have a second alert in the calendar that will send me a text message about 10 days before the bill is due. Then, if I haven’t paid it at that point, I have a quick reminder to get myself into gear and get it paid.

This system works great for us but may not work all that well for others. I like it because it’s easy and I am always online. A win-win!

I think if I weren’t such a “handwriter,” I’d do exactly that, Adam. Very similar philosophy, just the end method changed a bit! And I do love Google calendar!

I like your reminder system, too. I get email reminders from a couple of my credit cards just as an extra backup and really am glad I chose to do it. The extra email is well worth the backup!

Good post! I’d love to read more practical ideas like this. I’m horrible about keeping track of when each bill is due. I thought automating most of my bills would be a good idea, but then I tend to forget about the bills that aren’t automated.

Kim, I think automating is one of those things that SOUNDS really good for a lot of people. And if it’s 100% working, that’s great. But if it’s not, I feel like you can end up with MORE problems!

I’m glad you found it helpful – and I wish you the best in finding a good system for you! Keep us posted 🙂

Our system is simple. We schedule all our bills for the 1st or the 15th. Anything else is on auto pay. I do have an excel spreadsheet tracking our monthly debts. I can see how much we have paid each debt down and our total debt reduction. We are paying down debt and increasing our savings/investments by 54k this year. We planned it all before the year started. We also like to round up on debt payments.

The only unique item is the house payment. We pay 1 week early each month. For example, we pay the 5th Monday in Jan, the 4th Monday in Feb, the 3rd Monday in March, etc etc. We are 3-4 months ahead, so every 4th month we skip a payment and pay that money directly to principle. One extra principle payment like that takes 3-4 months off the life of the loan.

Jason

Jason, that sounds like you’ve found something that works for you! We use a spreadsheet to track our debt as well, which I’ve written about in the past – I find that incredibly helpful! We just keep the calendar separate to track both debt and recurring expenses like utilities.

I like that house payment system – neat idea!

Jason, can you please go into further detail on your house payment system? Sounds interesting, but I’m not quite understanding the process.

Thanks!

And thanks for your suggestions, Joan!!

Our system is simlar to Bart’s. We haven’t gotten them all due on the same day, but we do have at least a one month buffer and we setup automatic bill pay to schedule our recurring fixed payments.

Bill paying used to be a major headache for us. We were making good money, but were still living paycheck to paycheck. I had to figure out when I would have money in the bank in order to pay each bill. It was a major hastle.

Over the past two years, we have made drastic changes in our lifestyle that made bill paying easy for us. We changed our lifestyle to start living below our means, reducing our must have expenses to 50% of our income. That means there is always money in the bank, and I can simply pay a bill as soon as it arrives. Now, when I check the mail and find a bill, I login to my bank and pay the bill as soon as I walk in the door.

I think that’s a great system – and like I said to Bart, we have the money to do that, but we just prefer to make it more of an “experience.” But that’s an individual choice – and while it works for us, I know some people really don’t want to put that much time into it!

Once we’re not paying down debt – and quite frankly, that’ll mean we have many FEWER “bills” in a month, which is the bigger issue than amount of money for us – we’ve talked about doing a pay-as-it-comes system. Who knows? 🙂

One more thing, I wanted to compliment you on your system. I think it’s important to find a type of system that works well for you, especially when working your way out of debt. We only have one credit card that carries a balance, a remnant from living above our means, and so it’s easy to track that and plan payments to get it paid off. Back when we paid of all our debt the first time, we made it more of an experience, like you are doing now. The experience is important to keep your focus on the goals and to keep you motivated.

EXACTLY! 🙂

I use Quicken, and free online bill pay whenever it makes sense.

With Q, you put in your monthly transactions, plug in a monthly date, and it lists them all and will even give you reminders. The nice part is that I’ve figured out how to do both, arrange them in advance to avoid ever being late and bunch them together so that the majority of our payments are going out at roughly two major times a month (in my case, roughly the 2nd and the 15th of the month). It helps to have a 2-week paycheck as opposed to being on a more up-and-down pay schedule.

If you key your transactions to a master budget list (i.e. each transaction is broken into categories which are reflected on your budget), you can print reports of what you actually spend — it’s sort of an electronic envelope system, albeit an after-the-fact sort of approach. It does certainly help forecast the coming year, or any changes to our family’s finances, to be able to establish our actual last-year budget with real numbers from Quicken.

As for free on-line bill pay, I don’t like the PNC system much, but I do use it for my mortgages — it saves the the check / stamp, allows me to send within 5 days of when I want the payment posted, and is a big enough, regular amount that it’s a one-stop shop to pay all my mortgages at the same time, instead of going to various web sites for online payment (I have three mortgages — one primary and two rental properties).

For those without on-line access or Quicken, however, Joan’s system is pretty fool proof for never paying another late fee. BTW, my Quicken is version 2002, which I received with my PC purchase a LONG time ago. The new version is $85 or something, I even though it probably has great features — I’m too cheap to buy it because the one I have does plenty.

Jason, I love that you didn’t buy into the “I have to upgrade!” mindset! I do like Quicken – have used it for business stuff in the past – but embarrassingly lost my disks some computer switch ago. 🙂

I was interested to read through the comments and to hear from friends the number of people who use online bill-pay through a particular bank. In my case, I pay on the sites of the people we pay out to (for instance, our electric company’s website, etc.). Our bank does offer online bill-pay, but didn’t start until long after I’d started doing it the other way, and I’ve never been motivated to switch.

I guess the benefit is seeing everything in one place, but I like going to the various sites because it gives me a chance to check the account in general, update my contact info, all that sort of thing!

Anyway, glad you have a system that works – and that you’re budgeting and tracking, which is the BIGGEST takeaway, I think!

A simple, internet management system works for me. I keep a note in Google calendar to pay my bills on the 15th, and check Mint a few times a month to go over my expenses.

I control my spending, but don’t think about it much. As many others, paying $700 for a room stresses me out! College is becoming expensive quick!

Glad you have a good system, Michael – wish I’d set mine up while I was still in college! 🙂 Thankfully I was able to commute, but I understand from a lot of research how expensive living on campus was!

I’m a calendar girl too but when I see it loaded with stuff I feel as if all the spontaneity has gone out of my life! Life has become far too regimented and a busy life seems to be the criteria for becoming a member of the rat race. I’m in the race too but deep down am a quiet rebel. It’s not just death and taxes that we can be sure of but bills too!!

It’s all perspective, Lucille!

It definitely can look like that – or I can just look at the things on the calendar as ways to remind myself of my options. With bills, they’re not really “optional,” but on my schedule, a lot of what’s on there is, “If I choose to, I can do X at this time,” if that makes sense.

I also look at it and think, sometimes, “WOW – I can’t believe I have the ability to do all this stuff!”

I keep an excel sheet for each month and its marked for each payday(money coming in) and under that is when each payment goes out, for what, etc. That way nothings ever late. I sit down on payday and do the bills. All done and I don’t ever have to worry. I also have a total of what I’ve paid out. I also started an excel sheet to keep track of what I’m paying for groceries, gas, amazon( we are big readers here, eating out, and gifts. This is just for my own information. I find it interesting how much oil has gone down, yet gas is still over $4 dollars a gallon here.

Laura, that gas price is ROUGH! We’re in the $3.55 range and that’s bad enough! 🙂

Good for you for figuring out a plan that works!

I too have two set days each month that bills are paid. It makes it easier to keep track of and no late fees. Each year I start a new notebook/journal ($1 steal!!!) and write down every bill (each month) that needs to be paid. Something about seeing it visually and marking it off when paid makes me happy. What blows my mind is, I had job that paid well but I was always broke. I was stressed all the time, living paycheck to paycheck and even taking out payday loans. My job now pays less and I’m not living paycheck to paycheck and actually saving money! Being able to keep track of what I spend has helped me to cut down on spending. Wants vs. Needs 🙂 Thank you for the post! And thank you everyone for sharing your bill paying system. I started an excel sheet earlier this year and lost track…thinking I need to revisit.

Starlynn, I like your notebook system! That actually very closely matches what my husband did before we got married – and he liked it for the same reasons.

I’m so glad you’re saving – keep it up!

I love your system! I have a system that works for me, but I am totally adding the calendar idea & am going to try to plan ahead more. I’m right there with you- I LOVE paying the bills & keeping track of the $. It’s very motivating to me to see our debt total going down. Thank you for this awesome post! 🙂

Michele, I appreciate your kind words so much – and am glad you found this idea helpful! Definitely keep us posted on how the additional planning and calendaring work out!

Great ideas for simplifying the whole bill paying process Joan! I do not use the “visual” calendar approach, but may implement one as I like how you can get an “at a glance” idea of what is due as to avoid those pesky late fees.

One other reader mentioned YNAB and I thought I would second the suggestion. Having used Quicken for 10+ years, I never really knew where we stood with our money. After scouring the Internet for other home finance software options, I found “You Need A Budget” (YNAB as they call it). I have to honestly say that it is taking some time to adapt to this style of keeping track of our finances, but I really feel that this software can help anybody put a budget into place and make managing their money much easier. The one thing the software lacks that I would really like to see in future upgrades is….you guessed it….a Calendar to track expense due dates. This is one thing Quicken has and I really liked. Anyhow, great post Joan and thanks for the insight into your family’s system of doing your finances.

You’re welcome, Dav! And glad to hear you’ve found a system that works so far (and that you might consider the calendar, which I do personally find very cool!)

Joan! I love it. I do the exact same thing (although more computer based). Track when bills are due on my personal G-calendar, I’m working on signing up for online alerts for most of my bills (buying my first home and changing addresses has slowed this down) and pay my bills twice a month (online). I agree with you, facing my bills and paying them makes me feel accomplished and aware just exactly where my money is going.

I love it! That’s exactly it – I need to feel accomplished and aware!

Hi Joan,

I think it is great that you have a system for paying your bills by the way so kudos to you. My girlfriend lives in the States and I live in the UK. Last night we were going through our individual personal budgets and it was interesting to see a difference I have also noticed in your post and was wondering if this was an American mindset.

My mindset is to get as much value out of my time as I physically can. This means a lot of the actions that I have to complete (such as paying bills) need to be done faster. The more time I spend paying bills the less time I spend living life. I know what my monthly expenses are because I perform a similar task as you with the exception that mine if excel based. Then I set up my bank (online and by myself) to create direct debits. This way all of my bills are paid automatically. This saves me a HUGE amount of time. The tangible theory that you outline is still there for me because once per month I make adjustments to my spreadsheet and could see me debt coming down (I currently don’t have anymore debt).

Keep up the excellent work and I wish you all the best in your fight against debt.

Lee

Lee, you make an interesting point about the value of time. The good news for me is, this takes LESS time than I was taking before – though of course, you’re right, not as much time as if I automated.

But in my case, I choose how to spend my time, and I get more “value” out of the 15-20 minutes it takes twice a month to do this (it’s really no longer than that) than I would if I freed up that time but automated. (Honestly, I’d probably just spend more time on Facebook or something!)

Even at my salary for, say, freelance work, if I spent an extra hour a month on it, I wouldn’t recoup the money I used to lose in late fees, or the money I currently “lose” in interest payments on credit cards… so when I look at it that way, it’s just a choice about how I invest my time.

I’m so glad you’re debt-free now – that’s AWESOME! And I definitely think my system will continue to evolve as my journey progresses. But for now, it’s worth it! 🙂

Joan, I love ALL of your posts. Your style really appeals to me and I’ve taken quite a few of your suggestions to heart. I use paper but not a calendar…i just have a notebook with a list and every month I copy the list to the following month, with the amounts and due dates. Even though Baker says simplify your finances, I actually improved our bill paying system dramatically by opening a second checking account. My paychecks go into it and that is where all our bills are paid from. My husband’s paychecks go into our original checking account and that’s our grocery, gas, and discretionary spending money. I’m still really strugggling with getting a handle on our debt, but at least we’re paying everything on time which we were NOT doing 6 months ago. I’m grateful to the team at Man Vs Debt for the inspiration to work on our financial situation, and am hoping to be able to be a part of a class sometime soon!

Helen, thank you so much – you just made my day. I’m so glad you found a system that works for you, and in some cases, an extra account IS simpler – if it makes it more straightforward about what money is used for what! It completely depends on your situation.

Paying on time was our first step too, a few years ago, so that’s a very solid start! From there, and with a budget in place, you’ll be amazed what happens. Make sure you keep checking YouVsDebt.com too – then we can let you know when we’re starting the next session, which should be this summer! Would love to have you in that group!

Pingback: How to Take Charge of Your Bill-Paying System | Simply P Squared

The one thing I do to stay ahead of yearly bills or every six months bills, is this: when that yearly bill is paid I then divide that amount by 12 months and I then transfer that monthly amount into a savings account and by the time the bill is due again 1 year later I have the money already in the savings account. I do the same thing for the 6 month bills just divide it by 6 to get the monthly budget amount. Some bills have a six month billing with the option to pay monthly with a service charge tacked on, since I do the saving money ahead of time I am now able to save money because I can now pay 6 months in full instead of the option to pay monthly with a service fee.

Kathy, that’s great!! We plan to do that when we move to having our property taxes NOT escrowed (a few years from now). It sounds like it will work well for us and I’m glad you find it does for you too!

This is similar to how I do things with regard to bills. As soon as I get the statement, I log it to my planner (utility co. + amount) so that I wouldn’t forget. 🙂

Mike, way to go!

Pingback: Money Blogging Roundup: New Media Expo (#NMX) Edition

Joan,

This is how I do it as well. After years of struggling, late fees, and being totally disorganized, I discovered iCal on my Mac and iPhone and have never looked back.

I just don’t carry paper calendars around anymore after getting an iPhone, so I’m putting this expensive little gadget to good use.

AS SOON AS A BILL COMES IN – it goes on the calendar. Then, as soon as I’m paid I can see all of the debts owed until the next payday and I pay them all in one big whomp.

I too still get paper bills because you’re right – it’s the tactile experience of opening, reading, making notes on the envelope, and having a physical PILE to discard once they are paid. It feels good and keeps me thinking about squashing my debts down as quickly as I can.

I am working SO hard to pay off my disgustingly high balanced credit cards. I could kill my college-age irresponsible self. Sigh.

Thanks for posting this – it’s nice to know this system is working for other folks too.

Hang in there everybody… eventually we’ll get to KEEP most of the money we earn! Cheers to that!!

Michelle, CHEERS indeed! And I’m so glad to hear that I’ m not the only one who likes tactile experience. Maybe it will change when I am not fighting the debt – but for now, it’s a must-have! 🙂

Keep it up – we can cheer each other on!

Great system, one I use but without the calendar – I just put mine in a folder in order of due date. When I was younger (and had more time and less bills) I didn’t need to be quite so organized, but this system has helped many times to keep me from sending in a payment late. Glad you found something that worked for you!

You too, Kris!

Great post Joan, I have to have a system for everything that I don’t like to do, this definitely being one of them. 😉

Glad to hear it! 🙂

This is a really great idea. I love the visual and organizational aspect of it. I can see how it would also relieve some stress as you wouldn’t always be wondering if you missed something somewhere. My wife pays our bills at home now and she is very detail oriented. Although she keeps on top of bill paying very well, I’m going to have to share this with her as this would fit right down her detail-oriented alley.

Chris, good for her – and you! I think that’s part of what I like – not just do I see the bills, but if I look through a month and it seems to be “short” an item, I can look and say, “Oh, somehow I didn’t write down our Discover card bill” or something, you know?

Tell your wife hi from one “details girl” to another! 🙂

Great article, Joan. I also have a system like this. Glad to know that you have found a system that avoids you from paying the bills late.

Glad you do too, Lorii!

Hi Joan,

I like the system that you use here and use a similar one myself. I always write out all the bills that are due each month on my calendar which is hung right in front of my eyes on my desk backboard.

I cross them off as I pay them and write the date down when they were paid too. Having a system in place makes life so much easier. Take care.

Justin, I agree! 🙂

My calendar is on Google and I use Quicken (a very old version that works fine) to keep track of payments. I use automated payments for everything I can, and use my bank’s bill payment system for everything else. I spend about 5-10 minutes every Friday to check my bank’s account and enter payments into Q. Q lists reminders, too, such as quarterly estimated tax, etc., and it’s very easy at tax time to pull all the needed information from reports if you’ve had the foresight to set up your categories accordingly. It’s a life saver for me as I rent rooms which necessitates keeping close track of expenses that are tax-deductible.

Marie-Claire, you make a good point about taxes. We factored our estimated tax into the calendar, but that was one I was particularly worried about, so I can see why it’s helpful to have a bit more tracking there!

Very glad to hear you’ve got a system that works for you!

I struggled for a while trying to find the right way to schedule and plan my bills as well. I finally ended up creating a bill scheduling / forecasting app in google docs. This has worked amazing for the past few years. If you would like to use this free resource, here is the URL: http://j.mp/weeklyBillForecaster

Justin, how cool that you set something up that works for you – and thanks for sharing with our community!

I do all our bill paying with Microsoft Money. At the end of the year I print out a report and compare to the previous year, and my husband and I have a “meeting” to go over where we did well and where we can do better. I then do a cash flow projection in Excel (each week of the year as a column) with the average amounts of regular bills, and then other expected bills that aren’t regular. I have a formula that shows my net and balance at the bottom and it carries it over to the next week. As the bills come in, I plug in the actual amounts. This is great because it helps me see how much money I will need in the future. Even though the net maybe high, we may need it in the coming weeks. This allows me to put excess out of checking into savings where we won’t be tempted to spend it until we need it. I have been using this system for 7 years now, since we were planning our wedding. It really works for us.

That sounds like a very thorough system! I’m glad it works – and that you have a safety net that’s right for you. That’s the important part – it might be higher than some people want, or lower than others would, but it’s YOURS and meets YOUR needs! 🙂

I pay my bills like this: Every bill that comes in this week gets paid on Sunday, through my bank’s free bill pay service, or by check.

I write down every transaction I do. All electronic fund transfers are written on a calendar, and are first to be paid. I transfer, by hand, cash for Car Down Payment into my savings. I balance my checkbook with the banks website each Sunday, to make sure it matches. I am trying to pay off all my credit cards this year, so I try to pay as much as I can, with no minimum payments. I also have Credit Card of the Month, which gets at least $20 a week that month.

(It’s stressful, but my bills get paid) 🙂

Joan,

Thank you for these ideas! I’ve been using a spreadsheet to keep track of our bill and pay on time. Unfortunately, those numbers just don’t have the impact of having a calendar laid out in front of you. Nor does a digital spreadsheet give you the satisfaction of marking them off your list. For purposes of record-keeping, I like to write the payment date on the bill itself and file it away for tax time (business expenses) or to assist in our budgeting.

Also, LOVE the idea of cramming as much money as possible into that most-hated debt at the very end of the month. I’ve actually gone to the point of having two bank accounts where my paycheck is direct deposited: one is the pre-budgeted billing account where a predetermined amount of money goes every two weeks and the other is the “whatever” account. Keeping a tight budget meant that my “whatever” deposit was larger, but I end up frittering my hard-earned money away on….well, “whatever.” Considering I rely heavily on a personal accountability calendar at work, this just makes sense…though I wonder why it never occurred to me before.

Also, most calendars cover January of the next year so it’s cheap to get monthly calendars on the cheap.

Chris, I’m so glad this idea resonated with you!! I honestly don’t know what made me think to start doing it this way… but I wish I remembered, because I’m grateful to whatever it was. Like you said, it’s so easy to get a calendar, especially since you can use last year’s until the end of the following January, and it really does lay it all out.

I’d love to know what you think if you do decide to switch to this system!

I also like paying bills! Glad to know I’m not the only one out there!

As a few others, I also have the one month buffer in my account for all my bills. This account is used strictly for my monthly bills (this doesn’t include gas, groceries, or spending). All of my fixed expenses are setup as automatic withdrawals, and all my variable expenses are paid as soon as they come in. Once they are paid, I highlight them on my budget spreadsheet which I created using Excel. When creating my budget, I entered all my variable expenses based on the most expensive bill I’ve received from that company. This is great for three reasons 1) I’m ALWAYS excited to receive my bills because I get to see how much I’m under budget 2) If for some reason the bill is higher than usual, I never have to worry about it 3) Any money that I save by coming in under budget gets moved to another account I opened called my “Slush Fund”. It’s great watching this account grow each month which makes paying bills fun for me.

This was a good read. I am also a tangible person and my spreadsheet method has become harder with kids. I definitely think the calendar method would work well combined with my spreadsheet. We also do the debt tsunami but instead of hitting the most emotional debt we hit the lowest balance with highest APR and roll over to the next debt, its based off of the Dave Ramsey Financial Peace method and has definitely helped us condense. Thank you for sharing.

Pingback: Weekly Common Cents

This all sound goood. But I have a question …. How do you pay bills on time when you get paid weekly and there is not enough money to buy gas and groceries. ? a Weekly paycheck does not go far. have to wait for the monthly check come in mine on the 24th of the month and husband on the 3 of the month ….. Need help with this budget…

First, I have a buffer in my checking account, not to be confused with my emergency fund.

Secondly, I am naturally a nerd but have learned that simplicity is the key to freedom. I pay most of my bills twice a yearJanuary and June. These include rent, rolls of quarters for laundry, supplements, utilities, hygiene essentials, car insurance, cell phone service, and student loan. My other expenses are covered monthly. These include groceries, haircuts and massages, fuel/maintenance, itemized dues, and a spending allowance.

I think this system reduces stress significantly and opens up more opportunities for tithing, saving, and investing. As far as monitoring and keeping up, I don’t think too much about it. I simply assess each expense monthly and if its a jan/june expense I happily jump to the next one on my list. That’s it.

Interesting to see all the different ways people do this 🙂

I guess I’m abit of a nerd and I wanted a bill payment system that’s as automated as possible.This is what I do.

I worked out what all my bills are for an entire year and because I get paid weekly I divided each annual bill amount into a weekly amount.

Say for example if car insurance is $1000/yr. That’s $19.23/week.

I then set up an automatic payment of $20/week that comes out of my account the day after I get paid. 95% of my bills are paid like this and most of the time a “bill” comes I’m actually in credit and don’t have to pay anything lol.

For the bills I can’t automate I still save the small weekly amount in my account and pay them as soon as they come in.

The account my pay goes into is purely for paying bills. I’ve set up an automatic transfer to seperate accounts for things like spending money/holidays etc so I’m never spending money that’s needed to pay bills.

Hi, I know I am late to this post but I am glad I found it today. I have been using various online bill paying systems for the last few years. Over time I have started to ignore all the emails coming in that ” alert” me that something is due so that feature had long since stopped working for me. Lately Inhave felt unable to budget into the future when everything is on a virtual calendar. I iused a paper calendar all the years before online budget software.

I was beginning to think that my age was a problem remembering bills lately ( I am 61) but after reading this post I turned off my iPad and drove to Staples to get a paper calendar! I am so excited to go back to a system a can scan backwards and forwards with my hand quickly. There is no replacement for your own brain, your own hands and the spatial sense of using both to figure something out.

Of course I will still pay my bills online and automatically where possible. I just need to see and mark off bills that arrive in email by hand. I think that will cement them in memory far better than letting software handle it for me.

Again, good article at the right time. Thanks.

Hi all,

I am also very excited to pay my bills !

I have been doing this system for the last 15 years and never looked back.

I was always late paying my bills and bad with money.

Now I have an awesome credit record and pay my bills always in time.

Here is my system.

i use a binder, separtors and a note book.

I use a notebook, I write the dates of my pay from jan to dec, i get paid every 2 weeks

So let say I get paid on 7 Jan and 21 Jan, on the left, I write Wednesday 7 Jan and on the right page I write, wednesday 21 Jan.

Everytime I receive a bill, I look at the due date and write the bill and the amount on the date after i have a pay, exemple: If my credit card is du on the 12 Jan, I would write under 7 Jan : Visa 100.00 : and left it blank then when I have my pay on the 7 Jan I go pay online the bills that are under that date then i write the date, the payment number and then I put all my bills in a binder with separaters, at the end of the years I put all those bills aside and I start over. I love my system, cant live without it !!!

I love it! This is my bill paying system to a tee! It just works for me! I have tried all sorts of methods and just couldn’t adjust to them! I got a calendar and started jotting everything down and went from there. I LOVE IT and IT WORKS. For me anyway. Glad to see it works for you too.