[share_sc]

Note: This is a post from Joan Concilio, Man Vs. Debt community manager. Read more about Joan.

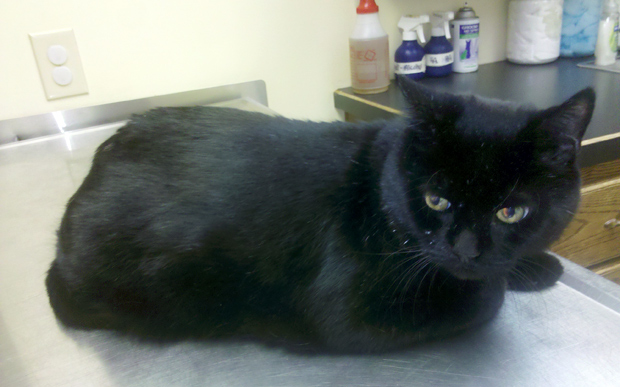

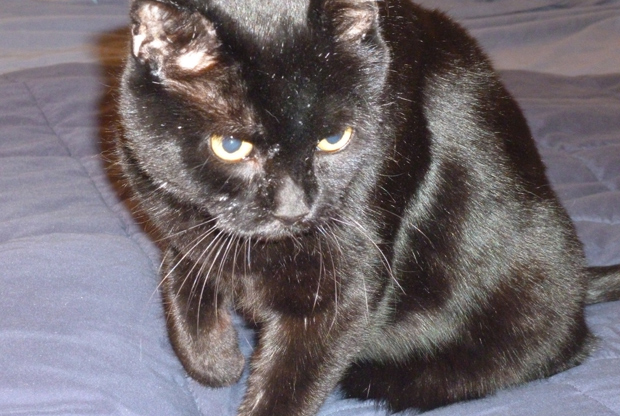

Meet my cat Floyd.

Floyd’s one of five cats in our household menagerie, which also contains one large dog, a hamster, and currently some monarch butterflies in a hatchery.

We like animals – but they’re awfully hard on the budget. In addition to the regular costs of food and supplies for that many living things, this month, Floyd’s unexpected dental surgery and related costs set us back about $600.

That’s my entire “extra payment” for the month on the hated credit card, you guys.

The whole thing.

After spending some quality time this week with my checkbook and my debt-payoff chart, I see that we now have $61,878.56 in debt to go. As of last month’s update, that number was $62,745.92, so we’re down $867.36 this month – about $600 less than our running average. Coincidence? I think not!

So instead of looking back at how things have gone otherwise this month, I figured my mid-month review would be a good time to look ahead – and to talk about a question that a lot of people I speak with seem to struggle through.

No, that question is not “Would you spend $600 on your pet?” I think that’s an area where we could debate for days and no one would change their opinion from whatever they went into the discussion with!

That said, I want you to imagine that you’re in a circumstance where some expense in which you’ll be spending $600 comes your way. Doesn’t matter what it is, except that it’s something you feel strongly about. In my case, it’s my aging cat’s health and comfort; in your world, maybe it’s a mission trip, your holiday expenses, your car repairs, travel to see an ailing relative or friend, whatever.

The question becomes…

When do you tap your emergency fund?

Here’s the thing. We have $1,755.51 in our savings/emergency account right now.

I could have transferred the exact amount of Floyd’s vet bill from the savings to our main checking account, paid the vet, and then paid on our normal amount against the Bank of America credit card this month at bill-paying time.

I didn’t. The savings is sitting there, untouched.

Why??

I wish I had a great answer to that question, but I’m kind of stumped. So I’d like to walk you through my thought process, then ask you to put yourself in a similar situation and tell us what you’d do!

The main reason we didn’t tap the emergency fund was that we HAD ENOUGH in checking for the expense. I guarantee that if the bill had been $1,000, we’d have had to use the savings.

So what does “having enough” in checking really mean, though?

Am I robbing Peter to pay Paul, or using money that should have gone to another use? Well, kind of.

If we couldn’t buy groceries this month, I’d feel differently. Instead, the money that we used for the cat came from what is, to us, discretionary income.

We CHOOSE to pay $600 extra on our credit cards most months. We feel strongly about becoming debt-free, but at the same time, the bottom line is it’s a choice we make, not an obligation!

The other thought we considered was that, if we tapped the emergency fund now, we’d simply spend NEXT month’s extra-credit-card-payment money restocking it. We prefer to keep in that fund about the amount that’s there now, which would cover our housing expenses for a month in a crisis.

So, with that in mind, it just didn’t seem to be anything except extra work for us to transfer money out of our savings. Like I said, I’m not claiming to have particular logic to that decision. It’s just where we ended up, and I’m all right with it.

Where do we go from here?

The thing I’m trying to keep in mind is that Floyd is feeling better. He’s back to his usual life of leisure, curled up on our bed, completely not earning his keep – a perfectly normal cat.

For me, the cost was worth it. And so was the decision not to tap our emergency fund in this particular case.

That said, I’m not willing to write off September as a month in which we pay only the minimums. We’ve decided to hustle and see how much we can put toward a second payment on our Bank of America card before the end of this month.

I’ve already picked up some on-the-side work that will get about a quarter of the $600 back, and we’re selling some crap to raise at least another $100 if not more.

Hopefully, what we’ll end up with is a win-win-win situation.

- First win: Large expense paid for in cash.

- Second win: Emergency fund remains at a comfortable level.

- Third win (hopefully): We make our now-customary BoA-bashing big payment!

· Unautomate Your Finances ebook

· You Vs Debt Sample Lesson

· What to Sell Where Flow Chart

· Debt Payoff Tracker

· 10 Tips for an Effective Craigslist Ad

So my question to you is, “What would you do in a similar situation?”

You have an unexpected $600 expense. You have $1700 or so in savings. And you want to make an extra payment against your debt of $600.

Would your choices look like mine, or be different?

[share_sc]

Leave me a comment – I’m curious!

No question that I would happily pay each amount I can on my pets. And even what I cannot, even if it means more debts – when I have a pet I know they can cost money. And although I’d hate as anyone else, I would always do it, no matter.

That’s our thing, too, Monja – if we really couldn’t afford to care for these animals, we wouldn’t have adopted them, but when we did, we realized we were in it for the long haul and we’d have to sacrifice in some other areas to take care of their expenses at times. Have never regretted it!

Stories like these are part of the reason why I have been so reluctant to buy any animals. I know I would fall in love with them and pay any amount to make sure they were taken care of. As far as your question goes, it depends on whether or not I had extra money floating around in the different categories of my budget. My husband and I have a strict 0-dollar budget, so if there was enough of a cushion to pull $600 from other categories then we wouldn’t use the emergency fund. If there wasn’t enough, then we would use the emergency fund.

That’s exactly our scenario! We want every extra dollar accounted for, so if we can pull from other areas, that’s fine; if we can’t, though, that’s what the fund is for!

We to have pets…they are our children We have 2 dogs and two horses. We’ve had a really tough year with them. When my husband and I met 6 years ago, we both had dogs and they were the same age. He had a huskey and I had a Pekapom. My little guy went everywhere.

Well, this year he passed away after one of our horses somehow stabbed himself in the eye…had to have surgery…and the year continued to suck from there.

One thing I’ve learned about paying off debts is….it’s kind of like being on a diet. Sometimes, you just can’t help yourself but tomorrow is another day.

Life is not always predictable…especially when it comes to things beyond your control…One thing that my husband and I are finding, life is so possible without credit cards. we’ve not financed one thing since starting to pay off our debts over a year ago. There were some months it would have been nice, but we are staying on plan. Go us.

Great job…love your posts!

Aww, thanks, Celeste! I very much agree – especially that life IS possible without credit cards. Keep it up – and keep me posted, I want to cheer with you as you go! 🙂

These things happen and I think you just have to roll with it when they do. You can get back on track next month with the extra $600.

In regards to the emergency fund. I think you made the right call using your extra payment instead of the emergency fund to make this payment. Keeping your emergency fund in tack is important also. I tend to use it when I don’t have the extra that month, or the one time expense is over the extra. Either way, personal finance is personal – so whatever you feel most comfortable with is ok in this situation, IMO.

Jason, I’ve heard that – personal finance is personal – before, but it really didn’t hit home to me until recently, as I’ve been trying to be very transparent with my decision-making! I appreciate hearing it again – now that I really “get” it! 🙂

$600? Find a less expensive vet!

Seriously though, I think you’re overthinking this. It would have been a $600 expense whether it came from the emergency fund or not. The emergency fund, in my opinion, should be for just that, emergencies, meaning you go to it because you don’t have enough money for whatever the emergency is. You had the money, and you still have the emergency fund, which of course you hope you don’t have to use.

So you made the right call. Just stay focused on the debt.

We just lost our feline friend Alex last Tuesday; and it’s the same story…we could have paid a couple of thousand dollars to keep him alive for another few weeks. Always guilt in that decision, but he was definitely in awful shape, and the vet told us he was trying to die. I think that’s a decision you’re going to need to prepare for more than this one–sorry to be a downer in that regard (treasure your pets every day!). Vets probably make a lot of money on people keeping their pet alive for a short time.

Oh, Kurt, I’m so sorry about your cat!!

We have been through that more times than I can count and it NEVER gets easier. In this case, we’re very happy to hear that they expect Floyd’s got a number of years ahead, but we’ve got some that I know will never make another trip out of the house. (Our oldest cat is about 18, and he’s hanging in there, but we have already decided that when it’s time, it’s time.)

It’s never easy… and I’m sorry you had to go through that so recently!

Yes it is hard to go through, thank you for the condolences…I went through it some years ago with my dog (who was also named Floyd, incidentally); it’s the worst day for a pet owner.

Strange thing though, I don’t think Alex wanted us to grieve. We still feel his presence in the house in a weird way that Ii don’t have time to explain here. I miss him jumping in my lap when I’m on the computer terribly, but my wife and I are handling it better than I thought we would.

Great job avoiding that emergency fund 🙂 Now set up a pet fund, ASAP! Something always seems to come up with our cat…. it’s inevitable as a pet owner. Putting a small amount aside each month just for Floyd will save you the headache from going through this again.

I know it, Stephanie! I was saying in one of the other comments that we do have pet expenses in the budget, but those cover the smaller and more predictable items, like antibiotics, flea treatment, dog grooming, etc. I can see us bumping this number up! 🙂

Joan, about 15 years ago I had 80,000 dollars in consumer debt (credit cards,car,student loans, and 2500 in unpaid bills to my vet.) my partner and I have had as many as 9 dogs as we have fostered some until we find homes my vet gave me my first copy of Rich Dad, Poor Dad. It took me from June 1997 until April 2001 to pay everything off. I built my emergency savings while I paid everything off. My beloved pets did help me out a bit. They were in the habit of injuring themselves every weekend, hence the vet bill. I sat them down when I decided to get my financial life in order and told them they had to be more careful. I told them “no more vet care!” The injuries stopped! The decision to use the emergency fund is a big one. I’ll share what a friend of mine told me, she used to be an investment banker.

I called her to ask if I should use the money in savings to pay off one of my credit cards.

She asked me how often do I get lump sums of cash. I had to tell her not often. She reminded me that lump sums can be hard to come by and then asked if I had a reasonable expectation of paying off the cards using the plan I was using in the time frame I expected. I told her yes. I kept my savings and continued with my plans to pay off the card. Now my decisions to use savings involve a complex series of internal negotiations that I really don’t mind putting myself through.

Ouida, I’m TOTALLY giving these guys a talking-to tonight!!! It can’t hurt, right?? 🙂

I agree wholeheartedly with your friend’s advice, too, and it makes a great point. The fact is, whether we do or do not make an extra payment THIS month, we are on track to pay off the debt at a point in the near-enough-to-imagine future. So we’re not talking that this is a total derailment! And you’re right – I used to live from large infusion of cash to large infusion of cash, and those weren’t very frequent, and it was ROUGH!

I have had some big vet bills lately, so I got a CareCredit account. It’s easy to get and you get 6 to 12 months to pay it off interest free. It’s been a huge help!

Gina, I have a friend who swears by it! We’re at the point where we aren’t doing credit at all, even interest-free, but I know there were points earlier on where that would have been something we’d consider!

I think you did the right thing and shouldn’t stress over it. If you had used your emergency fund, you would have wanted to pay that money back into it ASAP. But now your beautiful cat is healthy again, the emergency fund is still in place, and you will still pay off your debt as fast as you possibly can. What more could you do? I would also budget for future vet expenses from now on. I switched my 2 middle-age cats from cheapo cat food (used to live in the country and they freely ate mice, which are nutritionally complete for cats) to a very expensive grain-free food. But I’m aiming to prevent serious vet bills and make sure the cats are spoiled rotten like they deserve.

I like the idea of creating a pet fund as well as your emergency fund for future issues. I don’t know what you feed your cat, but I’ve heard that feeding them a meat-only raw diet can prevent those dental issues. I also don’t know the whole story behind Floyd’s dental problems, so don’t take this as pushing advice. Cathleen, maybe you could transition your cats to raw as well?

My daughter lives paycheck to paycheck, so she is feeding her 3 cats Purina Special Diet for Sensitive Systems. She gets it at Walmart, and it has no wheat (does have other grains, though). One of her cats is sensitive to wheat and this keeps him healthy.

I think you did the right thing using your discretionary funds to pay the vet bill instead of your emergency fund.

You ladies both make a great point – we do have “pet expenses” as a budget category, but right now, that’s enough to cover more routine stuff, like having the dog groomed, getting flea treatment, etc. This will definitely make me revisit that number! (And, sadly, it’s not the first emergency of its nature – our tiny cat had surgery a few years back for about $800 to remove one of his back legs after he got a cancerous tumor; yes, I have a tripod!)

Point well taken on the food, too – our cats are all rescues, and so in a lot of cases, they come to us with some existing issues, you know? Floyd is 12 and we’ve only had him for about a year, and apparently things weren’t so hot for him before!

Joan, I think you made a brilliant choice. The money was there, you’re not making your

financial situation painfully worse, plus you have the added

joy of ensuring the health of your beloved pet. Be happy you had the option of emergency fund or checking stash, hit BoA with what you can this month, and keeping pushing forward.

Thanks, Liz!! You can bet we will – and when I went to bed last night and there was Floyd, whapping me in the face to be petting, I was almost happy about it. 😉

I think you made wise decisions to keep your overall goal in mind. Sometimes a littel flexibility actually helps you reach the main goal. I have two dogs and two cats. The same thing has happened to us while we were getting out of debt. Vet bills are never cheap!

Congrats on moving forward and loving your family well. (Pets are family!!)

They sure are, Jeff! And I agree – why am I doing all this, if not for the flexibility to choose to use our money on what’s important TO US? 🙂

Hi Joan. You did the right thing taking care of Floyd. He is a member of the family. We had a black cat also named Mickey. He was a wonderful cat. He lived to 16 and we would have done whatever for him. Keep doing as you are. Chin up, earn whatever extra and the Doofus’ (Dave Ramsey’s name for B of A) out of your life forever.

I am going to manage to put the Dave rant against B of A from Labor Day on YouTube, I will provide the link. It is a good one, Doofus’ On Parade. Watch for that in the next few days.

Alan, I will! We love black cats, by the way. Three of our five are all black; one is tuxedo; and one is gray and white. We’re very monochrome. (Dog’s all black, too.)

A similar thing happened to us this weekend too! $600 on new tires after I hit a curb and popped one. I knew I needed a whole new set before winter anyway, but was hoping to hold off until next month. We also had a $1500.00 emergency fund and the money in our September budget to pay for it, so we chose to do it out of the budget. Besides, I kinda “knew” it was coming – so not really an unexpected “emergency”…just came a few weeks sooner than I thought! Great job on your debt reduction. We started with $80K of non mortgage related debt four years ago and will be DEBT FREE next week!!!! 🙂

Gina, WHOA!!!!!!!! That is amazing – not the tires (though I’ve been there, done that too), but four years debt-free. I hope you’ll celebrate like crazy when you get there – and come back and tell us when the last payment’s officially made! 🙂

Joan, you did the right thing, you had the cash to pay for it so there was no need to touch the ememrgency fund.Although,it will put h behind schedule this month you can make up for it in another area. I personally don’t have any pets so I can’t imagine paying a 600.00 vet bill, but I can empathize. Have you ever looked at how much more quickly you could get out of debt if you didn’t have so many pets? Would it make a difference in your goal?

We actually have talked about it several times – Floyd is the only “new acquisition” since we started our payment plan (well, except the hamster, whose cost is negligible!) but we’ve put a hard stop on any more new family members 🙂 Floyd was a special case, because he had some problems and was particularly pathetic.

That’s our personal decision-making process – we won’t get more because of the cost, but we won’t part ways with ones we’ve had for years (my Salem, my oldest baby, has been with us for almost 12 years!)

Obviously, if our situation became dire – facing foreclosure, unable to pay the minimums, whatever – we would use a different process, but for where we are, they’re definitely just a line item we’re willing to take on! 🙂

Joan

I’m a single mom with 2 kids. I decided when I began this journey. That for me personally? No pet is worth it. So we are currently pet free. I know how much pets cost. And the trade Off just isn’t worth it for me in this stage of life. But I hOnor your decision.

Barbara, I can understand that! Like I said in another comment, in other times our decision would be very different!

I agree with the others, set up a pet fund. I would without a doubt spend money on my dogs without thinking twice.

Michelle, we’re definitely going to be bumping up the amount in our existing pet fund! 🙂

I have had 3 cats at one time,all adopted with knowing health issues. They all at some point had health crisis that cost a lot of $ in addition to the weekly cat food, litter, prescriptions etc. In addition we had to add on the cost of a pet sitter for any vacations, trips etc. I set up an emergency pet fund where each month $100 direct credit went into that pet fund. At times it was never tapped and I had to use the $ for some other issue non-pet related. Rarely though because we had other emergency funds. When a cat needed a $900 ultra sound the $ was there. Unfortunately our last guy just passed away so we are catless. I don’t think we will adopt another at this point, due to our ages and the cost. Our cats were part of our family budget. When we got down to our last cat, I decreased the amount from $100 to $50. Now that same amount goes into our house emergency fund. To afford that $100 pet fund deposit monthly we cut out going out to eat as much and took some out of our weekly grocery budget.

PW, sounds like you had EXACTLY the right mindset! You know what you’re getting into and you plan for it! I’m sorry to hear you’re catless, though – in my utopia, everyone has an all-expenses-paid cat. 🙂

Thanks for sharing your story – it definitely shows the value of planning and being intentional, and how that can truly work!

Thanks, Joan, I loved this post and your honesty as always. I just had a similar thing happen with both my cat and my car, and did something similar to what you did money wise. I too have pet care in my budget, but the bigger expenses catch me by surprise — good idea to bump up those amounts in savings if we can swing it.

Exactly, Felicia! I feel like the pets and the car are the big ones for us, and we are definitely trying to be better prepared in BOTH those areas!

I really don’t need to answer that do I?

No, no you don’t. But I hope you enjoyed the Gratuitous Floyd Pictures! 🙂

Yes, I did.

I just spent $500 on our fat black dachshund last month. You have to take care of your pets. They are part of the family. Its good you have money in savings. Consider the money you used on the kitty well spent.

Laura, I DEFINITELY do. And I admit a partiality to fat and black animals 🙂 Ours are all a little on the heavy side, except for the three-legged kitty, who is very thin.

Joan

I am just about ready to cry here. I lost my sweet Tasha this past summer and miss her terribly. I lost her buddy Emme a year ago. It hurts so much to lose them. Sometimes there is nothing you can do. We are now a catless household, and something is missing.

I think a pet fund is a great idea. There are fewer surprises that way. I have always felt that a good pet owner is a responsible one. If you can’t afford one, don’t take on the burden. There will always be expenses to deal with, but we made a contract to take them into our lives and love and care for them.

Anne, I am so sorry for your loss!! All my kitties send big, lazy cat snuggles your way.

I agree wholeheartedly about being responsible. It’s not exactly a surprise that this living creature is going to need food and medical care, right? 🙂

Hi Joan,

I didn’t read every comment, but did anyone mention pet insurance? It can work out really well for some people. I also like the idea of setting aside a certain amount each month in a special “pet health and emergency fund.” I don’t do that, but if I ever adopt another animal, I will. Health care goes along with having an animal companion, which few of us can anticipate. And we can (ideally) plan on how far will we go. Something like 50% of dogs and cats die of cancer–how far do we go to help them? That’s a personal decision, but I wish I knew all this when I got my first dog, cats, etc.

As for whether I’d spend $600 on a pet, well that just covers yearly exams around here for two dogs, including full blood work, fecal exams, Lyme tests and whatever. I’ve had a dog and a cat survive cancer, a cat with kidney issues, one that had a stroke…you don’t want to know what I’ve spent in the last 10 years or so on my animal friends. Neither do I lol, but I could very easily pay off all of your debt with it 😀 Not wealthy here–haven’t bought a thing for myself in ages (no debt other than mortgage though), and I eat a lot of noodles….but I adopted my animals and I’m responsible. Oh well. Healthy and happy is good 🙂

Your gorgeous kitty Floyd is very grateful, I’m sure 🙂

Aw, Floyd says thanks! He doesn’t often get called gorgeous. (He’s a little, uh, ratty-looking in real life. Those are especially flattering pictures.) But we love him no matter what.

Pet insurance is an interesting concept, and one we didn’t really get into. I personally would prefer to just fund my savings to the point to “insure” myself in lots of ways, whether that’s pets, car repairs, healthcare, etc., but that’s just my nature, I think! At this point I think our biggest thing is continuing to build our general savings buffer and taking things as they come, but that’s certainly a valid consideration!

Pet insurance is hard to figure out (I don’t have it myself), but I’ve heard some great stories about it while sitting in vet hospital waiting rooms. I’m with you on the buffer and emergency fund and all that, which I don’t have at this point due to a cat’s 3-year cancer battle which we lost, unfortunately, less than two weeks ago. But the money spent was so worth the time with him, getting to know him better, cherishing every moment (ok most), healthy and happy. Gotta build it back up though!

Very cool to see so many animal lovers here! Big hugs to (the gorgeous if ratty sometimes) Floyd 🙂

Joan,

As you and previous commenters have stated, you made the right choice for the right reasons – your situation and circumstances. Your plan is in place, and shows that you are

able to handle the unexpected, because you planned for it!

And been there, done that: in 1991, lost our 3 year old male to urinary blockage the day before we moved 900 miles away, had to make the decision in the vet’s office right there by myself with husband on the phone. We couldn’t put Rascal through a risky surgery with a 3 month recovery time and the $$ just wasn’t there to cover, and there was no guarantee of quality of life. His sister, though, started kidney failure at 15 years old, and with our vet’s help we kept her going happy and comfortable for 3 more years with daily IV fluids.

I think we did the right thing by both cats, and though we miss them both, we know they had good kitty lives with us. We are on Prima and Terra time now (both 4 yo females), and it’s been a blast!

Anne, I think I would have done exactly the same in your case as well, but oh, how sad! And it sounds like Prima and Terra have a very good home with you (and I’m sure they appreciate their Latin-rooted names, how cool!)

A. Floyd is gorgeous! 🙂 B. I also would have just paid from my account if the money was there, and arriving at that action using pretty much the same logic as you listed. I like my emergency fund padding and if I have the money in my checking, it just makes sense to me to use that instead. I will do anything to not touch the emergency fund, though. I commend you on still trying to make that extra credit card payment this month!

Thanks!! And Floyd says thanks, too. Actually, he says ::yawn::, but close enough 🙂

Floyd is a beautiful kitty and I’m sure he’s grateful to have such a loving owner. 🙂

I just recently paid off a vet bill on my credit card, and my husband paid off another vet bill on his card as well. We have two cats and I swear they conspire to get sick at the same time!

In theory we have a “pet fund,” but finding the discipline to actually put money in it has proven challenging. I agree that it’s a great idea … if you can find the extra money to put into it. And then of course you must leave it there until you actually have a pet emergency (and don’t just want to go to a restaurant or something … did I mention my lack of discipline?).

Ellen, you made me smile. Isn’t that the whole problem when it comes to budgeting for irregular expenses and SAVING in general – “but the money is just sitting there!” A topic for a future post to be sure. And you’re not alone 🙂

Poor Floyd! I had a similar emergency vet visit last week too! Bullet got in a fight with a bee and lost. His face puffed up and he couldn’t breath out of one nostril. Yeah $150 medical bill and happily breathing puppy.

Not going to lie, I put it on my credit card. But I’ll be sure to pay it off at the end of the month.

Yeah, garage sale 🙂

Oh, poor Bullet – but very glad to hear he’s doing better! Give him a doggie squeeze from me. And way to go on the garage sale plan, too!

We’re dealing with almost the same situation right now, right down to the dental surgery for one of our two cats. We’ve been debating paying savings versus credit card, but struggle with which one is really less detrimental – and perhaps that’s a negative way to look at it – more like which one is more “beneficial”. My husband has a steady income, and being in business for myself, mine can fluctuate month to month, so while we have some wiggle room, I personally lean on the side of not taking huge financial risks. Thanks for sharing – gives some good insight. Cheers!

Dana, that’s a very good point – in all decisions, that’s really what it comes down to, which is the least detrimental when you weigh both the short-term and the long-term outcomes, huh?

I hope your kitty does well!

If you are $62k in debt, why do you have 5 cats? You obviously can not afford them right now.

I hope you’ll stick around and read some of the earlier posts, as well as later ones – we’re pretty happy with the progress so far ($30,000 paid off in a year and a half, cats and all!), but I certainly respect that our way isn’t for everyone!

I have 3 dogs plus a foster dog. After working with a rescue group for a few years and seeing first hand the costs for animals and emergency type things- you should look into Pet insurance (not sure if it covers dental) or also something called CareCredit- hate to add another dreaded card to the mix, but for cases of pet emergencies (and even human ones) it can be used in the spur of the moment.

I’ve had one emergency bill that was $1000. I charged it at the time, cause I was young and wasn’t in the paying down the debt mind set. Now, I started saving for their aging issues, I don’t have kids so it’s different for me.

Cheryl, you’re not the only commenter to suggest both of those! They’re definitely viable options for some folks – we’re choosing to kind of “self-insure” both our pets and ourselves in a way, by boosting our savings to even better prepare for these kinds of costs – but there have been plenty of times in our lives where that wasn’t our option!

One other thing I thought of was if you got them from a rescue group- the rescue can recommend a lower cost vet. I know we used several vets and knew the ones who were great and had lower prices.

Seriously since I love all of my fur babies well I guess the extra $600 would be well…you get the idea. I might do my best to either find a way to “find” or get more money some how even if I had to sell all of the books I own (which i am slowly doing now) plus have a garage sale and sell what I could.

Good luck and even if it is only a quarter to the dreaded BoA card it is still better than the minimum.

Rebecca, that’s the plan – I figure any amount “extra” against BoA is still an improvement, and all the hustling we can do will make things even better!

What I love about this column, Joan, is the way you lay out your decision-making about using the emergency fund. We have our emergency fund split up in two accounts – long story, all our other accounts are joint but not this one. My husband NEVER sees an emergency. If something comes up outside the budget (example: garbage truck came screaming around the corner, I pulled up on a curb to avoid it – two popped tires) that looks clearly to me like an emergency, he prefers we just eat ramen for the rest of the month.

I think he’s crazy.

But I don’t think you’re crazy, so to hear your decision-making process around staying out of that emergency fund was enlightening. For you, if you can make it work without ramen, it’s not an emergency. For him, I think, unless it means no ramen, it’s not an emergency. To me, if it means paying the babysitter late or no milk for the kids for half the month or something, it’s an emergency. Different frames of reference. Thanks for spelling it out!

I think that’s EXACTLY the idea – it’s not the end result of the decision that matters, deep down. It’s the questions you ask yourself and the choices you’re willing to make. I’m not a ramen-eater either, as it were. My personal choice, not one I’m going to say anyone else has to make, but I lived through too many years of can’t-have-anything-but-ramen-AND-no-cat to want to do it now! 😉

Good for you and your husband for finding a system that works. I’m a big fan of joint finances in MANY cases, but I’m an even bigger fan of things that allow you to be successful!! 🙂

Floyd wins every time in my book…

pjd

Ours too, as you can tell! 😉

I’m a veterinarian and I commend you for taking care of your kitty. Some ideas that may be helpful to other budgeters (been/am there too!) to consider is pet health insurance.

Pet health insurance is most effective is purchased for a young, healthy pet with no pre-existing conditions. It helps with large pet expenditures in that it pays the pet owner back a large portion of the bill after the deductible. There are many companies, some great, some not so reputable. You need to read the fine print. VPI is my current favorite. There are different plans — the lower cost, castrophic plans with a higher deductible seem to make the most sense to me.

In addition to pet insurance, regular preventive care is uber important. Just because a pet “looks fine” doesn’t meant that it is. Pets can’t talk and often hide illness until it’s quite advanced (and more expensive). Finding a vet who believes in preventive health care, one you trust and communicate well with is important. Don'[t rely on “Dr. Google.”

I recommend to my clients to budget $500 a year for preventive care for each pet, and then either have a pet savings account, empty pet “credit card” (my least favorite), or pet insurance to handle the bigger unexpected.

Sadly, I think families should consider the number of pets they adopt as well. I often see famiies with big hearts and empty wallets. In the long run, the pet pays the price and it saddens me.

Wow, thank you for weighing in! I am sure you see a lot of cases that would make me cringe – and I appreciate your insight! (I wish Floyd’s previous owner, a World War II veteran on an incredibly limited income, had been able to find a way to get him some preventative care – would have saved us a LOT of hard times!)

Didn’t read every single post, so maybe this was mentioned, but I found a fantastic vet that gives a nice discount when the services are for rescued animals. He’s connected with the local Humane Society – does all their spaying/neutering, etc. Just a thought.

We’ve been debt-free for years – including house & cars (old Mopars my husband can fix)! Admire your spunk & enjoy your writing – keep up the good work! Faith.

Faith, wow, thanks! And that’s a good point – we go to a vet that I know personally (grew up with), but comparison-shopping on pet care is just as worthwhile as comparison-shopping in any other spending area!

Cost does not equal equal quality. Be wise and be careful. Good communication right up front with your vet is the best. Let them know what you can afford, a good vet will come up with a plan B or plan C if plan A is too much.

a vet

If that happened to me, I would have done the same thing. Its great to have pets at home. Though once in a while, problems occur and we have to shell out money to take care of them. You just gotta have to roll with the punches, at least you have your emergency fund intact.

Dominique, you’re exactly right – stuff happens, and hey, we still have money for emergencies we CAN’T fund!

This month I’ve been hit with physical therapy expenses that are not covered by my insurance. It’s eating up what I’ve been saving from my extra tutoring.

Since I need to take it easy on my foot; it’s monsoon season and my full time job is taxing right now; I’m not following through on trying to ‘hustle,’ more – I’m looking at it as like well, at least my ‘extra’ income can go toward my healthcare costs even if I’m not saving.

Soon I’m going to have to dip into what I saved in previous months. But I remind myself hey; even though you’re savings (both here and ‘home’) have taken a hit and continue to do so – I am actually not in debt right now. I just would be if I returned to North America – so, my ’emergency’ fund is too low to cover relocation and re-establishing myself; but while I’m over here I’m still on the right track up. That’s a more positive summary of my situation than I’ve given myself credit for in some time.

Jenny, I appreciate seeing the change in how you describe your situation – and your positive outlook is AWESOME! Keep it up!

Thanks Joan. Glad your cat is feeling better!

I must admit – being a nomad, and the expenses are two of the biggest reasons I’m not a cat owner right now. I appreciate the cat family that lives in the roof above my classroom.

So many comments on this post! Pets really strike a chord with us, don’t they? As for me, I had a similiar “use the savings or take from the checking account.” scenario and I made the same choice you did. Funny thing, in reading your post I clearly saw another option – take a little from both! Someone may have said that already – I didn’t go through all the responses – but it makes sense to me to continue to pay off a little more on the credit card and save that extra added finance charge. The next month just half the extra payment to the credit card again and pay back the savings account. I love how your posts let me see my situation from another perspective!

Ginny, amazingly, NO ONE said that yet, and I didn’t really think much about that either!! Thank you for helping me see beyond black-and-white – something I’m as guilty of as anyone!

Joan,

Won’t go into details but to say often the same situation re a beloved pet(aka a member of our “FAMILY” and who relies upon us solely for their wellbeing EVERY single day they are with use) has occurred for our household so no explanation as to why you had to do it is necessary where I am coming from. BUT… as to where the money came from, I disagree. You should pull it from the EFA and since you have already paid the vet , then you use that amount which you set aside for that CC and make the payment that was planned before the “family emergency”. My rationale is 2fold: one – this type of situation is EXACTLY what the EFA is for-an unforseen emergency that is/has/will affect your family( which is what puss is) and 2nd by not paying the CC then interest is still been charged. You can top up the EFA again BUT you will never be able to get rid of the CC interest that accumulates even for that one month and in the long run you will have spent more in money and time.(ie: Puss’s vet bill + the interest accumulated for the missed CC payment for that period which also means a longer time projected to pay that CC off and be debtfree versus simply adding to the EFA when possible to bring it back up but which has no interest being charged)

Hope this all makes sense

ABgurl in Alberta

(I haven’t yet read thru any ot the others comments so I apologize if I am possibly repeating something that someone else wrote)

I think that’s a good point – in our case, we’re not as worried about the interest (I know, weird, right?) – but in large part, it’s because we are working so hard to still make the full extra payment, or as close to it as possible, and also because all of our previous extra payments have so drastically reduced what we pay in interest each month. It’s still bad, to be sure, but we’re kind of riding the momentum of having this card down almost $20,000 in a year and a half – so this month’s interest accrual seems small in comparison to what we were seeing as recently as this time last year!

You’re absolutely right mathematically – and that’s definitely a consideration!

Same here, $2,000+ aged cat vet expenses, completely unplanned and unavoidable, credit card. Failed to take this into account when adopted young pet, just to give him a roof over his head.

So, no more pets in the future, no matter what. Either you can afford medical care for pet, or not – pet requires what has to be done, and now you (I, really) have a debt for a long time to pay.

Helen, I’m so sorry to hear about your vet expenses! I can’t say what the future holds for us, but I would be willing to bet we won’t be without pets for many, many years – we’ll just continue to improve how we budget for them!

When it comes to medical care, be it family or my little rescue bird, I would do whatever it takes. Although I’ve never had any outrageous bills for my bird, so I guess I’m lucky. That being said, I would rearrange my monthly expenses so that I could keep my savings in tact. Something I do, though, is have a small account that is neither checking or savings that I use for expenses like this. I know it’s one more thing to manage, but it works for me. Kind of a discretionary account aside from the others. If a large expense comes up, it allows me to pay it without effecting my bills or savings. Then I slowly pay it back.

Kimberly, that’s a good idea – kind of an “in between” mindset, something that’s a clearly defined pool of money that can be used, but that is finite. I like that! (And I love birds – horribly allergic, but love them anyway!) 🙂

Ironically, we will be spending $600 on our dog today…but I’ve budgeted for it, and as long as I don’t buy anything else but groceries this month, we should be able to afford it. It’s been difficult living on our budget since my husband took a paycut, but I am just about anal enough to make all the pennies work out. It’s taken a lot of cut backs to make this work and a few sacrificies, but I now consider living-within-our-means a challenge every month.

Anna, that is a HUGE accomplishment – because for so many of us, we spent so many years getting further and further behind each month! So to end the month at least at zero – even if there isn’t anything left over – is a big, big, big improvement.

I hope your dog is OK, too – I’m sure he or she is worth the sacrifice!

I will be honest, like others, and say that I didn’t read every comment. This is definitely a situation that can be burdensome if you’re not ready. The fact that you had money available if needed is quite admirable.

This is one of those scenarios (that doesn’t fit all folks) that is a touchy one. That is, if you are strapped for money, living paycheck to paycheck, or need financial assistance then pets are probably not be a good idea. There are a lot of monthly and ongoing costs to having pets that impact making other financial goals.

Definitely a hard predicament here… Thanks for sharing!

Shea, I definitely agree – again within individual circumstances, but suffice it to say that when I was in that boat of not being able to pay the bills each month, we didn’t have 5 cats! 🙂 We did have one – who I’d had since I was a baby – but not five, and no dog. (Much smaller house, too, as it turns out.)

I do admit that we’re maxed out – and we don’t intend to take on any more, probably even AFTER the debt is gone. We’ve got the amount we can love and care for now! (That’s not to say we won’t help fund some adoptions from our local shelter once we’re debt-free, though; the animal-lovers in us need to stay involved somehow!)

Hi Joan!

You did the right thing to save Floyd. Since he is aging, you may want to consider pet insurance. Read the fine print. They cover certain things and you would have to pay $100 deductible but that sure beats $600.

Jane, we’ve definitely talked about it and decided we’d rather self-insure with savings (that we can use for any number of purposes) rather than take out the insurance right now, but that may certainly change in the future! It’s definitely a valid consideration!

I think you did the right thing, paying from checking, instead of touching your emergency fun.

One of the reasons I don’t have animals currently, it was a constant expense fest that never ended unfortunately.

I’m sure between selling some stuff and keeping an eye on things you can recoup that $600 soon.

Jeff, I think we will – at this point it looks like we should be able to make at LEAST an extra $400 payment against BoA before the next payment comes due, if not more!

Good to hear Joan!

Okay- I am really boggled here at most of the comments about not using the EFA funds since this was an emergency( unexpected event) since isn’t this exactly what the purpose of an EFA is?? Yes- I understand that there was some “extra ” money in the chequing acct-however, the truth of the matter is that there was NOT extra funds in the chequing by virtue of the fact , those funds were actually accounted for as being a “planned” cc payment ( even though it was an extra payment over and above the regular monthly one) at the time they were accumulated.

If one goes by the principal that “every dollar must have a job”( particularly when debt clearance is the issue) then that so called “extra” $600 in the chequing DID have a designated job which it now will not be doing.

I get the point entirely of that – but at the same time, isn’t it just shifting the same issue by a month? (Because our emergency fund is currently at the lowest we are comfortable maintaining it at, one month’s major expenses?) In other words, IF we were willing to let the emergency fund sit and build back up slowly, I’d agree with you, but as it is, we’d just be taking October’s money that was “supposed” to go to the credit card and putting it in the emergency fund. So by my reasoning, we’re 50/50 at best – not that it would have been bad to use the fund by any means, but simply that I don’t see how using the credit-card money this month or next really makes a difference either way.

Yes, there’s a mathematical difference with interest, which I did address in another comment, but for one month, it’s not enough of a difference to warrant the back-and-forth money transfers.

Now, if we hit ANOTHER emergency this month, you can bet where it would’ve come from – the emergency fund!

Pingback: 50 Personal Finance Blogs You Should Be Reading

Okay – I understand what you are saying and I think the confusion arises from I wasn’t implying that the funds for the EFA be topped up with the money that would be for the following month’s cc payment ( October). While the EFA would be lower than what you wanted it to be if you took out the vet bill from that and made that accounted for CC payment that paid for the vet, you could do one of 2 things- contribute to it abit more for the next few months( ie: if adding a $100 is the fixed amount you do each month than continue to do that but also add an extra $50 or more if possible each month till the 600 is paid back to it/this also may not take as long as thought if you add what they call snowflakes to it such you have 100 for groceries each week but you are able to achieve what you need for food that week with 20.00 left over so into the EFA with that or you had a certain amount budgeted for gas but ended up with 15 left over at the end so into the EFA it would go, or maybe abit of extra hours at work could be picked up to help in addition) or can you manage to find more items as you did before to sell that your household no longer uses?

I have to honest here – I do not have any debt with the exception of my mortgage which will be paid off in 22 months (15 years exactly from purchase). I do own my car ( paid out within 9 months of purchase and was new) , do have 2 major creditcards which I do use regularly as they are both cash back reward cards which pay cash back to me every Jan on all purchases made the year before(although I do not use them unless the cash is sitting there and I pay it in full as soon as I use the card). My home, which I bought when it was 5 years old, has been fully maintained over the last 6 years( from new furnace, roof, hot water tank,etc- all the major ones that need to be done once a house is over 12 years old because unless custom built , home developers use the cheapest they can put in and which are the lowest grade on the market-ie: roof shingles that are 10 yr or furnances that are too small for the load bearing of the home’s square footage,etc) through to design renos of granite counters, custom millwork,etc. However I do wish to make it known that I am a single mother although my daughter is now grown and on her own but I raised her without any monetary help from the other parent or family, I did not and do not have an occupation that pays much by most people standards ( I am a librarian who works in a hospital library)- as matter of fact many people are quite shocked when they compare what I have to what I am making. However my point of all this is to point out that I was able to be in this space and time where I am by coming up with “money” games- they were and still are challenges that I enjoy to see how far I can make the dollar stretch without ever feeling deprived)-I grew-up with a parent who could not manage money in any way, shape or form and I vowed that I would never never be like that ( where my kids ended up fielding calls from debt collectors or being moved every 6 months because the rent hadn’t been paid,etc)

So I guess what I am trying to say – is make getting that $600 a game, a challenge to stimulate creativity as to how to find the additional funds because it can be done and let you stay right on track with the plan you had laid out for the finances( and even more importantly keep that idea of a challenge as the motivation to take you and your family to the end result that of getting rid of the debt/make it a game albeit one you have to win but a game that with the right moves that being creative can trigger will let you win)

See, I think we’re in total agreement – because that’s what we did; we made the $600 a game to see how much we could hustle to still make the extra payment – and we’re already over $500, with a week to go!

I think there’s another comment on the idea of the emergency fund too – there are different schools of thought about having one at all while in debt, but it’s been key for us, and we’re at what we consider “bare minimum” now – one mortgage payment. So if we had it higher, we might feel differently, but we won’t take it any HIGHER than it is now until the debt’s paid off, but we also won’t let it get much lower!

BRAVO Joan and family on the “hustle”!!!!!!!!!!!!! That’s the spirit-kick that ” bad house guest” aka debt right in the ass and out the door. 🙂

Joan,

Good stuff. Its amazing how few folks talk about the hiccups in their finances. Those hiccups derail many folks from their plans. Its not a question of if, its a matter of when. Its almost as guaranteed as death and taxes.

I see no problems using checking or the emergency fund here. The key is doing exactly what you are doing. Double down and refill that void. You could have wallowed with the “woe is me” group, but choose to take action. That is the real lesson here for those wanting to run their financial life rather than be run by it. Congrats on a successful step this month. That deserves its own mini reward. Extra scoop of ice cream anyone?

Jason

I like ice cream! 🙂 LOL.

I have a question, would pet insurance be a better option? We’ve got an English Bulldog and they come with a host of breeding issues so took out pet insurance to cover against this, the small amount each month is worth the cloud of doom/vet bills that could happen. Fortunately she’s not had any since we got her, however it’s a cushion.

Will you put a stop to any more toping up of pets to the household while you’re going through your debt clearing?

Jonathan, we’ve already said no more – but we’ve had all these boys for many years, so they’re staying! 🙂 I don’t think we’d have this many again in the future, even separate from the debt, but who knows?

You have over $60,000 in debt, obviously you’re paying a higher % rate on your debt than you’re getting in your emergency account. Assuming you can reborrow up to whatever your maximum amount is (something over $60,000) you’re going to be better off not having an emergency account (or even a checking account) until the debt is gone in full.

Otherwise you are servicing a loan that is more expensive than the money your holding.

Ashley, there’s definitely different opinions about that – in our case, we are adamant that if it were not for the emergency fund, the debt would be farther from being paid off. Now, we’re not what we call “fully funded” – we have exactly one month’s mortgage payment in emergency, nothing extra – but we’re not taking it any higher for the reasons you mention.

The thing is, we HAVE tapped this fund before during our debt payoff – and we are definitely not interested in reborrowing. Credit cards are not an emergency fund! They are a loan, pure and simple, not a “fund,” and we don’t choose to use them. All but one of our cards are closed, so it’s not even an option for us, but we wouldn’t choose it if it were!

You have to save your Fur Babies or at least try. I have two cats and I think about it always. What can I do? I don’t have an emergency fund unless you call 275.00 a emergency fund. But I am going to try to get one up there as soon as I can!

I love my cats, they are family. I hope your baby feels better soon.

He’s doing a good deal better this week! He’s stopped hiding under the bed, he’s eating well, and he’s generally happier. Thank you so much for asking! 🙂

Pets are so worth the cost of their vet bills. They are even good for your long term health. There are studies that show they bring down blood pressure and provide a bunch of other health benefits. I’m with you on the whole not touching the emergency fund thing – even in an emergency, I get nervous to take money out of it.

Daisy, I fully agree – Floyd (and my other furry friends) keep me smiling! I think in my case, I like knowing that the money is there for a REAL no-other-choice emergency, because I didn’t touch it for a “maybe” emergency!

I agree with you. I would have taken it out of the extra payment as well. The savings is better left untouched. You never know when there could be an emergency or unforseen circumstance.

Pingback: Are You Tracking Your Debt-Payoff Progress? Joan’s Mid-October Financial Update

I would have done it the same way. In fact, I did. We had 2 aging cats when we were paying off our debt 3 years ago. Both cats passed and then we used some of our debt payoff money when we found 2 new kitties. For us to not have cats in the house was not an option, so using our debt payoff money wasn’t a problem. Our cats are 2 and 3 now and healthy AND we are debt free except for the house!

Good luck!!

I would pay any amount to give my aging cat any medical attention she needed, and if I didn’t have it I would beg, borrow, plead and get it somehow!

I intend to build myself up an ’emergency fund’ so that I have something to dip into if an something unplanned for happens so that I have something to fall back on.

Great to see so many fellow animal lovers here!

Have you ever considered finding new homes for your pets, in order to address your debts first? As you said, having that many pets can be quite the strain on your wallets. I myself own two kitties, but if I was in any other significant amount of debt aside from my home mortgage, I’d probably find new homes for them – though it would be an easier thing to do if I could find someone I knew like family, and get to visit every now and then, possibly even get them back once I’d paid off the debt?

Or even just considered reducing the number of pets you have? I’m not sure how much your normal pet expenses add up to, but hey, every cent counts right?

I’m under the school of thought that it is best to have debt paid off as quickly as possible because otherwise you’re just spending more and more on the interest as you take longer to pay it off, ALTHOUGH, I also love the security of having flexible savings as sort of a padding for things that do come up – I feel like that may be more of a psychological thing, kind of like a comfort blanket…

Also… have you also considered trying to find a way to consolidate all your debt as much as possible? Like, trying to loan money from sources with interest rates lower than your credit cards, and paying off your largest interest rated credit cards earlier? My husband was carrying some debt before we married, on his line of credit, which was much higher than his mortgage rate. So what he did was he refinanced his mortgage to include an additional 10k, in order to pay off his line of credit since his mortgage offered a much better rate than his line of credit.

Tyng

I agree that adding to your pets when you are in financial difficulties or trying to pay off your debt is just plain stupid. It’s like going out to buy another wide screen television when you’ve got one already. However when you have pets you take them on as a responsibility for life, they are not a commodity which you just get rid of when it doesn’t suit, if you don’t accept that then you shouldn’t be a pet owner.

Jonathan

I would have done the same!! It’s more psychological for me than anything. And sort of about self control, that I can find ways to pay unexpected expenses outside of using the emergency money. To me that emergency money is for when there is nothing else to scrape-up and use. 🙂