[share_sc]

Note: This is a post from Joan Concilio, Man Vs. Debt community manager. Read more about Joan here.

When I introduced myself to you guys a couple months ago, I was $70,858.26 in debt on credit cards and loans, and that meant we’d paid down 20% total on our worst-ever balance of $89,687.23.

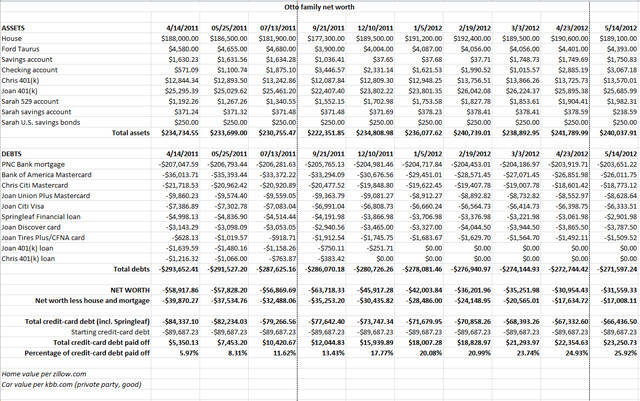

I’m incredibly detail-oriented – remember, I still keep a check register – so it probably shouldn’t surprise you that I set up a spreadsheet where I keep track of our debt payoffs.

That’s the “big picture” you see above – since I started the sheet in April 2011, we’ve gone from being $84,337.10 in credit-card debt to, as of today, owing $66,436.50 on credit cards and loans.

When is being $66,000 or more in debt a GOOD thing? Well, when it’s more than $23,000 less than you WERE in debt a bit more than a year ago. Even since earlier this year, we’re down considerably – and we’ve hit one of our key milestones, which I’ll talk about in detail later.

But since this is my first real update on our war on debt, I want to show you exactly what we’re keeping track of and why. (I promise future updates will be a lot more to-the-point!)

Our assets

Oh, doesn’t THAT look pretty? This is the top section of our spreadsheet, a look areas where we’re “to the good” a bit. Later on, I’ll talk about our net worth and how we choose to view it, but for now, let me just talk a little about some of these figures. (Also note that, for readability, I’m showing our starting figures from last April, but then I skip to 2012’s numbers – hence some big jumps!)

Our house. Oh, our house.

I agree with Baker that your primary residence is not an “investment.” Right now, we’re keeping track of the approximate market value of our house (using estimates from zillow.com) so that we can get a feel for when we’re no longer underwater on our mortgage. As you’ll see when we talk about the “debt” portion of my finances – that’ll be a while. Even so, we feel like the approximate market value is good info to have. As you can see, our housing market hasn’t changed much in the past year or so.

The Taurus of Wonder and Joy. Don’t forget, this is our only car.

We track this using estimates from kbb.com, the Kelley Blue Book. Again, we don’t intend to “do” anything about our car for some time. But we like having the information on hand, much like we do for the house, and it’s interesting to see this hasn’t changed much in the past year either.

The point isn’t that these are tangible “assets.” It’s that if we’re faced with a life-changing event – whether an opportunity or a crisis – we want to be armed with all the info we need to be as flexible as possible. And for us, that means knowing what we’d get if we needed or wanted to sell our two main physical “structures.”

Our checking and savings accounts. These are pretty self-explanatory, but I’d like to point out two things.

Following Baker’s advice, we are now committed to NEVER having less than $1,000 in our emergency fund/savings account. If we need to fall below that, we will replace that money as our absolute first priority. This is going to come in handy this month, in fact, as our house now needs a new hot-water heater! We’ll use some of that savings, but we’ll keep the balance over $1,000.

We’re also trying to save up a cushion of a month’s worth of expenses in our checking account. That will take a while, but we’re steadily increasing our balance on hand and, in fact, we haven’t had that account under $1,000 in a few months either, which is really an accomplishment!

Our 401(k)s. Here’s where I’ll make a few enemies, I think.

I wish we didn’t have 401(k) plans. I don’t want or need that vehicle for future savings, and it ties up my money when I have other uses for it in the short term. We started participating in them when there was a significant company match, and that made sense, but now, there is no matching, and that money is just sitting. Ugh.

Saving for Sarah. This takes a few forms.

First, Sarah has her own savings account, which she contributes to (and withdraws from) for her own needs and wants. Her “income” sources are basically birthday and Christmas money, the proceeds from selling her crap, and earnings from odd jobs, etc. Her “expenses” so far have been limited to a couple large purchases – a bike and helmet that she chose to buy for herself back in 2010, and her 3DS video-game system, which she recently saved up for.

So that’s “her” money, more or less, though of course Chris and I will guide her on how it’s used. But I’ve also started a 529 savings plan for her as well. The good news is, this money CAN be withdrawn for things other than educational expenses. If she goes to college, she essentially gets more than we’ve contributed, but if she withdraws it to use for another reason, she gets what we put in and basically nothing else.

If I had it to do again, I wouldn’t have used the 529 vehicle for this. To me, it just makes our savings more complicated, much like the 401(k)s do. But we have it, and we continue to contribute to it ($25 every two weeks).

You’ll also see that Sarah has a few U.S. savings bonds – I’m nothing if not thorough in my accounting! 🙂

Our debts

As weird as it sounds, this is my FAVORITE thing to keep track of with regard to our finances. Seeing these numbers drop, slowly but surely every month, is incredibly motivating to me.

One problem we’ve historically had with our debt payoff efforts is the sheer volume of what we’re trying to accomplish. We’re paying down a big dollar amount, as well as a long list of accounts, and sometimes in the past it has felt like we’re making NO progress.

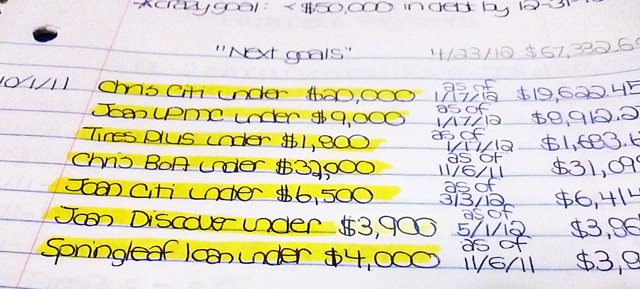

So we chart each debt like you see above. We celebrate when we get to lines like the two at the bottom – PAYOFFS! And we do something else, too. Maybe you’ve heard this before…

We set a Very Next Step for each account.

We keep a financial notebook with lots of goals and other things written down, and for each of the accounts in the spreadsheet, we set a “next goal.” Originally, for instance, we wanted to get the Bank of America Card of Doom under $32,000. When we reach that, we go down the page and set another goal. Then another. Then another. And we make sure we always have a goal for each account.

We keep a financial notebook with lots of goals and other things written down, and for each of the accounts in the spreadsheet, we set a “next goal.” Originally, for instance, we wanted to get the Bank of America Card of Doom under $32,000. When we reach that, we go down the page and set another goal. Then another. Then another. And we make sure we always have a goal for each account.

Our current V.N.S. goals are:

- Chris Citi card under $18,000

- Union Plus MasterCard under $8,000

- Joan Citi card under $6,300

- Bank of America card under $25,000 (WHOA – $7,000 down on this one!)

- Discover card under $3,700

- Springleaf loan under $2,500 (look how far we came on that one!!)

- Tires Plus card under $1,300

It turns into a game for us – seeing what goals we can hit. And we purposely make them attainable enough so that we always have something to celebrate!

· Unautomate Your Finances ebook

· You Vs Debt Sample Lesson

· What to Sell Where Flow Chart

· Debt Payoff Tracker

· 10 Tips for an Effective Craigslist Ad

Our bottom line

I mentioned earlier that in our bottom-line figures, we leave out the house, which we don’t view as an “investment.” So one of my goals is to get the “net worth less house and mortgage” out of the red. That’d be pretty cool.

I mentioned earlier that in our bottom-line figures, we leave out the house, which we don’t view as an “investment.” So one of my goals is to get the “net worth less house and mortgage” out of the red. That’d be pretty cool.

We do want to figure out our mortgage and housing goals eventually, but for now, we’re pretty sure we’ll be in the same home we currently own for at least the next five to seven years, if not longer, so the consumer debt takes priority!

Those are the lines we live for. What’s our total debt? What’s the total dollar amount of debt we’ve paid off? And how close are we to being 100% debt-free?

25% debt-free

Yes, as of this month, we have paid off more than 25% of our consumer debt, not including our mortgage. As I mentioned before, our current “big goal” is to pay off all credit-card and loan debt – and to REMAIN debt-free from those sources for life.

Next goal? Have paid off more than $25,000 total – and that’s only a month or two away!

[share_sc]

I’m actually relieved to have shared this update. You guys really stepped up and supported me after my introductory post, and since then, I’ve been worried that I won’t live up to the “lady who’s paying off debt like crazy” expectation I set up.

But when I take a look at these cold, hard numbers, I realize we ARE making progress. We CAN do this. And we’ll keep nailing our Very Next Steps until we get there!

Will you do the same?

hi Joan,

Wow! Good for you on the amazing progress you have made in one year! You are motivating me to get serious about my debt reduction plan….any chance that you would share your spreadsheet so that others could use it? I think that being able to follow along as the numbers go down would be very motivating (but I’m not that good at Excel to set up my own!).

Thanks!

Andrea

Andrea, that’s a great idea! I’ve actually got an idea to include a place for your V.N.S. right on it (mine currently doesn’t have that) as well as some simple instructions with it. Let me get on that and see what I can come up with! Thanks for the inspiration… hopefully I can get something really useful available to everyone in the next week or so!

Yes Please!!

Joan, very inspiring! And I know exactly where you’re coming from, I started my excel sheet for debt reduction in 2009, and I can tell you, it has been the only thing that works for me. Being able to see monthly the amounts going down keeps me going. We started with 49,300 in debt and now are at 22,100, it took 2-1/2 years, but we’ve been trying to save at the same time, so far since 2009 savings has gone the opposite direction of our stupid debt, from 20,000 to 45,500 today. My excel looks similar to yours, except I didn’t think of doing a net worth calculation and the percentages, that’s a great idea! I also like the Very Next Step idea and the $1000 emergency, I still need to work on that. Thanks for all your inspiration!

Thank YOU for your kind words – and for working so hard on your own goals! I think I like that net worth idea because it does give me some way to reflect on the “savings going up” part of our finances. I really do see the value in attacking both simultaneously – maybe not equally hard, but if I didn’t have at least some savings, I definitely would have had several setbacks toward the debt payoff progress!

Joan, I love your penmanship in that note 🙂

Once debt is paid off, is it really freedom though? Or just freedom from debt?

I need recurring income that’s hopefully passive to be free. Please google “Achieving Financial Freedom One Income Slice At A Time” if you’re interested in the various streams I’m working on.

You should check out my “side hustles” post at https://manvsdebt.com/make-money-with-side-hustles/ !! While only a couple are “passive,” we’re OK with that – we enjoy the things we do, and for us, the debt is the only thing holding us back from being free to do just about anything we want!

I appreciate you being so open and candid. Only recently have I started reading posts here, and your’s have been the ones that drew me in. Although my situation is far less in terms of debt, I feel as though my debt may as well be millions when I just can’t figure out how to sort it out with the income I have. When things were better I was oblivious to paying off debt beyond the basic payments. It sure boils down to “if I knew then what I know now”. I’ve created a fine mess for myself that includes claiming bankruptcy in the last year plus. After that income dropped more, the transcription I was doing on the side became extinct. In Canada we have a child tax credit, but it ends when your child turns 18 whether they’re ready to be self-supporting or not. That ended in 2011 and I’m still a single mom with a single income and no support. I’m not complaining about my circumstances. After all, there are so many who’s financial picture is worse; however, I struggle against losing all hope that my life will ever be without financial strain and struggle. That in itself tends to suck life from me.

I didn’t intend to say so much. Sorry to be a chew, but what I really wanted to say is how happy I am to see your success, and how much I appreciate you being candid. I have still been thinking about your other piece about multiple income sources (https://manvsdebt.com/make-money-with-side-hustles/). As I mentioned. I was earning doing transcription. My talents are many, yet turning them into other income sources… it can happen just have to figure out what and how.

Here I ramble again…

Sheri, if you can’t ramble here among people who understand, where can you? 🙂

I’m so glad you are thinking about what changes to make in your own situation. It CAN be done… and I think you’re right, just realizing that it can work, and that there is hope, is the biggest change!

I hope you’ll keep reading and keep trying things here and there. Set that Very Next Step, right now, that you can take to make one small change. Maybe it’s tiny – but if you keep setting tangible goals and reaching them, then you’ll start piling up bigger successes!

Nice progress! I love the spreadsheet, so much so that I just made one for my family!!

Brooke, that’s AWESOME!! You’ll have to keep us posted on how it works to track your progress!

Very interesting and helpful.

I’m curious…. how do you allocate payments? Do you attack the highest interest rate balances with the biggest payment or do you put a set amount to each credit card balance? Do you pay only the minimum balance due or do you pay more?

Hope I’m not being too nosy, but you’ve made great progress and I’m interested in the details of your success. Thanks!

Doug, that’s a great question! We use Baker’s “debt tsunami” concept, which basically says you attack the MOST HATED debt first.

In our case, that’s our Bank of America Mastercard, which also has the highest interest rate (25.24% even after repeated negotiations, ugh!) We’re dropping about $500 a month above the minimum on that card right now. For some debts, we pay just the minimum, or a slightly rounded-up amount over the minimum (like $75 on a $69 minimum, or something.)

We’ll also use the V.N.S. goals to allocate – like, if we want to get Chris’s Citi card under $19,000 and we’re at $19,400, but the minimum is $350, we’ll pay something like $500 on that one to give ourselves the “success” of hitting that step. That’s not at all scientific, but it’s fun and it keeps us going!

Thanks Joan!

I went back to review the Baker’s Debt Tsunami concept. Here’s a link to that post for anyone else who might be interested….

https://manvsdebt.com/debt-tsunami-the-ultimate-method-for-paying-off-debt/

Good job with the pay-offs…that’s got to be a huge burden lifted! Maybe you can even get the next 25% paid off in 9 months.

However, that being said, I’m done with Man vs Debt. Your feed is now unsubscribed.

You have a plan, but there aren’t any reasons behind it. You’re not focusing all of your payments on your highest interest loan, or snowballing the lowest amounts. You have goals for each credit account, but think a 401(k) or a 529 are not good plans because it spreads your savings around?

You can do whatever works for you, but I have a hard time seeing how this is instructive for anyone else.

Patrick, I appreciate the feedback! In some of my earlier posts (and Baker’s), as well as the comments here, we talk about the Debt Tsunami strategy… we pay off the MOST HATED debt first. There’s definitely a methodology – and it’s one our family personally finds much more helpful than the snowball of lowest amounts. (It happens our most-hated debt and the one we’re attacking IS our highest-interest credit card, as I explained here – https://manvsdebt.com/meet-joan/ – but we didn’t pick it just because of that reason.)

I also got into some of my feelings about 401(k)s and 529s in the comments too – I’m not saying those are bad by any means, but they’re not the right choices for us RIGHT NOW. That’s different for different people, and will likely be different for us at various points in the future. But this is an update on where we are now, and our goal is to simplify!

Unfortunately, some of those things have to be subjects of other posts – or else we’d have the “Joan’s War And Peace Length Review of Finances!” I do hope you’ll check back occasionally and see more – the great thing is, we can explain this in pieces at a time! I also encourage you – and anyone else who’s interested – to check out some of the key posts from the archives about the Debt Tsunami – especially this one! https://manvsdebt.com/debt-tsunami-the-ultimate-method-for-paying-off-debt/

Longtime readers, I encourage you guys to reread that too – because as you see, it’s the concept I’m really passionate about!

you are my inspiration!!! I love your posts and they are always so helpful. Keep up the great work!

Aw, thanks, Rebecca!! I really appreciate that!

Hi Joan! Congratulations on your achievement. Last month I paid off my last credit card and now except my rent and utilities I don’t owe anyone ANYTHING! And I have you and Baker to thank for inspiring me and showing me a different and better way from STUFF and accumulation of it. I saw your comments about the 401K and 529 plans, what would be your ideal way of saving for your retirement and your daughter’s education? I am curious because while I have been saving in the Thrift Savings Plan for the last 20yrs (I’m a federal employee) I am seriously considering starting a 529 plan for my almost 6yr old son. What better ideas would you have for achieving this? I don’t know if I know enough about the stock market to start “gambling” myself with my kid’s college money. Any ideas would be appreciated.

Kate, I can only speak to what I’d like personally – but I’d personally prefer to choose my own investments outside an arranged “vehicle” like a 401(k) or 529 and their somewhat complicated tax structures. For the balance I have in there now, I’d sooner just put the savings for Sarah in her savings account, which bears a good rate of interest (as it’s a “kids’ account” special at her bank). When the amount got higher, I’d probably put some of it in laddered CDs or something like that, but again, until after we tackle the debt, it just is an added account complication that we don’t really need. Added to the complexity of that is that Sarah is not likely to attend a four-year college, so some of the bonuses to that particular type of account aren’t likely to be realized!

The 401(k) idea is much the same. We have a good interest-bearing savings account and for the relatively low balances we have, I’d rather have those funds beef up that savings account, get a cushion in our checking account and pay down debt. Then, when we’re debt-free, we can choose to use other vehicles that meet our needs.

That’s NOT for everyone – and investing can really work for some people. But for us, once we’re not paying $2,400 a month servicing the credit cards, we “have enough” without ANY interest or growth percentage!

So for now, I prefer to go as simple as possible, and to keep my money as flexible as possible. Any account with withdrawal conditions, like a 401(k), is a red flag to me – it’s mine, and I want to be able to get it at just about any time! If I did choose to invest in stocks or bonds, it would be on my own through another type of account.

How’s that for a long and probably not very helpful answer? 🙂

like Doug I am curious too about payments. When I was researching there are at least two somewhat competing debt payoff methodologies out there. One says that you should arrange your debt by interest rate–pay just the minimum payments on all and then put every single penny into paying off the highest interest rate untill its paid off and then work your way down. Another school of thought is to help keep you motivated as you pay things off, is to arrange them lowest to highest balances and after making all the minimum payments–put everything else towards the lowest balance and keep working your way up. I sort of did a hybrid approach. I had a few credit cards with amounts varying from $1000 to $5000. The $1K card actually had the lowest interest rate, but even though I do realize interest is your enemy, I wanted to have one less bill I had to pay every month so i attacked that one first. So once the $1K was gone, luckily the $5K one had the lowest interest so I was able to tackle the lowest balance AND highest interest $3K one then the $5K.

Apparently the worst way to pay off debt is just evenly distributing whats left after paying all the minimum payments across them, as it doesn’t create momentum or make a real dent.

It’s a huge relief every month to not having those bills hanging over my head anymore (and especially that interest just making matters worse!) so I wish you much luck in your endeavor.

Nici, like I told Doug, we use Baker’s “debt tsunami” concept, which basically says you attack the MOST HATED debt first, or our Bank of America card.

That’s different than either of the traditional methods – low balance or high interest rates – and it’s been a difference that really works for us. We need the MOTIVATION factor, not just the numbers, so attacking the debt we really hate gets us that! It sounds like you very much followed your own tsunami – you picked the debt that would make the biggest impact on you personally at the time (getting one fewer bill a month), then attacked that. Then, you picked the one you wanted to get rid of next – and attacked that – and so on! That’s the tsunami in a nutshell!

Awesome job – and I can’t wait to be out of those bills myself!

Joan,

Two words: THANK YOU! I have been working my debt reduction program by myself (down from $42,375.31 in March 2011 to $27,919.77 in April 2012) and I have often felt like I am alone in my struggles (but of course, I know I am not). Seeing your spreadsheet and the transparency therein has given me a boost I really needed. Sometimes I feel like I am fighting a war all by myself and it helps me tremendously to know about other people’s successes in the face of suffocating debt. I have a similar spreadsheet and believe me…that spreadsheet lives and breathes for me. I am obsessed with it and nothing makes me happier than seeing my progress and projecting what the next year will look like. Seeing that there is a light at the end of this long, dark tunnel is what keeps me moving forward. Seeing your progress, right along with mine, is especially motivating. Thanks for sharing this personal information — more people need to go toward the light and we will all feel better about ourselves. There is strength in numbers! Thank you so much and congratulations on your progress.

Melissa, thank you so much!! And congratulations on your successes, that’s awesome! I think the problem is that so many people fight this war alone, and that’s really hard. It can really feel like there’s no hope if you’re not seeing people at various stages of the process. That’s definitely when we started to make progress ourselves – when we started seeing OTHER people doing it. And I’m constantly surprised by how many people in my real life have started reading these posts and come up to me and said, “We’re doing that too!” It’s amazing.

Keep us posted on your progress – I’m so thrilled!

Good job Joan! Sounds like you’re kicking some major fanny. I know what you’re going through. I had a negative net worth about 2 years ago, but got serious about my finances and have learned SO much during the process. Now my wife and I have increased our net worth over $60,000 in the last 2 years and are finally out of debt (besides are small mortgage). It feels good!! Keep churning and keep learning. I’m definitely rooting for you 🙂

Chris, way to go!! That’s awesome! We’ll keep plugging and will be joining you in that soon!

Joan, I LOVE this. There are plenty of folks giving theoretical advice out there, but to see how you actually put it into practice in your particular situation gives such incentive to those of us who, like you, have lives that don’t fit neatly into “theory.” We’re in a similar (okay, even larger ugh) debt paydown situation, and my husband, who would frankly prefer to pretend that money grows on trees, gets so discouraged when the net worth numbers barely budge. I’m adding your total debt paid off and percentage of debt paid off lines to our spreadsheets today – I think that will help keep him motivated. (I’m perfectly happy poring over the lines of minutiae, but it doesn’t work for everybody 🙂 )

Thank you! I eagerly await your posts!

I appreciate hearing that SO MUCH! I am so proud of you for taking that action today – and I know how your husband must feel – with a “big number” in total, that’s where I just get so frustrated! But I need to make myself feel like I’m making progress, and no matter where that is, it makes a difference!

I can’t wait to hear how you guys’ progress goes!

Can’t wait for the next update! Keep crushing it, Joan!

Thanks, Jenna!! 🙂

Joan, you continue to be an inspiration! I’m so glad I found you and Baker! 🙂 I also think that spreadsheet is great, you get to keep an eye on your progress, which is so helpful. I love seeing how far you have come! We are relatively similar in our amounts of debt. $169k in mortgage, $48k in home equity loan, $24k in citibank, $5600 in another card, and $1100 in a margin loan. I don’t really count the mortgage. Rent for a 2 bedroom house in our neighborhood would be about the same or more than our mortgage payments. An apt might be a little less. The others though, I so want to kick them to the curb. Selling our crap is helping. We’ve made some small dents, and the having $1000 emergency fund is great too.

I keep reading about this idea, take all of your irregular expenses (birthdays, car maintenance, vet appts, etc) add them up, divide by 12. And make sure you pay that amount into your savings every month to save up for those expenses. We’re working on that and building up the checking with one month’s expenses. One day at a time sister, one day at a time!

Anyway, giant kudos!!! Keep on keepin’ on!

You nailed it – one day, one payment, at a time. We’ll get there!! 🙂 You keep on too – and I can’t wait til we both get to celebrate BIG at the end of this debt!

Definitely a BIG celebration will be in order!

Joan,

I am so excited to hear of your progress. You have such a huge heart and the spirit of a champion! I am so thankful that our paths of crossed and I look forward to further updates. Cheering for you!

Thanks!! You’re pretty stellar yourself 🙂 Thank you so much for the kind words and encouragement – it really does keep me going.

I’m coming to this late but I just wanted to say thank you so much for these posts. They are such an inspiration. I am down to (mostly) just student loan debt and the mortgage, but with my husband out of work it feels as if the teeny little bits I can use to pay down debt (usually just the minimums) or put into savings have had me discouraged. However, you have inspired me! I will be following your progress avidly!

I totally understand that feeling, Stephanie – and let me just say you are AWESOME for sticking with it, even though it feels like it’s not going anywhere. Those baby steps will work, and then when your situation changes, imagine how much better off you’ll be than if you were starting back at square one!! 🙂

Thank you so much for your kind words – I look forward to hearing more about your success and sharing more of my own story too!

Hi Joan! Way to go! You are on your way to freedom and eliminating 25% is a HUGE achievement! Congrats and keep up the hard work!

Kristine, THANKS! 🙂 I can’t wait to get even farther!

Joan, I think it’s amazing to see the progress you are achieving. How did the credit card debt get so high, and then spill over onto others in the first place. I have just two credit cards, one which is a break glass in case of emergency one (which is never used, just in case the other one gets stolen/lost/fraud activity etc) and the main one that’s use for day to day expenses and cleared completely each month.

I used your principle of debt clearing to pay off my mortgage, I’ve now lived mortgage free for over 3 years, which has freed me up to do things I like in the work arena and build up a ‘Sod You’ savings account. So if I feel I am in a job where I am not appreciated, respected and treated like crap I can stand up and say ‘Sod You’ without fear of getting into a pit of debt and creating more stress finding a new job.

Jonathan

GOOD FOR YOU! You really are kicking butt. Can’t wait until we’re in the same boat!

In our case, most of this debt was accumulated in three big chunks: Chris’ and my college costs (books, mostly) accrued 5 to 15 years before our marriage, medical costs for me (also accrued before our marriage), and home-repair costs for both the home my husband and I bought together as well as the two homes I owned and sold previously. So we each came to the table with individual debt that would make a sane person wince, and then we put it together! 🙂

The good news is, now we have an emergency fund – and haven’t charged a single thing on any of these in at least a year (and that was the one for the mechanic – the others, we closed and stopped using more than 2 years ago!) So hopefully, our days of huge balances and bleeding debt from card to card are LONG over!!

Having an emergency fund is essential, in the UK many specialists say you should have at least 3 months salary/expenses in the bank to cover any unexpected events.

My Grandparents were my financial role models growing, both worked and earned approximately the same, my Grandfathers salary covered the monthly expenses, utilities, housekeeping, car and regular treats (days out etc) and my Grandmothers salary was put straight into savings, this was used for bigger purchases (replacing the car every 2-3 years, and bigger items) This worked very well for them and they enjoyed the rewards of this balance.

As a single guy I tried to save at least 25-30% of my monthly income, working two jobs through university and college ensured I left without any debt and had a lump sum to put towards a deposit for a house once I got my foot on the first step of the career ladder. Unfortunately the boundaries have changed now in the education arena, and fees that were paid for by the government are now the responsibility of the student, this totals £9,0000 a year for the degree alone, which automatically puts a UK student into around £50,000 of debt before they’ve left uni (assuming they don’t work during their studies and take out living allowance loans) It’s scary that the world is coming generally desensitised from having debt!

Keep up the good work clearing yours down, do you have a target end date?

Jonathan

March 2014 – but sooner is possible if we keep hitting it as hard as we are right now! 🙂

This was an awesome read!! I like how you keep track of everything down to the detail! I think everyone should have a spreadsheet like this in their lives!

Although my only question is, you class you car as an asset? I would be more inclined to put it under a liability. An asset is something that makes you money and doesn’t cost you money like a car does? Just an observation really!

However very inspirational and I like your openness with everything!

Like I said about the house and car, we don’t view them as “assets” in maybe the traditional sense – but they are our items with saleable value if we chose or needed to sell them. So when I consider “how could I get cash in my hands,” they go on the list. If I were to be consistent, I’d probably include ANY possession with a value over about $1,000, but (a) I don’t have many and (b) I’m not THAT detailed! 🙂

Looking at your spreadsheets of numbers makes me think and feel a lot of things.

One: I’m thankful I don’t own a car, and for the public transport in my city.

Two: I’m thankful I don’t own a home and have only rented apartments so far. Reminded that my choice to dwell in studio apartments to live within my means is indeed, wise.

Three: My credit union will not raise my credit limit due to my limited income level; so as frustrating as that is when figuring out international flights and how to pay for them, I can’t get this far into debt with the financial tools I currently have and that’s a good thing.

Four: Figuring out how to save for retirement is complicated.

Five: I DO have the will power to continue putting off shopping, even for basic goods like another set of bed sheets and kitchen tools (not applying this principle to groceries or health care. And I might have bought some nail polish this month, but that’s small ticket not big ticket and painting my toe nails keeps me from going shopping for several hours. See that? Justification, achieved.).

Keep going Joan! And glad you’re helping your daughter understand these matters at a young age! I know I wish I had been able to learn more at a younger age. I still cherish the day my father took me to open my own kid’s checking account. The bank that provided that service was bought out and the type of account I had no longer exists; but I have the memory.

Retirement planning is something that some of the ManVsDebt principles come adrift. In a previous post about singing the virtues of renting over buying. When you retire, how will you afford to pay rent on a limited income, or is the principle to work until you keel over and die? At least with purchasing a home after the mortgage is paid off you still have a roof over your head, admittedly with maintenance costs of running, but at least you have an option to downsize to a cheaper and more affordable home and have some spare capital to play with.

The way Joan is going the consumer debt will be cleared within a speedy amount of time, and if the principle is then used on the mortgage then by 2020 she’ll be completely debt free with a home and the ability to save for retirement.

Jonathan

Well to be fair on the home ownership aspect of things, in my case – I’m not yet 30, single and a globe trotting teacher that hardly makes it month to month, I teach in a third world country on a salary that’s considered high for most citizens but low for most International educators. I intend to stay here a few years, but probably less than 5 years before moving again.

And as an alien, I’d only be entitled to buy a home but not the land it’s situated on, if either of those things were currently within my means.

So aside from finances, I don’t think it would be wise to invest in housing right now. I guess the biggest point of the ‘don’t rush into buying a home’ argument is to make sure you aren’t just buying because that’s what everyone else is doing, when your situation may be completely different. And since I also have personal friends that rushed into the housing game in their early 20s and ended up unhappy, I’m more alluding to being happy that I’m satisfied with my housing for now, am living within my current means and don’t feel it’s something hanging over my head.

As an expat I’m focusing my retirement planning (and finances in general) on getting a better savings and investment plan going and the start of a fund so that some day, in some country, I would have the means to own my housing, and *insert list of financial planning goals here.* But I don’t think I have to have that settled before I’m 30, or even in my 30s. I’ve got some time.

I completely agree with what you are doing, and working overseas was something I did, travelling is a huge passion of mine, I left it until my late 20s until I set off on mine, and still continuing, we recently took off 2011 for a year long adventure living in mainland Europe, Asia and the Far East.

I feel the house price collapse has been more substantial in the states than in the UK, however I was fortunate enough to buy before it took off when I was 21.

I’ve been having discussions with my other half how to plan for retirement, I’m 39 and he’s 43, he’s got a pension fund and I don’t and as retirement is nearer than my youth I am concerned about my old age (perhaps overly so). In the UK we’re lucky that we have a small state pension and free health care (as with all of Europe).

The property market has been kind to me, living mortgage free for the last 3-4 years through buying upgrading and selling on, so now the property prices are still low I am considering do the same again with buy to let investments, but it means getting a mortgage to do so… which sort of scares me (even though the projected rent will cover the costs). I feel this is a better way to save and invest rather than trust the stock market, in the UK pension funds have been decimated leaving the elderly with very little in the form of an income and this is a terrify prospect, as people live longer the concept of having to be on the bread line is terrifying.

In the UK we’ve been seeing lots of documentaries of families loosing everything and having no immediate prospect of getting out of the situation. There is a tv series called Remake America which follows standard American families that have been hit with the downturn. Disturbing stuff.

Jonathan

Yeah all around me here in Bangkok I see nothing but housing bubble ready to pop. Seriously. Oh look another condo building at 10% capacity, but more expensive because it’s new. Look, there’s another one next door. Over here we have several ghost apartment blocks abandoned in mid construction when the crash hit 15 years ago, they are now advertising Coca Cola and providing cement canvas for the cities’ graffiti artists.

The SE Asia stock market crashed in 1997, originating in Thailand; and there are still hidden ghosts from that left to deal with another day. Add to that reading about the Chinese ghost cities built solely to boost the domestic GDP with no one living in them and being an expat and I want nothing to do with owning property in Asia right now. Sure, business is booming here but you’ve got to be in a position to take a large risk. If my family was here, and of Asian descent, I might be in a position to consider it.

Nor does it make sense to have something in the US if I’m not living there currently, especially the way annual property taxes work. I have family back home with ‘owned’ homes. Whatever they intend to do with them there will come a day when a younger member of the family will have to step in and decide how it goes. I see no reason to complicate my life with property of my own right now.

The ghost developments are all over the UK, they built hundreds and thousands of apartments, and what people need is houses, it’s very difficult to bring up a family in an apartment. And the price they were asking for them was ridiculous, but the price the developers paid for the land was astronomical too. There are families living on the bread line but they still cannot have a home to call their own, the rents are so high and there are only very limited homes available with low cost housing associations.

We were living in Phuket for a few months and the property available there is ridiculous, my sister in law has an amazing house with pool, air conditioning and staff and pays less than $1000 US$ per month including all bills! But the price they are asking to buy the houses is huge, it doesn’t make economic sense! We saw the same living in Turkey, properties that were selling for £120,000 for a holiday home are now selling for around £20,000, lots of ‘investors’ lost out.

Buying property used to be a golden goose however it got lame and died. There are still good buys to be had in desirable areas with good schooling, transport links and so on, however there is also a whole lot of crap property on the market, which has devalued so much it’s not even worth what someone originally paid for the land! Having said that we are always going to need a home to live in, and I’d prefer to buy than rent, if only for the long term advantage of reducing my outgoings in retirement.

Hi there,

My Mum and Dad have been together for 35-years and yesterday they became debt free for the first time in their life. They are both in their mid-fifties and I was so happy for them. I am also debt free for the first time in my life (aged 37) but for very differing reasons (I got divorced) but last month I found myself £1,400 into my overdraft with over £6,500 outstanding in unpaid invoices (I am self employed). I started to worry about going into debt again when my girlfriend told me to go to your site.

Just a fortnight later and I have whizzed through Your Money or Your Life and the Total Money Makeover books and thanks to your guys I have a totally fresh outlook on finances. I have created my own budget for the month of June (first time ever) and have decided to sell everything I own (not much).

I have realised that materialism and keeping up with the Joneses nearly destroyed me. I now know that with some hard work I can be financially independant in the future.

I have you to thank for this and not just that but I believe I can encourage more people to do the same through my progress as http://www.needyhelper.com.

So a big thank you guys and keep up that war on debt!

Lee

Lee, that is AWESOME progress – and we’re so glad to have been able to help a little bit along the way! KEEP IT UP!

Joan,

I want you to know I just published an e-book called Financial Bondage: Quit Getting Screwed on the Ugly Side of Capitalism and Enjoy Real Freedom. The entire goal of the book is to teach people how to mentally and physically get to ground zero (no debt.)

I made it 100% there this week (originally from the projects) and now am attacking my mortgage.

I’d like to talk to you and Baker about it for your community as it’s not my usual genre but it could help millions of Americans get to ground zero.

Your going to make it Joan. We can all tell!

Aw, Sheri, thanks! (Sorry I’m just now seeing this!)

Inspired!

Aw, thanks, Justin!

Good luck Joan and congrats.. I paid off my debt in 2005 and since then, have remained debt-free with the exception of one business venture which I risked and utterly failed at.

The day you can look at all of our statements and see $0 balances, will be one of the highlights of your life. Trust me on this!

Jason, I am ANXIOUSLY awaiting that day!! I sure can’t wait! Good for you on getting and staying that way – and for taking a risk. Even a “failed risk” is better than not trying, right??

As for that risk, well… no comment. 😉

However, yes I would rather have a life of risk and checkered failure and successes I never could have imagined, rather than dull and uneventful.

Although, many people who jump to take such risks do so in such a way that leaves them ungrounded and thus unsuccessful more times than not. But that is a different subject altogether. 🙂

Just stick with it. “That day” will come, and it is not the end of life but the beginning. Consider this your university, and prepare for life after graduation.

Your 401 (k) money is not sitting, it’s compounding. You two are young, you started early, you enjoyed a company match for awhile. I have always been self-employed, so I’m not as familiar with 401(k)s as IRAs. Once your debt is paid off, turn your attention to these retirement vehicles, maybe they should be rolled over to an IRA. And review the investments should be reviewed. If a rollover IRA works, I suggest Vanguard, very individual-investor oriented, low-low expenses for index funds and highly rated. We also could be in a time when we’ll be able to buy low and sell high, which, of course, is the investment holy grail.

Pat yourself on the back for being astute and getting into the 401(k) when you had a match.

Marlaina, I totally agree – except that rolling them over would only work if my husband left his job (they’re both through the company he works for full-time) and that’s not anywhere near imminent!

Hindsight is 20/20 – and while the match was nice, it wasn’t worth some of the downsides we’ve faced thanks to what we had opted to do with our contributions! The good news is, we don’t plan to “need” this money at all in retirement, so it’s not hurting us in that sense to leave it there and see what the market does – but we could be much further along toward our other goals without it there! 🙂

Joan, I am most interested in your spreadsheets especially the only where it measures the total percent of debt paid off. I attempted to create one but I don’t know that I have the formulas in correctly. Keep up the good work! Each person will have to decide how to reach becoming debt free. I like throwing around different methods.

Yes!! please share the spreadsheet formulas!!

Way to go Joan, it’ll be so worth it when in a few years time (based on your current paydowns) that you’ll have true Financial Freedom then you tackle and slay that mortgage dragon once and for all.

Very inspiring look into the transparency of your finances.

Dwight Anthony

Financially Elite Blog . com

Hi Joan, I have a question, how do u manage to pay all of those accounts. I mention this bc I have those crazy numbers too and I barely meet the minimum on each one. I sometimes have to be late to be able to pay minimum when I get paid. How do I start? Do I stop paying some to send more to my giant? Help!