[share_sc]

Baker’s note: This is a post by Joan Concilio, the “community manager” here at Man Vs. Debt. Expect to hear from her more and more in the coming weeks!

Hey, it’s Joan! Hi again. So in my introductory post here on Man Vs. Debt, I shared with you the cold, hard truth about our financial picture. (It wasn’t pretty.)

I got into the numbers behind our debt, to the tune of about $70,000 currently before the mortgage, and about $90,000 at its worst. But those aren’t the only, uh, not-pretty numbers I’ve been keeping track of in recent years.

While I was getting deeper and deeper into debt, I was also getting fatter and fatter.

After the birth of my daughter in 2000, my average weight was around 117 to 130. But at worst, in early 2005, I carried about 170 pounds on my 5-foot-4 frame. That’s not the end of the world, but it’s about 50 pounds heavier than I should be, especially in light of some health problems that weaken my joints.

50 extra pounds of weight on my knees meant I was, at one point, looking at having a knee replacement in my early 20s, to which I said NO FREAKING WAY.

That was my turning point.

I joined Weight Watchers, started exercising, and eventually reached a goal weight of 118 pounds around Christmas 2006, essentially dropping 50 pounds from my highest weight. I even became a Weight Watchers leader as one of my (many) side jobs.

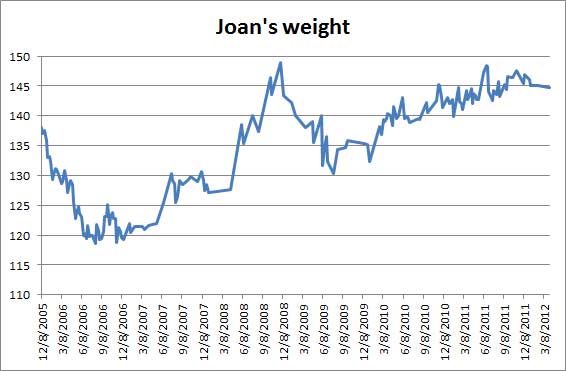

Since 2006, my weight has fluctuated like crazy, mostly between 118 and 145, all still in the “healthy” range for my height according to the body-mass index. 145 is my top “healthy” weight, and anything above that is considered overweight.

Well, guess what?

As you can see by my not-at-all-nice graph above (which doesn’t even INCLUDE the heaviest points, because of course I wasn’t interested in keeping track of those) … well, for the past year or so, I’ve been on an up-hill climb, headed suspiciously close to – and sometimes veering scarily into – overweight.

Like, “a heavy sweater on weigh-in day puts me over” kind of close. And my body-fat percentage is about 30%, which means about 43 pounds of ME is made up from fat. You need some fat – but not that much.

And I hate it.

Yes, I’m not back to my highest weight. I’m still in single-digit pant sizes (ladies, you know this is big!) But I’m not doing what I need to do to be my healthiest.

And, BMI aside, I feel fat.

145 is more weight than I’m comfortable carrying. I’m tired, and my knees hurt, and quite frankly I know that I’m not going to stay at 145.

If I don’t make a change, the fact is, I’m going to gain more weight back – weight I once worked really hard to lose.

So why I am writing about this on Man Vs. Debt?

Because Baker’s also trying to get back to a healthier weight? Well, yeah, that factors into it. But what really sparked my interest was a forum topic during our Kickoff 2012 You Vs. Debt class.

We were talking about “Patterns” – things we noticed that lots of class members had in common. And the biggest thing to come up was that being in debt seemed, for a lot of people, to be linked to both having a lot of clutter and being overweight or making unhealthy food and exercise choices.

It turned into an incredibly poowerful conversation, and I felt like one member, Laura, really summed up some of the problem I’ve noticed in myself. She says:

It seems like the urge to overindulge in food I don’t need comes from the same place as the desire to spend money I don’t have. Both overeating and overspending seem to be an attempt to fill a void in my life that can’t actually be filled with either food or possessions, but rather can be filled with relationships and rich experiences. Both overeating and overspending are a form of “giving up hope” and “giving up control” over my life. Tracking feels to me like I’m grabbing back the steering wheel, and making a choice about where I want to put my attention and steer my life.

That’s exactly it.

I firmly believe that when you make a CHOICE to change, you can alter the course of your life. I also believe that those choices and lessons are very transferable!

5 things I learned while losing weight that are helping me pay down debt

1. Write it down. In Weight Watchers – and MANY other weight-loss and exercise plans – a key tenet is keeping track of what you eat. If you don’t have an accurate record, it’s way too easy to delude yourself about what you’re really taking in and expending. In You Vs. Debt, a key tenet is writing down what you spend, and creating an accurate picture of what you owe, for the same reason.

2. Get support from others on the same journey. I was a big fan of the weekly meetings in Weight Watchers, even before I started leading them. (And now that I’m not leading regularly, I miss them!) It felt SO GOOD to know I wasn’t alone, and to get encouragement both when I had successes and when I had challenges. That’s also what brought me to Baker and You Vs. Debt as a participant – I needed a community around me. I’m not someone who can succeed on my own! Find your support system.

3. Splurge where it really matters. When I was losing weight, I would often make some pretty basic substitutions. (Baked chicken, veggies instead of fries, etc.) But if I was really craving a phenomenal cheeseburger, I did NOT follow the “diet” advice of having a low-fat English muffin with a veggie burger patty and low-fat cheese on it. I didn’t even “splurge” by getting a small McDonald’s cheeseburger. No, I would go to my favorite local restaurant and get the most wonderful concoction of feta cheese and ground beef layered on a thick bun, probably the equivalent of about 2,600 calories, and I’d dig in. It’s the same with money. I buy most of my clothing at Walmart or the local thrift store. But I spent $250 yesterday on a purse – because I’ll carry it every day and get years of use out of it, whereas my cheapo purses generally only last me a few months before getting holes in them. Pick what matters – and really enjoy your splurges. But don’t splurge where it doesn’t matter!

4. Don’t get frustrated when your progress plateaus. I’m pretty sure there’s not a human being alive who’s lost weight in a healthy way without hitting the occasional slowdown or plateau. I’m also pretty sure there’s no one in the world who’s tried to pay off $90,000 in credit-card debt who hasn’t had months where they were able to pay just the minimums. That’s OK. Don’t beat yourself up. Just keep doing what you need to do, and your progress will show again soon.

5. Check your progress regularly and assess what’s working. In Weight Watchers, members who are in the “losing process” are asked to weigh in each week. This, combined with the tracking system I mentioned earlier, gives you feedback on what’s working and what’s not. If the scale moves the direction you want, then the choices you made were probably pretty OK ones. If the scale doesn’t move the right way, then you can look back over your tracked food, drink and exercise, and see where you can make a change. The same goes for your finances and your budget. I don’t know how many people I know who’ve set up gorgeous works of art and called them a budget. But these same people – myself included – are often guilty of not revisiting them and seeing what works and what doesn’t. Check yourself. See what’s working, and CHANGE anything that’s not!

5 things I learned while paying down debt that will help me “re-lose” 20 lbs.

1. Don’t overcomplicate it. I am a famous overthinker. Until recently, I had spreadsheets for my spreadsheets when it came to debt reduction, and I was trying 10 different approaches at once. When I narrowed my focus, followed the You Vs. Debt course and didn’t try to throw in 50 other tips, I was successful. Same for weight loss and fitness. I’m struggling now because I want to do too many different things – Weight Watchers, juice fasts, 4-Hour Body… it all sounds great to me, but I’ve got to pick an approach. I’m also not going to be able to realistically schedule the gym AND regular tae kwon do workouts AND sessions with a trainer AND long hikes AND Nerd Fitness. So I’ll pick what seems most manageable and focus on those.

2. Set up specific, tangible “Very Next Steps.” This is a total You Vs. Debt thing. When you have more than your year’s income in debt staring you in the face, the old advice of “pay off your smallest debt first” doesn’t really get you psyched up. If you’ve got 100 or 50 or even 20 pounds to lose, it’s not really very motivating to say, “OK, that’ll be great when I reach that goal.” You need to pick what Baker calls your Very Next Step. Is it to track what you eat for a week? To exercise 3 times? To lose the first 5 pounds? When you reach that, set the next one. Then the next.

3. Don’t be overly restrictive. Ohh, I’m so bad at this. While paying off debt, we’ve gone through phases where we eat cheap hot dogs and don’t buy anything – ever. We use up the little toothpaste samples from the dentist rather than buying Colgate. That sort of thing. And you know what? These periods of “starvation” almost always result in a binge later on. The same goes for food. I’m not someone who’s going to succeed in long-term habit change by saying I’ll never eat a potato chip or a french fry again. I know that about myself. So, while I’m certainly going to limit those things, I’m not going to restrict myself in ways that aren’t sustainable.

4. Remember that it’s a marathon, not a sprint. Getting out of debt takes a while, and so does losing weight. If you take your time and do it RIGHT, you’ll make it to the finish line. If you try to rush – like, say, dumping a ton of money on paying off a credit card, but having no emergency savings – you’re only going to hit a setback later. The same goes with weight loss. I could lose 10 pounds this week, but that wouldn’t set me up with good habits for long-term change. So I need to commit to building good habits the right way.

5. It never ends. That sounds depressing, doesn’t it? But I realize that right now, I’m aiming for this really specific goal of having $90,000 in credit-card debt paid off. Great – but that’s where the real challenge begins; I need to live a life in which I won’t ever carry consumer debt again! I was slow to realize that about weight loss. I hit my weight goal, and I “sort of” maintained, but it wasn’t until recently that it really clicked – this is a forever thing. I’m ALWAYS going to have to work at this. Maybe not as hard at some points, but the fact is, there’s no rest for the pear-shaped! 🙂

So what’s next?

Much like with my debt, I’m going to put it all out there for you guys. You get to hold my feet to the fire! My “big goal” is to be down to 125 pounds and less than 20% body fat by the time I take my black-belt test in tae kwon do, in about another year.

My first step regarding my diet is to track what I eat this week and for the following three weeks using Weight Watchers’ system, and to stay within what they recommend for me as a daily target.

My first step regarding my activity level is to go to tae kwon do class at least 3 hours a week for the next month (if not more!) and to get to the gym at least once a week for an hour, preferably twice.

Can I do it? I think so – and the habits that are helping propel me out of debt will help me get there (and vice versa)!

[share_sc]

Do you feel like there are parallels between your “money life” and other areas of your life?

What habits or skills have helped you tackle both issues?

Would love to know what you think!

Thank you so much for this!

What an amazing and accurate association between two of the biggest things that cause stress and unhappiness in SO MANY PEOPLE!!!

Shared with my fans in the hopes that they will share with others and we can all spread this great article!!

Thanks:)

Perfect! I totally agree with your assessment, Joan. There are direct parallels between fitness and financial health – and the same underlying habits are often to blame.

Our family paid off about $60K in debt over three years, and I’ve had peak periods of fitness where I felt incredible (including completing a 100-mile century bike ride on my 30th birthday). While our financial habits have stayed (mostly) clean, I’ve found it’s easy to caught in the yo-yo cycle on the health side.

My wife is also a lifetime member of Weight Watchers, and I look to her for my model of consistency. That, coupled with helping others at Fit Marriage, helps me stay on track and treat my health/weight as a marathon that requires a long-term perspective.

Great post!

Dustin

Keep up the good work Joan! I’m loving your posts and you are so right weight loss is like paying off debt…slow and steady takes the race!! Thank you for your posts and motivation:)

I think the whole out of control thing can apply to so many things…getting them back under control one at time does seem to help things all the way around. Thanks for the nice blog. I can relate.

Hey Joan.

Speaking as someone who really has been there done that, I have no doubt that you can accomplish your goal weight. It seems to me that real change only comes about when we reach a turning point in our lives, when something inside us says “Enough, I can’t do this anymore.” When that happens not only will you make the changes, but you’ll stick to them. I firmly believe that’s why I haven’t touched a cigarette in more than four years, and it’s also why I know I’ll never smoke again. I’ll leave you with this really awesome quote from Jack Canfield: 99% is a bitch, 100% is a breeze!

Here’s to your good health and skinny ass! 🙂

Hi Joan!

I’m enjoying your writing so far, and amazed at the parallels in our lives. I too, have done the Weight Watchers thing, and became a leader (sad part about that, I got too busy to look after myself while doing it that I put my weight back on), have debt I’m working on clearing, and see the similarities between debt and excess body fat.

I’m finding that to lose both, there is a mindset I have to be in. I started with changing my thinking about spending, shrank my lifestyle to the point of being uncomfortable, then added just enough back to be happy. It worked with my money so I tried using the same approach with my food intake, and it’s working. I also find that once I’m comfortable with that level, I can scale it back a bit more, and a bit more, wash, rinse, repeat.

The most important thing I have learned is I am in control of what I do, I can choose what to spend and what to eat, and whether my choices are in line with my priorities.

Congratulations, Joan! Loved this post – spot on advice. Interesting how we get out of control in one area and that bleeds over into another. I used to think discipline was a dirty word (ha), but we’re so much happier and healthier because of it. My latest move is no going out or drinking wine during the week – only on Friday/Saturday nights. Even that one glass a night made a difference in my creativity, workout, energy level – everything. Feeling much better these days because of it. And, oh yeah, it’s easier to keep the weight off when you’re not adding alcohol into the mix!

I think you nailed it when you said that overspending and overeating have the same root cause. However, I really cringed at the $250 purse! (I have $40 Sak that’s lasted of for years with no end in site.)

If I had $250 to splurge I’d make some memories instead of having a “thing”. But that’s just me. 🙂

Dee I was wondering when someone would comment on that! Glad you noticed 🙂

I am hard on purses. Easy on every other type of clothing – but NOT on purses. I once bought a $30 fabric one that had a hole completely through the bottom of it within two weeks! Not a cheap brand, either. (Wrote to that company, let me tell you!)

After going through LITERALLY 10 purses (all $30 or less in cost) in 2 years, and I don’t mean getting tired of them, but wearing them out – spilling stuff inside them – sitting them down and having stuff spilled ON them – you name it, we’ve probably done it – I got fed up and found the one I wanted, and told my husband THAT was to be my Christmas and Valentine’s day present this year instead of anything else. This thing should last me 5+ years, even with my level of complete wear and disregard, but even if it lasts me 2, I’ll be better off than I was before – and happier, too, because I really love it – AND because my hubby didn’t get me a shirt or something that I’d wear twice and forget about! Now I think of him every time I see it. (Is that sappy or what??)

My debt affects my self-esteem negatively. I am overweight, though recently lost ten pounds when I was more active by working two jobs. Meal planning also helps the budget and helps me plan healthier meals. Yet I don’t feel motivated to work out. Due to my debt I can’t buy new clothes and that also hurts my self esteem. Today though I went shopping in my storage bins and hung up some jackets that fit again! Im close to wearing my old pants again! Some joys among the my debt marathon!

You are so spot on! These two are connected for so many people. I have just recently started taking care of my weight and when I look back, the triggers for weight gain and debt consumption are synonymous. For me, they are emotion-driven and fueled by impulse.

I don’t think it’s any coincidence that the month that I paid off my first credit card I also recorded my lowest weight in years.

Keep up the good work!

I gain weight when my financial resources are low because we eat more processed, preserved foods and also I can’t stand waste so I eat all the leftovers–on my plates and others’. Trying to break the cycle is tough because when I’m broke I can’t justify throwing food away.

Hey, Joan!

You are sooooooo right. I think that for many people, they are so overwhelmed with “clutter”, be it extra weight, extra debt, or extra stuff around the house, they just can’t or won’t deal with it because it means looking at ALL of it. But you pointed out a little-recognized truth: Deal with one and, more than likely, the rest will start to fall into place.

I think the first, most important step, is to turn around negative talk. Even as a health coach, I work on this constantly. Very recently, this short, encouraging clip from Danielle LaPorte has been firing me up. I watch it all the time! http://www.youtube.com/watch?v=cITNveY-kig&feature=share YOU CAN DO THIS!

Joan, you ROCK. GO, Girl!

Hi, Joan. Great post!

I’m totally with you on needing to not be too strict with myself, if I want to make any progress. I’ve been trying for about two years now to cut back on refined sugar. When I try to be absolute about it, I end up being “good” for awhile, and then wanting to stuff my face with something sweet.

Whereas, it is pretty easy to stick with my current guideline of no refined sugar unless the treat has been made with love by someone I know. That way, I still can partake in the lovely social aspects of people wanting to share their love by making a nice sweet-tasting deliciousness, and that, I truly believe, is healthy for me, even though it does have refined sugar in it. And I stay away from the “empty feeling” refined sugar, that doesn’t bring any love into my life and only brings extra weight I don’t need or want.

Susanna – Great point about allowing exceptions that make sense. I, too, have cut way back on sugar, but am sure as hell not going to skip a slice of delicious cake on my birthday!

I love this post. I think you’re so right about the same people commonly having issues with debt, weight, and clutter. I’d add one more — procrastination. I’m working on all four at hte moment. Thanks, too, for the quote from Laura about relationships and rich experiences being the healthy ways to fill a void in one’s life, rather than food and stuff. Good luck on your weight loss and debt elimination journeys!

Yes!!!!! I am totally with you Joan! Tracking leads to greater awareness and you cannot help but have that new-found awareness spill over into other areas of your life! I started tracking my spending as part of a finance class I was taking and it kick-started an awareness addiction that I now feed every day. Ha! I am soooooo close to being debt-free I can taste it! Only $6000 in consumer debt left to go!!! Student loans are NEXT! And I am currently back in my skinny jeans from HIGH SCHOOL because of a year long food tracking habit change program called MyBodyTutor. It was such an empowering process to know that I CAN change!!!! I am not a victim of my self defeating habits! Improvement is possible … Day by day. Choice by choice. Meal by meal. Every moment is an opportunity to start moving in the right direction! 🙂

Love the post!!!!!

Thanks for sharing your journey with us!

great post, Joan!! you nailed it 🙂

I am so glad I stubbled over you and Adam. I am old enough to be your grandmother and frustrated in my attempts to meet members of the millennium generation. I have no grandchildren of my own. My web page is not up to date. Click on the Silver Swans link to learn why. Because of my computer challenge, my Feasting With the Faeries link does not reflect my current best knowledge, but I would love to use my weight control expertise as a way to connect with you young folks.

Losing weight and paying down debt are my two current secret projects (not from my family, but from my blog readers). I keep them secret because I’m sort of embarrassed to talk about them, so I deeply admire your wonderfully open (and spot on) way of talking about both of these issues. Yes, they are totally related–indulgence, control, numbing out–all part of the same pattern.

Part of Adam Baker’s TEDx talk runs through my head constantly when I am making decisions about food and/or possessions. it’s when he says that whenever anyone asks him if he’s sorry about anything he got rid of, he thinks about it seriously, and each time, the answer is “no.” That has helped me let go of so much crap, I can’t even tell you! It also helps me disengage from food–“am I really going to be sorry that I didn’t eat this pizza? NO! But I will be sorry if I do.”

Keep up the good work, and I’ll be checking in frequently!

Joan…

Great post. I really enjoyed it and am excited to hear about your results. I started and have run a health and weight-loss non-profit for the last 2 years. I think you make a really interesting correlation between debt and weight gain. One of the things our non-profit focuses on is giving personalized coaching and motivation, so a lot of my time is spent interacting with people starting, or in the middle of, their healthier lifestyle journey. And there is no doubt that the weight gain and subsequent weight-loss is a reflected pattern in other aspects of their life. I think I may use your post as inspiration/springboard to address this subject with our members as well.

Since you a looking for some serious results over the next few weeks, check out our non-profit fitness and nutrition program. It is 100% free…workouts, nutrition plans, support…no catch. We believe the fitness industry to too focused on making money without enough emphasis about caring about people and their results…so we are doing something about it. People are getting amazing results because they see that we care about helping them…much like the philosophy here at Man Vs. Debt.

All the best in your journey. Thanks for sharing it with us!!

Jason – Love your site! I’m sharing it far and wide. Keep up the great work.

Pingback: Military Personal Finance Weekly Roundup April 16-20

Pingback: Weekly Common Cents | StupidCents

Pingback: Tracking and Getting Back on Track | Northern Cheapskate

Thanks Joan. So true!

Thanks, everyone, for the kind words and your feedback. I’m plugging away at the weight loss, just like the debt… and of course I’ll keep you guys updated as I go! It’s so nice to know I’m not the only person who makes this connection, you know?

Baker,

You and your people are brilliant. If only I had you insight and perspective 30 years ago…

-brad

If you want to loose weight fast, I can only recommend the slow carb diet from Tim Ferriss.

I gave it a try a long time ago and lost 7,2 kg in 15 days,

http://www.genvejen.dk/effektiv-slankekur-saadan-tabte-jeg-72-kg-paa-15-dage/

(my blog is in Danish, but Google Translate is your friend if you really want to read it all :))

You are totally right about writing it down. I’ve lost weight and become debt free, and both processes involved me jotting in my little notebook all money spent and calories spent. It really works. I stop spending when I’m out of money and I stop eating when I’m out of calories (or “points” if you are doing WW’s).

Wow, you summed things up really nicely, Joan! Mindful living encompasses so much — physical, spiritual, financial, social — one step, one prayer, one spending habit, and one smile at a time!

Hello Joan. You have an incredible way of addressing both problems with the same equation. And change starts in the mind where decision is first formulated. Let me share this quote:

“Watch your thoughts, for they become words.

Watch your words, for they become actions.

Watch your actions, for they become habits.

Watch your habits, for they become character.

Watch your character, for it becomes your destiny.”

If you just hold on with what you are doing, you will eventually get to your goal and enjoy the fruits of your personal development.

Pingback: How Could You Make An Extra $200 This Week?

Thanks for sharing. I’ve been getting the debt down and I’m trying to translate my debt dropping skills to dropping pounds. Good luck to you in your journey to lose weight and debt.

You too, Felicity!! 🙂 I know it can be done – so here’s to both of us doing it!

Hi Joan.

Have you looked into the Health at Every Size Movement?

I think you will like it. It’s amazing, empowering and free!

Julie. x

Pingback: Inspiration from Legos: Use Resiliency and Flexibility to Build Your Dreams

The more and more I look at it the more I see the similarities between tackling my weight and tackling my debt. For me, its all a struggle of determination. I’ll get really excited about my new exercise regime, or my new financial budget, but then a week or two later I fall right back into old eating and spending habits! I really liked your suggestion of just writing everything down. I’ve never been one to keep accurate tabs on these things but sticking to noting all of my eating/spending habits will really help a lot. I’ll give it a try as see how it goes!

Great article as always Joan 🙂

I’m fairly new to this blog, and I just read this post, and although nothing has been added for quite a while, I feel compelled to share my story. I am 51, 5’4″, and had gained 30 excess lbs over a couple of decades. My frame is small so, 140 was borderline obese in my case. I THOUGHT I was following a healthy diet; lacto-ovo vegetarian most of my life. Another thing – I was philosophically opposed to dieting, because I knew enough about dietetics to know that diets are most often doomed to failure. In early 2011, I came across ‘Why We Get Fat and What To Do About It’, by Gary Taubes. ( I’ve skimmed the 4 hour body book and think the message is pretty similar) This book changed my life! I lost 30 lbs in just 4 months, and am in the best shape I’ve been since my early 20’s. This was so easy – and I am very stable at 110 lbs. I am not thinking about food all the time! Also, I agree completely with Joan that it is vitally important to splurge here and there. In addition, I do an hour of walking most days, but mostly for stress reduction and fresh air!

Ah, Christina, the tyrrany of a small frame!! We are in the same boat – when I tell people that at my highest I weighed 150, they’re usually kind of dismissive, but if you are not particularly tall, and if like me you have a thin build (I’m thin in the shoulders, hips, etc.), that is a LOT of extra weight to put on that frame!

That is exactly the goal I have – get to a stable weight and STOP THINKING ABOUT FOOD. Build good habits, and just live them. I am a huge fan of walking as stress relief – and in fact, you’ve inspired me to get out there today… it’s beautiful and I don’t need to sit at this computer ALL day! 🙂

I’m so glad I found your article. I too have struggled with weight to lose and have recently lost 33 lbs. I found that I was trying to use food to fill up that hole in my heart (my dad deserted our family when I was a child and I began overeating.) Thanks for putting yourself out there.

OK … so don’t kill me … BUT I manage to keep my weight down without much effort. This does not mean that I’m one of those people who has always been genetically skinny, as if my eating habits were different, I could blow up with the best of them. Through the years, I’ve been able to able to maintain a figure that is pretty close to what is was in my mid-twenties. So, here is my advice … dump diets and adopt healthy HABITS. Don’t try to do it all at once – you’ll fail before the habits have a chance to ingrain themselves. These are some of the following “rules” in my life:

– If you drink any type of soda … dump this FIRST! I rarely drink anything except for water with lemon in it (alcoholic beverages are the exception).

– If you’re going to eat out, first dump all cheap fast food restaurants (McDonalds, Wendy’s, Arbys, etc.) Get this crap out of your life forever.

– If you’re going to eat out, eliminate second grade fast food restaurants (Applebee’s, TGIF, Olive Garden, etc) Don’t even touch these for “special” occasions.

– If you’re going to eat out, find a local restaurant that doesn’t fry everything or bury it in butter. Preferably, who uses fresh local food products …. and I know where you live, so I know that these places exist.

– Start looking at salad as a meal. I eat HUGE salads with tons of stuff in them and don’t worry about the calories in the dressing for now. Calories from a salad are better than calories from pasta.

– On that note, get pasta out of your life. Or, if you can’t do this right away, substitute with whole wheat pasta or soba.

– Slowly try to eliminate processed foods from your diet. You will not be able to do this over night, so don’t try. Little by little.

– Start experimenting with foods that may be foreign to you (soba, quinoa, tofu, etc.)

– Start trying to eliminate processed sugar from your diet. So many people have a “sweet tooth”. Like any addiction, once you stop doing it, the craving will go away.

– Watch the movie “Food, Inc.” … many times!!

Anyway, these are just some suggestions to start … again, understanding that you can’t do all of these things at once. Step by step. Once you start getting rid of the “bad” things and start replacing them with healthy alternatives, you WILL NOT miss the bad things and your body will actually start to reject them. If I tried to eat a McDonalds burger right now, I would probably throw up because my body would not handle the grease and fat well.

I hope I helped 🙂 Catherine~

OK … so don’t kill me … BUT I manage to keep my weight down without much effort. This does not mean that I’m one of those people who has always been genetically skinny, as if my eating habits were different, I could blow up with the best of them. Through the years, I’ve been able to able to maintain a figure that is pretty close to what is was in my mid-twenties. I’m 48 this year. So, here is my advice … dump diets and adopt healthy HABITS. Don’t try to do it all at once – you’ll fail before the habits have a chance to ingrain themselves. These are some of the following “rules” in my life:

– If you drink any type of soda … dump this FIRST! I rarely drink anything except for water with lemon in it (alcoholic beverages are the exception).

– If you’re going to eat out, first dump all cheap fast food restaurants (McDonalds, Wendy’s, Arbys, etc.) Get this crap out of your life forever.

– If you’re going to eat out, eliminate second grade fast food restaurants (Applebee’s, TGIF, Olive Garden, etc) Don’t even touch these for “special” occasions.

– If you’re going to eat out, find a local restaurant that doesn’t fry everything or bury it in butter. Preferably, who uses fresh local food products …. and I know where you live, so I know that these places exist.

– Start looking at salad as a meal. I eat HUGE salads with tons of stuff in them and don’t worry about the calories in the dressing for now. Calories from a salad are better than calories from pasta.

– On that note, get pasta out of your life. Or, if you can’t do this right away, substitute with whole wheat pasta or soba.

– Slowly try to eliminate processed foods from your diet. You will not be able to do this over night, so don’t try. Little by little.

– Start experimenting with foods that may be foreign to you (soba, quinoa, tofu, etc.)

– Start trying to eliminate processed sugar from your diet. So many people have a “sweet tooth”. Like any addiction, once you stop doing it, the craving will go away.

– Watch the movie “Food, Inc.” … many times!!

Anyway, these are just some suggestions to start … again, understanding that you can’t do all of these things at once. Step by step. Once you start getting rid of the “bad” things and start replacing them with healthy alternatives, you WILL NOT miss the bad things and your body will actually start to reject them. If I tried to eat a McDonalds burger right now, I would probably throw up because my body would not handle the grease and fat well.

I hope I helped 🙂 Catherine~

These are some excellent observations! One of the things that makes me the very sickest and saddest and angriest when I contemplate the debt AND weight problems that have plagued me for years is that a lot of my money over the years has been spent on junk food, eating out, expensive coffees, etc… Seriously, how much of last year’s food am I still paying for and wearing around on my body? Arghhhhh!!!!!!! The good news is I feel like I’m getting both under control at the same time because, as you and other people on here have mentioned, the impulse to overspend and the impulse to overeat are not dissimilar. Great post, Joan! 🙂