[share_sc]

I first read about the concept of creating a financial network map from Jim over at Wallet Hacks. Since then, I’ve become very interested in how other people set-up their financial accounts. Some of my favorite posts involve other bloggers discussing their unique systems and preferences for handling their own accounts.

What exactly is a Financial Network Map?

In his post, Jim describes it as:

A financial network map is a one-page diagram that shows the links and relationships between each of your financial accounts, which include but are not limited to bank, brokerage, mutual fund, retirement, credit card, and service accounts.

Alright, So What Does One Look Like?

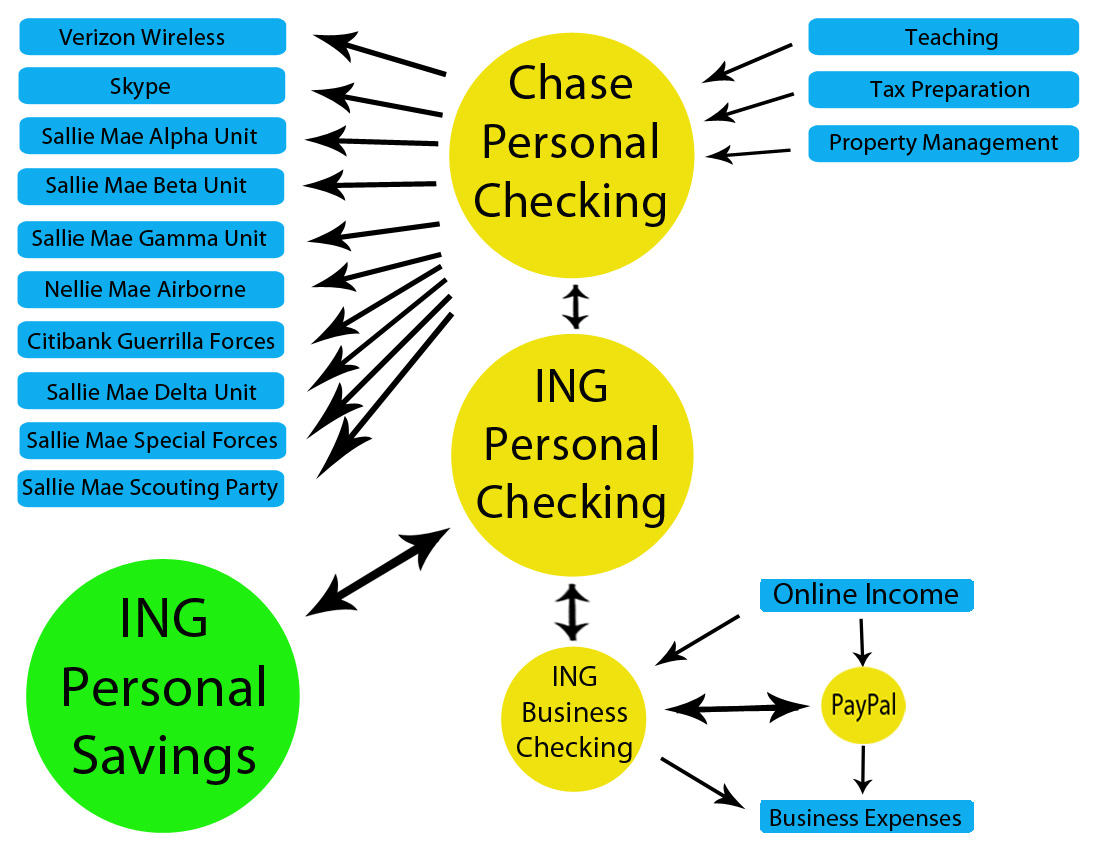

I’m so glad you asked! I happen to have my current map right here…

This looks much more complicated than it really is. In fact, our accounts are actually fairly simplified!

Important Notes About Our Financial Network Map

- We are transitioning from our brick-and-mortar bank (Chase) to our online bank (ING)

- Every account we have is a joint account

- We have no credit cards

- We have no retirement accounts

- We have no brokerage accounts

- We pay the vast majority of bills with cash

Relocation To Australia

As most of you know, we are prepping for our move to Australia in just under two months time. As part of this process we have decided to move away from using our traditional bank (I’ve been a Chase customer for 10 years) towards using an online bank (ING Direct). In case of an emergency, we won’t be totally closing our Chase account. This will provide us a way to quickly give or receive funds from family if needed.

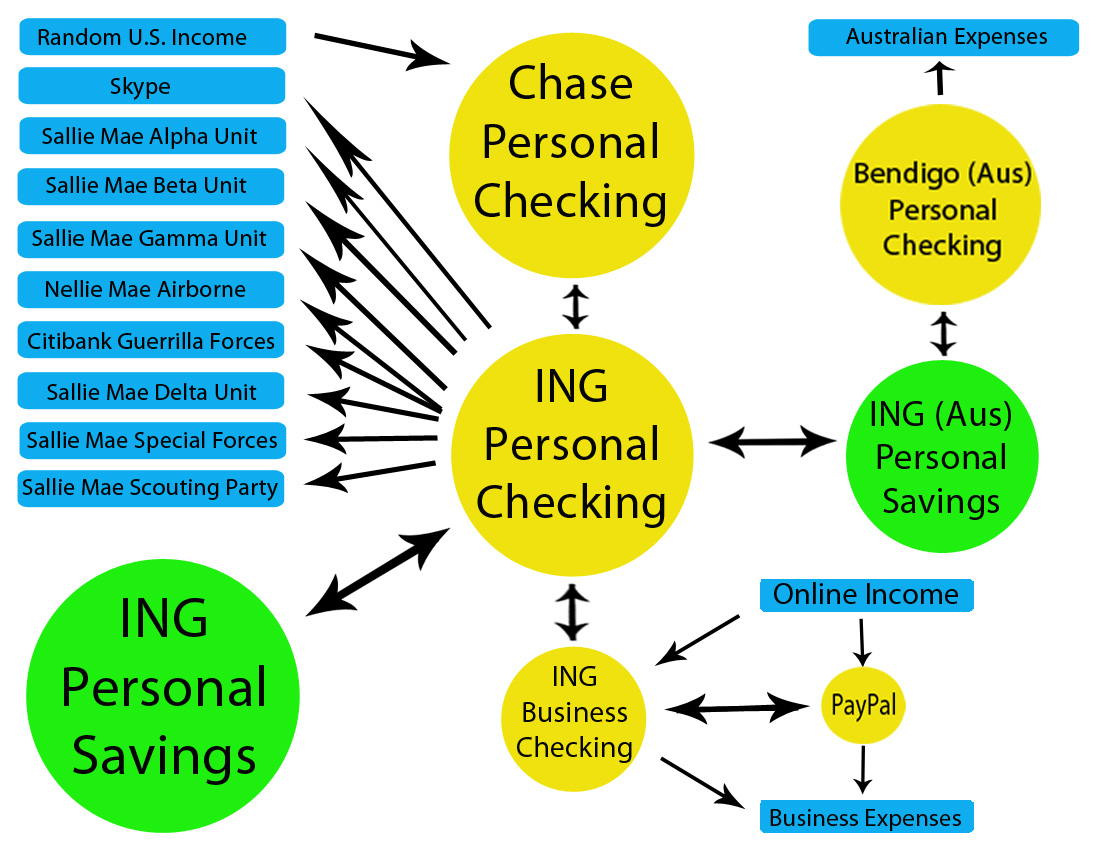

The majority of our money will be held in our ING Savings Account and will be transferred into ING Checking to pay our student loans on a monthly basis. In addition, we will need to open a checking and savings account in Australia. If we open an online savings account with ING Australia we can minimize transfer fees when exchanging US Dollars into AUS Dollars. For this reason we will have an Australian ING Savings account, in addition to a checking account at a smaller community bank in Cairns.

Upon arriving in Australia, we plan for our Financial Network Map to have these updates:

Even though I maintain great awareness of my financial accounts, creating my own Financial Network Map has been an eye-opening experience.

There is something additional that comes out of being able to actual see how your accounts flow together. Another benefit is that in the unfortunate event something were to happen to us, our loved ones would have an easy to read diagram of each of our accounts.

I strongly suggest you consider taking the time to create a Financial Network Map of your own. If you have any questions about the process or how I made the (awesome) diagram above you can e-mail me directly at [email protected] or simply Tweet me anytime!

What do you think of my map? Have you already taken the time to draw out your own personal Financial Network Map? Do you have any suggestions on things I could add to make this even more complete? Let me know below…

What did you draw your map with? It looks very slick (better than my pen and paper one!)

jim’s last blog post..8 Great Frugal Tool Options for Home Improvement Projects

@ Jim – Thanks for swinging by! I made my diagram in adobe photoshop elements. It should be known to the public that I am the biggest photoshop noob on the internet today. Only my wife and I will know for sure just how long it took me to create these!

By the way, thanks for the original post which turned me onto this concept in the first place!

Baker, I did one too!! http://dashtodebtfreedom.blogspot.com (I’m at work so I only spent 5 minutes on mine hence lack of color or any cuteness LOL

Aspiration’s Purse’s last blog post..Water Cooler Topics: Financial News Bits for Today

Mine looks quite like yours, but the blue debts on the left are considerably lower.

Not a bad idea. Am going to do something similar later on I think, once I get myself organized for my upcoming trip.

Am adding you to my reader. 🙂

Fabulously Broke’s last blog post..10 Tips to save money on Groceries each month

@ Asipration – I can’t believe you did that in 5 minutes… You are definitely making me jealous!

@ Fab Broke – My goal is to get those blue debts lower, too! Let me know if you put yours together. By the way, I’m honored you would add me to your reader… your site’s content, as well as it’s design, is out of this world!

I’m glad the post was able to help you, I think having these graphs are very important. If nothing else, you might learn how complicated your stuff is and be enticed to simplify it!

jim’s last blog post..Analyzing My Wife’s Old 401(k)

@ Baker – Is it kosher to post like we’re on twitter on non-twitter places?? 🙂 I’m really new to twitter!

Aspiration’s Purse’s last blog post..My Financial Network Map

Nice looking map. I did something similar a while back, but using PowerPoint. It’s great to have everything on one page doesn’t it.

Pinyo’s last blog post..I Am Just A Blogger, Damn It!

@ Pinyo – I totally agree man. I guess I was a little cocky, I thought that having the picture wouldn’t really do anything for me because I knew my accounts so well. It really did feel very neat to be able to visualize everything in one quick spot!

Pingback: Weekly Round Up: Decompressing for the Weekend

I do it this way too! Currently making one for an upcoming vacation. I have one for regular expenses, and another one plotting a theoretically lay off scenario, so I’ve already plotted what I need to do if it happened. http://rainydaypennies.net/2009/04/creating-mindmaps-for-budget-planning/

Cathy’s last blog post..Productivity: Do Your Less Important Item First

@ Cathy – You’re mind map looks a lot better than my graph! Of course, your situation is a little bit more complicated than mine to begin with. Thanks for taking the time to stop by, I’m interested in your site and will be checking it out more later!

Can do it in 5 mins on powerpoint! I know you may not agree with the separate banking accounts….but it works for us

http://www.myjourneytomillions.com/articles/the-wife-and-i-finally-implement-a-plan/

My Journey’s last blog post..Planning for Children Special Needs – Part II Letter of Intent

@ My Journey – What you meant to say was YOU can do it in minutes in powerpoint, haha! I’m very disabled when it comes to graphic design of any sort. By the way, I “agree” with anything that “works for you.” I just don’t understand why anyone would want separate finances! Thanks so much for taking the time to comment!

I am not sure it is “a want” vs. it works for now. I think a lot of it has to do with the fact the wife and I were together for 7 years (living together for 2 of those) before getting married! There was no reason for the combination of finances prior to the marriage, and we have yet to completely intergrate.

Also you should install the plugin that lets you subscribe to the comment section.

My Journey’s last blog post..Planning for Children with Special Needs – Part II Letter of Intent

@ My Journey – I understand what you are saying. By the way, I did install the plug-in via your suggestion. Let me know if it is working for you on other threads! Thanks for the feedback!

Pingback: Rainy Day Pennies | Debt Free Living and Personal Finance » Financial Network Maps Roundup

Hey Baker:

I know you saw my financial map already (and love it!) ;-), but I wanted to encourage you to go ahead & link to it in your post if you would like.

I loved the process of creating my map and especially appreciate the visual overview it gives my wife & I of our entire financial picture!

Good stuff man.

Matt Jabs’s last blog post..Jabs Family Financial Network Map

Pingback: How Financial Maps help your overall Personal Financial Health | Debt Free Adventure!

Baker,

More on decluttering your life…….

This weekend our small town had a city-wide garage sale. I took the opportunity to gather all un-used or un-needed stuff from our house, my mom’s house and my daughter’s house. My niece did the same for their household and we had one big family garage sale. We priced everything at .25 or .50 cents to make sure it left.

I packaged up an abundance of my organically grown parsley and gave away a large bunch with each purchase. Everyone loved that. Every kid that came was given an organically grown apple to munch on while garage saling with their parents. The parents and kids really appreciated that.

My niece had said she hoped to make enough money to purchase a new pair of leather boots for trekking through the wet rains on her college campus. She said the pair she wanted cost $100. During a slow period of the sale I asked her if she would go to the garage sale across the street with me while the others manned our sale. Right across the street she found not one but two pair of Doc Martin leather boots that fit her perfectly. One pair was brown leather and the other pair was black. She got both pairs for $10 total!!

She made enough money from the sale to purchase 2 pairs of boots plus plenty of gas money for commuting from campus to work and back again. She took a bunch of un-used stuff and turned it into a much needed pair of boots and gas money for going back to school. That is one smart student!!!

My daughter will be moving soon and thanks to the garage sale she figures she will have at least 8-10 fewer boxes of stuff to pack up and move. This made her very happy because everyone hates the process of moving so knowing that she eliminated almost an entire load is very motivating.

Kim,

Thanks for the awesome story! This is a perfect example of decluttering, saving many, being resourceful… it’s just an awesome story!

Pingback: My Financial Network Map | Suburban Dollar

Pingback: Discovering Your Financial Priorities

Pingback: Update on my progress | The Life Year Project