[share_sc]

Note: This is a post from Joan Concilio, Man Vs. Debt community manager. Read more about Joan.

A couple of months ago, Chris and I were browsing in a local antique store and he picked something up and said, “Hey, Joan, this is totally a Man Vs. Debt post!”

He’d found a 1939 pamphlet on “Money Management for the Family.” He loves old books and papers, and while he can blog about literally anything, I think he was mostly kidding.

The thing is, it turns out that MUCH of the advice is truly timeless and, dare I say, even a little familiar-sounding, so I thought it’d be fun today to share a few highlights.

And for more Family finances and budget chat, check out the Clever Dude blog. You will love it!

On working together (and talking about money!)

- “The child should have some part in the family budgeting, for one who understands something of the effort required to produce the family income, as well as the number of demands upon it, is likely to be a thoughtful spender.” Oh, wait, that sounds familiar!

- “The child should understand that his allowance is his regular part in the family spending. It should not be withheld for misdeeds, added to for good behavior, nor used as pay for regular family duties.” This, by the way, is a subject for a whole separate post, but we don’t do allowance-for-chores in our house, following almost exactly this system!

- “A child needs guidance in spending his money, but the final choice should be his. He will make mistakes but he will learn the more from them.”

- “The best plans are developed in a family council… everyone either shares in making the plan or knows enough about it to appreciate both the limitations and possibilities of the income.”

- “The council plan may result in the family’s working together, each one watching his spending to accomplish a desirable future goal which might be difficult to attain otherwise.”

I love the last one most of all. I’ve said before that one of the best things about our family’s debt-payoff efforts is that we’re a team. We are more than the sum of our parts, and we are so grateful for it!

On budgeting

- “Your budget should include everything for which you spend your money.” Oh, so simple, but so many of us don’t heed this advice!

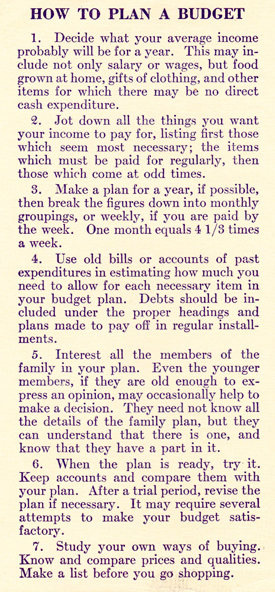

- “Decide what your average income probably will be for a year… (then) jot down all the things you want your income to pay for, listing first those which seem most necessary; the items which must be paid for regularly, then which come at odd times.”

- “Use old bills or accounts of past expenditures in estimating how much you need to allow for each necessary item in your budget plan.”

- “With a weekly income, reserve your rent weekly. An old rule, and a good one, is never to pay more than a week’s wages for a month’s rent.” It was an old rule then – and it’s STILL a good one today.

- “If you own or plan to buy a house, consider regular payments on mortgages, interest, taxes, water bill, insurance and upkeep and repair as rent.” While talking to my mom about this post, she pointed out that owning a home when she was growing up was almost unheard-of. Hmm. I think there’s value in not “defaulting” to a mortgage!

- You are not your budget. You are a person.

On having a plan

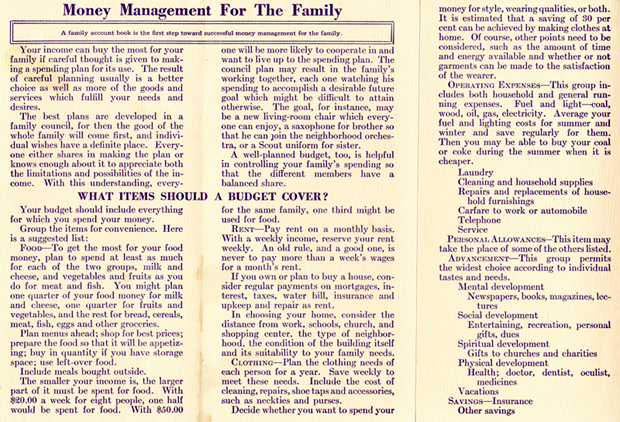

- “A family account book is the first step toward successful money management for the family.”

- “To get the most for your food money… plan menus ahead; shop for best prices; prepare the food so that it will be appetizing; buy in quantity if you have storage space; use left-over food.” This is a huge one for us. We have a grocery-shopping system and tons of ways to make sure we’re using all our leftovers.

- “Plan the clothing needs of each person for a year. Save weekly to meet those needs… Decide whether you want to spend your money for style, wearing qualities, or both.” I’ve talked about this in detail before – that our clothes-buying is frugal, but not always cheap!

- “When the plan is ready, try it. Keep accounts and compare them with your plan. After a trial period, revise the plan if necessary. It may require several attempts to make your budget satisfactory.”

Just for fun

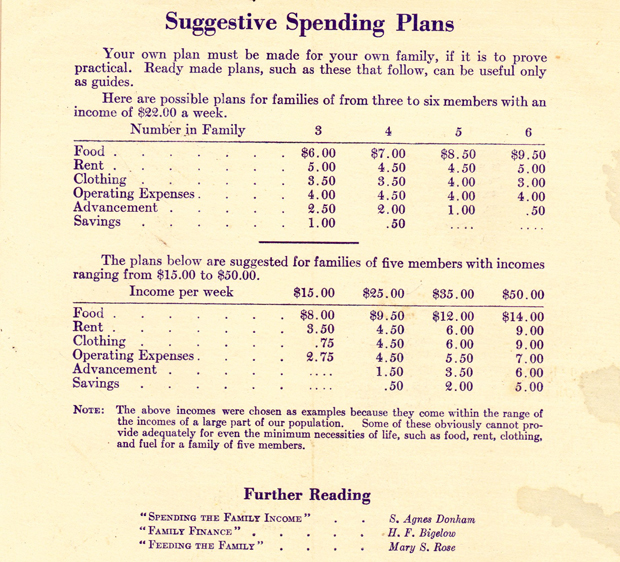

Check out the “Suggestive Spending Plans” here – for an income of $22 a week! Our family of four, at that time, ought to have been spending $7 of our income, almost a full third, on food – more than the $4.50 we’d want to allot for rent or housing. I love that we would be planning 50 cents for savings. That matters – it’s more than 2% of that income, and I humbly submit that most of us aren’t saving at that rate now! What do you think about htat?

For a true comparison, I ran these through the Bureau of Labor Statistics Inflation Calculator. You might be surprised to know…

- A salary of $22 a week in 1939 would equate to the purchasing power of $368.42 a week in 2013. This is equivalent to one working adult making about $9.20 per hour – so, while low for a lot of Man Vs. Debt readers, absolutely realistic in America today.

- Using the same percentage for food, that would be $117.19 a week for our family of four. This veers lower or higher, but I think it falls in the category of “fairly possible,” especially at that salary. (I also think that for a dual-income family, this cost probably would not fully double, so that makes it even more likely to work even today.)

- Ah, but then we get to rent. Housing expenses should come in at $75.34 a week, or about $326 a month (averaged). Can you tell that housing costs have WAY outpaced inflation? Yikes!

- The same amount should be spent on “operating expenses,” which includes utilities, household supplies, cleaning equipment, furniture, phone and so on. I think we’re starting to see the areas where the modern lifestyle is harder to maintain!

- Finally, savings of 50 cents per week on that 1939 salary would translate into a savings of $8.36 weekly now – or about $435 per year added to savings. While I think that’s a modest goal, I wonder: Can most people say their savings increases $400 to $500 annually? I hope that in the Man Vs. Debt community, our answer is yes – or at least that we’re working on it!

[share_sc]

I hope it was kind of fun for you to see some financial advice from 74 years ago.

Any surprises – or family memories from that time? I’d love to hear your thoughts!

Great post, Joan, it seems humanity has been struggling with money since its invention!

It’s a shame, but it’s true!

Fantastic post Joan!! I loved it. It is so refreshing to see that common sense (and wisdom) never goes out of date. Thank you for sharing the pamphlet and your perspective on it’s message.

Thanks, Philip! I hoped it’d be different and fun, and I agree – TRULY wise advice is often timeless! 🙂

Funny to see how the price of things have changed over time, but the overall message of the advice has not.

Isn’t that the truth!! 🙂

I loved this, if only my mother had taught some of these principles early on, maybe I could have had a better understanding of debt and how not to accumulate it!..

Dani, I hope a LOT of families start putting these ideas into practice – and teaching their children! Not all, but definitely many of the awful financial situations we find ourselves in could have been prevented with more education at a younger age.

I’m just glad you’re here now! 🙂

My wife has mentioned not paying the kids for family chores. I really like the concept and will have to explore it further. Our little one is to young yet (18 months), but it doesn’t hurt for us to have a game plan now. Joan, I look forward to your post on the subject.

If you think about it, finances are painfully simple to follow. The richest man in Babylon was written in 1950’s, think and grow rich in the 1930’s, pushing to the front in the 1890’s. Our founding fathers had excellent investing advice that is nearly 250 years old. Investing advice is timeless.

The only difference between then and now is we have much better opportunities than they had. We have easier system to track budgets, we have more flexibility for long term wealth protection and saving, and we have a much easier way to invest in millions of different ways in all corners of the planet. We have more information at our fingertips than Bill Clinton had in the White house. I sidetracked, but it is very exciting to see this “old” information. People with limited resources could keep a budget on a quarter of the annual household (inflation adjusted) income. We have no excuses.

Jason

Jason, you are SO right. We make more (proportionally), or at least many of us do; we have so many more tools to make things easier; we have so much more information – yet we’re not living like we do!

I now see MULTIPLE future post topics 🙂 And I will definitely push the chores/allowance one up on the list; I’ve been tossing it around for quite a while and I need to just sit down and get my thoughts out!

That is super unique and fun to read. It’s amazing how much the advice from way back when still applies today. This just furthers my belief that these items will also be valid 70 years from today. If they were valid back then and now, why won’t they be valid in 70 more years?

I think it’s also fun to look at the amounts from back then. Saving $0.50 a week sounds like absolutely nothing, but it still equates to $400-$500 in today’s terms which I agree with you that not many people save that much.

Jake, I think that’s exactly it – not nearly enough people make even that “small” savings! And you’re right, too, that this advice will continue to be valid moving forward. Heck, my daughter’s grandkids may someday view holographic Man Vs. Debt posts and say, “Look at this old advice. Wow, it still works!” 🙂

Thanks for sharing this Joan. It is fascinating!

Thanks, Christina! I definitely thought so – especially the more I read!

The cost comparisons to today’s dollars are really very interesting! Life has become so much more complex…

Isn’t that the truth???

Thanks a bunch. This was a great post and really awesome of you to break it down from 1930’s costs to what it would be for today. I actually feel much better since I save at least $600 every six months so I am way ahead of the “recommended” amount for saving.

You are correct that most people cannot save any amount and instead seem to spend their money almost as soon as they receive their paycheck. It is very sad.

Thanks, Rebecca – and congrats on being well ahead of the game! 🙂

Joan,

Great stuff! I love how you’ve translated the historic numbers to today’s dollars. It’s shocking to see how much more expensive housing is now compared to before.

Regardless of the actual numbers, it’s great to see that some advice just works regardless of which era you apply them to. While we may have more complicated money issues today (e.g. credit card debt), it’s nice to see that some timeless principles still apply.

All we have to do is follow them, and things should turn out OK! 🙂

Ivan, that is so true. So much of this is really “Do you get the principle behind it?” And if you do… then you’re good, no matter the numbers!

A good friend of mine has a martial arts school. It’s amazing to hear the kids interact with their parents when they want something. They don’t ask – they demand. I’ve heard parents say “no, we don’t have the money for that” only to be countered with, “why, don’t you have your card with you?” Start early and teach your child how hard you have to work for your money, and why it’s not just there for all of your whims!

Dona, I get super-sad when I hear any family members treat each other that way. In some cases, it’s even spouses who are pulling the “Well, I’m DOING this” line, as if the other people in the family’s needs and wants don’t matter. That’s such a shame!

Pingback: Quick Hits: What got you broke won’t get you free. Money management tips from 1939. Near space exploration. « A Bodey in Motion

Pingback: Best of the week - April 27, 2013 | More Money Than Month