Note: This is a post from Joan Concilio, Man Vs. Debt community manager. Read more about Joan.

Nobody wants to talk about insurance.

For real. Me included – and my dad was an insurance agent for much of my life.

But when I finally manned up (or, uh, womanned up?) last year as part of our You Vs. Debt course and really paid attention, I realized I’d been paying WAY too much for our car and homeowner’s insurance for years.

How did I let this happen?

It didn’t start out too badly.

When I started driving in 1999, I shopped around with my mom for a good auto-insurance policy that would cover us both. It was just the two of us – and the deal was that I’d pay insurance and gas, since Mom had paid the $1500 for the ’89 Nissan Sentra that I was rocking.

At the time, we got a competitive rate. Later, when I bought my own house, my mom moved in with my daughter and I, and since I was no longer a minor, some companies would not cover having us both on the same policy, though we lived together, which limited our options.

We ended up staying with the same company for 12 years for our car insurance.

Meanwhile, our homeowner’s insurance had been with my father’s company for most of my childhood. After my father passed away, a friend of his assumed the management of the policy, and we continued to do well on our rates. But that gentleman later retired, and still we stayed with the same agency, being passed from agent to agent.

When I bought my first house, time was of the essence. I asked the same agency to get me quotes from a handful of the companies they worked with, and chose the lowest-priced one.

Later, when my husband and I bought the house we now live in, again, time was an issue, and again, we simply took the path of least resistance, getting what seemed like a decent quote from the same company. We’d been using the same agency (though different insurers) for homeowner’s insurance, as a family, for more than 30 years.

We never intended to waste money. We simply applied a “set it and forget it” mindset to our car and homeowner’s insurance purchases, and our lack of attention cost us.

Why I finally pulled back the curtain – and what I found

Last year, as part of the You Vs. Debt course, Baker asked us to do an “insurance audit.” We were supposed to become informed on our health, life, auto, and homeowner’s or renter’s insurance.

That meant calling up various agents, human-resources folks and national customer-service lines. It meant digging out long-ago-filed coverage paperwork. It meant paying attention to the “why” behind this money we were paying out each month.

In our case, the areas we chose to focus on were our auto and homeowner’s coverages.

When we sat down to evaluate, we found the following:

- We were paying about $1,300 a year for car insurance. That covered two paid-off cars – ours, and my mother’s – and three adult drivers with clean driving records.

- We were paying about $750 a year for homeowner’s insurance. This was a middle-of-the-road policy; some money put in for replacement of some items of particular value, but standard otherwise. However, it covered our house at a value it hadn’t had for more than four years, thanks to changes in the local economy.

In our case, the LEVEL of coverage was good on both, once we finally figured out what that level was. The biggest problem was price.

We’d never spent much time shopping around, figuring it was “only” $100 a month or whatever. But when you see you’re putting out $2,150 for something annually, it suddenly seems worthwhile to comparison-shop.

How I saved $700 a year

This time, we did it the “right” way. We took a few minutes here and there and requested quotes from as many insurers – and brokers – as possible.

Surprisingly, it only took about a half-hour of work to get a REALLY good quote.

This new package bundled together the auto and homeowner’s and took advantage of several discounts.

- Our new car insurance would be $854 a year for more coverage, a lower deductible AND with the addition of one accident claim that added a $105 annual surchage.

- TOTAL CAR INSURANCE SAVINGS: About $450.

- Our new homeowner’s insurance would be $483 a year. This reflected more accurate coverage based on changes in our property and home value.

- TOTAL HOMEOWNER’S INSURANCE SAVINGS: About $250.

For a half-hour of work, I saved almost exactly $700 a year.

We cut our insurance spending by a full third of what we were paying.

In a half-hour.

I was kicking myself for not doing this YEARS ago.

What you can do today to get the best insurance deal

I couldn’t believe how much money I was leaving on the table each month.

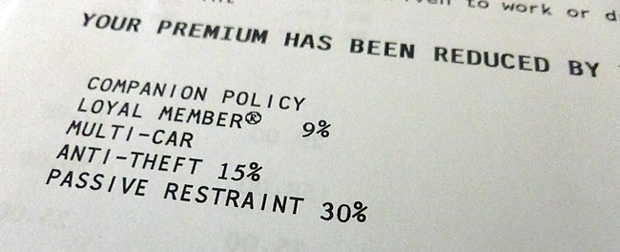

For instance, simply because both our cars have a passive restraint system – aka airbags – we save 30% on our car insurance. That is our actual “reduction list” above.

I’d never mentioned the to our previous insurer – and they’d never asked.

Similar savings came on our homeowner’s policy.

Certain renovations earned a 12% savings; a membership discount (AAA) took off another 10%.

Insurance CAN be complicated – but you CAN figure it out. Here are my suggestions on how to get started today.

1. Be willing to change.

This was the #1 obstacle in our way – we’d been with the same companies, carrying essentially the same coverage, for so long that we became afraid to shake things up. In fact, I mistakenly believed I couldn’t switch my coverage before the policy expiration date – which wasn’t true, but which tied me down!

Mindset is fundamental to ANY financial change. If you’re willing to change, you gain flexibility, and you can often leverage that flexibility into serious savings!

2. Really understand your coverage now – and your needs.

This is exactly what Baker challenged us to do in You Vs. Debt. We had to get on the phone and figure out what we currently had – and learn what that would and wouldn’t get us.

You DO NOT want to be Joan in 2008, who only learned that her (fully finished) basement wasn’t covered for water damage unless the water came in through the ceiling, since it was below ground level. I learned that when I had water 2 inches deep coming through the walls and floor. I should have known that – and changed my coverage – but I didn’t until it was too late.

3. Arm yourself with plenty of quotes.

I don’t care if you use ANY of them. Even if you stay with your current insurer, you’ll become a ton more knowledgeable by getting – and really reading – quotes from a variety of sources.

Some are valuable simply because they outline what various coverages cost in a clear way – which can help you make sense of your current policy, too!

4. Ask about all possible discounts.

In our case, our biggest savings simply came from bundling two types of coverage together. We also did well by leveraging anything from our AAA membership to home and vehicle safety features to our personal history of being free of most kinds of insurance claims.

A great insurer or agent will tell you about these – but even a good agent may not. Make it a point to ask.

5. Stay actively informed about your insurance.

Earlier, I mentioned I was mistaken about when I could switch carriers – a piece of misinformation that cost me big-time! The sad part is, I had documentation to the contrary in my possession – that I’d never read.

Once you get informed about your current coverage, stay on top of that knowledge. Read the disclosures you get with your policy documents each year.

In fact, I even recommend you call your insurer annually. Simply ask politely whether there have been any changes you should know about, and whether there are any new types of savings you might qualify for.

And if something has changed for YOU, let the insurer know as well! Staying connected will not only keep your premiums reasonable – it will keep your coverage level accurate.

Before my insurance audit, I was still carrying homeowner’s replacement-cost coverage on a significant amount of jewelry I’d sold – UGH! On the other hand, if you start a collection of first-edition books and DON’T change your coverage, you might find yourself out a considerable amount if any damage occurs!

[share_sc]

So where do you stand with your insurance?

Are you carrying the right amount – and paying a fair rate for what you carry? Are you informed on your coverage – and taking advantage any applicable discounts?

What one step will you take TODAY on this important issue?

We’d love to know!

Oh my gosh – a blinding flash of the obvious! Getting to work right now…

Thanks!

Man, that sums it up, doesn’t it William? Sure was MY reaction. Keep us posted on what you find!! 🙂

My husband and I took a good hard look at our insurance policies about two years ago. We switched carriers and saw substantial savings. But here’s the thing. The next year, when the policies came up for renewal, the premiums were much higher. The insurers didn’t even point out the increase. They just sent invoices for the higher amounts. Sneaky!

What we learned was that insurance companies will offer you a great rate to get you in the door. Once you’re a “part of the family,” they’ll make up lost ground by increasing your premiums every year thereafter. So enjoy your “cheap coverage” this year because it may not continue into the future. 🙁

Also, don’t forget to check your health insurance policy, too. You may find you can save a lot by switching carriers, just as you did with your other insurance policies, at least for a year or two.

Susan, those are definitely things to watch for – good tips for everyone to keep in mind!

I did the same thing. Was on my parent’s car insurance for years (same guy and everything) and then when I got my own I compared his rate to some competitors and made the switch. Not only that but my parents did too!

Awesome, Jenna!! It’s amazing, isn’t it??

The only time you find out the true value of insurance is when you have a claim.

One thing that bothers me in your post. Your assert that your homeowners insurance covered you at a value that your house hadn’t had in years. Although the value of your house may have decreased, the cost of repairing or replacing it has not. You should NOT reduce the amount of your coverage just because property values go down.

When it comes to car insurance, there is more to consider than just the amount of premium you pay. Does your company offer accident forgiveness (ie if you have an at-fault accident you don’t lose your good driver)? Will your company stand behind you when you have a claim? Will you be able to get your car repaired quickly or will it turn into some nightmarish hassle?

Food for thought:

Some budget companies may not renew your insurance after an at-fault accident. So up to that point you may saved a lot on insurance, but now you are faced with finding another insurer with a recent claim on your record. Will you be able to afford another company’s high rates if your budget company drops you?

Doug, some extremely important points you brought up.

Doug, I touched on the homeowner’s part below (in reply to Jason’s comment), but I have to say, I actually changed auto insurance companies in large part BECAUSE of our accident. It was handled incredibly poorly by our former company, and that motivated me to switch! That is definitely something I hope no one ever experiences – but you’re right, you find out how good (or bad) your company is when you need them.

That said, don’t let anyone tell you that an at-fault accident (if you don’t have a pattern of them) is a problem for insurance. That’s a common misconception – and one my dad really worked hard to put to rest among his clients. Obviously there are a LOT of factors at play – but in our case, WITH the at-fault only three months earlier, our family’s combined driving record was still well above the average for the company we switched to, and we got well below an average price as a thanks!

You’re right, though, about budget insurers. I don’t prefer them and have chosen not to work with certain companies for that reason – WAY too fickle; they’re the ones that jack prices up after a year like Susan mentioned in a comment above! You definitely do not need that type of company to get a great rate.

Great article. I would say not to forget about checking “restricted” companies that you didn’t know you might qualify for. One example would be USAA (I don’t work for them). You can qualify if your grandparents were members and served in the military or your parents. They aren’t always the cheapest but sometimes they are, it falls along the lines of using your AAA membership to get all the discounts you can get. Arm yourself with quotes but use referrals too. My cousin has a great policy with you for . . . what can you do for me.

Christena, great advice – thanks!!

This was a great reminder — we meant to check into our home owner’s insurance earlier this year, but never really got around to it. Wow! Complacent, much?

We don’t intend to shop around for our auto or health insurance, because these are two items which come straight out of my hubz’ paycheck before it even hits our account. The piece of mind in knowing these necessary items are paid for with zero effort on our part, never late / always on time, & therefore one less thing to worry about on our extremely long laundry list of concerns — totally worth any extra out-of-pocket expenses for us. I can see how for someone else, this system might not be good enough incentive to stay put, but as we are slowly building ourselves up & learning to be responsible, this frees us up to put our efforts elsewhere. *shrugs*… works for us, anyway!

Andi, you have to do what works for YOU. There are a lot of reasons why we chose to focus on our homeowner’s and auto rather than health and life, and some are different, but some are similar to yours!

The key is that it’s a CHOICE – you’re not being complacent about those coverages, you’re saying “OK, I understand that MAYBE I could save money, but the tradeoffs make that less valuable to me.” And no matter what the situation, when it comes to finance, if you DECIDE, well, I support it, if that makes sense!! 🙂

Thanks, Joan! This only applies to the auto & health, though. We’re DEF. being lazy & complacent when it comes to homeowners, & I intend to rectify that this month. Making an intentional decision to put off a concern by having it paid automatically isn’t the same as ignoring one altogether. I hereby declare that the hubz & I will spend some time in August looking further into our homeowner’s insurance, & I’ll report back on what we learn. Thanks again for the kick in the rump! 🙂

A few months ago, I got the bill for renewing my homeowner’s policy. Enclosed in the envelope was a notice about how your credit affects your rates. It said that I had the righ to ask the company to re-check my credit rating — they said it could only lower your rates if your credit was better than they thought. If your credit was worse they would not increase the rates. I was being billed $1400 for my insurance – I figured, “What the heck?” I knew that my credit rating would probably be higher than it was 4 years ago when I had purchased the house, since I’ve paid off alot of debt. I figured maybe I could save a few bucks.

Well, when the woman came back and told me that my new police would be $330… I thought she meant $1330. No, she said — you just saved over a thousand bucks! I was absolutely floored!!!!! I then told her to do the same on my car insurance and also a policy I had with another company on a rental property.

Well, to make a long story a little bit shorter… I ended up saving about $1500 from that one phone call. WOW!

Martha, that’s AMAZING!!! I am so thrilled for you – what a testament to the value of asking, right?! 🙂

Thanks for doing a post on insurance.

It reminded me – oh right, I should think about that stuff, too.

I don’t have a car, I’m not a homeowner, and I have the basic package on my storage unit (required). But otherwise, insurance…uh…? This is complicated, I’m frustrated I’ll do it later.

As an expat, insurance is a completely different ball game.

But even though I’ve said “oh no, I won’t go without” that’s exactly what I’ve been doing (insurance situation through my employer(s) has been a series of confusion and dropped coverage) based on my income bracket and age, and just being a foreign teacher (as opposed to some big wig company or on a spouse visa) – playing chicken because it’s complicated.

I don’t have coverage that would – worst case scenario – repatriate my body after death, for example, because it’s just been out of my budget and I haven’t taken the time to research (it also changes really, really quickly and changes if you visit home, it’s painstaking).

But this kind of reminds me to get on that, as I keep telling myself and then promptly forget. I’ll work on that before the end of August, maybe…

OK, I’m calling you on it – you better check back in on Aug. 30 and tell me you’ve at least made some inquiries, girlfriend!!! 🙂

A couple years ago our homeowners policy took a huge jump in price. That got me motivated to look around and was I ever surprised by what I discovered. We too had been paying way too much. I ended up switching to a different company altogether and saved $1500 between our house and car insurance. Yes, fifteen hundred! I was amazed how much we were being ripped off. And I just love, love, love my new agent (who is local and seems to always be available if I have a question).

Pat, I think finding a good agent is DEFINITELY key… and that savings is awesome! Good for you!

I want to echo what Doug is saying. I look at this all the time as real estate is my business. The replacement value of your house has likely gone up not down (due to inflation). A good example is my home. The value is ~ $64 per square foot. The replacement cost is $110 per sq foot or more. This is the average replacement cost in my market. (Aurora, CO). That’s a huge huge difference. Nearly 50%. Please be very careful with this. I suggest you consult an expert before making that move. This would be a case of being first cost sensitive.

As far as the motive, I think you are spot on. Insurance tends to give nice rates for new customers. Those rates can creep up over time if your not vigilant. We are in the research process ourselves.

Jason

Jason (and Doug), I oversimplified a lot on that, because my point was simply to get folks to look at their coverages. We’re good – and actually have a better and more accurate coverage (and this is per a family member who is a building contractor and real estate investor). As a simple example, the previous coverage included considerations for structures the previous owners had on the property – that left when they did, but that we were still carrying replacement for!

Thanks for checking, though!

I figured you had already looked into, just wanted to be sure. (especially for others reading) Once again knowledge is power.

I am in the sunny UK and have been following your posts and stuff and I just changed to a joint policy with one company and now insure two cars for the same price as I was insuring one!! What an incredible waste of money we keep making!! Now I started I know this may sound a bit sad I know but I have just been looking at my mobile bills. In 12 months I paid out exactly £450 on a contract mobile / cell phone. In reality, the ACTUAL usage (you know for calls, internet & texts etc) came to just £85.14. I just wasted £364.86 in a year which is just over £30 a month! How many other people are doing this???? I’m off to see O2 (the mobile phone company) about this…..

Ian, that’s awesome that you’ve started looking into these – and please, keep us posted on how you do with the phone company!! It is sometimes amazing what you find when you really start looking into your bills, huh?

Good for you for making these changes – keep it up!

And if you do this every 2-3 years you will stay ahead of the price increases. You would think that insurance companies would give long time customers the best deals. But the reality is that my experience shows that new customers get better rates. Doesn’t make much sense to me, but if that’s what I need to do to save money (I usually don’t switch unless i save at least $200 to save myself the hassle) the I’ll do it!

Exactly, Kris!! And you can bet I’ll be more attentive moving forward and work that into my plans!

My husband has had the same insurance company since 1998 for vehicle coverage. He added life insurance in 2005, then home insurance in 2007. When our lives changed, we switched from home to rental insurance in 2009. We’ve been happy with the coverage, and the customer service is phenomenal- but it doesn’t hurt that our premiums have gone down $100+ per year, every year.

Despite our satisfaction with the company, I am taking your blog post to heart and just requested a reduction list from my insurance company. I dug our policy paperwork out of the fire safe and was surprised to find it didn’t include the reduction list!

I’ve also been cranky about the much higher-than-average premium hubby pays for his life insurance through the same company. Like you said, we’ve been a little hesitant to “shake things up” with our consolidated policies, mainly for fear of retribution through increased premium costs for the other policies. But at this point, I don’t think it would make sense for them to “punish” us for dropping one little policy while retaining the others.

Thanks again for a great, thought-provoking post!

J.J., sorry I just now saw this comment – I’m curious, how did it go when you sought the reductions list?? I’m SO glad you took the step of asking!!

Pingback: How to Slash Your Bills: 4 Steps to Paying Less Each Month

Wow, awesome job. I need to do a better job of this.