This article may contain links that help support this website.

You are looking at leasing a car, and wonder what Dave Ramsey would say. If you haven’t already, you may want to read my article covering Carvana’s financials if you are even considering purchasing or leasing.

Dave Ramsey has some quite interesting views about leasing a car. But before discussing the nitty-gritty of Dave’s opinion on leasing a car. Let’s help you make sense of what leasing a car entails.

We wrote this article covering paid off cars that was fun, and we also covered being a one car family.

Also, one thing to consider is helping you understand whether it makes sense to remodel your kids bedroom on a budget.

What does it mean to lease a car?

By leasing a car, it means that you’re renting the car for an extended period. This is often between 24 to 48 months period, although you might get either shorter or longer-term duration if their policy supports that. The service provider has the right to retrieve this car when the lease ends.

Rather than use the term “Leasing,” some service providers use PCH which stands for Personal Contract Hire. Don’t be deceived, Dave believes that it’s all the same junk in a different package.

Car buying on the other hand means that you’ll have full ownership of the car for an unlimited period of time till you choose to relinquish that ownership to a new owner. This transfer of ownership is done either by gifting, selling, or as collateral for credit.

Let’s talk next about what Dave Ramsey thinks about a car.

What Does Dave think about leasing a car?

New York Times reports that one out of every four new vehicles is rented, but Dave Ramsey believes that this is not a prudent choice. In fact, Dave Ramsey says that no one should ever lease a car. Car leases are fleeces he says. He’s quite vocal in his opinion about car leasing, and that’s expressed in a reply he gave to a question on how to get out of a car lease.

Dave vehemently opposed this transportation style simply because of its capacity to increase transportation costs. It’s not unusual for individuals to purchase vehicles that are out of their payroll. But Dave believes that it’s another option that creates the same effect as before and should not be considered as an alternative.

Dave says that in most cases leasing something is similar to financing. He claims that he will never lease anything except an instance where it’s taking a short-term lease on a building or an office space. Dave’s opinion is expected as leasing goes against some of his baby steps. It also goes against some of the advice he gave in his book titled, The Total Money Makeover.

If You Need To Short Term Lease A Car

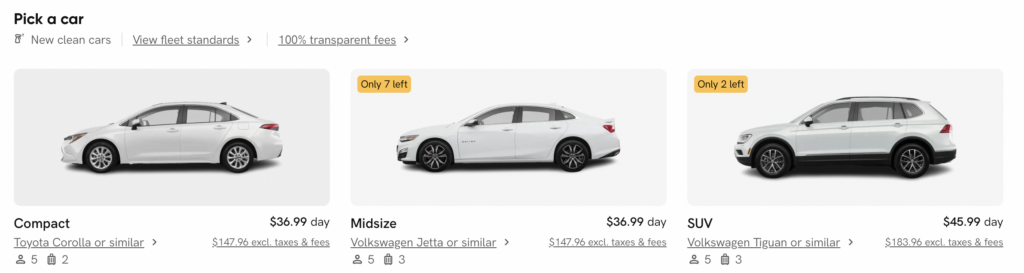

If you need to rent or lease a car for the short term, I would consider a company such as Kyte that actually will deliver the car to you. I checked the availability here in San Jose, and the cars were decently price in the $37-$46 per day for an SUV.

What do we think about leasing?

Although we wrote an article covering how to negotiate a car lease, our position is that it’s often more expensive to lease rather than purchase a vehicle.

If you’ve ever gone car shopping, I’m sure that the dealer would’ve definitely given the option to lease a car. We believe that these car lease deals only seem good on the surface, and there are better alternatives. If you take a lease on your car, you’ll get to take the car home for a lesser monthly payment than if you had taken a loan to purchase the car. But in some years, the dealer will ask that you return the car, buy out of the lease to permanently keep the car, or get a lease on another car. What shouldn’t you like about a car lease? Why are experts like Dave Ramsey against it?

Car leases are a subject that many financial writers have opinions about. Take a look at some of their articles and a lot will tell you that “Never ever lease a car!”

Our opinion on car leasing also aligns with that of experts like Dave Ramsey and other financial gurus. If all factors are taken into account, opting for a car lease is way more expensive than buying a car.

Understanding Luxury Car Leases

Okay! So what if it costs a bit more? Since the value of a car depreciates with time, isn’t it best to lease. What if I just want to avoid the cost of maintenance and just enjoy luxury?

If you feel that way, then you’ll think getting a car lease is better than purchasing it. But that’s because you’re alluding yourself to the reality that:

1. You’re purchasing a luxurious service

2. You’ll be required to pay more than necessary for that service

Purchasing a luxury is affordable to someone that’s financially free and can afford the price-tag that comes with it. But even at that, the alternative forgone is the opportunity to invest the money and grow their wealth.

The only time leasing a car pays is if you invest the cash you would have used to purchase it. And even at that, it requires that you:

1. Invest the money in a profitable venture

2. Allow the money to grow enough for the profit to offset the total cost of your car lease.

However, a much better alternative is to buy a used car as we believe that it’s more economical in the long run. In an article by Dave Ramsey titled how to buy a used car, he supported our view that it’s more financially prudent to own a used car than buy a new one. We hold this opinion on used cars based on the fact that:

- The rate of depreciation of used cars are lesser than their new counterpart

- Used cars are more reliable and they suffer a much lesser chance of being recalled.

- The cost of registering a used car is lower than that of a new car

- You may save on the cost of car insurance

What does Dave Ramsey think of leasing vs buying?

To make a decision about leasing a car or buying, it’s in your best interest to know the advantages and disadvantages of leasing a car. This way, you can make an educated decision on what’s best for you.

The Pros of leasing a car

Brand New Car: Leasing is much about convenience and luxury. You’ll get to use a new vehicle without bothering about the cost of maintenance. This is not to say that you’ll spend nothing maintaining the car, but you won’t have to spend on any major repair.

Low monthly payment: Most time, the monthly payment required to service your car lease is often lesser than the total monthly payment attached to a car loan. However, most leases will require a down payment before the car can be taken.

Little Commitment: It makes sense to lease your car if it’s only required for a very short time e.g. a two-year supervisory role in a different city.

Can help you build credit: If you just filed for a Chapter 7 Bankruptcy or any type of debt settlement and you want to improve your credit score, then you can opt for a car lease. But, you should endeavor to make a timely payment because your credit score can drop if you miss payments.

Cons

You own nothing: You have no ownership right over anything you use. Even though leasing is a good alternative for a short while, in the long, you won’t stop making payments. Yes, cars depreciate in value with time, but if you follow Dave Ramsey’s tips on buying cars you will opt for a new car.

You can’t drive for long: You should stay clear of leasing if you drive long-distance regularly. Dealers maximize their profit by capping the distance you can drive in a year, this allows them to sell the car for a higher price since the mileage is low.

In Summary

The option that most dealers will offer you is to either purchase a car or lease one. This is a simple but delicate option that can contribute to your financial woes or prosperity, it all depends on your choice.