[share_sc]

Note: This is a post from Courtney Baker, chief seller and long-time running wo-man of MvD.

It’s been ages since we hosted our last book giveaway and even longer since we’ve had a video! We’ve been adding to the MvD library over the past year, and it’s time to ship these good reads out to the community.

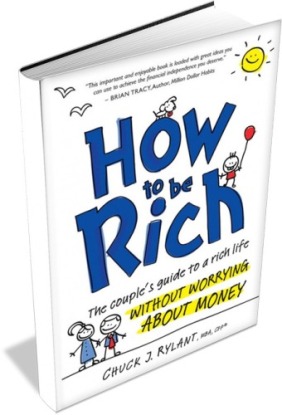

How To Be Rich: The Couple’s Guide to a Rich Life Without Worrying About Money

I’ve always struggled with reading financial books. I connect so much better with stories, which is why this book is refreshing. Chuck Rylant is a certified financial planner who has written a fictional story that peeks into the life of newlyweds Janet and Richard.

It starts with the ebb and flow of Janet and Richard getting to know each other, financially. A couple of pitfalls, an unplanned baby, and several avoided conversations later, Janet and Richard are suffocating under their debt.

Janet primarily tracks their finances. Her husband has a vague sense of where they stand, but couldn’t really toss out any numbers. And honestly, neither could Janet. She’s crumbling under the pressure that finances are her responsibility. It’s time to sit down and look at the damage, but both of them are avoiding it.

This story does have a happy ending – woohoo! – but Janet and Richard had to learn one really important skill…

Like I said in the video, Adam and I have moved back and forth on our systems. He’s solely taken care of our finances, I’ve solely taken care of them, and we’ve also both been equally engaged before. We’ve always been most successful when we were both actively tracking, budgeting and planning our money.

Our current system has me paying the bills and tracking our spending. We create a budget together, look at how much we’ve spent each week, and plan for future spending together. This is a great balance for our family!

We’re giving our copy away and will randomly select the winner on Friday, March 1, at Noon EST.

** Update: Our randomized winner is KP, commenter #25! Congrats KP, and I’ll reach out to you for a mailing address.

[share_sc]

We want to know: Who keeps track of the finances in your house?

How does your system work?

Would love an opportunity to win this book. My husband and I married later in life with a lot of ‘set ways’ financially. We thought we’d just split everything 50/50 but that got rather muddled a year or so into our marriage! Anyway – it would be great to read this book! Thanks for the chance!

For the most part I am taking care of the finances, and unfortunately my husband doesn’t really tune in. I think we would be soooo much more successful if we were equally engaged in it!

When we were flat broke, I couldn’t bear to look at our finances regularly. I just knew we couldn’t spend any money. So I just didn’t spend any and let my husband take care of it. But, once our financial situation greatly improved (new, better paying jobs) I took a larger role in our finances. We discuss our debt frequently, which ones to pay off next (student loans that have several parts, thanks to the USDE and a mortgage) We plan on having my student loans paid off by the end of the year, and the house paid off in the next 5-10. I can’t wait!

I cant tell you how much I need this book right now!

My fiance and I are currently in the process of combining all of our individual accounts into a system of shared finances. Right now, I’m primarily the one keeping track of our finances because budgeting and keeping up with the day to day money situations is definitely one of my skills and interests that he does not have. I would love to read this book since we’re just starting out in managing our money as a couple.

When we first got married, we didn’t really have any plan or order to the way finances were done. I was in the military and had a pretty stable assignment at first, i.e. I was not deploying. After the first three or four years, I moved to a new assignment where I was deploying all the time. Prior to this, we shared bill paying and did not really think much about finances. When I started deploying, my wife took over the finances and paid most of the bills, etc. for the next five years. Then I retired and she relinquished all responsibility for finances.

A few months before I retired, we attended Dave Ramsey’s Financial Peace University. We determined that I am the “nerd” and she is the “free spirit” in our relationship. I did not know at the time, but for the first eight years of our marriage, she was a pretty free spender. I was working so much that until we attended the Dave Ramsey class, I didn’t realize what was going on. So we started to pay down debt. We were working together for a short time, but when I retired, she stopped participating in the financial planning and started spending again, but not as copiously as before.

We decided to attend Financial Peace University again last year because my wife was not really fully committed to getting rid of debt. So during the class she agreed that we needed to get rid of most of our credit cards and carefully follow a budget. This worked for a few months, but then she started relying on me to take care of finances. She also started spending again.

Recently we have come to the conclusion that we both need to be involved. I will probably still take care of most of the bills, but we will at least talk about everything and she will be more involved in the budgeting process. We had a communications breakdown. We have found that communications is the key to a good relationship in all areas, including and especially in finances. So our new mantra for finances is communication and collaboration.

My fiancé and I share a bank account where both our paychecks are direct deposited. I handle all the moving of the monies for our monthly expenses and loans. We put all day-to-day expenses on a cash-back credit card that’s paid off each month. We each contribute the maximum to our IRA’s and the matching/discounting in our 401(k)’s. Extra money at the end of each month goes towards loans.

Our system is pretty similar to yours! I keep track of our daily spending and pay the bills. Then we sit down each week to make sure we’re on track!

This book does seem pretty interesting… I love reading books about personal finance. For the longest time I sat on the fence, but this year my wife and I made a game plan and are on track to be out of debt sooner than we both ever thought.

Newlweds ourselves, and both bringing in a good amount of both consumer debt and education debt we generally budget household expenses together, figure each person’s input and since I moved into her place and most of the bills are in her name I write her a check and she doles it out.

We each contribute equal amounts to a shared account that foots the grocery bill.

Beyond that the remainder of our money is our own.

Budgeting together is great!!! Okay, it is a real pain at first, but once you are both on board with the agreed to budget it makes things a lot easier. Getting to the agreement point is hard, especially when money is tight. My wife and I are both savers, but she is more frugal than I am. We would be entirely debt free (excluding mortgage), I had given her the full rein on the finances over the last 10 years. I am slowly learning to play to her strength. Mine strength is to see the bigger picture that things are getting better and encouraging us to keep going. It really does take two people to be committed to the same specific goals when it comes to finances.

My wife and I budget together but I take care of all the finances. Can be stressful at times but I am planning on automating the hell out of them all here soon…time will tell!

This was a tough transition for me. My whole childhood, young adult life, was “spent” worrying about money. I was too paralyzed by the fear to do anything but ignore it. I was completely reliant on my husband for the bills and finances of our household but 1.5 years ago was financial meltdown (an entire blog post needed for sure!) for us and I knew I had to step up and take control because we were on the fast track to nowhere. I got educated and support from websites like these and I got it done. We now have almost 40,000 dollars in savings, no credit card debt, finished early on the braces for two kids, and no car payments. I upped our retirement savings and we are in a better place there too. We have a time share to pay off and we are slowly kicking it to the curb. I owe this journey to site like Manvs Debt to keep me motivated and on track.

I am solely responsible for tracking and budgeting our finances. I use an excel spreadsheet to track expenses per paycheck and use mint.com overall for looking at trends, where we are overspending, etc. We are great at creating budgets, and not so great at sticking with them. I sometimes feel that it’s my second job (third, if you count part time grad school) to fret and worry over the money/debt issues, and my partner’s job to spend it without a care in the world.

I keep track of the finances but mostly because my wife has been incredibly busy since we really started tracking everything. I also enjoy having her not worry about it and she appreciates the time I take to organize things. It’s a process that really works well for us! Thanks for running this contest and good luck to all!

I keep track of the finances, but my husband and I have started meeting once a week to talk everything through. We have a (flexible) agenda each week of what we want to accomplish. It’s been a slow process working ourselves out of debt, but we both feel much more empowered now that we’re both actively involved.

My husband keeps track. Not gonna lie, it works better when we do it together. He’s more of the spender and I am the saver.

I used to be solely responsible and that was no good. Now, my wife and I are learning to share the responsibility. It’s a process.

I would love to win this book. I can’t get my wife to read any financial books, shes says they’re too technical for her. Hopefully this one will be different.

Thanks for the opportunity to win!!

As I always say, FREE is better than CHEAP!

I am the bill payer/budgeter in our family most of the time, though I don’t have a dedicated system and desperately need one to get our debt/spending in order. My partner and I want to have another child and in order for it to work for us financially we need to take care of our debt and get on track with a system that works for us. I would love the opportunity to win this book. Thanks!

I take care of our finances. Usually it’s a shotgun approach when I have the time, and it doesn’t work very well. Transitioning to a budget next month that should help us get out from under debt!

My husband and I have very different views about money. I tend to worry and stress about money and our financial future, while my husband takes a “live for today” attitude. We are currently in the process of putting ourselves on a strict budget starting March 1st. While I am the one that does the research and planning for getting us out of debt and thinking about our future, I hope my husband will start to take a more active role. I think a book filled with real life stories, instead of boring financial jargon, would help immensely in getting him on board.

My husband and I both work together, yet separately, on our finances. That does sound confusing! But we are both savers in different ways. I actually pay our bills and pay close attention to any money “outgo” of our household. He works on fixing things himself, turning off the lights behind me, and selling things on craigs list.

I would love to read this book. I am the one responsible for keeping track of our finances at home, but the wife and I both are active an assuring we stay within our budgets.

I’d love to get my hands on a copy of this book! My girlfriend and I are closing in on “making the leap” and I think this would be a great book to start things off on a good note. We both have student loan debts (~$70k together) but other than that we’re ok (No high interest debt). Our focuses are maximizing our incomes as we both have PT jobs in additon to our FT ones and were saving as much as we can without drastically changing our lifestyles (We work in opposite ends of the city and both need to commute, etc). We’re still young so we’re not ready to settle down anywhere just yet but we would like to be able to travel and not have to worry about the financial armagedon when we come back. Hopefully this book will have some pointers!!

Hey KP! You’re our lucky winner! Keep an eye out for an email from me.

My wife and I budget together. She leads this activity because she is a better numbers person. She had a lot better financial education/upbringing and really lives the mantra live below your means. I was more of a free spender and to this day I still am although I have become better. I think the best thing we did as newly weds was go back to the basics and create a budget on paper. I was trying to be too fancy with spreadsheets and automatic transfers/bill pay and while that can work seeing it all on paper in terms of where things are going and what is due really helps us stay on track.

Right now, my fiance and I have separate accounts. I do the monthly budgets, but we both have to give them our stamp of approval- we are each others accountability partners.

I am the one that does our finances. I try to engage my husband but he really has no interest. I really don’t like being the only one and I am trying to get him on board. He just likes making the money and just lets me deal with everything else. Some people might like this but I don’t like the pressure of doing everything and making the decisions.

My wife takes care of the finances. This book will inspire us to put our heads together about our budget, about our savings, about our debt. Thanks for introducing me/us to it.

My husband has taken care of all the money for 17 years, completely. therefore when we recently went through Dave Ramsey’s program and it was highly stressed to share the duty, I then began to try to become more involved. My involvement , even though small, has been a great support and it has made me very aware of how much I had been spending!! No more daily Lattes!!

Like you, our finances have gone back and forth — for some time, my husband was tracking and paying bills (when he was the major earner), and now that I’m the major earner, I’m tracking and paying them. I’ve begged him to sit down on a weekly basis and work with me on this — I want us both to be involved in setting our goals, monitoring our spending, and making financial decisions. I believe we’ll get there, but it’s going to take some work. But I’m not actually writing this post to win the book for me, I’d actually like to win it so that I can pass it along to my 22 year old daughter who is married with three kids, and struggling financially. We have talks about money, goal setting, life goals, financial goals, and so on, regularly. I think this book would be absolutely invaluable for her and her husband. I don’t want them to struggle through the pitfalls that I we did — I want her to learn early on how to control their financial situation so they aren’t living a life of complete and utter stress, frustration, and despair. I see it beginning in them already, and if this book can help them avoid that, I would be a very, very, happy mommy. 🙂

I do all the finances in this family. I do show my husband the Visa bill and he hands over extra money for that bill, but he is not interested in the other monthly bills. I’ve even offered to show him our electronic banking, but he is not interested. His only interest is in that everything gets paid every month.

We have been married for fifteen years and I handle all of the bills as both of our checks are direct deposited into one central checking account. Although, my husband is not hands on with the day to day transactions, I don’t make any financial decisions without his approval, although, I would love to because it takes him too long to do so. I am definitely the nerve and he is the free spirit when it comes to our finances. I am grateful that we are on the same page, neither of us spends more than their given allowance and our future savings plan has been agreed upon. I like handling the money, it makes me feel empowered!!

I take care of the finances. I’m a control freak so I like doing it. I keep my husband updated on what is going on and I don’t make huge financial decisions without discussing it with him first. Works great for us!

How to know when you’re young and then in a new family that everything, especially lack of communication and knowledge, is asset or debt? It’s one of those (cue Cher) “If I could turn back ti-ime!” issues. Sounds like a good book

In our family, I, our online bank, and You Need a Budget for budgetting (me) are the money handlers. I am busy and we make more than it seems like we have (debt has dogged us), but, and, we are hoping for clearer better days ahead–and to help our child learn more than we did!

I’ve always kept the finances with my husband not really paying that much attention. Last year he began accumulating credit card debt, investing in a business. I was completely against it but they were his cards with only his name on them. He got to more than 20K in debt and the business flopped. We are now separated awaiting divorce.

I’m getting married in May and this would be a great gift for our best man to present my new husband during the speech . Payback for the mother in law jokes I have put up with the last 18 months 🙂

I keep track of the finances however my wife and I both discuss what gets paid and when. No surprises! I like to use Mint.com in a combination with an Excel spreadsheet that I created. I enjoy reading personal finance books, blogs, and magazine articles. It is refreshing to see how other families keep track of their finances in this tight economy and how they find ways of saving money. I think in this economy it is also important to teach our kids frugality and how to control there money.

I primarily take care of our finances, but give my boyfriend an update every payday and remind him what he needs to set money aside for. We each keep our own chequing account, and then a joint chequing that all of our direct debits, etc come out of. This has made dealing with our money so much easier. We still fight about money sometimes, but it has gotten a lot better because even though I take care of everything, he knows whats going on and we talk about it on a regular basis.

Our system sounds very much like the characters in the book! I have always been in charge of keeping up with the finances but we are still floundering in debt after 22 years of marriage. I have tried to talk my husband into taking over but really, neither of us is convinced that he could do a better job. He thinks he has a clue about where we stand financially but then he tells me that if something were to happen to me he wouldn’t know where to start or where to find any paperwork dealing with our finances.

I think we need to communicate more about money, and I think reading this book might help me understand where/how to begin!

My wife pays the bills, but the budget spreadsheet she uses is one I created and maintain. We talk about the budget regularly and I am in the spreadsheet at least once a month to track some of the metrics of our current financial standing. We discuss which bills are the next to be paid off and rank the next few to be paid. Currently our budget is projected out to the end of 2014 with the targeted bills to be paid off highlighted and already set for when payments will be paid until the balance is zero for each. These numbers are adjusted whenever we have “extra” money come in or are under budget on expenses like groceries and gas.

All the balances and minimum payments are linked to a single table of obligations so the amounts only need to be changed in one place and are updated automatically in the budget. This allows us to quickly adjust the planned payoffs any time something changes.

Typically I am in charge of our finances. I plan our budget and then I am the one who is entirely responsible to make certain that we stay in our budgetary categories. It’s exhausting!!!! I try to get my husband involved but I guess I am the “nerd” and he is the “free spirit” to quote Dave Ramsey, and it never really works for us to both be engaged in creating and tracking. We end up just arguing. This book sounds like it might speak directly to my budgeting issues!!

I started taking a serious look at our finances almost a year ago. Up to that point we had lived on “awareness” but not a budget…we would take a look at what was due that month before the next paycheck was deposited, then declare at some point within those thirty or so days, “Don’t buy anything else until pay day.”

After being introduced to Dave Ramsey last spring, I decided to create a budget for our family of four, and it has helped us a lot. However, I took control of the budgeting and money allocations as my husband is the spender and I didn’t trust him with the responsibility. Dumb of me. Now, a very intelligent nagging voice in my head is constantly telling me that we need to communicate more about finances and both play a role in becoming debt-free, lest one of us explodes as a result of financial misunderstanding (me thinking he spends too much, him wondering why he can’t afford that new “insert-crap-here” item, etc.).

I’ve been playing the avoidance game as I know the conversation will be difficult, as there is some financial and emotional baggage that we both carry that will be addressed, and it may be a little bit ugly. However, if we are ever going to clean up this mess, I know deep-down that we need to do it together.

We use Mint.com and online banking, automatic payments for most bills, and use PageOnce to make sure we haven’t overlooked anything. My partner handles more of the bill-paying and calling customer service when necessary, and I handle more of the day-to-day budgeting (though we’ve been slacking on that!).

This book is timely as my husband and I are having serious budget talks and concerns at the moment. In the past, I have paid all the bills and managed the bank accounts. He has set the budget, but never maintained the tracking of it, and hence, we fail to follow it. I could really use this book as a tool to guide our discussions and future planning.

Hi-I keep track of the finances in our family. However, both my husband and I talk weekly about what is in our bank accounts and any changes in any bills since we talked the previous week. We talk about the future and what goals we have as a family and as parents.This works for us, I am a control freak.

My wife is the primary financial person in our home. As a CPA she loves numbers, excel, and graphs… BUT, we have learned that it is a two person operation and we discuss the situation together now. One thing she taught me was that numbers are just numbers. What it is, is what it is, deal with it and work through it.

Right now, we mostly pay everything half/half and our finances are almost completely separate, besides a joint savings account that we use to pay for things while on vacation. I’d like to integrate our finances more and set some joint goals for the future.

I have kept the track of all the money for both home and our business from the first day of our marriage. It has been a burden at times to do it all but it has given me a lot of freedom too. I’m just better at it so I do it all

My wife and I both agree on the budget, but I am the one that pays the bills. Looks like a great book, too!

My wife and I just married and we are going through the discussions of how to manage our finances. We come from different backgrounds and look at money management from different perspectives. I like budgeting, saving… and, honestly, I have a fear of not having enough (yes, I am in counseling). My wife does not worry as much. Neither is wrong, just different. For now, I am tracking our spending and budget, and I pay the house-related bills. I use Quicken for my accounts. At the end of the month, I take her receipts and add them into a excel spreadsheet with all of our expenses. We review the file then to see what and where we spent and our budget track. On reading some of these posts, I would like to refine our system.

I keep track of our finances and pay all our bills, as well as initiate things like getting life insurance and writing wills. My husband has offered to do it when I show signs of stress, but it is less his strength than mine (not that it’s really mine either) and he really doesn’t want to, he’s just being kind when he makes the offer. He asks me occasionally how we’re doing, especially if something unusual comes up that we need to purchase. In my first marriage, my husband handled most of it, with me having a separate household account that he put money in just for buying groceries, school clothes, etc. That was a little less stressful, honestly, but I think that we have to work within our areas of (comparative) strength. I am actually going to a seminar in a couple of weeks at a local church on this topic — hoping it will be helpful!

would love to receive this book! I track the finances in this family. Thoroughly. Not every month, though I do hope to start doing it every month. It has been quarterly until now.

I do most of the bill paying and tracking but my partner and I meet each month to plan a monthly budget and every so often within the month to review spending.

I’m the designated financial planner in our house. Truth be told, I actually enjoy playing with the numbers and figuring out what we’re contributing to each savings fund once all the bills are paid. My wife, on the other hand, has zero interest in the nuts and bolts of budgeting and investing, but she at least provides me with “emotional support”. There was some tension initially, but we’re a fairly well oiled machine now that we’re on the same page.

We sortof both do in our family. My husband pays the living expenses and I pay for my expenses including our daughters for the most part.

I am the keeper of the finances since there is only me! I still meet with a trusted friend on a monthly basis who keeps me in line with what to pay and with what money because income is sporadic and not always in line with when things are due. The life of a freelancer! 🙂

I do…and I have been sloppy lately. I am trying to hand it off to my husband now!

I keep up with our household finances. We’re getting married in a few months, and I’d like to start out right!

For the most part, I take care of the finances in our family but my husband and I discuss the big decision items.

I manage everything financial because I’m detail-oriented and a planner. My husband is a mellow kind of guy and would rather go with the flow, so it didn’t take long before he let me took the reign even before we got married. This works for us because I could be stressing and worrying about things and my husband will neutralize me and calm me down. It can be hard when numbers are in front of you and you can make predictions and know what effort it would take to get “there”, but it also has helped immensely to have my husband’s support or I would’ve been nail-biting my way all this time without much enjoyment for daily life. It’s still a process after 6.5 years but we’re far from the situation we had when neither of us knew exactly how much credit card debt we had. Whenever I get resentful for being “stuck” doing the finances, my husband would offer to do it but I can’t let go either. It’s like allowing someone who has very little cooking skills to manage the kitchen. It’s just me venting, but we both realize that the roles we play in our family’s finances are based on our strengths, personalities, and goals as a unit. So, in essence, we all do our part but I just take more active role in it.

I do all the finances all, this would be a great book for my family. My wife and I try to get on the same page each week, but excel sheets over whelm her, please help!

I take care of the money mostly because I am a control freak. But I am also an impulse buyer, so that can get tricky! My husband and I have a joint account and out own separate ones because of our debt. So he takes care of his in a way as well. We really need to figure out a better system! I hope we win the book! It looks really helpful 🙂

This book sounds just like us. I keep track of the finances in our household and my husband vaguely knows what’s going on. Obviously, this system isn’t working very well.

Currently we are both involved but the majority of it falls to me. I’m more of a planner, action-step maker. Our system is a budget and cash envelope system with automatic saving features.

I do all of the finances and have all payments automated. Makes the process much easier for us! My wife agrees.

I “take care” of the finances, although I use the term loosely. Neither of us are good at administrative tasks….I am slightly less terrible. Our finances are a mess, I am so glad I found your site…I am tryng to incorporate some of the ideas but it is difficult to maintain. Also, trying to declutter. I would LOVE to read this book!

I do the finances in my household, but periodically update my husband on where we are with our assets and debts so I can keep him in the loop. This has worked well for us for about 20 years.

Oh, fun giveaway! Thanks! I do the finances in our family, but my husband and I try to have a regular meeting of the minds to stay organized about it. I could definitely be more rigid/budget conscious. Working on that!

I handle all the finances all the time. My wife has full access to all accounts and information at all times, she just has no interest in it.

None of us keep track of finances, we spend what we have 😀

I am new to Man vs. Debt, but I am loving everything I have learned so far. We are in a situation where I pay some bills, my husband pays some bills and he does our taxes. We need to do a better job of working together on our finances. Yet with three young kids, both of us working, and my husband traveling often for work, it has been challenging for us to communicate more than “Hi!”, “Bye!” and “Love you!” We definitely can use this book! Thanks for the opportunity!

My wife and I are just getting started on the program and are off to a great start. We’ve paid off 2 credit cards in February, and are using our tax return to pay off 2 more (instead off blowing it on crap we don’t need!). Currently, I handle the finances, but am in the process of teaching my wife our current system so that she can be involved

Right now I “take care of” our finances, which basically means I have a general idea of how much money we have. We, my husband and I, need to both work on our finances together.

I create our monthly budget and my husband reviews it. If he needs more or less money for a category, he gives his input.

I am in charge of all things financial in our home, which has both good and bad points. It’s good because I am fiercely independent and this enables me to feel more in control. It’s bad because I feel so much pressure to keep us afloat some months, and moving ahead others.

I currently take care of all of our finances (paying the bills, etc.). Unfortunately, this is not a good system as my husband doesn’t have a clue what is going in/out, and how much debt we truly have. This is about to change, we have started to track our spending and are working on a goal to pay off this debt!

I keep track of all my finances, very meticulously. We talk about finances a lot, but as my partner is still in school he isn’t as willing to go into detail as I am. It’s hard because both of our incomes fluctuate quite a bit each month.

I “take care of” the finances in our house, but the systems hasn’t worked out too well. Basically, it’s a “Peter vs. Paul” scenario which gets scarier every months. Came into a small windfall in January and getting an income tax refund this year. Hopefully, I can put it to good use pay off some debt. What I really need is a full-time job which has eluded me for the past 5 years. Please pray that one comes along soon!

I do now, but my wife did a wonderful job every time I’ve been training in the field or deployed overseas!

There have been times that one or the other do it but now we both do and. Been much more successful together… we do a cash envelope system

right now my husband takes care of our finances but I would like to be a bigger part.

I am the financial keeper of the keys. As much as I love my husband, we are completely financially incompatible, and I’m always looking for more resources. I’d love to read this book!

I am an artist and my husband has a business administration degree, but I am somehow still saddled with the financial burden.

I would love to have a resource that will help us sit down together and figure out what is best for our family because I am tired of being the money nazi!

My (new!) husband and I still have mostly separate finances–he has his checking, I have mine, though when we married five months ago, we set up a joint savings account and deposited all the wedding gift money into that. We generally split everything 50/50: we each write a check for half the rent, he takes care of the internet/gas/electric bills every month and I pay our hefty cell phone bill, we each pay our student loans out of our paychecks, I buy groceries one week, he buys the next, etc. I’m the one contributing to a 401K, I track where my money goes with Mint and keep a budget because if I don’t I will absolutely overdraw every month. He’s a saver, never buys things unless he’s thought about them for a year, and a freelancer, so he doesn’t get regular paychecks and we don’t file a joint tax return, either. Our system works for now, but we’ll definitely need to change when we have a more settled and “adult” life and want to buy a house or have a child.

So, this book would be a help!

My husband handles the finances – he insists on it. He is a hopeless spendthrift, so it has not worked that well. I’m frustrated that no matter how much I economize (he thinks I’m silly to do so) or don’t spend on myself – nothing changes. We sure need this book!

Your and Adam’s situation sounds so familiar! After nearly 13 years of marriage, I feel like we’ve tried it all. We continue to “play” (sometimes that word is far too light of a term) with how we handle it. Right now, he is the primary tracker of the account while we both pay separate bills (from the same account). Haphazard indeed!

I took over managing our money last June and have managed to turn around the debt and lower many of our monthly bills. My wife stressed because we were always so close to the edge. We use YNAB to manage our budget and it works great. It syncs with our smartphones which makes it easy to make smart buying choices when we are out and away from the computer.

My husband keeps track of the “big picture” – investments, outgo versus income, etc. and I keep track of the day to day of paying bills, transferring money to different bank accounts, etc. I would love to win the book.

My wife now have a good system in place. That wasn’t always the case. For many years she kept track of the finances. Then it switched to me keeping track. But it always seemed like one of us was in the dark.

Now, we alternate each month. One month I will take care of all the finances (it’s my month until tomorrow!) The next month, she will handle the finances.

This has many benefits, for us at least. We are now never in the dark. We run all things by each other. It’s also quite fun and challenging to see who can accomplish certain goals, i.e. save, spend less, make, trim, etc.

Great post! Love the info and the book review!

I do it all!!!! It is a lot of stress for one person, especially trying to make a cop’s salary work for a family of 6 in the Chicago ‘burbs. I would love for my husband to be involved. Would love to win this book in hopes of finally getting him to jump in.

My husband works, and I stay home (unable to work due to an illness)and do the finances. sometimes things work out and sometimes not. we are always looking for ways to make it work.

I have always taken care of the finances. We do ok but I think that it should be better. My husband wants to step only when things seem bad. I want him to be involved more but i just can’t get him to set down for regular ‘meetings’. I think that would really help but I just can’t get him to do it.

My husband and I have an agreed upon budget and individual allowances for personal spending out of that budget and I take care of all the monthly bills and keep track of family spending. We’ve worked out this arrangement basically out of necessity since my husband hates to talk about money and dislikes seeing how much we have to spend on the house, car, heating, electric, etc. after living in practically nothing in the Peace Corps for years. We definitely need to come to a better place were we’re comfortable with money and how we spend it so I’m always on the look out for great books which will help us get there. Great review of this one, I look forward to checking it out! 🙂

I need this book! I take care of all the finances and my husband really isn’t that interested in knowing what goes on as long as he has money in his account. I am the one that figures out what needs to be paid at what times and figures out what money to put toward debt/savings….We really need to find a way to come together and be able to talk without and resentment. Sounds like this is the book that could help!

In our household I solely take care of our finances. My husband is mostly oblivious and I’m not quite sure how to get him actively involved. To be totally honest, there is no system and it’s not working. I’m trying to figure out what I need to do to make our finances work for us.

This book looks great! I would love to win a copy of it. My husband and I work as a team to get our debt down as much as possible. Both our paychecks are allocated relative to what we make towards all our collective debt. This book can help us even more!!

I do. Wish it was more of a partnership, but it’s mostly me. We could use this book!

Me. Which is odd, because he has an Economics degree. I would love for him to take a greater share of the responsibility.

Until last week, it was solely my husband who took care of our family’s finances. I was always very uncomfortable with that situation. I felt ignorant and disconnected. Also, I felt like my husband emotionally carried the burden of our financial struggles alone, and I didn’t know how to help. He always seemed uncomfortable with my involvement, like it was an intrusion. Last week, he came to me and said he’s overwhelmed at work, and he needs me to take over our family’s financial management. I’ve only just begun. I’m confused, scared, and nervous that I’m up to the task. I’m a smart girl–I used to do this for myself–but it’s been a long time. So, I’m learning, and I will figure this out. Right?? 🙂

I am the main financial person in our household, but I tell my husband where we stand on the budget about once a week. All of our regular bills are automated, but I keep an eye out to make sure they go through. Any irregular bills that come, I take care of. I let him know when money is being saved and for what and how much is going into the retirement accounts.

We budget together. it is easier and there are no secret spending habits which is the downfall of many couples. We like to discuss the bills and our purchases. We attempt to be supportive of each other and in paying off our debts as much as possible. i would love to be able to win this book!

I was always the one with money problems. I bounced checks

Went to court about them, now I do the finances

In our home. My husband and I make good money but every year we see how much and say what do we have to show for it. It has gotten do bad that my husband is very depressed. I have managed to pay off a few things but have so much more to go. With this book maybe we could finally be debt free.

I am the main person who tracks our spending and pays our bills (mainly because I am super anal about doing it) but we do our budget together. About once a month, we sit down together and look over how much we have spent/saved that month and what’s ahead for the next month. We also look at our long term goals together. We plan on moving to a different state in a few years, so our long term goals are looked at each month to figure out when we think we can make the big move!

I track all of our spending. However, my husband is very aware of our finances and participates when I need assistance. I have needed a lot more help lately and he has stepped up to the plate!

I keep track of it all and do all the bill paying, but we sit down twice a month to review the current expenses and look ahead to the next month. We also set goals in December for the year ahead and do a quarterly check-in to make sure we stay on track with our big-picture goals. So far, so good, since we should be debt-free by July!

Just like other married couples, we have tried it many ways … I have been in charge – he has been in charge, Now, we both check in once a week with each other on our financial health. We trat it just like a business meeting … sit down at a table with our notebooks and truly discuss where we are at!! I love it this way!!!

I’ve always done the finances but never had a system that was coherent enough to give that task to my wife. She wants to help, and with me running our business (computer repair), I’d love her to be able to help more with this!

Hi – I love the sound of this book, we have a bank advertisement in NZ at the moment that touches on the difficulties we have in discussing our finances. It says – we can ask all these big questions about life (where did we come from, should gays be allowed to marry, what is possible and what’s impossible?) but we can’t ask each other about money. It’s a taboo.

In our family I buy the majority of the groceries – my husband loathes supermarket shopping – and I pay the bills when they come in, but he tracks our finances and we talk several times a week about anything that needs to be covered in our future or those things that pop up.

One comment I do have that’s not related to finances – why ask for a comment if you’re randomly selecting the winner?

Cheers,

Leonie

I am the one who keeps finances in my household since my boyfriend doesn’t really know where anything is, lol. This is definitely a problem that we need to discuss because it takes both of us to come up with a budget.

Great post!

It’s too late to win the book, but I just wanted to stop by and thank you for this post. My wonderful partner and I have had challenges managing our personal and business finances with all the demands of work and life. This is the year that we BOTH start to actively plan, budget, and track our money.

Thank you Courtney for the inspiring reminder that it is possible 🙂