What is a Credit Report Freeze?

Consumers in all 50 states have the option of placing a credit report “freeze” with each credit reporting bureau that effectively prevents any potential creditors, companies, and/or thieves from gaining access to the consumer’s credit report and credit score. The freeze does not prevent companies with whom you have existing accounts from the information contained in your report. In addition law enforcement and certain government agencies will still have limited access.

Why would someone authorize a credit report “freeze”?

There are several reasons one might issue a credit report “freeze”. Primarily this is a preventive measure against forms or identity theft and fraud. A credit freeze on each of the consumers three bureau reports prevents anyone (including yourself) from opening new lines of credit in your name. This type of identity theft is not only the most common form, but it also one of the hardest to catch in a timely matter. It is important to note that a credit freeze does not help prevent fraud that may occur on existing lines of credit or bank accounts. Luckily, the risk for fraud on an existing account is far less than the risk of a predator opening new lines of credit.

Authorizing a freeze is especially helpful to consumers who have already been victims of identity theft. Once an account is compromised the risk for additional fraud to occur goes up exponentially.

How long does the credit report freeze last… Can I remove it?

Once a credit freeze is placed on a report it will stay in place until either temporarily or permanently lifted by the consumer themselves. For example, someone may temporarily lift the freeze from April 15th – April 25th to shop for a mortgage or conduct any other business requiring access to their report. On April 25th, the freeze will go back into place. You can also permanently lift the freeze at any time. One potential drawback is that bureaus have up to three days in order to lift the freeze, meaning that it may be difficult to grant same-day access to your report. However, if you have a problem with applying for credit impulsively, this may actually be a benefit to you!

Why not just place a fraud alert?

A fraud alert is a helpful option, however an alert only forces the creditors, in compliance with the federal Fair Credit Reporting Act, to take extra steps to verify identity when they see the alert on a report. This step comes after they’ve already pulled the report and scores and will only prevent cases in which the criminal is not able to produce the additional identification needed. In addition, typical alerts only last 90 days for consumers who aren’t already victims of identity theft.

You also may consider disputing account that are fraudulent on your account.

Now, if you do dispute and receive a letter stating Account Information Disputed by Consumer Meets FCRA Requirements, then the account may be legitimate or you may look at pursuing a second dispute.

What kind of fees are involved?

Unfortunately, this is the most complicated part of the entire process. Credit freezes are controlled by individual state laws, which means fees vary from state to state. Currently, Indiana is the only state which is completely free to add, temporarily lift, and completely remove freezes. (Yes, ironically I live in Indiana). Fees for other states vary from $3 to $20 to place the initial freeze. In addition, fees for temporary and permanent lifts may also vary. Equifax has an easy to view website outlining all state-specific fees. Please also note that some states have reduced rates for those who are over 65, and all states allow previous victims of identity theft to freeze their reports for free!

If, like me, your financial goals include rarely applying for new credit, a credit freeze can be a cheap, effective alternative to credit monitoring services and/or identity theft insurance.

How do you actually place the credit report “freeze”?

Luckily, two of the three bureaus allow you to place credit freezes on your reports online. Equifax is a different story… we will get to them later.

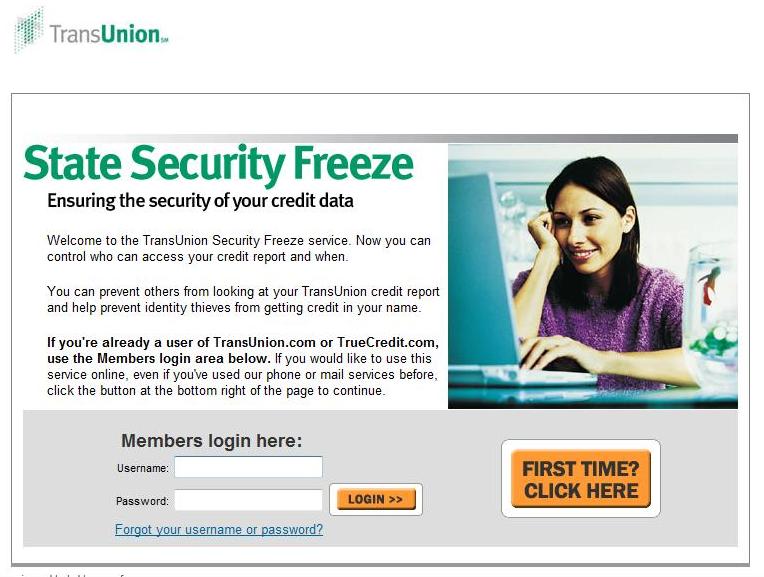

The following TransUnion link will take you directly to the online portal to place your freeze.

If you don’t have an existing TransUnion login you can create one with the big orange button above, or simply login to the bottom left.

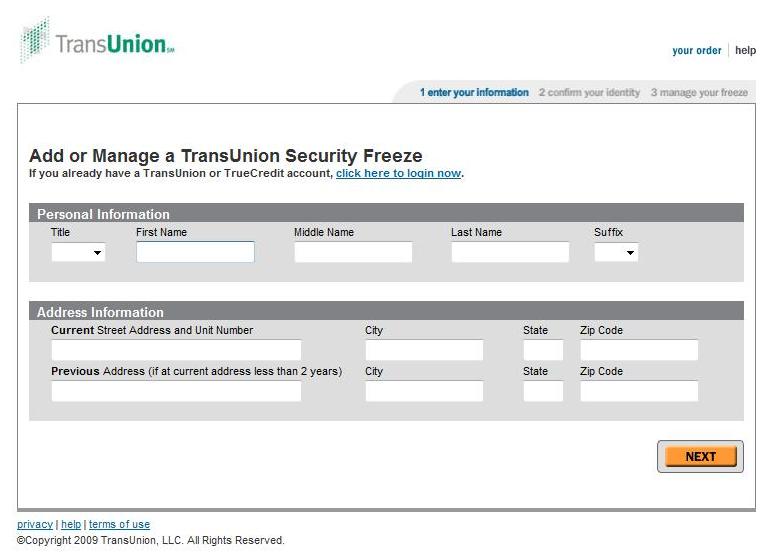

Those of you who need to create account will see a series of screens starting with the one above. Fill out the forms, click next, answer some specific questions (to confirm your identity) and you’re good to go.

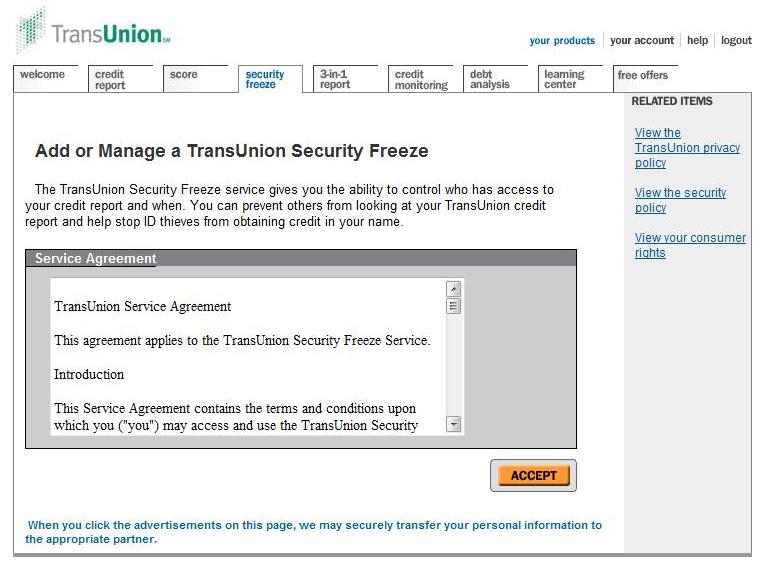

After setting up your account and/or logging in you will need to read through the Service Agreement and click Accept.

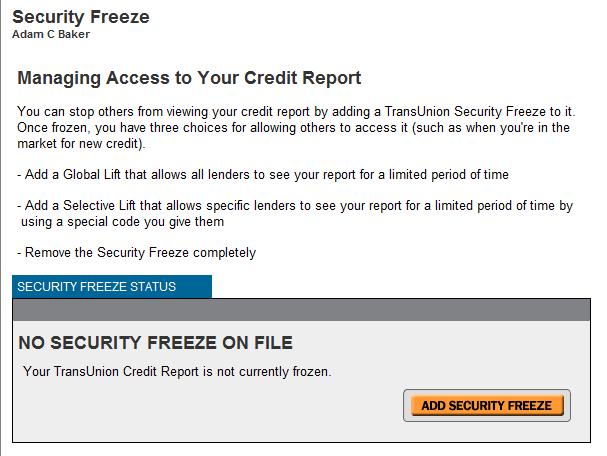

This next screen provides you with an overview of the freeze and your options for adding lifts or removing the freeze altogether. Click ‘Add Security Freeze’.

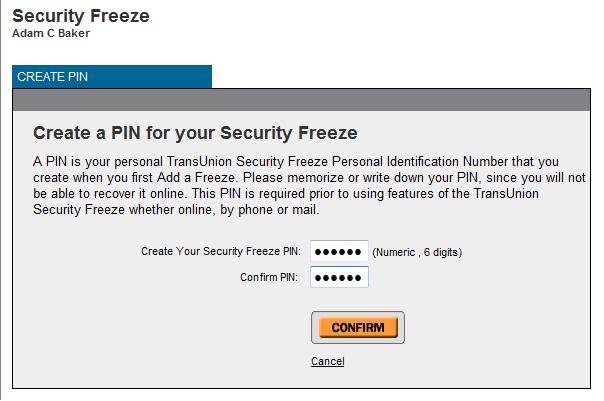

You will need to generate a 6 digit PIN Number. This number will be used in the future should you need to add any lifts or removals to the freeze. Enter your PIN and select Confirm!

Wah-lah! You’re TransUnion report is now cold as ice. You aren’t done yet though…

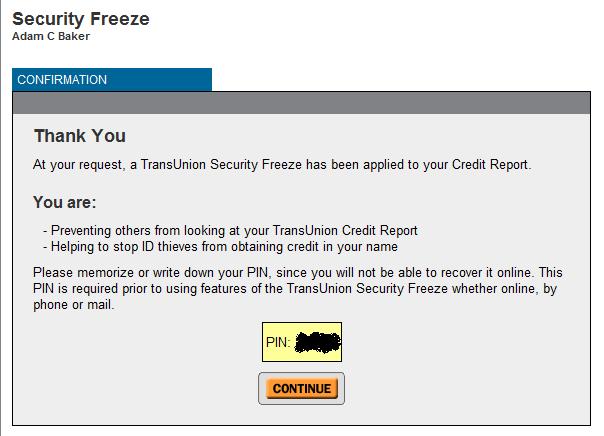

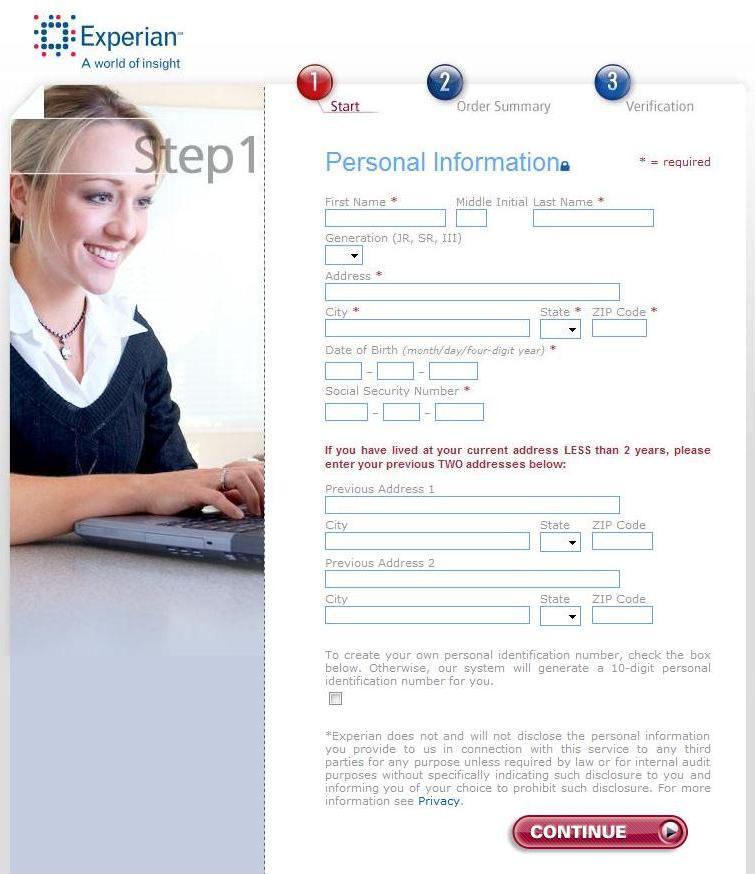

You can initiate your freeze with Experian here!

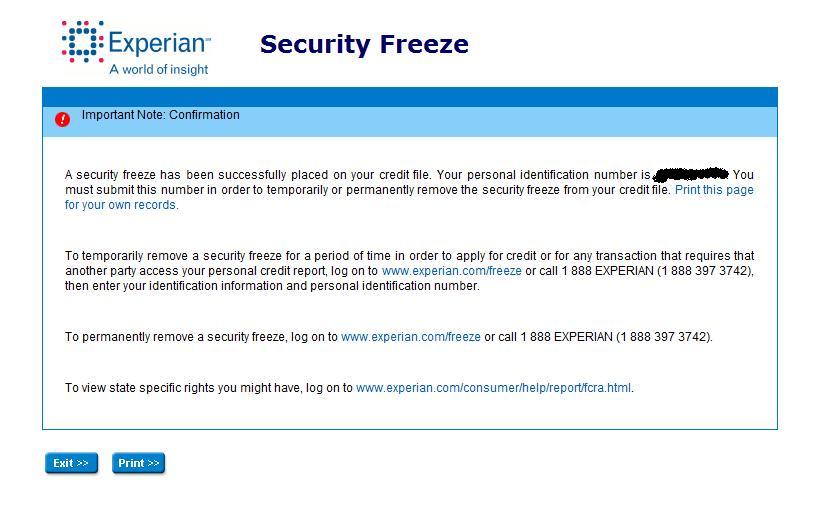

On the opening page you will need to fill out your personal information again. Using the check box will allow you to generate you own 10-digit PIN number, which you will need to lift the freeze. As it clearly states, if you don’t select one they will generate the pin for you at the end. Click Continue!

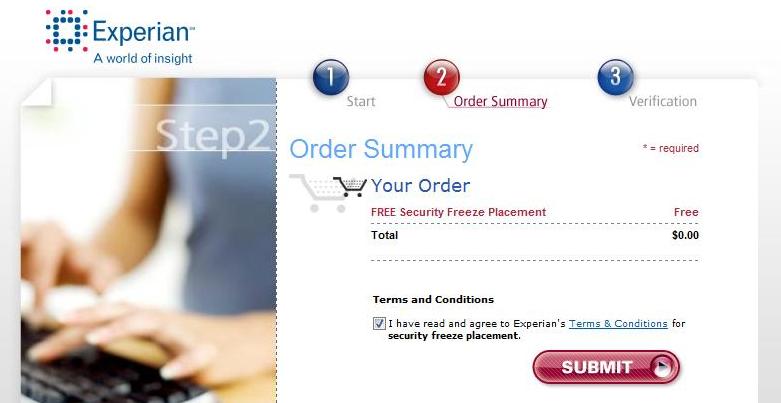

Quick summary of the cost of the freeze. Equifax has an easy to view website outlining all state-specific fees. Yes, for once in my life living in Indiana has paid off! Submit!

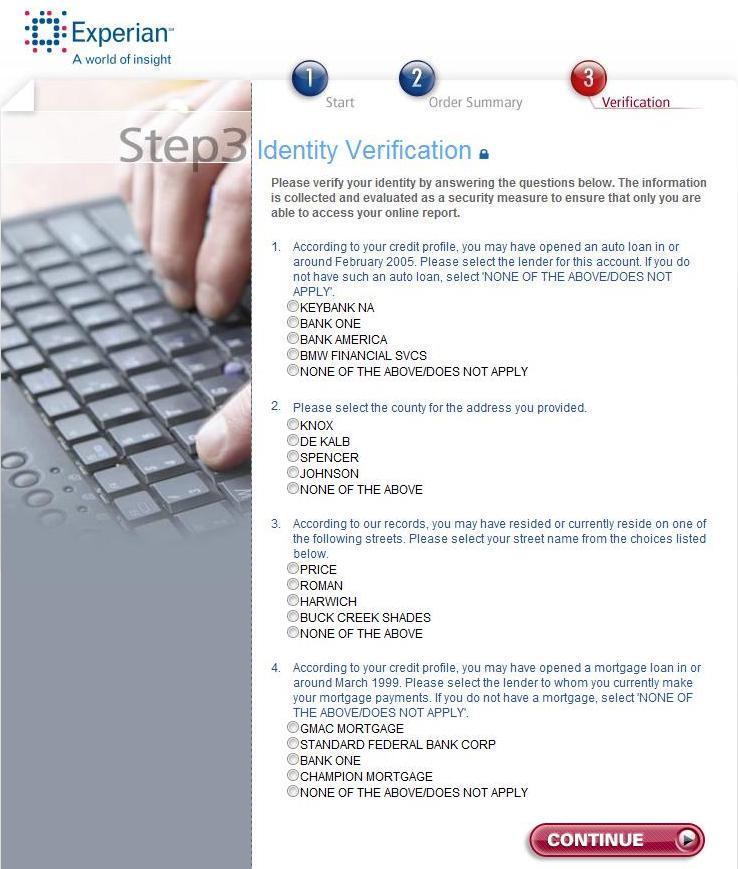

You will be asked several questions. If you haven’t been through these type of questions before take your time. For example I’ve never had a mortgage on number 4. Tricky Experian! Unless you’re interested in mailing in your request take your time and get these right! Continue…

Two down… Only one to go!

Unfortunately that one is Equifax. After a little digging around and several phone calls, you can find out that Equifax does not allow you to request your freeze online. In fact check out this quote straight from the website:

“Although some states allow a security freeze to be placed, temporarily lifted or removed in other ways, in most cases to request that a security freeze be placed or removed on your Equifax credit file, please make your request in writing to us by mail.”

Translation: “Although the other two bureaus allow you to easily place a freeze in minutes online, we here at Equifax suck and can’t figure it out with so many different states involved…”

Placing the credit report freeze by phone…

This is the best remaining option for Equifax. However, if you find it more convenient you can also place freezes at TransUnion and Experian over the phone as well.

Phone Numbers:

- TransUnion: 1-888-909-8872 (Automated Freeze Line)

- Experian: 1-888-397-3742 (General Cx Service)

- Equifax: 1-888-298-0045 (Credit Freeze Department)

Equifax tried to sell me a product several times when I called them. They call it credit “locking” instead of “freezing”. They are trained to try and sell this to consumers who call to request a freeze. Check your state specific fees first and make sure you are not buying an Equifax product.

Placing the credit report freeze by mail…

Unfortunately, if you are a previous victim of identity theft and are putting on a freeze for free you will most likely have to mail in your request to all three bureaus. You will need to attach the local law enforcement report you filed as part of the identity theft, which they are unable to process online.

Mailing Addresses and Information Required:

- TransUnion, Fraud Victim Assistance Department, P.O. Box 6790 Fullerton, CA 92834

- Experian, P.O. Box 9554, Allen, TX, 75013

- Equifax Security Freeze, P.O. Box 105788, Atlanta, Georgia 30348

Be sure to include your full legal name, current address, any previous addresses in last 2 years, Social Security number, date of birth, proof of address (driver’s license, utility bill, bank statement, etc…), and copy of police report (if applicable). If you are not an identity theft victim you will need to also include payment of state-specific fees for placing the initial freeze.

Is a Credit Report Freeze appropriate for you?

You’ll have to answer this one yourself. You will need to calculate the fees, your reliance on new forms of credit, and your overall financial goals.

Personally, we have no reason to use credit, so we don’t use it. Because we will not need to open any new lines of credit anytime soon, this is a wise decision for us. In addition, I’m lucky enough to live in Indiana where placing and removing a freeze is completely free. So this is a free way for my wife and I to have extra security and peace of mind while we are traveling overseas.

While this may seem a little extreme to some of you, it’s really helped increased our dedication and intensity to our cause. We regularly attempt to incorporate these types of processes to keep our Debt Tsunami going strong!

Have you considered a credit report freeze? Did you realize it was so simple to file online or over the phone? Join in on the discussion by leaving your thoughts below!

Great Post! I would highly recommend that everyone does this, I have had identity thief twice and I have a folder about 2 inches deep with , paperwork. I caught it the first time when someone opened two credit cards, but had not use them yet. I filed a police report and everything, but I believe the same person opened another card a year later and had spend 1800.00 on it. I finally got it off my credit report but it was a process. Right now use lifelock for all this and it is a huge pain in my butt to open any type of account, but it is so worth it to A) have piece of mind B) not ever have to go through that paperwork again. The thief who stole my identity not only tried to steal money, but he stole at least of week of my life in following up with police reports, writing letters, lawyers, etc…

Don’t let it happen to you!

Atlas@mymoneyshrugged’s last blog post..Atlas Shrugged: Real Life Edition

My wife has actually been a victim, as well. It was several years ago and we still have a random thing pop back on every now and then. It is one of the most annoying things to deal with in the world!

Hey Adam

Nice post – great use with the pics. I guess since you are flying off to Australia, this makes sense even if you have to pay for it. Cos if anything happens, the overseas call to sort out any mess will far exceed any upfront cost now.

Mr CC

Mr Credit Card’s last blog post..Credit Card Bill Sails To The President

That’s exactly what we thought. However, once again we lucked out being that it was free. Can we get any more lucky? not sure.

Pingback: Friday Quotables - Memorial Day Edition | StretchyDollar

This is a great post, I’m going to bookmark it for future reference. It’s extremely helpful how you laid out the steps to initiate a freeze like that with pictures and instructions from the specific websites.

Dave C.’s last blog post..Pension Insurer Deep In Debt

Thanks, Dave! Glad you connected with it. It took time, but I thought it was cool/important.

As you mentioned in the first paragraph this doesn’t prevent companies you are already from accessing your credit. It is a good idea to keep on eye on your credit even with a freeze in place.

The screen shots make for very clear instructions on how to a freeze on, thanks for taking the time to put that together.

BTW I love your blog!

I absolutely agree. Doing this doesn’t mean you can ignore your report. It just helps get you a little more security. We have to be diligent when fighting against identity theft!

Pingback: Top Ten Bloggers of the Week (May 16th - May 22nd) | Viralogy Blog

Pingback: What is a Security Freeze and Other Related Questions

Having spent the last ten years working in the financial fraud industry I can strongly recommend that you must be very careful on what you do with any financial transactions, especially online. Because once you get any “black marks” on your credit report it is very difficult to get it off. Even if you are the innocent party and have evidence to prove it.

.-= Jim@Improve Your Credit Scoring ´s last blog ..Credit Score Interpretation – Why Is Your Credit Score Important? =-.

This article is very useful. Thank you so much. I just placed freezes on all three of my reports. It was extremely easy.

Equifax now allows you to place a freeze online. They have also expanded the list of states in which it is free to place a freeze, however there is a fee (about $5 for my state of NJ) to lift the freeze at all the CRAs. Here’s Equifax’s freeze link:

https://www.freeze.equifax.com/Freeze/jsp/SFF_PersonalIDInfo.jsp

Pingback: 24 Quick Actions You Can Do Today That Can Change Your Financial Life Forever

I’m nervous about providing these agencies so much personal information on line. Why can’t it be hacked and create problems for too?

Thanks! I was able to freeze Equifax also online. Appreciate your help!

Pingback: McGinley Financial Advisory, LLC is an Arizona based investment adviser.

Thank you for this post!!!! I recently found out that one of my family members was using my ssn…so I used your website to put a freeze on my accounts and now I can focus on cleaning my credit reports up…you were so right about Equifax trying to sell you stuff…they do not want you to apply on-line so you will have to listen to their sales pitch…he still called it a lock oppose to a freeze but I took your advice and checked the fees and all is well.

Looking for work? Freeze your credit report. Employers are able to discern quite a few personal items from a credit check– general medical condition (while listed without the collecting hospital/clinic, the so called ‘secret code’ that is standard is easy to spot), marital and family status, etc. plus many other personal items you’d rarely suspect of being included and where clues are often misinterpreted. One of my HR department favorites was previous address information they’d follow up on to figure which neighborhoods you’ve lived in in the past. Rented in a low income heavily urban area? Red flag. We need far stronger privacy laws rather than this corporate sponsored, government accessible file every American is now carrying. Character counts. Files are what matters, though, good or ill.

Looks like Equifax has wised up. I found their freeze site.

https://www.freeze.equifax.com/Freeze/jsp/SFF_PersonalIDInfo.jsp

Worked like a charm!

I just tried that avenue and it failed. After I entered all of my proper personal information, I was told by Equifax that I had to mail in my request.

BTW, I also called the 800 number and was once again told by the automated system that I had to mail in my request to freeze my report due to lack of information. Seems fishy to me?

One more thing, I had zero problems with both Trans Union & Experian’s online freezing process, both of those reports are now frozen and it took me all of 5 minutes to complete the freeze process.

Thanks for the easy to follow instructions.

It’s $2/month for the equifax product to lock/unlock online.

So they do know how to do this, they just don’t want to give it away for free

like the other 2. Also helps them to get around the state laws if they call it something

other than what it is (lock vs freeze). Criminal.