[share_sc]

Note: This is a post from Joan Concilio, Man Vs. Debt community manager. Read more about Joan.

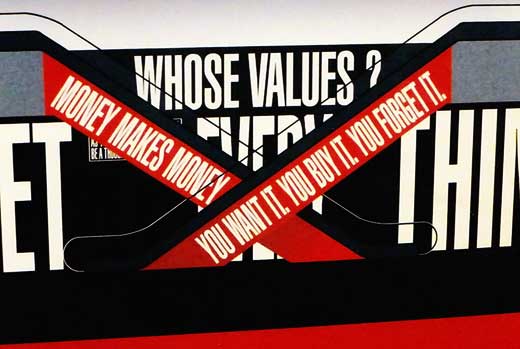

Two summers ago, while visiting an art museum in Washington, D.C., we came upon an exhibit in the process of being installed. Huge letters and swaths of red, black and white covered every square inch of wall and floor.

When I saw it, I took the photo above, hoping it would serve as a reminder to go back and see the finished exhibit and revisit the phrases plastered throughout.

WHOSE VALUES?

FORGET EVERYTHING.

YOU WANT IT. YOU BUY IT. YOU FORGET IT.

And while I haven’t gotten back to see the final installation of Belief+Doubt (I hope to – it’s on display through the end of this year!) … the phrases have stuck with me, and I’m reminded of them at the weirdest times.

“Where did I get that?”

Like last night. I was balancing my checkbook, a regular weekend occurrence, and I saw a transaction for about $40 that I simply didn’t recall. “What on earth did we buy?” I asked myself…

And earlier in the week, when I was cleaning some clothes out of my closet, hoping to donate a few unneeded things on our next trip to the local Goodwill, I came across a shirt and a pair of pants that weren’t at all familiar to me. “Where did I get that?” I wondered…

I like to think I’m conscious about my spending. If not perfectly so, at least WAY better than when I found Man Vs. Debt at the start of my financial journey, and moreso than at least many of my peers.

Even so, I struggle with the needs-vs-wants mentality. Do I need a new pair of work pants, or a second or third pair of jeans? To see that movie, or to buy that box of organic strawberries? Or are those just wants?

And even when I save and plan and treat myself to a want item, am I really making sure it’s worth it? Or am I in danger of doing exactly what’s plastered on the escalator of that art exhibit?

You want it, you buy it, you forget it?

It’s a common complaint for those of us with children. You know, that loom to make rubber-band bracelets that my daughter had to have, only to have it sit unopened? The same with those silly Littlest Pet Shop figurines when she was 8. Wanted, bought, forgotten.

But you know what? We’re just as guilty of this as adults.

How many times are we sure we have an item that we just can’t find, so we buy another?

How often do we dig into the far reaches of our closet and come out with an item that we didn’t remember having?

That new device comes out that allows us to peel potatoes and stream music at the same time, and we’re positive it’ll revolutionize our time in the kitchen.

(OK, maybe not that last one…)

In all these cases, though, it’s easier than we think to want something, buy it and forget it. Our society tends very much toward the disposable and the replaceable… AKA, the forgettable.

Look, that can be OK. I’m sorry, wasteful or not, I’m glad that I can use paper towels and not cloth ones to clean up after my five cats. Disposable can be good.

But too often, we do things out of knee-jerk reaction. Want. Buy. That’s fine, but if you didn’t put a lot of thought into acquiring something, is it likely you’re going to put a lot of thought into it once you have it?

You want it. You buy it. You forget it.

[share_sc]

This is something I’ve been thinking a lot about lately, and would love to hear your thoughts on in the comments.

Does this happen to you?

What do you do to stop the want-buy-forget progression?

Hi Joan! What a great post. I’m guilty of this – and I could have written this post because I like to think I’m pretty aware of where my money is going and that I’m thoughtful about my spending. However….

I keep a running “wish/want” list on Evernote (phone app) to include travel, items I want/”need”, and even reminders about upcoming birthdays or other gift-giving events like graduations or weddings. When I’m thinking of getting something, I check that list and sometimes the length or expense of items on there quickly guides me to a “not buying this right now!” decision. Or, I might go to put an item on there and find it’s already there. That tells me I’ve been thinking about it and considering it for awhile. I might keep a note about why I want it, too. Looking forward to learning what others do, too.

Karen, those are great ideas! I keep a pretty thorough wishlist on Amazon (not just books, all sorts of stuff I want/”need” as you put it so well!) but I need to do a better job of maybe creating some separate lists to help myself prioritize better!

I have a wants budget. I don’t worry so much about what I buy as long as the spending is contained within that budget. Even so, I try to be realistic about my purchases. I lean toward being conscious of my spending and spend my money where on things I enjoy. I typically lean towards activities and events over stuff.

I don’t mind so much spending $50 to $100 on dinner, movies, or event tickets, but I’m much more hesitant to spend that amount on physical stuff that will be coming into my home. I’d rather create memories than fill my home with stuff.

Doing a whole-house declutter helped me realize what types of items ended up being wasted money and what items were worthwhile. Following that up with mini-declutters keeps me alert to the types of things that don’t last or that don’t maintain my interest.

I am DEFINITELY an “experiences” spender over a stuff-spender, and for the same reason. It’s hard to bring stuff in after I’ve worked so hard to purge!

I believe this sign was made for me because in the past I have bought many things that I forgot about once I brought it home. It’s amazing as a women how many outfits we can have in the closet that still has the original price tag hanging from it. To break the habit I had to change my mindset and I now only buy things I really need….Thank God for change.

Petrish, you are so right – isn’t it amazing that we CAN change?? Congrats on the mindset changes you’ve made!!

I have had the same issues with shopping. I also have a VERY tight budget that has inspired me to create some better shopping habits for myself. Often i find the “idea” of a something is what I actually desire and I don’t actually need to buy or possess the “actual” item. This kind of shopping mentality (as opposed to the “we are out of milk, I need to buy milk” woman on a mission kind of shopping) has something to do with self-identity and developing one’s sense of taste. The process of shopping is the majority of where the pleasure comes from. This is where my handy-dandy iphone camera comes in to play. As I shop, I click away, taking photos of all the things I really like. I make sure to document price and location. If I find myself going back to the photo days later, or often, then I will reevaluate my need vs want status for that item. I love the topics you come up with Joan – always so interesting.

Hey, thanks for the kind words!! I think you make a great point, too, about the idea vs. the actuality. I was talking with a friend the other day about buying new jeans because we’re both always SURE that the next pair will fit better/make us feel better about ourselves/etc. And, of course, since I can’t afford magical jeans, it never happens. It’s just the idea that I like!

Waiting before buying something works pretty well for me and gives me a chance to see if I can make do. I somehow misplaced my yoga pants, which were worn out anyway. Turns out I can wear my otherwise-neglected leggings to get to the gym and back. Thought about buying hand cream–turns out a little Aquafor or Vaseline at night does the trick. And so on.

I think I have done that sort of thing a lot too! Right now I’m trying to find a happy medium between not having even the “needs” – like, at one point in the recent past, when I didn’t have a pair of sneaker that didn’t have a hole in them – and having a few too many “wants,” you know?

I might be the odd woman out here, but tracking ever dollar I spend makes me incredibly stressed out. So I go about things a different way: All my bills are automatically deducted from my account. Whenever I get a raise or bonus (not very often), I increase my contributions to my debt and to my 401K. I’ve gone from -$65K to -$13K in 3.6 years this way. I’m also putting 13% of my pay into my 401K this year. I only have $1K in my emergency savings and I know that if I was more mindful with my “fun/clothing/etc.” budget I could save up more. However, I like having $ to be able to accept the random invitation for drinks with friends or to be able to replace my mascara when I need to. Having a “fun” budget and indulging in “wants” (that are in my allocated budget) allows me to keep from feeling deprived or manic about living frugally.

Katie, that is EXACTLY the mindset I have – I have got to be able to splurge and indulge, because when I don’t, that’s when I just give up. Right now I’m just trying to figure out how to do it in a very different budget than I’m used to with some changes in our family employment situations, and it’s been harder than I expected to reduce my fun budget as much as I’ve felt I need to!

If I want something that is more than, say $20 or so I will wait a day or two after I see it. If I still want it, I usually buy it. I also think about how/when I’m going to use the item and if it’s worth the money (and the time spent earning that money). It also depends on how much money I have at the time.

That wait-before-buying idea is one of the simplest and best ones I know, C! You nailed it.

It’s funny, again a very timely subject for me, just yesterday I bought something on a whim and have regrets. I’m sure if I went through my house there will be tons of stuff I bought on vacation or when I felt low or with friends at a home party that I never use, just because I got caught up in the moment. But I’m still a believer in saving and living, so I try to incorporate both into my life, just still need to work on unneeded impulse buys :(! Thanks, Joan

Mary Ann, you hit one of my huge weaknesses – home parties! I love to “help out” when my friends have them and I’m exactly the personality the pitches at those are targeted toward. I’ve learned to work around that, but it’s soooooo hard 🙂

For me = Home party “splurges” are great gifts for other people. Time and money well spent helping a friend, getting an oh-la-la thing and then instead of hanging on to shoppers remorse, spin it and gift it as a thank you gift or bday gift. The gift that keeps on giving. If you bought it and really hate yourself for it (aka still in the bags with tags on it) geepers, I learned to get over myself on that one — I take it back. It takes 3-5 days for the $4 to reappear into my account, but when it does that $$ goes immediately to a bill or debt or something else. I still “spent it” but after returning it to the store, I re-allocated the $$, and that feels so much better.

I am also a HUGE fan of take pictures of everything. I go to a store to mentally shop and I take pics of stuff on the rack, a fabric I adore, the thing on the shelf… pics are free and the mental health of “taking a creative ounce of it home” is a huge help. I use Amazon lists too, see it click it to Wish List, move on. I can’t deny we live in a consumer driven society, and I have been trained well in it, but with new technology I have found ways of not spending. And its great!

As for stuff in the closet (I only shop thrifts and garage sales, so I have to really want it b/c I can’t return them) but I like the “which way do your hangers live?” application of turning all the hanger hooks to face me (can be done at the beginning of a month or season) and then when I use it, the hook faces the back of the closet — and I can “see” which garments need me to LOVE them again, REdiscover them with new eyes and possibilities or they need to go back into the Universe.

My downfall? I can’t yet part with the clothes that I love love love that are un-used because I am not yet that size. I go to my dreamy smaller-healthier-me clothes and get excited about wearing them … and then re-appreciate my treadmill time. I’ve also been known too look at those items as possible ebay sellers — and sometimes they are worth more me to me vs the prices ebay is getting for them. Being in love with the idea of me as a smaller size — it is not rational. Its not practical. Its my “first world problem” but I’m okay with it.

Side note about stuff/ clothes on a budget: I keep thinking I need to create a clothing swap event in my community — and just see what happens. I’ve seen this model talked about living-room style (yeah, that’s not happening) but what if I tapped into faith communities, or my non-profit circles? I wonder if this is a topic for you Joan. I’m curious if others have done this.

OOH. Clothing swaps – awesome idea, Bee!! And I am the same way regarding my too-small clothes. I have built a good habit of getting rid of ones that are too big so I don’t grow back into them, but too-small, it’s hard to part with (especially because those are some of my nicest clothes!)

My personal key to not over-shop is to categorize. I categorize in “need that” products and “don’t need it” products. If you ask yourself that little question — do I really need that item? –, you’re buying stuff more consciously. And the cool thing is: you really buy less things!

Best wishes from Austria,

DividElephant

That is a great strategy for consciousness for sure!

Recently I’ve read an interesting article on de-cluttering in a German magazine called Simplify your life (maybe something to check out DividElephant 🙂 and one sentence particularily struck me “When evaluating your belongings (and new purchases) try imagining you had lost it in a fire. Would you replace it?”

I absolutely love it and I’ve been doing this little thought experiment ever since. Really puts your wants into perspective…

best

Andrea

Definitely! Though I’m making progress on buying with more mindfulness. I keep a wishlist on Amazon, and I’m finding if I let something sit on there for a month or so, I don’t really want it. Or other things I need/want more come up and then I can remove it.

Downsizing our family’s home from a 3BR Townhome to an 1,100 square foot condo helps too. If there’s no room to store it, there’s no room to buy it! This helps TREMENDOUSLY with clutter!

Jacqueline, I wish more people applied that mindset, not buying it if there’s no room! (I fear that in our storage-unit culture today, that’s not always the case…)

Ha ha ha == Its not supposed to read “3-5 days to get my $4 back;” it is supposed to read “3-5 days to get my $$ back.” Proof reading, I hate it when my eyes dance over little details like that. Parallel = Money and stuff — its like its own sphere of proof reading and editing. 😀 Ha ha ha! Right?

HA, Bee, that cracked me up!

ghehe I actually liked that part. I was like yeah she is RIGHT. $4 is money too! Don’t be lazy, bring it back! So sad to hear it was a typo.. 😀

Hi Joan,

I’m the oddball I guess. I’ve never had the experience of finding clothing in my closet with the original price tag still on it. My clothing is usually many years old and just put together a different way when I want a new outfit. I’m not a shoe person so If my grandmother and son didn’t think it their mission to add shoes to my closet I would have exactly two pair of shoes. It is actually a good thing that my husband and I can balance each other out because i would never spend any money and he would forget to hold on to money for bills.Not that he wouldn’t pay bills, he just would see a bill for Oh $500 for the hospital well here is my paycheck let me pay the whole thing And oh here is this doctor asking for $350 let me pay the whole thing. So now when the mortgage and utilities come due oops we are short because he neglected to hold anything in reserve for those bills. He can actually go to the grocery store and not freak out over the high prices where I would come home without anything so we balance each other out pretty well. I just have to give him an amount to spend and let him know that there is no more when that is gone.

Tina, I (thankfully) don’t find new-with-tags stuff, but I do find things like two of the same basic black long-sleeved shirt or something, which always floors me!!

You’re right that it’s important to have a balance in your relationship, too. I am probably not one extreme or the other, but I have had a few significant relationships in which I experienced exactly what you talk about, that if the money was “there,” it would get spent, not irresponsibly but without future thought, and I’ve had to work to be the voice of “Hey, uh, wait, what about that thing that’s due before you get paid again!”

I realized for me the thrill was in the act of buying, not actually buying. So I ran a little experiement. I searched online for things I wanted to buy and made it all the way through the process until the time came to checkout. At that point I abandoned the cart. Basically it would have been the same result if I ordered the items because once they arrived, they would have been forgotten about.

The lesson I learned was that I had the same thrill going through the motions of buying but didn’t need to actually make the purchase.

So if you ever have the urge, go ahead, shop online, fill your cart, and then just at the point of no return, click that red X, close your browser and don’t look back!

Judi, now THAT is a cool strategy! Love it!

Human impulses are extremely powerful! regardless of how financially savvy we are, most of us often become victims of impulsive spending. That’s why I believe in having an allowance in the monthly budget for “want” items instead of just “needs”. Of course, this is providing there are no debts to repay.

When I was reading this, I was going “Me, Me, Me”. Yes, I have several(That would mean more than 2-3) of the same colored stuff, Yes, I have clothes with original price tags attached to them from my shopping trips one or two years ago, Yes, I have clothes that I bought with the hope of fitting into someday and finally Yes, I keep wondering how they all landed in my closet. With constant decluttering, giving away and not buying anything new, i am hoping I will get my closet (And hopefully my money) under control.

Needs vs. wants have always been my downfall. Especially since I have never been in a dire financial position. I like to think every since starting my blog about personal finance and money management I have done a better job at differentiating my wants vs. my needs. This has been the most prevalent in my sneaker purchases. I used to just buy them because they were releasing and I thought I needed them. As I have evolved in this process I have been able to pass up on a good majority of sneakers I would have bought in the past and save my money for only ones I really want. For me, its hard though because I don’t technically need any of them but sneakers are a passion of mine so I continue to buy them, just a lot more sparingly now.

Online shopping has helped a bit with this by limiting my in-person impulse purchases in stores. I’ll often keep something in my online shopping cart for day, sometimes agonizing over whether I need it, if it’s the best price and if I should wait. In ways it’s more nerve wracking to analyze every purchase, but it saves us money and trips to the store in the long run.

My personal strategy for not over spending is priorities. I always make a list of the most important things for me and my family. The only items that make it on this list are those which are crucial for my family to live comfortably. Most people don’t realize how important it is to think about these financial decisions before you buy something that could potentially set you back debt wise.

Hi Joan! I hope that I didn’t come too late to comment on this post.

I just want to share my thoughts about what you said.

“You want it, you buy it”, sure consuming goods and services is one of the ways that we make ourselves happy each day. So there is nothing bad at all in buying and consuming what you want.

For the “you forget it” part, I think that this is up to everyone. I understand the guilty feeling is the buying was something totally spontaneous, but these kinds of buying habits should just be repaired and always think ahead before you buy something but never feel ashamed or guilty cause you did.

If it’s a mistake it will not be repeated, if you like it it will make you happier ;).

Ironically running up my CC help to lead me to stop the want buy progression. With no available credit limit it put a halt on unnecessary spending. After a long enough withdrawal from impulse buying I don’t have that “need” nearly as much as I used to.

Honestly, I think I have a problem with compulsive spending. One minute I have 400 dollars in my bank account, then the next there’s 100 left and I forget what I spent 200 dollars on. I feel like a cleptomaniac, only in the form of spending. I have to wonder if it’s all the little expenses adding up over time. Can it really be those occasionally cups of coffee that make up the bulk? Obviously it’s on temporary expenses, and not something like electronics, I just can’t quite remember what though…… I feel very guilty, and horrible. I get bailed out a lot by family. I think I need some professional help here.

And there, between this article and the comments, sits an ad for “a tactical flashlight that can blind a bear.”

Is that something I need? No.

Is that something I want?

Probably not. Hadn’t really thought about it until I saw the ad just now. A super-bright flashlight would be pretty cool to have, even though I would certainly not want to go around traumatizing bears with it.

My point, though, is: this site ain’t what it used to be. I don’t know what Baker is up to these days, but apparently he sold this site and made enough to move in to other things. And now the site that was once about doing with less stuff so you could live better and have more experiences, is just another site designed to bring in advertising dollars… by tempting visitors with gadgets and junk we don’t really need.

Pretty sad. I used to check in here once in a while. I suspect today will be the last time.

I can’t imagine the number of times that I’ve bought something on a whim to think that I might need it at home and in the end it sits on a shelf or in a storage cupboard somewhere gathering dust. It makes me really reconsider my properties when I think I have the money to splurge on things that aren’t an absolute necessity in my house. Haha!