[share_sc]

Since we left for overseas in early June, our budgeting has been on one hell of a roller coaster ride. For the year and a half leading up to the trip, we were budgeting ninjas! We had grown comfortable, become great at predicting expenses, and really found our budgeting sweet spot.

Long story short, we had no idea what we were in for! Traveling like this was a shock to our budgeting system. We’ve had extreme success in areas like lodging and food, set against the occasional huge spike in categories such as airfare and visas.

These ups and downs prompted us to finally launch the financial transparency project here at the start of October. It was great timing as we were starting to settle in more than we had in the months prior.

From a psychological standpoint, the project has been a huge success. Courtney and I have felt much more compelled to justify any impulse purchases. As we hit our budget limits for the month, it forced us to look twice as hard on whether we could hold off on those categories (although we still exceeded our limits in some cases).

Our October Numbers

New Zealand Income: $2395.19 NZD – [$1720.23 USD]

New Zealand Expenses: $2907.04 NZD – [$2087.84 USD]

U.S. Income: $668.80

U.S. Expenses: $521.04

Places we failed to project properly:

- Didn’t know that one of Courtney’s paychecks would be 60% of normal, due to fact that she hadn’t accrued full holiday pay. Although, she’ll make this up over December holiday.

- Rent is paid weekly in New Zealand and this was a 5 week month for our rent. We only projected 4 weeks.

- Utility bonds (deposits) were more than we anticipated.

- We did not plan for expenses accrued when obtaining Driver’s License.

- Our washer was broken upon moving in. Spent $40 NZD at LaundryMat before it was fixed.

- I bought two extra domain names, causing ‘Business Upkeep’ to exceed projected. (Although they are good ones for future projects)! 😉

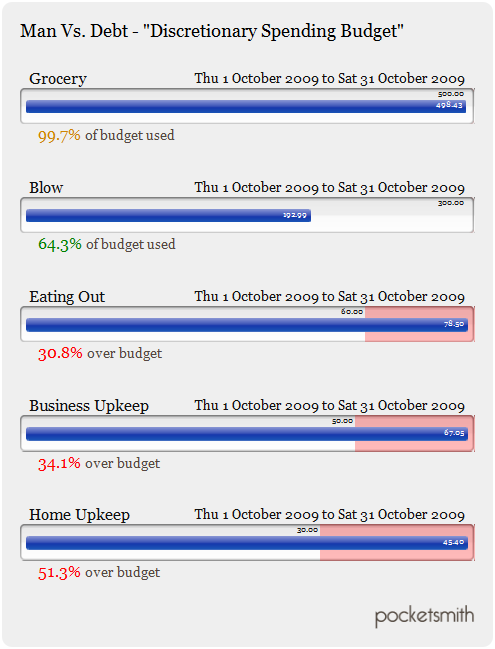

Here’s how our discretionary spending categories ended:

The above screen shot shows both positives and negatives.

The negative side is we did exceed 3 of the 5 categories we wanted to actively control. That’s obviously not a good success rate. However, upon closer noticed we saved more in our ‘blow’ category than we overspent in the others. As we started to go over, we intentionally spent less out of this category to make up for it.

However, the point of the ‘blow’ category is not to simply make up for our other mistakes. If that were the case, our whole budget would just be one big Misc account. We subdivided these categories intentionally, because we wanted to control them. So we need to buck up, make less excuses, and spend our ‘blow’ category on experiencing New Zealand while we are here (not covering our Subway visits and household purchases).

Changes for November

Most notably we are going to be adding a discretionary budgeting category for our upcoming South Island trip in December. Since we’ve already started incurring minor expenses, I want to keep a separate tally of these to make sure this event doesn’t get our of hand. We’re currently budgeting $2500 USD for this, which includes airfare, extending visas, getting driver’s license, renting a camper, any hostels, bungee jumps ;-), food, gas, insurance… you get the point.

This new budgeting category will remain on the finances page through the end of the trip in late December.

Other big changes include raising the ‘Business Upkeep’ category from $50 to $500! That’s not a typo. The e-book will be launched in November and there are some expenses leading up to launch (including some minor work on the site). The point of an increased expense budget is, of course, increased income this month. I expect this to rise significantly over October. *crosses fingers*

We also are expecting for Courtney to receive a $2000 NZD relocation grant sometime in November. This is something she qualifies for as part of accepting the job to teach in New Zealand. Unless something unforeseen falls through, we plan to allocate this against the cost of the South Island trip. 🙂

How was your October?

How did your budgeting (or lack of budgeting) turn out in October? How are you adapting or changing your budget for the final two months of the year?

Lastly, feel free to include any tips and/or observations for us. Budgeting while mobile like this has been a much more difficult undertaking than when we were more stable back in the U.S. We’d love to hear your suggestions!

Oops, going over food budget can be dangerous, but good job on not going over for the BLOW category!

For September, I ended up 85% under normal budget for everything b/c I made a promise on Oct 1 that I wouldn’t spend money on ANYTHING other than food and my monthly buss pas. So, I’m exactly on budget for the new budget I guess, which is 85% below normal budget.

Now that it’s November, and the holiday season is coming up, it’s time for me to spend money on others.

Best,

FS

.-= Financial Samurai´s last blog ..A Weak US Dollar Doesn’t Matter Folks! =-.

Sweet job, man.

It sounds like you sucked it up this month to be able to spend some extra here in Nov, Dec. That’s inspiring!

Thanks Baker. You know it’s kinda funny, the wife and I TRIED spending money other than junk yesterday (Sunday), and we couldn’t. We went for a 3 mile hike along the coast of the Bay, grabbed some lunch, and then remembered there was a free Asian Art Museum entry day thanks to Target.

We ended up spending another 2 hours looking at the neat Siam/Burmese artificacts, and watching a classical Burmese puppet show which we found fascinating.

Afterwards, we just went home and watched some football and some TIVO 🙂

Donno, it’s pretty easy not spending money on stuff if you have no desire to buy anything!

I’m excited for your vacation Baker. Let us know how it goes, and take some pics! You take some good ones!

FS

.-= Financial Samurai´s last blog ..A Weak US Dollar Doesn’t Matter Folks! =-.

I love the transparency, that helps the rest of us so much. Thanks for the post. I also like Pocketsmith, I think we need to start using that. Good luck and good job on being realistic and keeping track. It’s a process, including both the ups and the downs.

.-= Michelle Traudt´s last blog ..Envisioning Greater Things =-.

Thanks, Michelle! Courtney and I are digging PocketSmith, obviously. We like simple pen & paper, too… but PocketSmith has the benefit of enabling us to share online, so it’s winning out right now. 🙂

So your radical financial transparency thing means we’ll see exactly how many e-books you’re selling, once you release it, huh?

I’m curious about your claim at the end of the post about “budgeting while mobile” — you don’t seem mobile. You’re renting an apartment. It seems like you’re planning on staying there for a while. “Budgeting after having moved” seems more accurate.

Also, your categories for business upkeep and household upkeep are *tiny*. It’s no wonder you exceeded them. Imagine your computer broke and it cost $200 to fix. Should that *really* take up four months budgeted expenses for the business? You could exceed your household budget by replacing lightbulbs.

I still don’t budget. I still don’t think it helps me with anything except spending more time looking at spreadsheets. I just make my savings contributions, pay my bills, and then keep the checking account balance positive. This system works great for me.

This project is a partnership. As such, I might not share EXACTLY the number of sales at the point they happen. However, I *will* share full income I receive at the end of each month from ebook sales.

To your ‘mobile’ concerns. This was our first month in the apartment, so we are still feeling the effects of settling somewhere new (and realizing a few things we didn’t anticipate are need). Also, in terms of mobile moving forward… well… things might not always be what they seem. 😉

Good call on the business expenses, which is why I’ve raised them (and probably will continue to do so).

Lastly, you do budget. Obviously what you’ve laid out is budgeting. You simply don’t do it on paper or on a spreadsheet. From everything I know, you seem like the type of person that could budget specifically in only about 15 minutes a month. I’m amazed you don’t get 15 minutes of increased value from writing down your budget. Do you write down goals, projects, objectives?

A.k.a. do you believe in written goals?

Interesting question. First, let me separate goals into two categories.

1) Real Goals. These are thins like “Move to New Zealand”, “write a book”, “learn Italian”, “raise a family”. These are things you *really care about*.

2) To-do goals: These are things like “go to dentist appointment”, “change oil in car”, “mail christmas cards”. These are things you don’t really care about, but should probably do because life is better in one way or another if they get done.

Now, do I believe in writing them down? Sure. To-do goals are easily forgettable if you *don’t* write them down, so you put them on your to-do list. But for real goals? You can write them down if you want, but you shouldn’t need to. If you forget about trying to move to New York, you were probably lying to yourself when you made that goal. If you forget it, it’s not something you *really care about*, it’s just something you thought sounded cool or romantic. If these goals were really the right goals for you, you wont need to write them down. I sometimes write things down, but they’re things that fall into the “to-do” category.

Now, to relate it to budgeting — I don’t care if I spend $400 or $700 on food each month, as long as the bills are paid, savings contributions are made, and the checking account balance remains positive. I could write “$400” in a spreadsheet, then come back at the end of the month after spending $700 and compare the numbers. What does this get me? It gets me an extra thing to throw on my to-do list, but I don’t need more items there. “Spend less than $400/month on food” isn’t a “real goal” for me. It’s at most a to-do item, and even then, I don’t feel like I benefit from it.

You say you don’t want a single giant “misc” category — you want to control each separate category. I don’t. I want one big “misc” category. The budget for my “misc” category is the balance of my checking account. I just don’t see how my life improves because I was able to predict how much transportation costs or restaurant bills would be this month, so why bother?

I guess it only improves your life if you have something you’d rather do with that $300. If you don’t, you are really saying that your budget is $700, etc… Or your budget is ‘everything’ that is left over.

For us, of course, we have lots we want to be doing other than letting our grocery budget inflate on unnecessary items. (Or the other categories).

“I guess it only improves your life if you have something you’d rather do with that $300. ”

The thing is, I don’t. That’s the whole point of funding my savings goals first. Everything else that’s leftover is just that — leftover. My goals have already been accomplished, so whether or not I have $300 left at the end of the month makes no difference in terms of accomplishing them.

I think it’s clear Tyler’s goals are:

1) put “X” dollars a month into savings

2) don’t spend over “Y” this month – where “Y” is the balance in his checking account

Everyone’s system is different, the point is there should be a system in place. Tyler’s is loosely defined, whereas some people need more rigid guidance, such as the envelope method.

I can see Tyler’s point in NOT budgeting certain items – after all can we really control how much we spend on electricity, for example? Turning off lights and the TV when not in use gets us some benefit, but only to a certain degree.

Great point. While utilities obviously can’t be controlled as much as a leisure category, we still consider them against our income. For example, making sure we are aware of how much our utilities add to housing costs, etc…

But yeah, that’s why you don’t see Utilities under the ‘discretionary’ spending category on our finances page. Not something we are trying to actively control at this point.

I agree with what Tyler said. For any product launch past a simple ebook, you’re going to need far more than $50/month. FYI, my biz expenditures category is $2,000/month, and my goal is to be “net cash flow positive” on my business — i.e. make at least the $2K back every month.

-Erica

.-= Erica Douglass´s last blog ..How To Make A Mind Map =-.

Yeah, next month is $500. It’s hard for me to get in the mentality ahead of time to increase this, but I know it’s time. I estimate it’ll continue to rise through Q1 2010. 😉

We’ve been busy the past few months. Good news is we managed to sock most of my temporary job’s paychecks, so our emergency fund can have some more padding. I did spend more eating out with the temp job, but now that it’s over, I’m back to my normal routine.

I’m happy to see that you’re working on building your business upkeep. Can’t wait to see what you have in store.

Something that helped us with eating out is asking our friends who’ve lived here for years about happy hour and specials around town. It’s cut some dinner outings almost in half.

.-= Laura ´s last blog ..October 2009: Financial Progress Update =-.

Great news, Laura. I’m sure the efund having some extra padding feels nice.

That’s a great tip on eating out. I think what I want to do is eat less at say Subway (vegetarian friendly so our choice for fast food), and save up for more authentic restaurants once a month.

I think you’re doing pretty well. It’s impossible to budget accurately when you are doing something different (ie moving to a different country). I mean you ended up in a different country then the one you planned to move to…hard to predict some stuff.

I agree with Tyler and Erica about budgeting more money to certain categories but given the fact your income isn’t all that high (no offence), I’m not sure how you are supposed to budget money that may not exist.

Your ‘eating out’ category is quite small ($60) so to exceed it by a few bucks is no big deal. Ditto for the ‘business’ category and home upkeep. Your combined overspending in those 3 categories was only $50 – no biggie.

I would question the ‘blow’ category. Given your overall modest income and the fact that you spent more than you made – I think allocating $300 is a bit too much.

I agree. Obviously, we ‘thought’ we were going to spending less. The half paycheck and other areas I outlined meant that we didn’t! Of course, if we had foreseen this, then our ‘blow’ category would be the first to have been reduced. 🙂

You’re very brave to be so transparent. I see no expenses for babysitting. Do you take your daughter everywhere, even hip hop dancing? And how are you able to concentrate on writing while taking care of her? She must take long naps!

I’ve also wondered how you can concentrate to work when you seem to be on Twitter all the time. Can’t argue with your success, though.

We don’t have any babysitting budget. Milligan goes everywhere we do! Although we might use some of our blow money, if we get good deal on Pearl Jam tickets this month (which includes a sitter).

My wife takes the Hip Hop dance classes, not me ;-).

Lastly, I can’t concentrate on writing during the day. I do all my writing at night after Courtney is home or Milligan goes to bed. I can (& do) waste time on/off throughout my day on Twitter, E-mail, networking, etc… But I have to shut those completely off when I am able to write!

“Although we might use some of our blow money, if we get good deal on Pearl Jam tickets this month (which includes a sitter).”

As someone who has been accused of being somewhat fanatical in my Pearl Jam devotion, I say screw the budget, go to the show!

http://www.thehappyrock.com/2009/06/07/want-a-sure-thing-invest-in-pearl-jam/

.-= DD´s last blog ..A Tale of Two Athletes – Phil Coke and Antoine Walker =-.

“You could exceed your household budget by replacing lightbulbs.” LOL @ Tyler, this comment was great. 😛

I really never got into the budgeting thing. I work on setting aside money for bills and money to save, and the rest is spent as we see fit. Only time I really break into budgeting is when my husband’s deployed and I don’t have to convince anyone else to do it with me. 😉

.-= Foxie | CarsxGirl´s last blog ..Goals aren’t always met =-.

Yes, that Tyler character occasionally has glimpse of wit. 😉

I think that ‘setting aside money’ and ‘as we see fit’ mean you ARE budgeting. How do you see fit? What portions are you ‘setting aside’? See.

I’ve noticed this pattern and it might be it’s own post. I’m interested in the distinction between different levels of budgeting… mental, written, before the month, after the month (reviews). Interesting.

Hey Adam!

Loving your transparency! It’s great to read and see how possible it is to live like you do. It is also nice to hear that you are not perfect and sometimes overstep the budget you set for yourself.

I’m going to do the same with the budget for my trip to europe in december, keep a log on Upgradereality. It’ll be interesting to see if I can stick to the budget I’m going to set for myself. 🙂

Cheers!

.-= Diggy – Upgradereality.com´s last blog ..Giving Value vs Taking Value =-.

Diggy, haha definitely not perfect!

I’m interested to see your Europe budget for December. I hear that country can either be really affordable or really expensive! Good luck! 😉

We went over in our “eating out” and “shopping/misc” categories this month…I’m thinking that my original budget was a bit too low. May adjust for this month but will still keep looking for ways to cut. That being said we have cut WAY back on eating out since signing up with mint.com. When we first started looking at everything, we were spending $500/month eating out- we had NO idea- no wonder we were broke. Those trips to starbucks add up. My budget now is $150. We travel a lot so it is unrealistic to cut that budget down super low.

We also went way over in our pets category. We helped a stray cat find a home this month, get shots, etc. I told my husband- don’t bring home anymore strays!! 🙂

The good news is that we paid down our credit card by $1500. $500 more than I budgeted for. Yee-haw! Our emergency fund has also remained untouched and I add $80/week to it.

My goal for Nov is to pay $1700 toward debt and hopefully our credit card balance will be under $10,000 by Christmas! It was over $18,000 in Aug, so this is a big feat. It feels so good to watch it go down!

Best of luck to you- great blog!

.-= Melanie´s last blog ..news: blastin for boobs! =-.

Melanie, it sounds like you’ve had your own ups & downs! 🙂

Awesome progress on the credit card! When Courtney and I were chunking against them, it made the intensity of the other area of our finances increase too!

Keep watching it plummet and keep leveraging it to inspire you in other areas.

And, no, you can’t keep it! 😉

Melanie, I have the same problem. Eating out adds up! The money goes so fast. I am a single woman so I go out to eat once or twice a week with friends. It’s really hard to say no because they’re my social life – no husband or kids to spend time with at home. My meals out (mostly dinner and brunch) are my relationship-management tool.

I have toyed with the idea of finding something else to do with my friends, and occasionally we go to an art museum. But my best solution has just been to go on 1/2 priced wine nights and to find BYOBs. I’ve just given up taking too much out of that category.

I actually kicked ass at budgeting in Oct. I decided to make Oct “no buy” month. I’m still waiting for the final transactions to show up on my account before I run the numbers, but things look very very good. My estimate is that I spent only about 30% of net income this month.

Wow, nice work. Now that is intense. Courtney and I wanted to experiment with no buy weeks and even a month (as far as discretionary of course). We haven’t gotten up the guts to do it now, although we came close some of the last year and a half. 🙂

Although October was a VERY solid month for our budget… we REALLY feel like we nailed November! We’ll see in about 28 days if that feeling holds true.

One thing we implemented for November? The Cash Envelope System. What do I think? I think it rocks the hizzle. We are already spending less due to using cash… much less. I’m convinced one cannot know the true power of this system until one implements its love.

Keep up the tracking, your determination and discipline are your best friends… especially in the uncharted waters you seem to find yourself each month!

Cheers.

.-= Matt Jabs´s last blog ..Personalized Gifts – Spend Less and Love More =-.

We love the envelope system, as well. Even having to grab the envelope saves us money occasionally, haha.

I wish we were as confident in our November projections as you guys! I think we’ve improved, but am still nervous about what this and December hold for us.

October was another hugely spendy month for me. I knew it was going to be that way (along with the next few months) but I let it get out of control in a few unplanned areas as well. So I’ve got to get that part under control this month.

.-= Jackie´s last blog ..Getting Out of Survival Mode =-.

Go get it, Jackie! If you are anything like us the unplanned expenses can sometime derail the other areas, as well. Don’t let ’em! 🙂

The more accurate we get at projecting expenses, the more smoothly all areas seem to click.

It sounds like my system is different from most everyone else’s here. I budget every category to the dollar. My categories are more specific, like “utilities”, “grocery store, “entertainment”, “medical”, etc. Because I have a steady paycheck, I know exactly how much will come in the door each month, but I think I would use the same system even my salary was more unpredictable.

Each month of my budget rolls into an annual budget. I can go over or under each month a little because I keep one extra month’s worth of cash in my checking account. For instance, my clothing budget is about $1,800 for the year. If I buy $600 worth of clothes in January, I just adjust the rest of the year to reflect that I now have 11 months to spend the remaining $1,200.

My October was fabulous – I was able to pay off my smallest student loan. I cannot wait to get them out of my hair!

This sounds very similar to the system we used before leaving. We have some items that are really ‘yearly’ but often we break those mentally down in to monthly for own own purposes, too.

Way to give that smallest loan the boot! 😉

Our Oct. budget came out…. well, not terribly different than Sept, Aug, or July – on target, or at least close to it. But we’ve been budgeting off of my one income in this city for nearly 3 years. The Mrs. (our chief budgeting ninja) has this pretty well down.

In your case, Baker, everything has been spun around, turned upside-down, and shook. you’re going to have to give yourselves some leniency to goof up a bit as you guys are getting settled and figuring stuff out. I’m not sure it matters how long you had been budgeting previously prior to moving, or how good you were at it then. There’s going to be some things that smack you on the back of the head (like the weekly rent thing!).

.-= Mr. Not the Jet Set´s last blog ..Health Insurance: Open Enrollement Time =-.

Yeah, we moved from San Antonio to Seattle this year, and it took several months to get used to the difference in grocery prices.

Yeah, that’s why I’m not too disappointed about this month. Room to improve, but there are a lot of variables and I know we’ll get better over time at projecting them.

We have daycare, but no babysitting for evenings, so we save a lot of money on dining out b/c our kids are terrors and it’s too embarrassing to take them anywhere. They’re like monkeys: cute and disgusting at the same time.

Right now I’m in a unique budgeting situation. I’m able to save 50% of my income! As long as I put it in a CD on payday, I can’t spend it. The rest is enough to pay the bills with a little extra for junk (aka “fishing equipment”).

I did have to buy plane tickets this month though.

Haha, I know what you mean about kids keeping your from spending a ton ‘going out’. 🙂

That’s awesome that you live on under 50% of your income. Courtney and I were able to do that for a long spurt and it felt great. It was a HUGE security booster as we new we had the power to be extremely flexible if something came up!

Where are the tickets to? 😉

Going to visit in-laws for the holidays. You know what’s weird? Round trip tickets from TX to WA used to cost us $5-600 each. Now that we’ve moved, the same tickets (but from WA to TX) only cost around $200 each.

Good job Baker!

Glad to hear that you’re working on the income side of the equation in the coming months. Are you planning to keep your expenses (approximately) the same if your income increases? If you do, I think you’ll amaze yourself.

Have you thought about having a category for “entertainment/sightseeing”? Given that you’re in a new country, that’s what I would do as a measure also of what I’ve been doing in that country that I couldn’t / wouldn’t at home.

I wish you’d do a post about “a week in the life of Baker” that makes me want to travel more with my own kids while on a budget (not as tight as yours fortunately and much heavier on the entertainment scale).

I’m also curious as to why your grocery costs are so high? About 150% more than mine for the same demographic and we’re not vegetarians. I know it’s not location as grocery costs in NZ are similar to Canada if not cheaper.

We could do a ‘entertainment/sightseeing’ specific category, but a lot of that is our BLOW money. That is why I pointed out that I want to actually SPEND it that way and not just use it to make up for other categories.

I’ve done (and will do) more ‘week in the life’ type travel posts. Right now, it’s a little less sexy (just talk about it in the personal update), but as we tour the South Island the posts will get bigger and more travelish :-).

Not sure about grocery costs. Assuming you’ve done the conversion from NZD to USD or Canadian Dollar, I’m not completely sure. We normally spent around $250-300 USD when back home. Sometimes this category includes diapers, or paper towels, etc… We don’t buy a lot of that stuff, but we get it at the grocery store… so it is often included.

We buy nearly 0 junk food. I think my ‘mocha’ habit is around $40 NZD per month, which is probably the highest ticket splurge-ish item. Other than that we buy a lot of produce. Hmmm… not sure! 🙂

Our October was challenging…we have also moved..into a new home (previously rented)..we have had a couple late payments and the organization piece of our budget took a hit..specifically..out internet service was terrible…we now have Verizon Wireless…things will be better (fingers crossed).

That sucks Ken! Sounds like you might be back on the horse now, though. Keep it up.

Our October was quite traumatic. We bought a car in September (we’d been saving for it for 10 months) and it’s a POS! It’s bad, bad, bad and bad. We put another 2K into it and it needs a new freaking transmission. It doesn’t show up on the Ford computer system but you can feel it.

Anyway. Traumatized.

We budget like Tyler- we put $ in 401K, roths, investments, 529, long term savings, and checking. We basically spend whatever we want from the checking and plan trips out of it (and cars, and car expenses BAH!). Occasionally when it gets high we put some of the money into long term savings (which we spend as wanted/needed- but it still carries a high balance). This works for us but we are quite disciplined. There have been times in the past when we had $300/month to spend on gas and groceries and misc for 4 (including one severe food allergy to wheat) but we were saving $1200/month.

I have trouble with categories esp when you have small kids (DD needed new sandals, school swimsuit and school sweatshirt in the past month- this was well over $100 and completely unexpected). We are also expats and there seem to be a lot of unplanned expenses.

Yikes, talk about a big hit on the car!

I like your budgeting system (and Tyler’s). It sounds like your maxing out the ‘pay yourself first’ principle. And that’s an awesome principle as long as you don’t spend more than the remainder (which you obviously aren’t).

And I can definitely feel the unexpected expenses with kids. Milligan is fairly controlled now in terms of needing new things, but even now her growth is going to cause us to project and plan even more! I’m sure we’ll miss a thing or two, but be better ready for the next one!

Our Oct went ok. We went over in clothes, groceries, and entertainment, but all other categories were either right on or under.

Clothes and entertainment are not a big deal, because overall for the year we are still under budget. Groceries is my worst budget category. We nearly always run over, and are over YTD. I guess we will simply up the budget for 2010, but I really wish I could understand why we seem to spend so much more than others even though I bargain shop, use lists, plan meals based on sales, etc.

.-= Annie G´s last blog ..Contest! Win Dr. McDougall’s Soups =-.

Nice work, Annie. Even if you run over a little if it forces you to be more careful throughout the year… then that’s a benefit still!

I love your “lifehacker” attitude! You know what I have found is that most people (including myself) are not very consious about their lives. By that I mean if we were able to slow down and really think about what we really need to be doing, right down to the basics, we could eliminate alot of wasted time money and regret! We go out to eat because we fail to plan in our grocery budget. We don’t consiously spend or track our spending. By not doing these things we drift along the river of life like we are on a raft without a rudder!

I love your blog because you are the everyman! YOU ARE DA MAN! By this I don’t mean that you are smarter, better looking, more articulate or anything that would raise you up in anyone’s eyes above the rest of us. What you have is a genuiness that comes through everything you do and write!

With this being said it is because of these qualities that you are able to inspire me to strive for the best in my life! Thanks for all you do! Randall

.-= Randall´s last blog ..Sunday afternoon Blues! =-.

Wow, Randall!

I’m flattered and really appreciate you words. Talk about pumping me up for the week! 😉

I’m glad to have you part of the community and will do my best to keep it up!

I’m wondering if things don’t turn out as expected on the income side if you will cancel the trip?

I’m guessing your $500 will pay off, but you never know, it’s a risk.

.-= Kelly´s last blog ..$50 Genuardi’s gift card giveaway #2 =-.

Well, I’m not exactly sure what you mean, however the trip *isn’t* tied to making money in terms of the business or blog.

So, we will still be taking the trip regardless of any USD income success or failure. Hopefully, we’ll be getting a 2k grant and our plan was to make the other up in NZD income.

We may fall a little short, but we won’t *cancel* the trip. If both NZD and USD incomes looked weak, we would simply tap the emergency fund to fly back home and build back up savings/attack debt!

We’ll keep our fingers crossed it doesn’t come to that ;-).

Well it looks like you are doing considerably well. I really applaud you for using Pocketsmith and for even setting up a budget. When I was studying abroad, I just seemed to lose all focus on budgeting, even though most of the money I had were in the form of student loans. Luckily, my girlfriend was with me and forced me to eat the same exact sandwich EVERY single day! I do love and hate her for that! I just didn’t want to stay in and make food, I wanted to be out and about “experiencing” the moment. If I had to do it all over again, I would find a happy balance between eating out and making my own food.

Also, I want to echo what others have said. It’s good that you have increased your budget for business “expenses”. Mine are going up as well, but instead of using the word “expense” I really try and look at them as business “investments”. Sounds a lot less depressing, and keeps me somewhat accountable and forces me to take daily action to make sure those “investments” pay dividends later on.

.-= Mike´s last blog ..Journey of 1000 Miles: Part III of III =-.

So what you’re saying is that you can spend more on blow?

.-= mbhunter´s last blog ..Friday Fiscals: Wii Fit Plus edition =-.

Pingback: Carnival of Debt Reduction » Welcome to the Carnival

Pingback: Carnival of Money Stories – My Money Flaws Edition

Pingback: Carnival of Financial Planning