This article may have affiliate links that help support this website.

You’ve probably heard for years that Dave Ramsey considers mutual funds as a lucrative investment. But after researching mutual funds, you’re lost in the lingo and more confused than before. The internet is filled with multiple and divergent opinions on mutual funds. As such, you may want to consider the opinion of a financial expert like Dave Ramsey. Now we covered Dave Ramsey financial coach experience, but do you need one to do Mutual fund investing?

We don’t always agree with Dave Ramsey, we do agree with him on a lot of things. In this article, we will share:

- A Brief history on Mutual Funds

- Dave Ramsey and Mutual Funds

- Dave Famsey’s Mutual Fund Mix

- A Vanguard Type Portfolio of Mutual Funds

- How Much and Where I am Invested And What I Use

- Why does Dave recommend that you invest in mutual funds for at least five years?

- What We Don’t Necessarily Agree with Dave Ramsey On Mutual Funds

Let’s get started.

What Are Mutual Funds?

Before investing in Mutual Funds, it’s best to properly understand what a mutual fund is. Going by Dave Ramsey’s definition, mutual funds are investment portfolios managed by a team of professional investment managers. The investment managers choose a mix of money market funds, bonds, and stocks in a ratio that aligns with the objective of the investor.

For example, if you and your friends drop a $100 bill each into an empty bowl. What you’ve all done is to mutually fund a bowl. This is a replica of what a mutual fund is. Hope this makes sense?

Most mutual funds contain stocks of multiple companies. So anytime you invest in a mutual fund, you’re purchasing a small part of numerous companies. Dave Ramsey suggests that you invest in a reputable mutual fund company. This is because a reputable Mutual Fund company will spread your investment over numerous company stocks. This way, even if the price of a stock falls, the rise of other stocks will cushion the effect of that fall on your finances.

What Mutual Fund Does Dave Ramsey Recommend?

Dave Ramsey is quite passionate about investing in mutual funds, and it is well explained in his blog. Dave sees mutual funds as a very reliable investment vehicle, but he has expressed his preference for Growth Stock Mutual Funds. He also suggests that it is mixed with one international fund, one aggressive growth fund, and an income fund.

Growth stock mutual funds prioritize purchasing and holding growth stocks over other stocks. Investors that pick this type of stock usually look at growing their assets over time, a strategy that reflects Dave Ramsey’s philosophy on investing. To identify growth stocks, investors lookout for companies that have a potential for future earnings that is higher than the overall market, even when the stock price evaluation seems higher than other stocks in the market.

What does Dave Ramsey say about the right mix of mutual funds?

Dave believes that to build solid financial support for yourself via mutual funds, then it’s best to have the right mix of mutual funds. He further explained that the most appropriate mix is one that has growth funds, growth and income funds, aggressive growth, and international funds.

However, let’s help you elucidate the meaning of each fund type—this way, you can mix the funds as Dave Ramsey expects. Dave Ramsey’s recommended mutual fund breakdown is as follows:

- International – 25%

- Growth and Income – 25%

- Aggressive Growth – 25%

- Growth – 25%

Growth: These funds are usually from medium and large corporations that are fast-growing. Although their prices fluctuate based on numerous factors, their value rises over time.

Growth and Income: These are often funds from large corporations that have a value of over $10 billion. Investors with a preference for low-risk stocks prefer this because the risk of loss is low.

Aggressive Growth: These funds have much smaller companies that have huge growth potential. Because their prices fluctuate, they are seen as the gambling stock in your portfolio. Dave Ramsey suggests that you make extensive research before adding any aggressive growth stock to your portfolio.

International: As the name suggests, it involves investing in foreign own companies that you consider profitable.

Dave Ramsey’s Recommended Vanguard Mutual Funds

Examples of growth funds are Fidelity Growth Company and Vanguard Growth Index. Although most growth funds usually have the word “growth,” some don’t have it. As such, that is not the determinant that a fund is a growth fund.

In 2021, let’s take a look at a Dave Ramsey style portfolio looking based on the above investment mix of 25% International, 25% Growth and Income, 25% Aggressive Growth, 25% Growth. I have a Vanguard account, so it’s easy for me to do this research.

- Fidelity Diversified International Commingled Pool (Foreign Large Growth)

- Vanguard Emerging Markets Index Fund Institutional Plus Shares (I think of this as more aggressive growth)

- American Funds The Growth Fund of America® Class R-6 (RGAGX) (Growth)

- Dodge & Cox Stock Fund (DODGX) (Value (Income)

What Are The Product I Use To Manage My Mutual Fund/Investment Portfolio?

I realize that I am about to share some personal financial information, but I thought it would be useful for you to understand how I use these products.

So, let’s go through a few financial products that I use with an investment that use for mutual fund and other investing.

1. Personal Capital

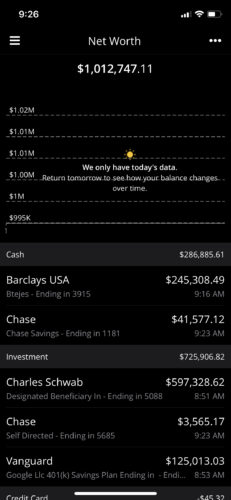

Personal Capital is one of my more favorite accounts. And best of all, it’s free. What I like is that you can see all your investments and net worth in one place. You can also see transaction data, cash flow, and budgeting. I believe this is good if you are in Dave Ramsey’s Baby Steps.

In addition, you can schedule a call with a financial advisor as Personal Capital manages over $21.8B in assets. You can have an investment checkup and also go through financial planning all through a simple to user interface.

You can sign up for a free Personal Capital account here.

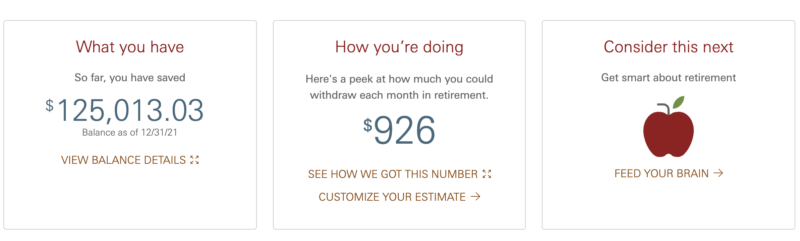

Here’s a screenshot of my Personal Capital Account.

2. M1 Finance

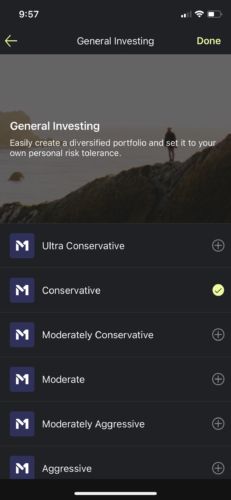

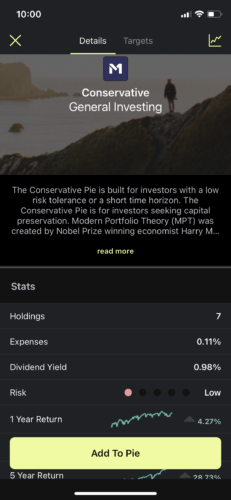

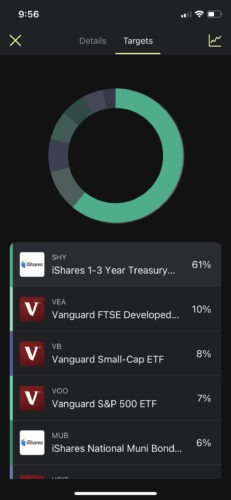

M1 Finance has been a $0 fee, $0 commission that I have been tracking since 2018. That said, I decided that it was time to move off Robinhood, so I was in the market to really dive into a new investment app. So, M1 Finance has fit the bill perfectly. You can sign up here.

What I really like about M1 Finance is the idea of investment pies. You can easily select an investment pie that fits your investment preferences. One of the things I like least about Vanguard is that it has been really difficult for me to find: 1) What stocks are in a mutual fund. 2) The expense ratios of those mutual funds.

Thankfully, M1 Finance really solved these 2 pain points for me.

Check out this M1 pie investment flow

To get here, you would open your app on the “Invest Tab” then click the “Choose Securities” button at the bottom followed by the “Expert Pies” button. I clicked on “General Investing”.

You can borrow money on M1 Finance, but I would not do that as I don’t think Dave Ramsey would approve, and I don’t like borrowing money in general, especially after the baby steps.

3. Vanguard

I use Vanguard, but I sort of have a love/hate relationship with the product. I am not sure how Dave Ramsey feels about Vanguard. For one, I don’t necessarily love the selection of investments. For example, I haven’t found a great money market investment, and you really have to look at the fees. Here are a few screenshots from my Vanguard account that I got when I worked at Google in Mountain View in 2012-2015.

I have 19% allocation in my portfolio in Vanguard Emerging Markets Index Fund Institutional Plus Shares (above), which I believe may be the most aggressive growth. Oh!

5. Schwab

I personally only use Schwab because I decided to allocate stock to this account, but I have been overall pleasantly surprised by the customer experience. I have loved the chat functionality and the general competency of the customer service team.

Why does Dave recommend that you invest in mutual funds for at least five years?

I have been having trouble finding where Dave talks about how long you should invest in a specific mutual fund. That said, he mentioned that you should be focusing on long-term returns of 10 years or longer. He said not necessarily focus on the specific rate of return, but that you do want to choose a fund that outperforms other funds in its category. Dave also mentions having a long-term perspective when it comes to investing and not bailing on your investments.

How is Dave Ramsey wrong about mutual funds

Dave Ramsey provides much information about mutual funds However, Kent Thune from the Balance provides some wise words to share about where Dave Ramsey may be wrong about mutual funds, which is summarized below.

Lack of Bonds

A vital part of asset allocation is having more than one type of asset. But sadly, Dave’s mix only has a type of asset; they only include stock funds, no cash or bond funds. And as most investment experts suggest, a portfolio that consists of 100% stocks is very inappropriate.

Overlap lessens diversification

As explained earlier, Dave Ramsey suggests that investors hold four mutual funds in their IRA or 401(k). But chances are high that his suggested fund mix might overlap.

Also, I just did a backdoor Roth IRA conversion with Schwab, which I was pleased only took about 10 minutes to complete.

For example, if you purchase an aggressive growth fund, it may grow to become a growth and income fund. This further reduces the diversification you were trying to create in your portfolio.

International funds may also invest in U.S. stocks, which can also create overlap that leads to less diversification.

In summary, following Dave Ramsey’s advice strictly can leave one in an undesirable situation that’s a reminiscence of having a portfolio of one or two assets.

No mentioning of no-load funds

Dave suggests that investors use loaded funds; a strategy that means the investor will pay commission to an investment adviser and broker. However, Dave didn’t mention the no-load funds’ option in his investment philosophy.

A major reason for this is primarily because of his ELP’s; the ELP’s get a commission from the investment advice they give and not the product they sell. As such, you might prefer the no-load funds option.

In Summary

Dave Ramsey has a lot of financial advice from money market accounts to annuities to extended warranties to mutual funds. While some say Dave Ramsey is wrong in his advice on certain topics, I still like to understand what he says on investing to be informed.

However, some of his mutual fund investment strategies don’t fit with that of other finance experts. As such, you might want to make some alterations to Dave’s investment philosophy to give a more outstanding profit.

You’ve probably heard for years that Dave Ramsey considers mutual funds as a lucrative investment. But after researching mutual funds, you’re lost in the lingo and more confused than before. The internet is filled with multiple and divergent opinions on mutual funds. As such, you may want to consider the opinion of a financial expert like Dave Ramsey.