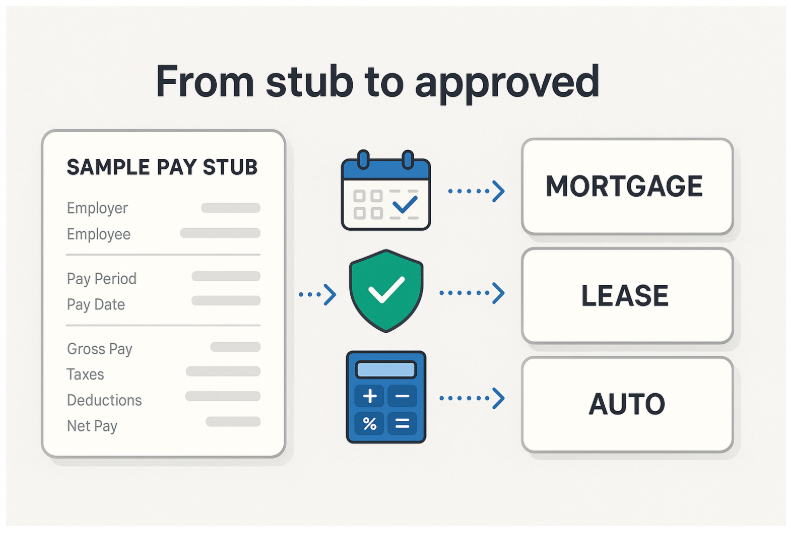

Need to prove your income for a mortgage, lease, or car loan—fast? A pay stub is usually the quickest, clearest way to do it. On one page, it shows your gross pay, tax withholdings, deductions, and the net cash that actually hits your account. Because the numbers come straight from payroll, tampering stands out, which is why underwriters commonly ask for two or three recent stubs. Landlords rely on them too, often requesting a small stack of recent copies. Stubs also speed up lender math (hello, debt-to-income ratios), help catch fraud before it becomes a charge-off, and travel well as clean PDFs you can scan, snap, or share.

In this guide, you’ll learn exactly how to use a pay stub as proof of income—whether you’re a W-2 employee or a 1099/gig worker—and, if you don’t have one handy, the fastest legitimate way to generate a lender-ready pay stub online. We’ll compare top tools and give you a red-flag checklist so you can move forward with confidence.

Who needs to see your stub and what they look for

Mortgage lenders

Mortgage lenders typically want pay stubs that cover the most recent 30 days of income for a conventional mortgage backed by Fannie Mae or Freddie Mac. In practice, that equals two–three stubs depending on whether you’re paid weekly, biweekly, or monthly.

Each stub must be dated within 30 days of the loan application and show year-to-date totals. Any mismatch with the salary on your form triggers follow-up questions.

Most lenders cap debt-to-income (DTI) at 43 percent of gross monthly pay—the CFPB ceiling for a qualified mortgage. Your stub’s net pay shows real cash flow against that limit.

If commissions move your paycheck, expect extra proof: more stubs, recent W-2s, and matching bank deposits. The aim is simple—show the income on paper matches the money in your account every month.

Send clean, current stubs first, and you move faster from conditional approval to clear-to-close.

Landlords and property managers

Most apartment owners use one rule of thumb: your monthly household income needs to be at least three times the rent. A 2024 survey of rental listings showed that 78 percent cited the 3× rule, while only seven percent listed no income requirement.

To prove you clear that bar, managers usually ask for the last two or three pay stubs, enough to cover 30–60 days of earnings. The American Apartment Owners Association even recommends three months of stubs to “provide an accurate picture of the tenant’s usual income.” Staff check pay dates first to confirm you are still employed, then multiply your net income by three to verify you meet the threshold.

If you changed jobs recently or work variable hours, expect follow-ups such as an offer letter or a bank statement that shows recent direct deposits. The pay stub remains the primary document because it bundles employer name, pay period, and year-to-date totals in one tidy column.

Fraud is another concern. A 2024 National Multifamily Housing Council survey found that 84 percent of property owners have spotted falsified pay stubs or other income documents. Red flags include perfectly rounded numbers, mismatched logos, or uneven fonts; any of these can trigger manual verification before your application moves ahead.

Auto finance and other lenders

Auto lenders, personal-loan platforms, and card issuers all start with the same question: Can this borrower repay on time? A computer-generated pay stub dated within the last 30–40 days is their quickest way to confirm. Tools such as FormPros’ pay-stub generator, which generates lender-ready stubs with accurate tax calculations, illustrate how quickly borrowers can produce the type of document finance companies now expect.

Capital One Auto Finance, for example, asks for a stub issued within 40 days that lists year-to-date earnings and taxes withheld.

How the math works. A finance manager enters your net pay into an affordability calculator, pairs it with your credit score, and compares the result with the monthly payment you want. When the stub is clean and current, this review can finish before you complete a test drive.

Fraud filters keep tightening. Synthetic-identity and falsified-stub schemes cost U.S. auto lenders about two billion dollars in exposure during the first half of 2024, the highest of any credit segment. Lenders now run documents through pattern-recognition software that checks tax withholdings, pay dates, and even font spacing against known payroll layouts. If something looks off, they ask for back-up proof such as bank-deposit records or a direct call to human resources.

Show up with a recent, legible stub that lists gross pay, deductions, and employer information, and the conversation moves quickly from “Can we trust this?” to “Which rate fits your budget?”

Government programs and insurers

If you’re applying for SNAP, WIC, a state child-care subsidy, or an ACA health-insurance plan, be ready to provide pay stubs that show the last 30 days of earnings.

State benefit offices typically define “current” proof as stubs dated within the past 30 days. For example, Michigan’s Department of Health and Human Services uses this standard for cash, food, and medical aid.

For child-care subsidies, Wisconsin Shares asks each adult applicant for stubs covering the past 30 calendar days, plus the employer name, pay rate, and hours worked.

Health-insurance marketplaces give applicants up to 90 days to resolve income mismatches, but the federal Marketplace advises uploading documents immediately to avoid subsidy changes.

Even a one-dollar error can push you above or below a program threshold, altering a tax credit or benefit level. Clean, recent stubs shorten follow-up requests and speed approval for the help you need.

Use-case nuances

Home loans: stricter by design

Because a mortgage can last 15–30 years, lenders need proof that your income is both current and consistent. Conventional loans backed by Fannie Mae or Freddie Mac follow a three-part check: underwriters want pay stubs that cover the most recent 30 days and include year-to-date totals; they also ask for the last two years of IRS W-2 forms—or full tax returns for self-employed borrowers—to confirm today’s pay aligns with prior earnings; and if commissions, overtime, or bonuses make up part of your income, you’ll need 12–24 months of documentation plus a note explaining how that pay is calculated.

A stub from a brand-new job does not knock you out, but it triggers extra steps such as proof you cleared any probation period, letters that outline compensation, and sometimes a thicker “stub stack” of up to six months. Most lenders accept PDFs through a secure portal, yet analysts still compare each line to bank deposits and may call human resources when figures look off. Supplying clean, consistent stubs with supporting W-2s or returns can trim days from the path between conditional approval and clear to close.

Rentals: quick yes or no

Because non-payment is a landlord’s biggest risk, most U.S. listings advertise an income-to-rent ratio of 2.5 to 3 times the monthly rent. A LeaseRunner analysis calls 3 times “the industry standard,” and notes that stricter markets may push to 4.

Provide two or three pay stubs covering the past 30–60 days, and screening tools such as RentPrep or TransUnion SmartMove can confirm in seconds whether your net income meets the bar.

Managers rarely ask for tax returns unless something looks off. Red flags include irregular pay dates, perfectly round numbers, or an employer name that does not match your ID. Application fraud is rising; 84 percent of property owners reported falsified income documents in 2024, so many landlords now run authenticity checks before approval.

If you recently changed jobs, add an offer letter or a bank statement showing your first direct deposit. These extras show that the numbers on your stub will keep arriving each month and can turn a possible red flag into a green light.

Gig workers and freelancers: DIY, but honest

Driving for a rideshare app, designing logos on Upwork, or invoicing through your own LLC rarely comes with employer-issued pay stubs. That does not erase the need for proof of income.

Most verifiers accept Form 1099s, bank statements, or a year-to-date profit-and-loss report, yet those documents can bury your net pay in pages of deposits. Creating a self-generated pay stub tidies the picture as long as the numbers match your bank records and 1099 totals.

According to Zillow’s 2025 rental guide, many landlords will accept two–three months of bank statements or recent 1099s for self-employed applicants, provided the figures match a clean earnings summary. For mortgages, non-QM “bank-statement loans” usually need 12–24 months of statements instead of W-2s or stubs.

Best practice for freelance income verification:

- Generate stubs from real deposits. Pull totals from your bank or accounting app, then use a reputable stub generator that auto-calculates taxes.

- Match supporting papers. Attach the related 1099 or a snapshot of the matching bank deposits so reviewers can reconcile totals quickly.

- Explain swings. If income is seasonal, add a one-sentence note such as “design work peaks November through January” to pre-empt follow-up questions.

Pair honest stubs with recent 1099s or tax returns, and even strict underwriters will view you as an organized, credible borrower.

Need a pay stub fast? How online generators work

Picture this: the leasing agent likes your application but needs proof of income before the office closes. Instead of digging through emails, you open a pay-stub generator and create a document in under 5 minutes; many tools promise a PDF in 3 minutes or less.

A generator is simply a secure web form that mirrors payroll software. You enter details such as company name, pay period, hours worked, and deductions. The engine applies current federal and state tax tables, formats the math into neat columns, and lets you download a polished PDF instantly.

Speed matters, yet credibility matters more. Look for:

- Independent ratings. FormPros, for example, carries an A-plus rating from the Better Business Bureau.

- HTTPS and clear privacy terms. A locked URL keeps salary data encrypted.

- Accuracy guarantees. Reliable sites offer a money-back or free-edit policy if calculations are wrong.

Use these tools responsibly. The numbers must match your bank deposits or 1099s. Treat the generator as a convenience, not a “Photoshop shortcut,” and your stub will pass both the quick glance and the forensic zoom.

Comparing top pay-stub generators

Price is only one factor; accuracy, security, and refund policies matter just as much. Below are six popular services with their public pricing. Each entry notes typical cost, speed claims, and standout features.

FormPros

Priced at $8.99 per stub or an $8/month unlimited plan, FormPros delivers instant PDF downloads. Enter company, employee, and salary details and create a pay stub in minutes; the generator auto-calculates earnings, taxes, and deductions and produces a printable PDF. It also carries an A+ BBB rating, SSL-secure checkout, and a 30-day money-back guarantee for buyers who want clear trust signals.

PayStubCreator

At $8.99 per stub, PayStubCreator claims sub-5-minute generation. Its accountant-built templates and 30-day satisfaction pledge make it a straightforward pick if you want a clean layout without subscriptions.

ThePayStubs

Typically $8.99 per stub (often ~$5 with coupons), ThePayStubs offers instant downloads and state-specific layouts. The 24/7 live chat is handy if you need help late at night.

PayStubs.net

Choose $7.95 per single stub or subscription tiers if you create stubs regularly. Expect ~2-minute PDFs, secure cloud storage, and bulk options that suit small businesses.

MrPayStubs

At $5.99 per stub, MrPayStubs emphasizes speed with a ~30-second turnaround. You can preview for free before purchase, making it a quick, low-friction option.

123PayStubs

Priced at $3.99 per stub with the first stub free, 123PayStubs offers instant downloads. Its step-by-step wizard is beginner-friendly and among the lowest single-stub prices.

Each service produces a PDF in minutes, so weigh the factors that matter most to you:

- Volume. If you create stubs every month, PayStubs.net’s subscription may beat per-download fees.

- Around-the-clock help. Need late-night support? FormPros and ThePayStubs provide live agents 24 / 7.

- Security first. Confirm the site uses HTTPS, lists a physical address, and offers a written refund policy before entering payroll data.

Remember, any generator is only as truthful as the numbers you enter. Pick a platform you trust, use accurate income data, and your stub should pass both a quick glance and a detailed review.

No recent pay stubs? Other documents that work

If you are between gigs, paid in cash, or newly self-employed, lenders and landlords will usually accept one or more of the documents below, as long as the numbers align across each source.

Bank statements. A bank-statement mortgage can qualify a non-traditional borrower with 12–24 months of personal or business statements instead of stubs or W-2s. Reviewers look for a steady rhythm of deposits, so highlight the income lines before uploading the PDF.

Tax returns. A full Form 1040 or recent W-2 shows last year’s earnings exactly as the IRS recorded them. Most underwriters ask for the last two years if current income varies.

Employment letters or contracts. A letter on company letterhead that confirms title, start date, and salary can bridge gaps for a brand-new job. Many landlords supply templates for these letters.

For teams that issue these regularly, a legal document generator helps standardize employment-verification letters and contracts so reviewers see the exact details they expect.

Profit-and-loss (P&L) statements. Freelancers can pair a year-to-date P&L with paid invoices to show both revenue and cash collected. Add two–three months of bank statements so the math is easy to trace.

Benefit or award letters. Social Security, VA, or pension letters list the exact monthly benefit and payment schedule, offering solid third-party proof for fixed-income applicants.

Whichever mix you choose, aim for overlap. When two documents echo the same dollar amounts, trust builds quickly and your application moves forward with fewer questions.

Spotting scam generators: a 9-point checklist

Thousands of pay-stub sites exist, but only a fraction follow basic security and accounting rules. Before you enter salary data, run the service through this quick audit. If it fails two or more items, move on.

- Unrealistic pricing. Legitimate tools charge $4–$9 per stub. “Free forever” often hides data-harvesting schemes.

- No HTTPS padlock. A missing lock icon means your income details travel unencrypted.

- Missing contact info. Reputable sites list an email, phone number, and physical address. Anonymity signals risk.

- Zero or awful reviews. Search the company name plus “reviews.” Legit platforms collect feedback over years; scam sites vanish once complaints mount.

- “Undetectable fake” language. Any pitch that sells deception encourages fraud. Income-document scams drained auto lenders of $3.6 billion in 2023.

- Sloppy template. Real stubs show pay period, employer address, taxes, and year-to-date totals. Misaligned columns or rounded tax figures scream fake.

- No tax withholdings. Unless you are a true 1099 contractor, a stub with zero deductions is an instant giveaway.

- Sketchy payment flow. Be wary if the site accepts crypto only or routes payments through unsecured portals.

- No terms or privacy policy. Trustworthy businesses publish clear legal pages that explain data use and refunds.

Trust your judgement. If a generator trips even one of these alarms, choose a platform that leads with transparency and spare yourself—and your landlord—a verification headache.

Conclusion

Consistency builds confidence: make sure the dollar amounts on your stub match the deposits in your bank statement, the salary on your offer letter, and the totals on last year’s W-2. Use recent documents—most lenders and landlords want stubs dated within the past 30–60 days—and remember that mortgage underwriters often re-pull credit and request fresh income documents once that 60-day window closes.

If you’ve had a spike or dip (a quarterly bonus or lost overtime), add a short note so the change doesn’t raise a red flag. Save digital copies for at least one year—the IRS advises keeping income records until they’re reconciled against your W-2—and note that many lenders can request re-verification during a refinance or renewal. Finally, ask before you send to confirm that self-generated stubs are acceptable. When your paperwork is current, consistent, and well organized, approvals move faster and you stay in control of the timeline—especially if you understand what lenders want to see when reviewing proof of income documents.

FAQ

Are self-generated pay stubs legal and accepted?

Yes—if the numbers are accurate and reflect real income. Acceptance is up to the recipient, so be ready to back them up with bank statements, 1099s/W-2s, or tax returns.

How many pay stubs do I usually need?

Most lenders and landlords want 2–3 recent stubs covering about 30 days. Some rentals ask for up to 60–90 days; government programs commonly require the last 30 days.

Do digital copies or phone photos count?

Generally yes. Clear PDFs uploaded through a secure portal (or legible photos) are widely accepted. Make sure dates, employer info, and year-to-date totals are readable.

What if I’m self-employed or a gig worker without employer stubs?

Provide 1099s, bank statements, and/or a year-to-date P&L. You can generate your own stub using your real deposits, but mortgages may still require 12–24 months of statements or tax returns.

My income varies (overtime, tips, commissions). What should I include?

Submit more history (often 12–24 months), plus a brief note explaining how variable pay is calculated. Ensure your stubs’ YTD totals align with deposits and prior-year forms.Can I redact sensitive information?

You can usually mask full SSNs or account numbers (leave the last four if requested), but keep names, employer details, pay periods, gross/net pay, and YTD totals visible.