It’s no secret that we are living in some pretty unprecedented times. Geopolitical strife, wars, and a seeming challenge to the status quo when it comes to the hegemony that has had the sole power to bend the world to its will over the past 70 years. But while all of this is generally pretty esoteric stuff for the average person, figuring out how to pay the bills, ensure your family doesn’t go without, and all while attempting to save for a rainy day, is what is on the minds of most of us mere mortals. These issues are further compounded when you’re only bringing in a single income for whatever reason and trying to make it stretch as much as possible, even when the cost of goods is seemingly on a never-ending rise.

However, for those willing to learn the dark arts of financial planning and are able to make a few sacrifices that don’t take away everything that ensures we are living life rather than merely existing, there is light at the end of the tunnel. The points in this post won’t secure your future overnight, but with a sustained effort and the discipline to carry out some changes, you can be assured that there will come a time when you are worrying less about how much money occupies your bank account, and thinking more about which colleges to send your kids to that are based on quality rather than what you can afford.

Image source: https://images.unsplash.com/photo-1758522487140-f6d76156d7d3?q=80&w=1332&auto=format&fit=crop&ixlib=rb-4.1.0&ixid=M3wxMjA3fDB8MHxwaG90by1wYWdlfHx8fGVufDB8fHx8fA%3D%3D

The Challenges Of Single-Income Households

While there are plenty of families that bring in multiple incomes that are still struggling to get by, single-income households tend to have a unique set of challenges that can sometimes feel almost impossible to overcome. Fortunately, when you can get into a rhythm, money management for single parents or those with parents unable to work can start to become far easier. Perhaps the three most common concerns that families in this situation encounter include:

- Over-reliance on credit: When you need money fast, it’s easy to fall into the credit trap. Nd what a trap it can be because once you’ve succumbed to it, it can feel insurmountable to escape (although as we will note, you can consolidate and reduce over time, so all is not lost).

- Ignoring lifestyle inflation: When you come into a windfall, too many people feel as though it’s a time to splurge on the things they want rather than need. This is perfectly understandable, especially if you’ve gone without for a long time, but it can lead to further disasters down the line.

- Underestimating healthcare costs: It’s probably unfair to infer that people underestimate the cost of healthcare since most will have actually experienced this issue at some point. But it’s still an issue facing many single-income households.

So that’s the bad news, much of which you are likely already au fait with, but what are the solutions to these concerns?

Image source: https://images.unsplash.com/photo-1633158829556-6ea20ad39b4f?w=600&auto=format&fit=crop&q=60&ixlib=rb-4.1.0&ixid=M3wxMjA3fDB8MHxzZWFyY2h8MTB8fGJ1ZGdldHxlbnwwfDB8MHx8fDI%3D

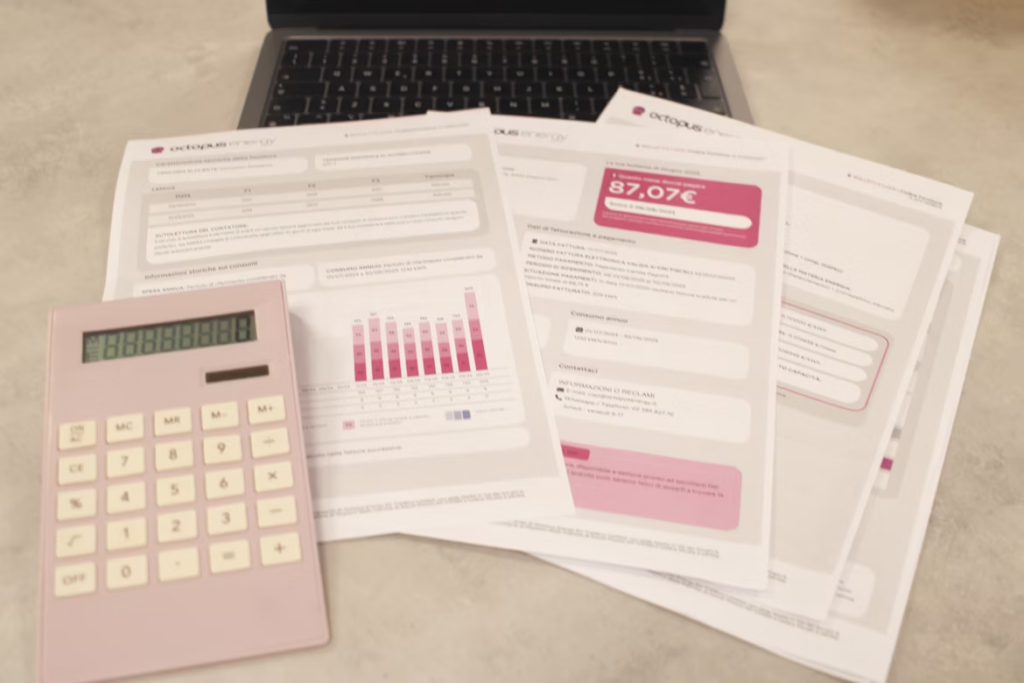

Creating A Bulletproof Budget

The first and arguably easiest and most low-hanging fruit to collect is to sit down with a cup of coffee and go through (or create from scratch) a household budget. Your first step is writing down everything that comes out of your bank account on a daily, weekly, and monthly basis, then seeing how it tallies up with your income. Even if you are just about making ends meet, you really want to be in a position where you have enough to save for the future or a rainy day. It can be fairly tricky at first, because there is often an urge to massage the figures in order to avoid having to make difficult choices. But by using any of the literally thousands of mobile apps, or simply creating a good old-fashioned spreadsheet from an online template, you can easily achieve this task. Be aware, though, if you are really struggling, you will need to be ruthless with the things you cut. It might be that you need to condense your decisions down to wants vs needs, and no, Netflix and Taco Bell are not needs.

Consolidate If Possible

For those of you currently drowning in debt, there might be a solution in consolidation. You need to note that this isn’t a panacea for curing your vast amounts of unmanageable debt obligations, but it can help to turn multiple repayments that occur at disparate intervals into one much easier amount that only occurs at one date. This makes it much easier to plan for and ensures that you won’t forget about an upcoming payment and suddenly find your account in the red again. You can use a dedicated company or possibly enlist the help of local charities to help you find companies able to assist you with this task.

Image source: https://images.unsplash.com/photo-1753955900083-b62ee8d97805?q=80&w=1170&auto=format&fit=crop&ixlib=rb-4.1.0&ixid=M3wxMjA3fDB8MHxwaG90by1wYWdlfHx8fGVufDB8fHx8fA%3D%3D

Investing Wisely To Build Wealth Over Time

Financial planning isn’t just about figuring out which subscription service to cut and what sacriciesyou need to make to stay afloat. It also involves setting up plans that can help you not just to save money, but to actively use the money you invest to compound and grow over time. Most people avoid this out of a fear of the unknown, but investing has become easier than ever. While there are absolutely risks involved, taking a slow and steady approach that spans decades (such as investing in an ETF that tracks the S&P 500 rather than sinking everything into BTC) pays off more often than not. For example, investing just $200 per month into an ETF that grows at 7% (which is relatively conservative) can yield the following amounts:

| Years | Monthly investment | Total invested | Projected value |

| 5 | $200 | $12,000 | $14,318.58 |

| 10 | $200 | $24,000 | $34,616.96 |

| 20 | $200 | $48,000 | $104,185.33 |

This shows that after 20 years, you will have spent $48,000 to end up with $104,000 ish! Can you imagine what you could do with that extra money? Can’t afford $200 per month? That’s OK. Any amount, even just $10 per month, is better spent in an investment like this than on something frivolous.

It’s difficult to arrange your life when struggling for money and living paycheck to paycheck. For anyone in this situation, life can feel like a never-ending struggle. But, by drastically cutting back on things that aren’t needed, and putting those savings to work, you can leave this life behind you and get into a position where you are genuinely able to plan your life and those of your family, leading to a much happier and more comfortable outcome.