You are starting Dave Ramsey baby steps and are learning about starting creating $1,000 Emergency fund per Baby Step 1. This is an amazing feat considering that many Americans are financially vulnerable and would have difficulty covering an emergency expense of $400 (Source and Source).

Dave Ramsey calls on us to create an emergency fund to handle those emergency expenses. If you have an emergency fund, you can then focus on handling your debt without the need to go back and use your credit card.

The purpose of this article is to help you understand Dave Ramsey’s emergency fund and also show you which tools you can to help you track it.

Also, as a Dave Ramsey die hard, I created the 3 best, simple things that you can do today (in my opinion) that can help you get to baby step millionaire just that much faster. I’d encourage you to check it out!

The Purpose of Dave Ramsey’s Emergency Fund

Dave Ramsey says the purpose of the emergency fund is insurance, not an investment (source ~ 1:15). Your emergency fund is to protect you from unexpected events. Your emergency fund isn’t designed to make you money. If you do not have debt, Dave Ramsey’s recommended emergency fund is three to six months of expenses. He calls this a fully-funded emergency fund.

So, the key is that it’s an emergency such as a car accident or a hospital visit or a leak roof.

What Are Best Practices To Build An Starter Emergency Fund?

In my opinion, the best option is to start small. You could start by saving $1 per day or $2 per day. You can add that to an envelope or have that moved directly into a new checking or bank account. Just make sure there are no fees with starting a new account.

You may want to get religious on tracking your income and expenses. For example, in Baby Step 1, I would highly recommend that you find an app for your phone that is both a debt payoff planner and a zero-based budget. After a long search, I wrote about how I found the perfect tool for Baby Step 1 and Step 2.

Tracking Your Emergency Fund

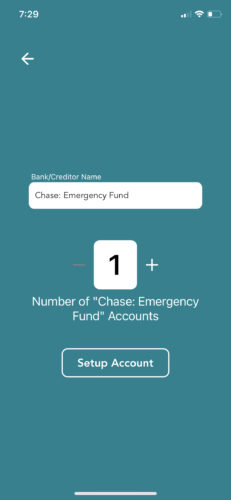

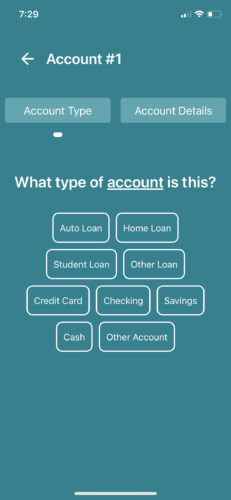

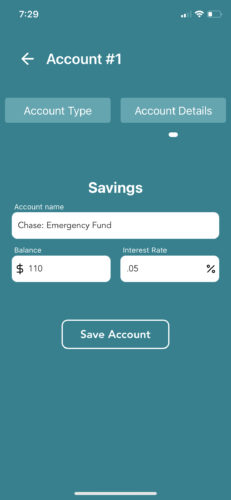

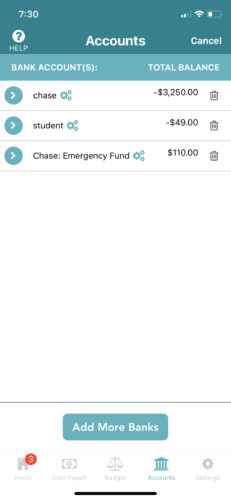

Let’s say you wanted to start a Chase savings account for your emergency fund. I provided some screenshots of the tool I use. Basically, you would create the account with your bank then you can start tracking your information in your tracking tool.

Add an Account

Select “savings account” or “checking account” for your emergency fund

Add information about your emergency fund

Save the information for your emergency fund

The above option is using the manual option. If you used the automated version, your balances would update automatically for your emergency fund.

Where Does Dave Ramsey Say To Keep Your Emergency Fund?

Dave Ramsey states that your emergency fund should be in a place that is easily accessible such as a simple savings account, money market account or an online bank account. The key is that it’s accessible whenever you need it. Rachel Cruz mentioned that they keep her husband and her keep it in different bank accounts to make sure they don’t dip in it. So, you may stay away from keeping it in cash.

When should you use your emergency fund?

Dave Ramsey has 3 questions to ask yourself whether you should use your emergency fund. Is it unexpected, necessary and urgent? If so, this may be a justifiable case.

Is a $1,000 Starter Emergency Fund Enough?

No, this is where Dave Ramsey and I differ in our views. He even mentions this in his recent article that the point of this emergency fund is to light a fire under you. His point is that having only $1000 available will make you payoff your debt event faster. I don’t necessarily agree with this point.

You can see my viewpoint here, but I strongly believe you should build your first emergency fund based on the percentage of your monthly income. Here’s the reasoning:

- Inflations exist; as such, $1,000 does not worth the same as it did 20 years ago—which means that you may need to invest back into your credit card if your dishwasher breaks and you need to replace it.

- In reality, you may earn a lot of income and have a high expense; as such, you should have an emergency fund that is designed based on a percentage of your income.

Understand Dave Ramsey’s Fully Funded 3-6 Month Emergency Fund

Thankfully, Dave Ramsey doesn’t end with a $1,000 emergency fund. Baby Step 3 is dedicated to building a 3-6 month emergency fund of your expenses. Dave describes this emergency fund to protect you against bigger life surprises such as a job loss or a car breaking down. This emergency should protect you from going back into debt.

How do you setup a 3-6 month emergency fund?

Now that you are out of debt, you can start putting the money that you were putting towards your debt to fully fund your emergency fund. Personally, I would just add these funds to your existing $1,000 emergency fund as you are essentially continuing to build onto that original starter emergency fund.

How Do I Set Myself Up to Succeed in Baby Steps?

You are in this in the long haul because you are gazelle intense. To stay gazelle intense, I would recommend that you find a great debt payoff app that will help you along the way. Get in a Facebook community group that can encourage you along the way. Check out my six milestone strategy for Baby Step 2.

As a Dave Ramsey die hard, I created the 3 best, simple things that you can do today (in my opinion) that can help you get to baby step millionaire just that much faster. I’d encourage you to check it out!

Finally, Dave Ramsey’s baby steps may provide you with a solid finances that can help prevent financial hardship, and the need for a pay day loan. Pay day loans traditionally have high interest rates, and can incur additional financial hardship. That said, if you absolutely need a pay day loan and live in Ontario, there are payday loans in Ontario.

That said, you may consider the pros and cons of each of these options.