This article may have affiliate links that help support this website.

Baby Step 7 of the Dave Ramsey Baby Steps is all about “building wealth and giving”. I like to be very transparent to my readers, so here are a couple of personal examples:

- One of the biggest questions I researched and wrote on is Dave Ramsey and Mutual Funds, so I created an article covering how we invest and which products I use for investing

- My wife and I like going on vacation, but in 2014, we decided we would like to travel for free. Since 2014, my wife and I have gotten over $50,000+ in free travel. Instead of using money out of pocket, we were able to go on some fun vacations without breaking our pocketbooks.

Dave’s Baby Step 7 says “build wealth and give.” He believes that now that you’re debt-free, and you have some money stockpiled in your investment portfolio, it’s best to keep building wealth and be generous. Let’s help you understand this baby step better by answering the questions on your mind.

What are the Ideas that Dave Ramsey Provided to Build Wealth

In his article titled “how to build wealth at any age” he gave some tips that are designed to help people of different age groups to increase their wealth.

How I Build Wealth in Baby Step 7

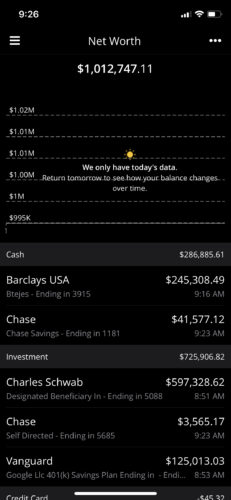

Let’s discuss how I have built wealth in Baby Step 7. Firstly, here’s a snapshot of my Personal Finance account. If you haven’t seen already, here’s what sort of tools I use for my finances.

What I do not have in my above accounts is my Coinbase account which manages my cryptocurrency. You can find more information on Coinbase here. I do not own a lot of cryptocurrency, but I do have some Etherium in my portfolio. What does Dave Ramsey think of Cryptocurrency? I actually covered that in this article covering Dave Ramsey and Cryptocurrency.

Personally, here’s where my money is situated at the moment. This is not investment advice, but hopefully you can get a sense of how I am building wealth in Baby Step 7.

- Mutual Funds

- Gold Stocks (IAU, GLD)

- Cryptocurrency

- Digital Assets (mainly blog assets)

- Investing in Startups (Angel investing)

- Short term investments (money market, not a great return)

- High interest bank accounts

The two more interesting things that I invest in are digital assets and startup investing. As I have my own startup, I believe I have a knack for understanding startup operations. We will see whether that proves to come to fruition. Please reach out to me directly at [email protected] if you have any questions.

Now, let’s cover what Dave Ramsey states about building wealth at any age.

Building Wealth At Any Age

Let’s talk about how people can build wealth at any age.

For People In their 20s

AVOID DEBT: Dave Ramsey believes that this is the best age to avoid debt. And in an instance where you’re already in debt, he suggests that you use the debt snowball method to eliminate the debt as soon as possible.

LIVE BELOW YOUR MEANS: Always say no to purchasing things you can’t pay cash for. Dave noted that overspending will gradually make you poorer.

START EARLY: It takes a little time to build a million-dollar, you only need to start as soon as you can, and invest diligently in your retirement portfolio.

For People in their 30s-40s

WATCH YOUR HOUSING BUDGET: if you can’t pay cash for your home, ensure that you don’t pay more than 25% of your monthly payments.

SECURE YOUR EMERGENCY FUND: Your emergency fund is very important to prevent you from falling into debt.

SAVE FOR RETIREMENT FIRST: You’ll definitely retire someday. Always have it at the back of your mind when spending money, and when you’re planning your investment.

For People above 50

MAKE ANNUAL CATCH-UP CONTRIBUTIONS: if you’re above the age of 50, or you’re exactly 50. It’s best to invest an extra $1,000 in your Roth IRA. One thing to consider is Dave Ramsey and Annuities and whether that may be a good option for you.

HEALTH INSURANCE: The probability of requiring medical care increases as you grow older. As such, this is the age to invest in a health insurance scheme as soon as you can.

Can You Invest Your Fully Funded Emergency Fund?

Don’t invest your emergency fund, except it’s in an asset that can be quickly liquidated. Dave believes that an emergency fund should be liquid—which means that you should keep it in a place where you can easily convert it to cash and spend easily.

He recommends that your emergency fund should be kept in either of these accounts:

- A savings account that’s linked with your checking account

- Money market that features check-writing privileges or any other mode of withdrawing money.

- A bank with high interest rate where money can easily be withdrawn without hassle.

The main thing is that it should allow you to pay for emergency services and needs with ease. However, ensure that your emergency fund is not kept I a place that’s too easy to access. Doing so will result in a situation where you’re spending the money for non-emergency purposes. n

What Does Dave Ramsey Say About Giving?

In Dave’s article titled “Gain a New Perspective on Giving” Dave recommended that giving should always be a priority, irrespective of the situation. However, he says that he’s not supporting the kind of giving that’ll hurt your financial goals; he also believes that everyone has some money to spare. It’s difficult being a cheerful giver if it means your kids won’t feed.

Should you wait till Baby Step 7 before Giving?

Dave believes that giving to causes and people you care about is not just beneficial to the recipient, but also to you as well. As such, he believes in always giving back based on your capacity. In summary, Dave Ramsey believes in the philosophy of “Give back what you can.”

Our perspective is that you may choose to give before you reach Baby Step 7.

In Summary

Dave Ramsey has a gamut of opinions on numerous personal finance topics. One such topic as depicted by his baby step 7 is the act of giving and building wealth. If you’re a Dave Ramsey’s follower, and you want to tap into his idea on this topic, then read this article as it contains the thoughts of Dave on those topics.