I appreciate so much about Dave Ramsey’s baby step method, but what does he think about student loan consolidation?

You may be looking at $100,000+ in student loan debt and wonder what Dave Ramsey thinks about student loan consolidation.

After working at Google in Financial Operations, I was an executive at a loan debt consolidation firm. You also know that I write a lot about Dave Ramsey and the Dave Ramsey’s Baby Steps. So, I know a lot about student loan consolidation and what Dave Ramsey thinks about it.

Secondly, I absolutely love Zina Kumok’s course at Student Loan Knockout that provides a 20 day course to help you eliminate debt quickly with many of Dave Ramsey’s principles. Check it out!

What Is Student Loan Consolidation?

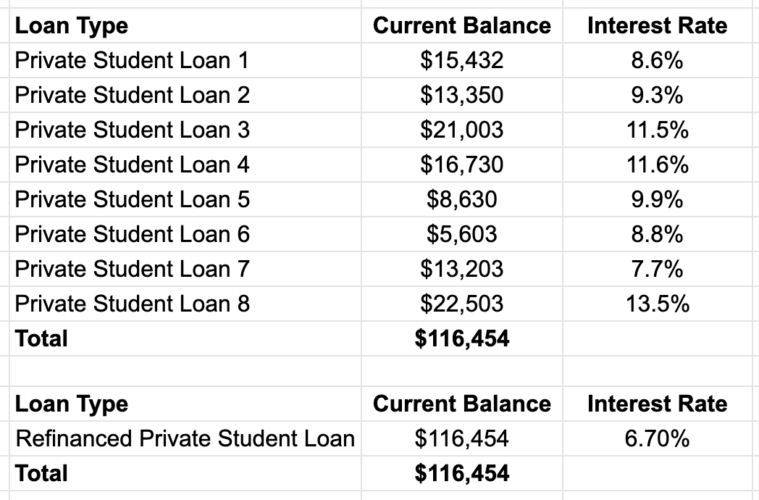

The goal of student loan consolidation is to take multiple smaller student loans and consolidate them into one larger student loan and one monthly payment. The goal can also include: 1) Obtaining a lower interest rate to save money. 2) Getting a fixed rate instead of a variable interest rate to protect against future interest rate growth risk (i.e. your student loan interest rate going from 5.4% to 11.7%).

See the simple student loan debt consolidation example below. You are consolidating higher-interest student loans into one student loan. You are also lowering your total interest rate. In this example, you would save significant money. Voila.

What Does Dave Ramsey Think About Student Loan Consolidation?

Thankfully, we know a lot about what Dave Ramsey thinks about student loan consolidation. Why? Because Dave Ramsey shares his views openly both on his website and on his Podcast. While we know that Dave Ramsey does not approve of credit card and unsecured loan debt consolidation, he has a somewhat different approach regarding student loan consolidation.

So, when does Dave Ramsey state that student loan consolidation is okay? Dave Ramsey approves of student loan consolidation in certain situations.

Let’s go through the situations.

Dave Ramsey states on his podcast (1:55 mark), “the only reason you consolidate student loans is if you get and end up with a lower overall interest rate…”. He also mentions on his podcast titled, “When Is It Smart To Consolidate Student Loan Debt?” at the 0:45 mark that moving from a “variable rate to a fixed rate” can make sense. He goes on to talk about how it’s important to understand how much you will save from consolidation.

So, how much will you save from Dave Ramsey’s recommended student loan consolidation?

This is the most important question. Our time is worth money, so consolidating from 10 payments into 1 payment is helpful. But how much actual money will you save and which loan provider should you choose?

Who should I choose to refinance my student loans?

I have never recommended a specific student loan consolidation company because I had always thought they were the same. So, when a head of business development reached out and told me that you could save additional interest rates through group negotiation, I was intrigued.

Theoretically, I understand the concept. You group your student loans with $100-$200 Million (Yes Million) in other student loans. An entity takes those student loans to a bank and negotiates a better interest rate directly. Voila.

By negotiating with other individuals with student loans, you may be able to secure a better interest rate or cash back, saving you hundreds to thousands vs SOFI or other student loan consolidators.

What is it? It’s called Juno (formerly called LeverEdge (it took me a while to see that it’s a play on leverage)). Essentially Juno uses leverage to get you a better interest rate. As someone who is constantly trying to figure out ways to eliminate debt faster and cheaper, I was excited to partner with them.

How much will I save?

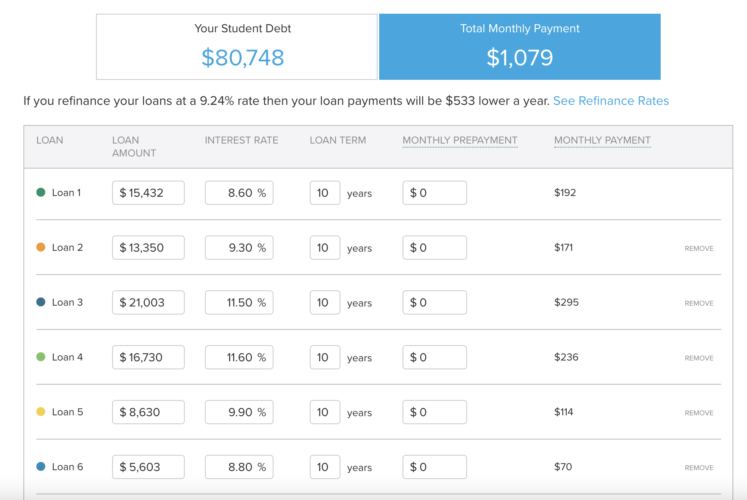

I am working on my own, simple student loan amortization calculator as many options are inundated with ads. I liked Smart Asset’s calculator the most thus far as you can enter multiple loans. That said, I didn’t like that the maximum was only 6 loans. So, to calculate how much you will save, I would suggest to do the following.

1. Add your current debts to the calculator. Let’s look at the example below.

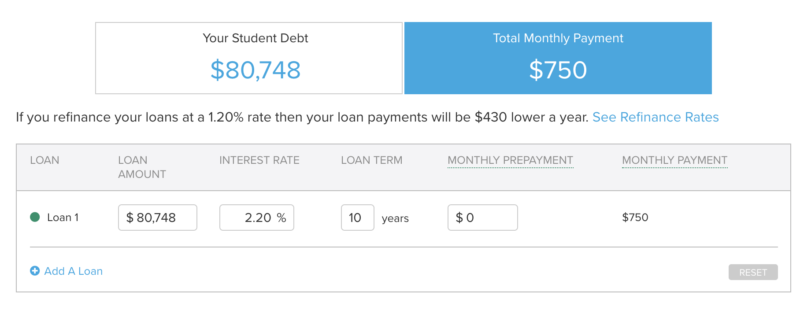

2. Get a rate from a student loan refinancer such as Juno and plug that rate in the calculator.

This is an extreme example to make a point. That said, you’ll see your monthly payment decreasing from $1079 per month to $750 per month. In 10 years, you would save $39,480 in interest payments ($329 per month x 10 years x 12 months per year).

What is the difference between student loan consolidation and refinancing?

In Dave Ramsey’s article covering whether you should consolidate student loans, Dave states that only federal student loans can be consolidated. Your other student loans can potentially be refinanced.

What does Dave Ramsey mean about student loan consolidation?

What Dave means is that you can consolidate student loans via the Federal Student Loan website one time.

When you consolidate your federal loans, you are essentially consolidating them into one payment instead of multiple payments.

Do you save money? Not necessarily, the website states, “If you have multiple student loans you may be able to combine them into one loan with a fixed interest rate based on the average of the interest rates on the loans being consolidated.” They are taking the average of the interest rates.

Before you consolidate federal student loans, I would highly advise you to read the government’s website that states the pros and cons of federal student loan consolidation, specifically that consolidating your federal student loans can simplify your payments, but it can also result in loss of benefits.

What does Dave Ramsey mean about student loan refinancing?

In the same article, Dave writes about student loan refinancing. In student loan refinancing, you are taking private student loans or a mix of private and federal student loans and attempting to get a better interest rate to save on interest. You may also be looking into consolidation to get out of a variable interest rate that can be risky if the market interest rate increases.

Again, check out Zina Kumok’s Student Loan Knockout that provides a 20 day course to help you eliminate debt quickly with many of Dave Ramsey’s principles if you’re interested.

Let’s Dig Into Some Cautionary Signs About Consolidating Student Loans?

- You may not be able to consolidate when you are enrolled. On the same Dave Ramsey podcast, Dave mentioned that you may not be able to consolidate loans if you are currently enrolled. This may be challenging if you quit school, and are now facing high-interest rates. In this case, you may have to make sure you are not enrolled before you consolidate.

- A bankruptcy attorney once provided this word to the wise. If you refinance your federal student loans, you are effectively giving up all of the federal student loan programs, so it may not be a very good idea to refinance federal student loans. On the flip side of that, are you going to need the programs or is the interest savings better?

- Your loan term may reset, making your payments on those loans longer. Let’s say you have 4 years left on your student loans, and you refinance into a 10-year loan. Your monthly payment will undoubtedly go down, but you are also now paying on student loans for another 6 years.

What Do I Think of Student Loan Consolidation?

You know I don’t always agree with Dave Ramsey, especially regarding the debt snowball method. That said, I agree with Dave Ramsey about student loan consolidation. When done right, student loan consolidation can save you both significant time and money.

Before doing so, I would caution you to do your research and make sure that you are actually saving money. I may also see whether you could be eligible to be included in the group negotiation rates via Juno.