Initial Disclosure: This article is for informational purposes only and should not be considered financial or legal advice. The views are that of the author of this article and should be understood as such. In addition, the author of the article has purchased puts in Carvana, which means that the author is investing with the belief that stock‘s price will fall. Please read full disclosure at the bottom.

Disclosure: I have purchased a put position in Carvana (NYSE: CVNA)

3/10/2025 Update: From the recent market shakiness and Hindenburg’s report, I wonder what information Rajat Gupta (Chase’s auto analyst) could see that would change his belief that Carvana is in a far stronger position operationally and financially than in 2022 to weather economics shocks. In addition, one of my readers sent this interesting reddit post that I found amusing, specifically in relation to Carvana’s TrustPilot rating.

1/2/2025 Update: I woke up this morning to read Hindenburg Research’s coverage on Carvana titled, “Carvana: A Father-Son Accounting Grift For The Ages”. I found the article an interesting read. As of today, Ernest Garcia II or Ernest Garcia III has not responded to my letter, but I am still hopeful.

11/3/2024 Update: I published the article below on the morning before earnings were announced, and my prediction was 100% correct. Carvana’s GAAP Retail GPU increased for the 8th consecutive quarter to $3,497. The stock has continued to climb, and many people I have corresponded with are dumbfounded that I sounded so positive after some of my put options have become essentially worthless. That said, I am in Carvana for the long game, so I am not concerned with these short term fluctuations. My hypothesis remains unchanged as Ernest Garcia II or Ernest Garcia III has not responded to my letter (yet). :0) In addition, if any readers want to reach me, please feel free to email me at [email protected].

Dear Ernest Garcia II and/or Ernest Garcia III,

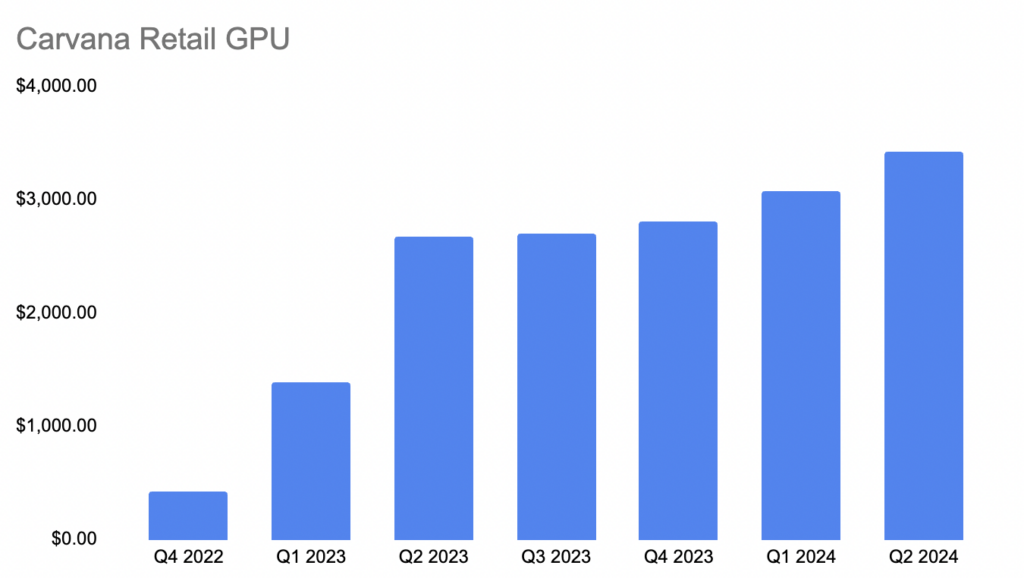

Your son is announcing earnings today, and my 99.9999% bet is that you will have the 8th consecutive increase in Carvana’s retail gross profit per unit (GPU).

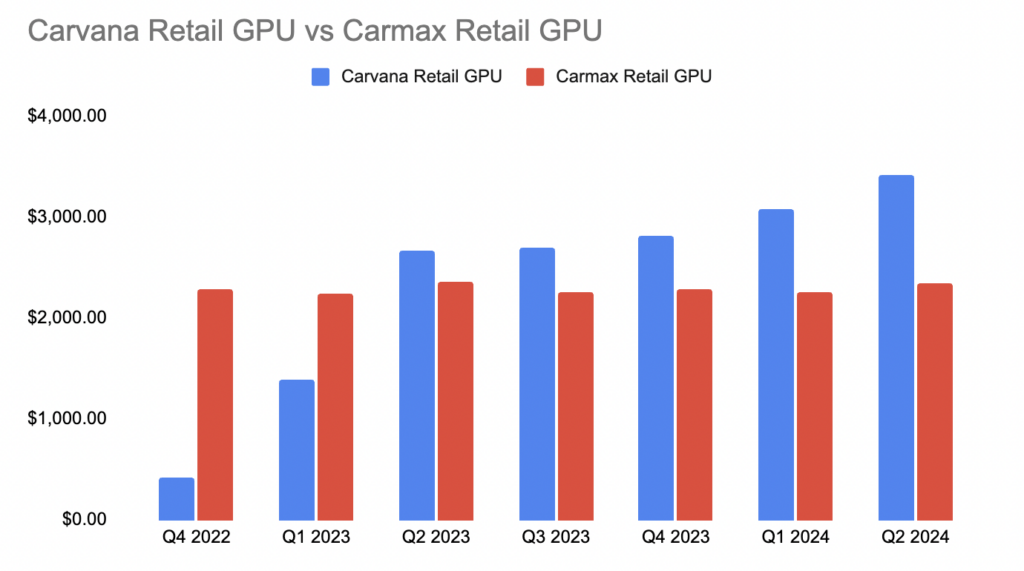

That is an amazing feat for multiple reasons, but here’s the two off the top of my head:

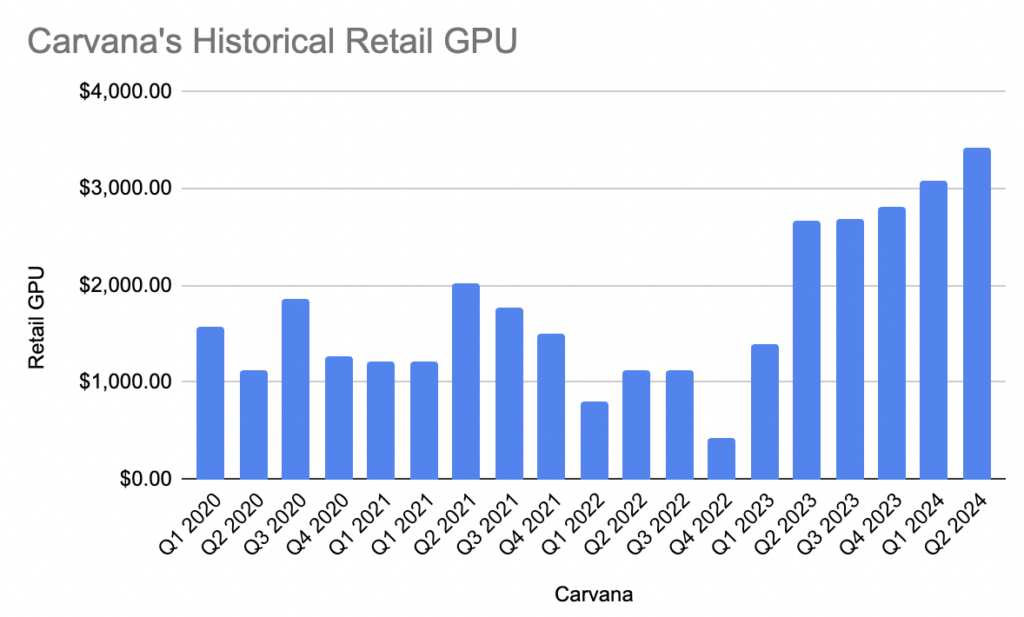

1. Your Retail GPU used to zig zag all over the place

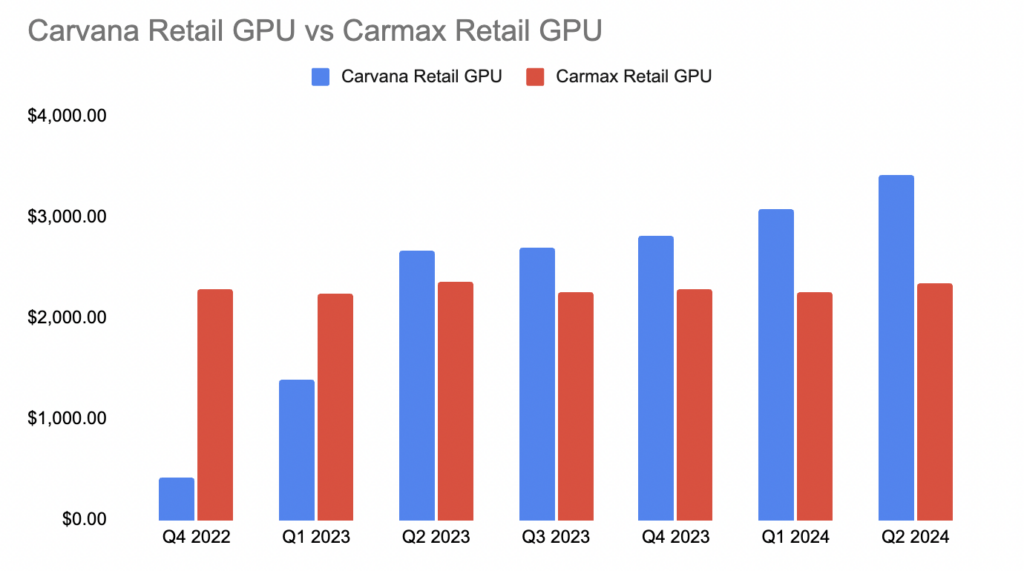

2. You are producing these numbers at SCALE and destroying Carmax’s numbers

Please note Carmax announced Q1, 2025 results in June 2024, so I did our best to match up the dates.

Now, I know you have sold hundreds of thousands of shares, so I took a similar approach by buying the ability to sell over 200,000 Carvana shares via put options. That said, my investment is looking rather foolish at the moment, given that Carvana’s stock doesn’t seem to know gravity.

That said, I am here for the long haul, so I plan to be patient.

Anyhow, I wanted to write you a letter anyways because my questions still linger.

Also, I may have a part 2 of this letter (especially if you readers reach out) with more questions as I am currently researching Dignifi and just how conveniently close their headquarters are to Carvana/Drivetime and how their business works. I

Why I Researched Carvana

For those of you who are reading this open letter, Carvana is an online used car dealership. Ernest Garcia II, the CEO’s father, owns most of the company’s shares—over 70,000,000 per the August 15, 2024 SEC filings. Carvana recently announced that its non-GAAP gross profit per unit (GPU) was $7,049 in Q2, 2024, well above that of a traditional used car dealership.

I am the CEO of a fintech startup, and I enjoy researching companies. I realized how Strategic Financial Solutions was screwing people over before the CFPB sued them. I also wrote about LPG’s interesting business practices before they filed for Chapter 11 bankruptcy.

I am a net negative on the auto industry. I believe we will see a correction in the auto market after speaking with a popular TikToker who stated that banks have not tried to repossess her Tesla, which she stopped paying for in November 2023. I was shocked. Why on earth would a bank not repossess a Tesla in a great condition? I had to ask her a follow-up question to which she replied:

I still do not know the answer, but I started researching the car market, Ford’s insane current inventory, and the number of days outstanding of inventory that car lots have.

I started purchasing puts in different auto-related stocks.

But then I spoke with a friend of mine who owns a large law firm spanning multiple states. I asked him why the bank wouldn’t repossess the vehicle, sell it at auction, and then sue for the auto deficiency, a common thing we see in my industry.

He answered that he wondered if banks did not take the vehicle back because they did not want to increase their loss reserve. I wondered if this could inflate how well the auto market appears to investors as investors closely monitor vehicle loss reserves. If banks repossess more vehicles, would that show that the auto market is on fragile ground?

So with that being said, it’s clear why I am net negative on the automobile market, but let’s get off this tangent and back to my story.

Back to Carvana and You

I watched Car Edge’s video covering Carvana’s ridiculous quarter last quarter and Ray said something like, “I am not a forensic accountant, but I would love to see how Carvana got to those numbers”. In the recent earnings call transcript, I wanted to see the analysts really dig into how the numbers worked. But after listening, it felt more as if the analysts were simply so excited about the numbers that they provided comments like the one below.

So, I started researching Carvana extensively.

1) My Initial Research

The first thing I did was input multiple quarters of Carvana’s quarterly financial data into ChatGPT and started asking ChatGPT questions about Carvana’s finances.

I knew I was not a forensic accountant, as Ray mentioned in his YouTube video, but I figured ChatGPT may be. Please note ChatGPT has been known to lie “confidently,” so I am not sure if it’s a trusted source, but I do appreciate its insights.

I will include how I researched Carvana with ChatGPT, but I am not going to share my findings just yet.

What I provided ChatGPT

I provided additional data to ChatGPT including:

1. 15 pages of Carvana’s 1-star Glassdoor reviews where Carvana commands a 3.3 rating based on over 2500 reviews. It was not hard to find 1-star reviews as the last 3 of 4 reviews are 1-star. Check out the most recent review that says, “they think they’re in the wolf of wallstreet”.

If you are unfamiliar with the Wolf of Wall Street, check out this Google quote that summarizes the main point. It would be highly interesting if the executives compare themselves to the Wolf of Wall Street.

2. Enron’s financials and then asked ChatGPT to compare Enron’s financials to Carvana’s financials.

3. 57 pages of people commenting about Carvana’s stock online.

The result is that I created over 40 pages of material of questions and answers with Carvana. I sent the data to a couple of close friends to try to dissuade my theories about Carvana.

I had a very specific question for ChatGPT about a key piece of Carvana’s financials that I will not release in this post, but it was interesting to see the probability of that action start low and continue to increase once I gave ChatGPT more data.

2) Next, I researched you.

As the CEO of a small ~10-person company myself, I realize the importance of morals. If I cave on my morals as a person, how can I expect anyone that I lead to not do the same if it means higher compensation?

Here’s a summary of what I researched.

- Carvana stated that it receives a gross margin of $7,049 per quarter, which is much higher than many other used car dealers. CashFlow Hunter did a really nice analysis showing his actual numbers to explain how difficult that would be to achieve in the used car market.

- Ernest Garcia II is the largest shareholder and has sold 75,000 shares (~$10-12M) per day for a while (source). His last sale was on August 14th.

- From Ernest Garcia II’s Wikipedia page, Garcia pled guilty to a felony bank fraud charge after he “fraudulently” obtained a $30-million line of credit. In addition, in 1999, Garcia was involved in 6 lawsuits alleging he had “abused his position to profit” from a real estate deal where he ultimately acquired 17 company properties at a 10% discount.

- Ernest Garcia II owns a used car sales business called DriveTime, which can purchase and sell cars to Carvana. Purchasing cars from Carvana could inflate margins if DriveTime purchases cars at a premium and sells them back to Carvana at a loss.

- Some very interesting Glassdoor reviews about how the company handles various things (source).

Before my questions to you, let me share with you what I don’t like about Carvana.

3) What I Don’t Like About Carvana

There are a lot of things I don’t like about Carvana, so I wanted to go through each of these one by one.

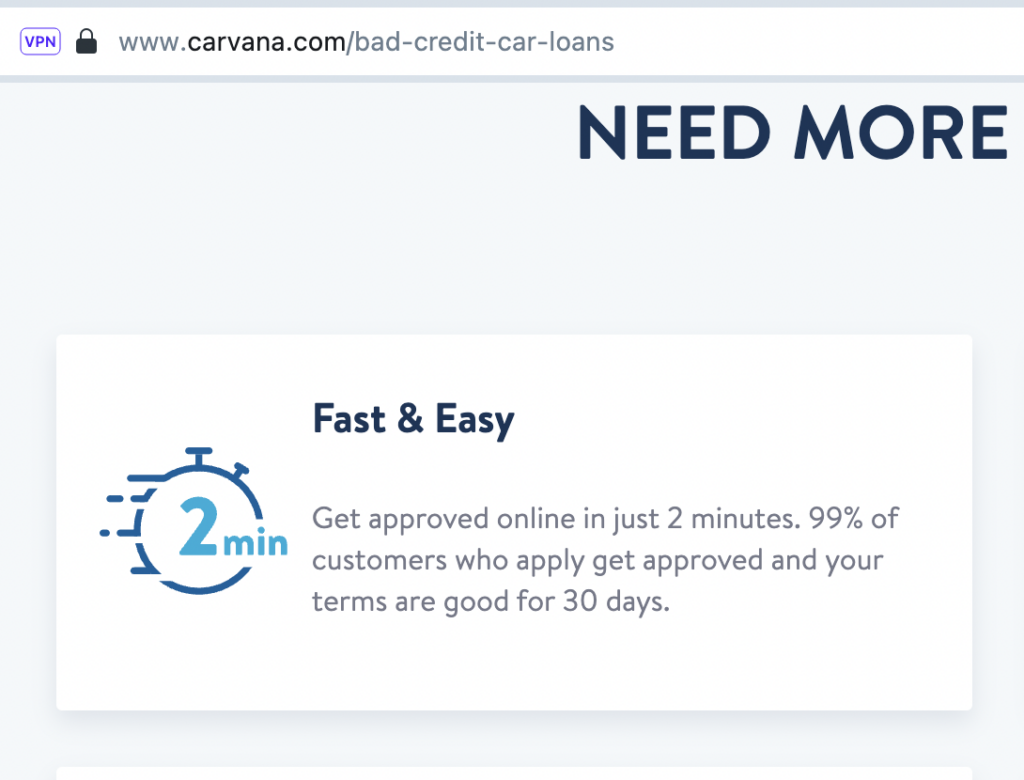

a) You give loans to 99% of people who make $10k income and are 18 years old?

Yes, we know that most money is made from the auto loan, but seriously, you approve 99% of people?

b) Your Income Requirements

You mentioned tighter lending requirements on March 1st, so I am wondering if that is why the Wayback machine updated ~March 2nd, 2024 shows that you increased the annual income requirement from $4,000 per YEAR (source) to $5,100 per YEAR (source), an increase of around $92 per month.

How on earth can someone who makes $5,100 per YEAR afford a Carvana car?

Before:

After:

c) Many Of Your Employees’s Reviews

As someone who cares about employee well-being, I ask my employees once a year to provide anonymous feedback to me how I can improve as a leader.

Your employee’s reviews are interesting at best. I’ll highlight some of the reviews that give me pause.

Carvana

I also understand that you may have some disgruntled employees, but honestly, when I see this review from an alleged “former manager”, it makes me question all of your positive reviews.

On Glassdoor, Carvana has a 3.2 rating based on over 2500 reviews. Here are the two most troubling recent reviews that I found.

1. What does “half the data and numbers being used in shareholder reports is questionable at least” mean?

(Source)

As shareholders, we have to believe these reports as true. Why is a potential former employee who was an analyst at your firm state that those numbers are questionnable?

2. What does this title clerk mean by “fraudulent documents”?

(source)

I have no idea what this means, but I am so so curious.

C) Carvana is a Controlled Company

In addition, Carvana is a controlled company. I knew nothing about what a controlled company means, but here’s the information directly from Carvana’s annual report.

We are a “controlled company” within the meaning of the rules of the NYSE and, as a result, we qualify for exemptions from certain corporate governance requirements. Our stockholders do not have the same protections afforded to stockholders of companies that are subject to such requirements.

The Garcia Parties continue to control a majority of the combined voting power of Carvana Co. As a result, we continue to be a controlled company within the meaning of the NYSE corporate governance standards. Under the NYSE listing requirements, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and need not comply with certain requirements, including the requirement that a majority of our board of directors (the “Board”) consist of independent directors and the requirements that our compensation and nominating and governance committees be composed entirely of independent directors. We do not intend to utilize these exemptions; however, for so long as we qualify as a controlled company, we will maintain the option to utilize some or all of these exemptions. If we utilize these exemptions, we may not have a majority of independent directors and our compensation and nominating and governance committees may not consist entirely of independent directors, and such committees will not be subject to annual performance evaluations. Accordingly, in the event we rely on these exemptions in the future, our stockholders would not have the same protections afforded to stockholders of companies that are subject to all of the corporate governance requirements of the NYSE.

Basically, my understanding is that Carvana does not have to have independent directors or a fully independent compensation committee. It states that it does not intend to do this, but can in the future. It further states that shareholders may not receive the same governance protections as those companies adhering to NYSE corporate governance standards.

Essentially, my understanding is that you have a lot of power in how he operates Carvana, including that he does not have to run decisions by an independent board of directors.

4) My Questions To You

Please help me by answering my questions.

Question #1

Can you please break out, quarter by quarter, the last 8 quarters for the following metrics?

- Percentage breakdown of all the different components that go into retail GPU/wholesale GPU/ Other GPU

- Percentage breakdown of all the different components that go into COGS for retail GPU/wholesale GPU/Other GPU

Also, when breaking out the components, please do not do what you do for your SG&A where 41% of SG&A expenses are in the “other” category.

It feels lazy, especially when compared to Carmax.

Carvana SG&A “Other” Category is the Biggest Category

Carmax SG&A “Other” Category accounts for 19%

We know from your earning reports that you have spent so much time focusing on “operational efficiencies”, but achieving what you’ve done at scale needs further explanation to shareholders.

Carvana’s Incredible 7 Quarters

I mean 7 consecutive quarters of increasing retail GPU while Carmax’s retail GPU stays constant is ridiculously good, especially considering your previous 7 quarters where there were increases and decreases.

I mentioned this above, but please note that Carmax’s numbers are completely parallel to those of Carvana, as I did my best to match dates, not quarters. So Carvana’s Q2, 2024 is most similar to Carmax’s Q1, 2025.

Carvana’s Previous 7 Quarters

How on earth did you go from a choppy retail GPU to constant “up and to the right” for the last 7 quarters without ONE down quarter?

Question #2

I have a lot of questions. I will ask each one individually and try to provide context.

How many times (if any) in 2024 has your own money from the sale of Carvana’s stock or other means been used to fund purchases of Carvana’s cars (wholesale via DriveTime and/or retail) at a premium or inflated the other GPU in any other way?

Between April and August 2024, Ernest Garcia sold over $623,000,000 of Carvana’s stock. According to Carvana’s Q2, 2024 shareholder letter, the company sold 101,440 retail units.

If DriveTime or Ernest Garcia II, as a retail buyer, purchased 75,000 cars from Carvana at a $4,000 premium, the net purchase cost would be $300,000,000. If Ernest Garcia then used DriveTime or personally sold those same vehicles back to Carvana, you could have a transaction where your GPU is higher.

According to the recent form 4, Ernest Garcia II owns over 70,000,000 Carvana shares. The stock has gone up over 200% since the beginning of the year, meaning that if DriveTime loses money on purchasing cars, then it would work out to great benefit for Carvana’s shareholders.

Finally, I asked ChatGPT to examine 8 quarterly reports from Carvana today and asked ChatGPT, “Do any of the reports mention any transactions or any exchange of money between drive time and Carvana”?

Would that sort of transaction be illegal?

I am not even sure that if DriveTime purchased cars at a premium, then selling those same vehicles back to Carvana at a huge loss would be illegal.

DriveTime is a private company, so we do not know its financials.

That said, I’d imagine that many investors would find this information relevant because it shows much higher gross margins than other used car sales.

If You Ever Read This, Ernest Garcia II…

… I would be very interested in the answer to my questions. And if you are comfortable answering this question, I have a lot of other questions that I would like to ask you.

So, please reach me. I’d like to start this conversation.

Full Disclosure:

Use of ManvsDebt.com’s (“ManvsDebt”) research is at your own risk. Under no circumstances shall ManvsDebt or any affiliated party be responsible for any direct or indirect trading losses resulting from reliance on the information provided in this report.

It should be assumed that as of the publication date of this short-biased letter to Ernest Garcia II., the author of this ManvsDebt.com article may hold a position in the securities, bonds, derivatives, or other financial instruments covered in this report and therefore may realize gains if the value of these securities move.. Following publication, ManvsDebt reserves the right to continue trading in the securities discussed and may alter its position at any time by going long, short, or maintaining a neutral stance, irrespective of its initial position or viewpoint.

ManvsDebt’s investments are guided by its internal risk management strategy, which may involve adjusting or closing some or all positions based on security-specific, market, or other relevant factors. This letter does not constitute an offer to buy or sell any security and is not a solicitation to engage in trading activities in any jurisdiction where such actions would be prohibited under local securities regulations.

ManvsDebt is NOT a registered investment advisor in the United States or any other jurisdiction. To the best of ManvsDebt’s knowledge and belief, all information herein is accurate, reliable, and derived from public sources deemed to be trustworthy, not affiliated with the issuer, and without any fiduciary obligations. This information is provided “as is,” without any express or implied warranty. ManvsDebt does not guarantee the accuracy, timeliness, or completeness of this information, nor does it make any assurances regarding the outcomes from its use. All opinions are subject to change without notice, and ManvsDebt disclaims any obligation to update or supplement this report or its content.

By using this information, you agree to conduct your own research and due diligence, and to consult with your financial, legal, and tax advisors before making any investment decision related to securities discussed here.